General Mills Shares Slide On Dismal Sales Outlook Amid Consumer Pullback

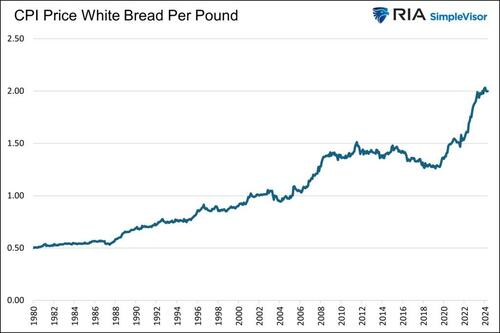

General Mills shares plunged nearly 8% at the start of the US cash session, marking its steepest intra-day drop since May 2022. The decline followed the packaged-food company’s report of fourth-quarter sales that missed average analyst estimates, coupled with a full-year sales forecast that also fell short. This disappointing outlook signals more evidence of a consumer pullback amid elevated food prices and builds on our weak consumer theme.

The maker of Lucky Charms cereal and Yoplait yogurt reported net sales of $4.71 billion, -6.3% year over year for the quarter, below the average estimate tracked by Bloomberg of $4.87 billion. Volumes for the quarter were also lower in its North American retail business and pet segment. Also, retailers were reducing inventory in the quarter.

Here’s a snapshot of General Mills’ fourth quarter results (courtesy of Bloomberg):

-

Adjusted EPS $1.01 vs. $1.12 y/y, estimate $1.00

-

Adjusted gross margin 34.9% vs. 35% y/y, estimate 34%

-

Net sales $4.71 billion, -6.3% y/y, estimate $4.87 billion

-

North America Retail Net Sales $2.85 billion, -6.9% y/y, estimate $2.93 billion

-

North America Foodservice Net Sales $589.0 million, +4.4% y/y, estimate $571.1 million

-

Pet Segment Net Sales $602.1 million, -8.1% y/y, estimate $627.4 million

-

International net sales $667.5 million, -10% y/y, estimate $730.2 million

-

Organic net sales -6%, estimate -3.31%

-

North America Retail organic net sales -7%, estimate -4.41%

-

Pet organic net sales -8%, estimate -4.32%

-

Change in North America Foodservice Organic Net Sales +4%, estimate +1.04%

-

Change in International Organic Net Sales -10%, estimate -2.58%

-

Organic sales volume -2.0 pts, estimate -2.36

-

North America retail organic sales volume -6.0 pts, estimate -2.3

-

Pet organic sales volume -7.0 pts, estimate -5.27

-

International organic sales volume +1.0 pts, estimate -2.67

-

North America retail organic sales price/mix -1.0 pts, estimate -2.91

-

Pet organic sales price/mix -1.0 pts, estimate +1.05

-

North America foodservice organic sales price/mix +1.0, estimate +0.98

For the current fiscal year, the company forecasts organic sales to range between flat and a 1% increase, falling short of the average analyst estimate of 1.18%.

-

Sees organic net sales 0% to +1%, estimate +1.18% (Bloomberg Consensus)

-

Sees adj. EPS in constant currency -1% to +1%

-

Sees Adjusted operating loss in constant-currency -2% to 0%

General Mills Chairman and Chief Executive Officer Jeff Harmening called the macroeconomic landscape “a more challenging operating environment.”

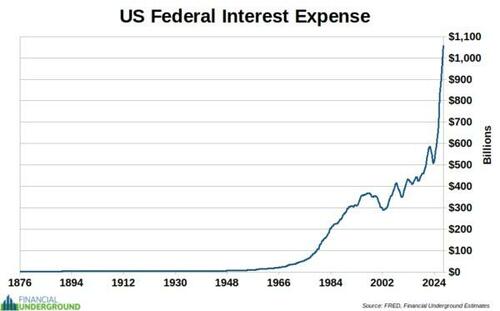

This comes as elevated interest rates and persistent inflation have triggered a consumer slowdown, mainly affecting the working poor segment, but new evidence of stress has emerged in the middle class.

Consumers have been cutting back on spending in recent months and buying less food. Some consumers are replacing branded goods with cheaper, private label versions, while others are simply making do with less — particularly for packaged foods. The company said it expects consumers to continue seeking value given the economic environment. -Bloomberg

Pro subs have been provided the theme of the consumer slowdown in various notes, the most recent one being titled Goldman Tells Top Clients To Start “Shorting The Middle-Income Consumer.”

Tyler Durden

Wed, 06/26/2024 – 12:05

via ZeroHedge News https://ift.tt/OaEAScm Tyler Durden