Authored by Mike Shedlock via MishTalk.com,

Let’s discuss the Kyoto Protocol climate objectives and dozens of reasons why a net zero by the 2050 target has virtually no chance.

The Kyoto Protocol

The Kyoto Protocol was adopted on December 11, 1997. There are 192 Parties to the Kyoto Protocol.

The ultimate objective of the convention is to stabilize greenhouse gas concentrations at a level that would prevent dangerous anthropogenic (human induced) interference with the climate system.

The current goal is net zero carbon emission by 2050.

Halfway Between Kyoto and 2050

The Fraser Institute reports that we are Halfway Between Kyoto and 2050 with virtually no progress, despite all the hoopla.

That article is 44 pages long and worth a read from start to finish. I post some key ideas below.

Carbon Impact on Climate

The Fraser Institute is not a carbon denier. Let’s start there to not immediately lose all of the climate cheerleaders.

The Earth is made hospitable for photosynthesis and habitable for all higher organisms thanks to the regulation of its atmospheric temperature by several naturally occurring trace gases—above all by carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), and ozone (O3). Without their presence the planet’s surface would be permanently frozen at about -18oC, but by absorbing a small share of the outgoing (infrared) radiation these trace gases keep the mean tropospheric temperature at about 15oC or 33oC higher than in their absence (NASA, 2023).

There is nothing new about the realization that these trace gases could affect climate. In 1861 John Tyndall concluded that variation of atmospheric CO2 “must produce a change in climate” (Tyndall, 1861). In 1896 Svante Arrhenius explained that exponential rise of CO2 would result in a nearly arithmetic rise of surface temperatures and that the doubling of pre-industrial CO2 levels might raise the Earth’s temperature by 5 to 6o C (Arrhenius, 1896).

Energy Transitions

The goal of reaching net zero global anthropogenic CO2 emissions is to be achieved by an energy transition whose speed, scale, and modalities (technical, economic, social, and political) would be historically unprecedented.

What is particularly clear is that (in the absence of an unprecedented and prolonged global economic downturn) the world will remain far from reducing its energy-related CO2 emissions by 45 percent from the 2010 level by 2030: for that we would have to cut emissions by nearly 16 billion tons between 2023 and 2030—or eliminate nearly as much fossil carbon as the combined emissions of the two largest energy consumers, China and the USA.

On the face of it, and even without performing any informed technical and economic

analyses, this seems to be an impossible task given that:

- We have only a single generation (about 25 years) to do it;

- We have not even reached the peak of global consumption of fossil carbon;

- The peak will not be followed by precipitous declines;

- We still have not deployed any zero-carbon large-scale commercial processes to

produce essential materials; and

- The electrification has, at the end of 2022, converted only about 2 percent of

passenger vehicles (more than 40 million) to different varieties of battery-powered cars and that decarbonization is yet to affect heavy road transport, shipping, and flying (IEA, 2023c).

Renewable generation also needs expanded high-voltage transmission lines (overhead wires and undersea cables from offshore wind sites) to bring the electricity from the windiest and sunniest places to often distant cities and industrial areas.

Moreover, there are many final energy conversions (ranging from heavy ocean shipping and long-distance commercial aviation to chemical industry dependent on fossil carbon feedstocks) that cannot be readily electrified. Further, we would need substantial quantities of solid and liquid fossil carbon even in the zero-carbon world for paving (asphalt) and for industrial and commercial lubricants. Producing what I have called the four pillars of modern civilization—cement, primary iron, plastics, and ammonia—now depends on fossil fuels, and replacing them with alternatives will require the development of new mass-scale industries and distribution networks ranging from green hydrogen (made by electrolysis of water by green electricity) and ethanol to new synthetic fuels (Smil, 2022a).

If more complex innovations are cheaper than the established ways, or if their higher costs are outweighed by higher quality, efficiency, and convenience, then the transitions can proceed rapidly. Examples include black versus color television, reciprocating engines versus jet engines in long-distance commercial aviation, landlines versus mobile phones, and high-efficiency natural gas furnaces versus coal stoves.

In contrast, renewable conversions start with the inherent disadvantages of having low power density and greater intermittency, and hence their full costs (with service comparable to the on-demand supply and reliability of fossil fuel converters) are considerably higher than the marginal cost of purchasing and installing new PV panels or wind turbines (Smil, 2015; Sorensen, 2015).

The cost differences have been narrowing but the latest comparisons of the levelized costs of electricity generation in the US indicate that the overall cost of solar PV (with a capacity factor of 28 percent) entering service in 2027 will be only 9 percent lower than the cost of combined cycle gas turbine (CCGT, capacity factor 85 percent), and that onshore wind will have the same overall cost but offshore wind plus battery storage will be still more than three times as expensive (US EIA, 2022).

Our Record So Far

The most obvious way to start assessing the progress of the required energy transition is to look at what has been accomplished during the past generation when the concerns about global decarbonization assumed a new urgency and prominence.

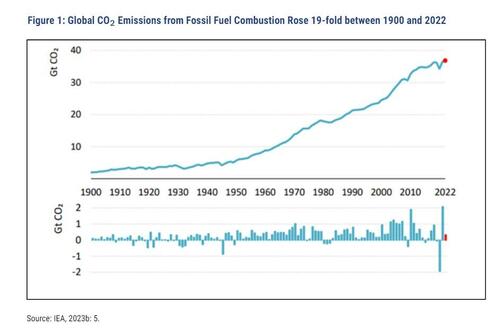

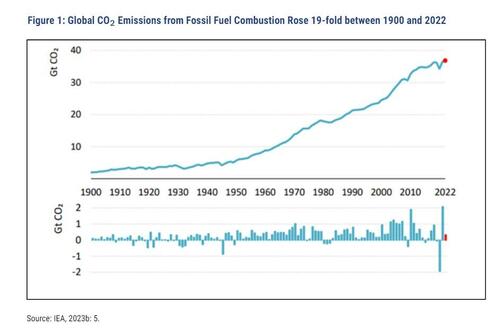

Contrary to common impressions, there has been no absolute worldwide decarbonization. In fact, the very opposite is the case. The world has become much more reliant on fossil carbon (even as its relative share has declined a bit). We are now halfway between 1997 (27 years ago) when delegates of nearly 200 nations met in Kyoto to agree on commitments to limit the emissions of greenhouse gases, and 2050; the world has 27 years left to achieve the goal of decarbonizing the global energy system, a momentous divide judging by the progress so far, or the lack of it.

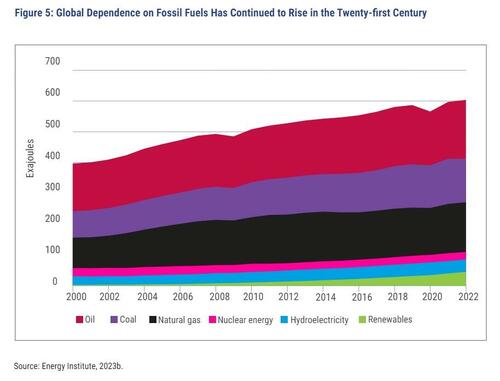

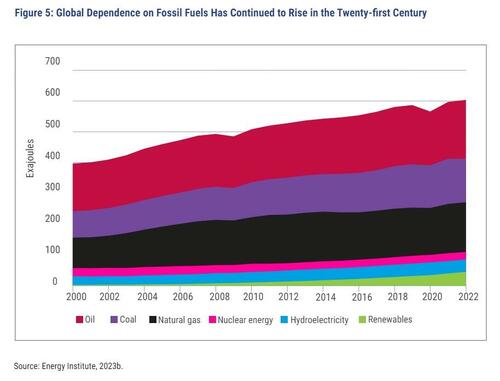

The numbers are clear. All we have managed to do halfway through the intended grand global energy transition is a small relative decline in the share of fossil fuel in the world’s primary energy consumption—from nearly 86 percent in 1997 to about 82 percent in 2022.

But this marginal relative retreat has been accompanied by a massive absolute increase in fossil fuel combustion: in 2022 the world consumed nearly 55 percent more energy locked in fossil carbon than it did in 1997 (see figure 5). The conclusion is unequivocal: by 2023, after a quarter century of targeted energy transition, there has been no absolute global decarbonization of energy supply.

What It Would Take to Reverse the Past Emission Trend

After cutting our relative dependence on fossil fuels by just 4 percent during the first half of the prescribed post-Kyoto period, even if there was no further increase in CO2 emissions we would have to cut it by 82 percent by 2050.

Another revealing way of viewing the daunting magnitude of this challenge is to look at the cuts that would have to be made by G20 economies to meet the interim 2030 goals: for nearly all major economies, it would generally mean halving the 2020 emissions, with cuts of 45 percent for Canada and 46 percent for Saudi Arabia, to 55 percent for the EU, 56 percent for the US, and 63 percent for China (McKinsey, 2023). Only an unprecedented economic collapse could bring such cuts during the next seven years.

The Task Ahead: Zero Carbon Electricity and Hydrogen

Hydroelectricity now supplies about 15 percent of the world’s electricity generation, followed by nuclear fission, which generates about 10 percent (Energy Institute, 2023b). New renewables, wind and solar, have grown rapidly during the past three decades and in 2022 they supplied 12 percent of all electricity generation, still less than the total generated by the two older carbon-free alternatives. Moreover, primary electricity (hydro, nuclear, wind, solar, and a small contribution by geothermal plants) accounted for no more than about 18 percent of the world’s primary energy consumption, which means that fossil fuels still provided about 82 percent of the world’s primary energy supply in 2022.

What is clear is that the total addition of zero carbon electricity will have to go far beyond just replacing today’s fossil-fueled generation, which is about 62 percent of the total of more than 29 quadrillion watthours (PWh) in 2022. Electricity demand will continue to grow: the International Energy Agency forecasts annual growth of 3.3 percent until 2050 and that would raise the 2022 total nearly 2.5-fold to just over 72 PWh (IEA, 2022). Even if hydro and nuclear were to cover 20 percent of that total, wind and solar would have to reach about 58 PWh in 2050, about 17 times their 2022 output and almost exactly twice the 2022 electricity generation from all sources.

Spotlight Steel

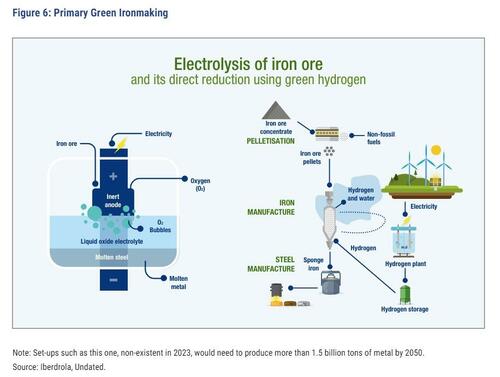

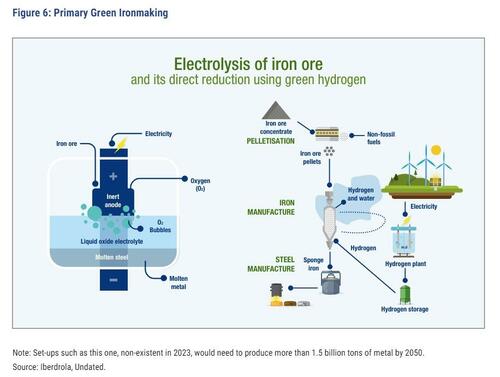

Steel is, and it will remain, modern civilization’s dominant metal, indispensable for all infrastructure, housing, transportation, agriculture, and industrial production (Smil, 2016b). Roughly 30 percent of the world’s steel is made by recycling scrap metal: this is done in electric arc furnaces (EAF) and hence this effort can be fully energized by green electricity.

But 70 percent of the world’s steel comes from basic oxygen furnaces (BOF) using cast (pig) iron smelted in blast furnaces (BF) fueled with coke (made from coking coal), coal dust, and natural gas. In 2022, the output of this primary BF-BOF steel reached 1.4 billion tons. The forecasts are that no less than 2.6 billion tons of the metal will be needed in 2050. Even with raising the EAF steel share to 35 percent, demand would require roughly 1.7 billion tons of green iron (World Steel Association, 2023; ArcelorMittal, 2023).

Instead of reducing iron ores with carbon (and emitting CO2), in the zero-carbon world we would have to reduce them with hydrogen (Fe2O3 + 3H2 2Fe + 3H2O). This means that by 2050 the annual output of 1.7 billion tons of green steel would need about 91 million tons of green hydrogen

Spotlight Ammonia

Ammonia is an even more important product: about 85 percent of its annual production is used to make synthetic nitrogenous fertilizers without whose continuing applications about half of today’s world population could not survive (Smil, 2022a). Ammonia is now synthesized with nitrogen taken from the air and hydrogen produced through a shift reaction from natural gas, coal, and liquid hydrocarbons (N2 + 3H2 2NH3), with less than 5 percent coming from electrolysis of water (green hydrogen). In 2022 the annual output of ammonia reached about 150 million tons; forecasts are that at least 200 million tons will be needed by 2050.

Electrolytic production of green hydrogen needs about 50 MWh/ton: making 500 million tons of green hydrogen by 2050 would thus require about 25 PWh of green electricity, the total equal to about 86 percent of the 2022 global electricity use (IRENA, 2023). To repeat, this renewably generated electricity would be dedicated to the production of green hydrogen alone!

Spotlight Copper

A typical electric vehicle contains more than five times the amount of copper (80 versus 15 kg) of an internal combustion car engine. Replacing today’s 1.35 billion light-duty gasoline and diesel vehicles with EVs and supplying the expanded market (estimated at 2.2 billion cars by 2050) would thus require nearly 150 million tons of additional copper during the next 27 years. That is an equivalent of more than seven years of today’s annual copper extraction for all of the metal’s many industrial and commercial uses (EIA, 2021, October 26). In addition, the IEA estimates that, compared to 2020, the take-over of EVs by 2040 would need more than 40 times as much lithium as is currently mined, and up to 25 times the amount of graphite, cobalt, and nickel (IEA, 2021c). Cumulative demand for materials to achieve total decarbonization by 2050 has been estimated at about 5 billion tons for steel, nearly a billion tons for aluminum, and more than 600 million tons of copper (to list just the three largest items).

Such massive mineral needs bring not only technical and financial concerns, but also environmental and political implications (Energy Transitions Commission, 2023; Sonter, Maron, Bull, et al., 2023). Copper offers a stunning example of these environmental externalities. The metal content of exploited copper ores from Chile, the world’s leading source of the metal, has declined from 1.41 percent in 1999 to 0.6 percent in 2023, and further quality deterioration is inevitable (see figure 7) (Lazenby, 2018, November 19; Jamasmie, 2018, April 25; IEA, 2021c).

Using the mean richness of 0.6 percent means that the extraction of additional 600 million tons of metal would require the removal, processing, and deposition of nearly 100 billion tons of waste rock (mining and processing spoils), which is about twice as much as the current annual total of global material extracted including harvested biomass, all fossil fuels, ores and industrial minerals, and all bulk construction materials.

Extracting and dumping such enormous masses of waste material exacts a very high energy and environmental price as it puts new, supposedly “green” energy uses even further from the goal of maximized material recycling. Moreover, copper’s production is dominated by just a few countries (Chile, Peru, China, and Congo), and China alone refines 40 percent of the world’s supply. China processes even more of the other minerals required for green energy conversion: nearly 60 percent of lithium, 65 percent of cobalt, and close to 90 percent of rare earths (IEA, 2021d; Castillo and Purdy, 2022). That makes OPEC’s grip on crude oil (now 40 percent of global production) a relatively restrained affair!

Costs, Politics, and Demand

Nobody can offer a reliable estimate of the eventual cost of a worldwide energy transition by 2050 though a recent (and almost certainly highly conservative) total suggested by McKinsey’s Global Institute makes it clear that comparing this effort to any former dedicated government-funded projects is another serious category mistake. Their estimate of $275 trillion between 2021 and 2050 prorates to $9.2 trillion a year. Compared to the 2022 global GDP of $101 trillion, this implies an annual expenditure on the order of 10 percent of the total worldwide economic product for three decades.

In reality, the real burden would be far higher for two reasons. First, it cannot be expected that low-income countries could sustain such a diversion of their limited resources and hence this global endeavour could not succeed unless the world’s high-income nations annually spend sums equal to 15 to 20 percent of their GDP. More importantly, this ultimate global transformation project would face enormous cost overruns. As the world’s most comprehensive study of cost overruns (more than 16,000 projects in 16 countries and in 20 categories, from airports to nuclear stations) shows, 91.5 percent of projects worth more than $1 billion have run over the initial estimate, with the mean overrun being 62 percent (Flyvbjerg and Gardner, 2023).

Only once in history did the US (and Russia) spent higher shares of their annual economic product, and they did so for less than five years when they needed to win World War II. Is any country seriously contemplating similar, but now decades-long, commitments?

We must also consider the poorest continent, the population of which will grow from 1.2 to 2.5 billion by 2050. Africa has seen how China became relatively rich during the past generation by quadrupling its combustion of fossil carbon and becoming the world’s largest producer of cement, steel, plastics, and ammonia. Affluent countries themselves have no large-scale non-fossil alternatives that could be transferred to Africa and enable the continent to pursue green development. That is why “African Nations Tell COP27 Fossil Fuels Will Tackle Poverty” (Mcfarlane and Abnett, 2022, November 10).

Realities versus Wishful Thinking

Denmark, with half of its electricity now coming from wind, is often pointed out as a particular decarbonization success: since 1995 it cut its energy-related emissions by 56 percent (compared to the EU average of about 22 percent)—but, unlike its neighbours, the country does not produce any major metals (aluminum, copper, iron, or steel), it does not make any float glass or paper, does not synthesize any ammonia, and it does not even assemble any cars. All these products are energy-intensive, and transferring the emissions associated with their production to other countries creates an undeservedly green reputation for the country doing the transferring.

Responsible analyses must acknowledge existing energy, material, engineering, managerial, economic, and political realities. An impartial assessment of those resources indicates that it is extremely unlikely that the global energy system will be rid of all fossil carbon by 2050.

Belief in Miracles

Belief in near-miraculous tomorrows never goes away. Even now we can read declarations claiming that the world can rely solely on wind and PV by 2030 (Global100REStrategyGroup, 2023). And then there are repeated claims that all energy needs (from airplanes to steel smelting) can be supplied by cheap green hydrogen or by affordable nuclear fusion.

What does this all accomplish besides filling print and screens with unrealizable claims?

Instead, we should devote our efforts to charting realistic futures that consider our technical capabilities, our material supplies, our economic possibilities, and our social necessities—and then devise practical ways to achieve them. We can always strive to surpass them—a far better goal than setting ourselves up for repeated failures by clinging to unrealistic targets and impractical visions.

Failing to reach an unrealistic goal of complete global decarbonization by 2050 means failing to limit average global warming to 1.5oC. How much higher the temperature might rise will not depend only on our continued efforts to decarbonize the global energy supply but also on our success in limiting CO2 and other greenhouse gases generated by agriculture, animal husbandry, deforestation, land use changes, and waste disposal. After all, those contributions account for at least a quarter of global anthropogenic emissions but, so far, we have been almost exclusively focused on CO2 from fossil fuel combustion. But that is a topic for another inquiry.

Mish Comments

That’s a pretty long snip but it’s from 44 pages. I suggest reading the entire article if you have a few extra minutes.

Absolutely Brilliant Speech by British Satirist, Konstantin Kisin

Climate Deniers

I have been accused of being a climate denier. Mercy. Actually, I am a climate realist.

Climate change is real and constant and has been ever since the earth formed.

The debate is over how much is manmade and even more importantly, what to do about it, whether it’s manmade or not.

Let’s assume recent climate change is 100% manmade. So what do we do about it?

Play the above video then think about the path of China and India while noting the whole continent of Africa is not even on the scale.

Also note that India just passed China in population and would like to catch up economically. That requires more energy.

The Problem of Politics

The problems of politics and rushing things too fast are easy to spot.

On January 26, 2024, I discussed The Rise of the Farmer’s Daughter and Another Green Energy Revolt

Yet another farm protest in the EU has farmer’s spraying “merde” on the streets of France. Green energy regulations are at the heart of the protest.

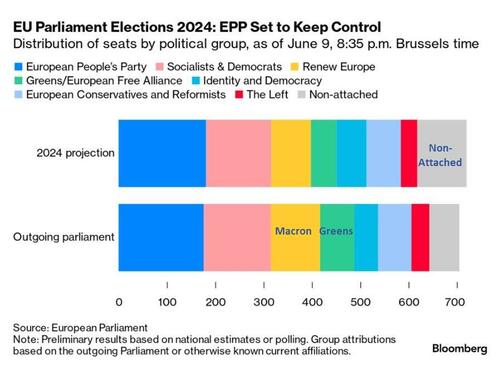

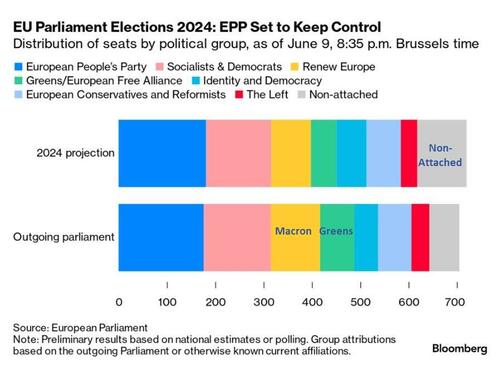

An energy revolt also led to a collapse of the political center in the June 2024 Parliamentary Elections.

I discussed the results in Marine Le Pen Set for Record Win, Macron Calls Snap French Election

Winners: The Far Right

Losers: Renew Europe (Macron), and the Greens.

Ford Loses $36,000 on Each EV, Cuts Production of Electric Trucks

On January 20, I noted Ford Loses $36,000 on Each EV, Cuts Production of Electric Trucks

Demand for EVs is nowhere close to projections so car makers are slashing production.

Did I say $36,000. Oops, strike that.

Ford Loses $132,000 on Each EV Produced

On April 26, Ford admitted a new amount: Ford Loses $132,000 on Each EV Produced, Good News, EV Sales Down 20 Percent

Ford (F) reports a huge loss on every EV. Sales are down 20 percent holding the losses to $1.3 billion.

Please note the good news. Sales were down 20 percent holding the losses to a mere $1.3 billion.

Unsold Tesla’s Pile Up in Mall Parking Lots, Big Discounts Likely

On May 14, I noted Unsold Tesla’s Pile Up in Mall Parking Lots, Big Discounts Likely

Tesla is renting parking lots to store thousands of vehicles. This helps explain the mass layoffs.

This is what happens when governments mandate solutions.

Toyota ignored the hype and the US mandates and instead put a focus on hybrids. After laughing at Toyota, the big three are scrambling to catch up on hybrid technology.

If Trump wins the election, and I believe he will, the energy backlash is likely to set environmental goals back at least for years if not more.

Meanwhile, ironies abound.

Please note Biden Wants EVs so Badly That He Will Quadruple Tariffs on Them

Astute readers will immediately notice the title of this post makes no sense. It’s not supposed to. But it is exactly what President Biden is doing.

Wishful thinking coupled with unsustainable, hypocritical government mandates are worse than doing nothing at all.