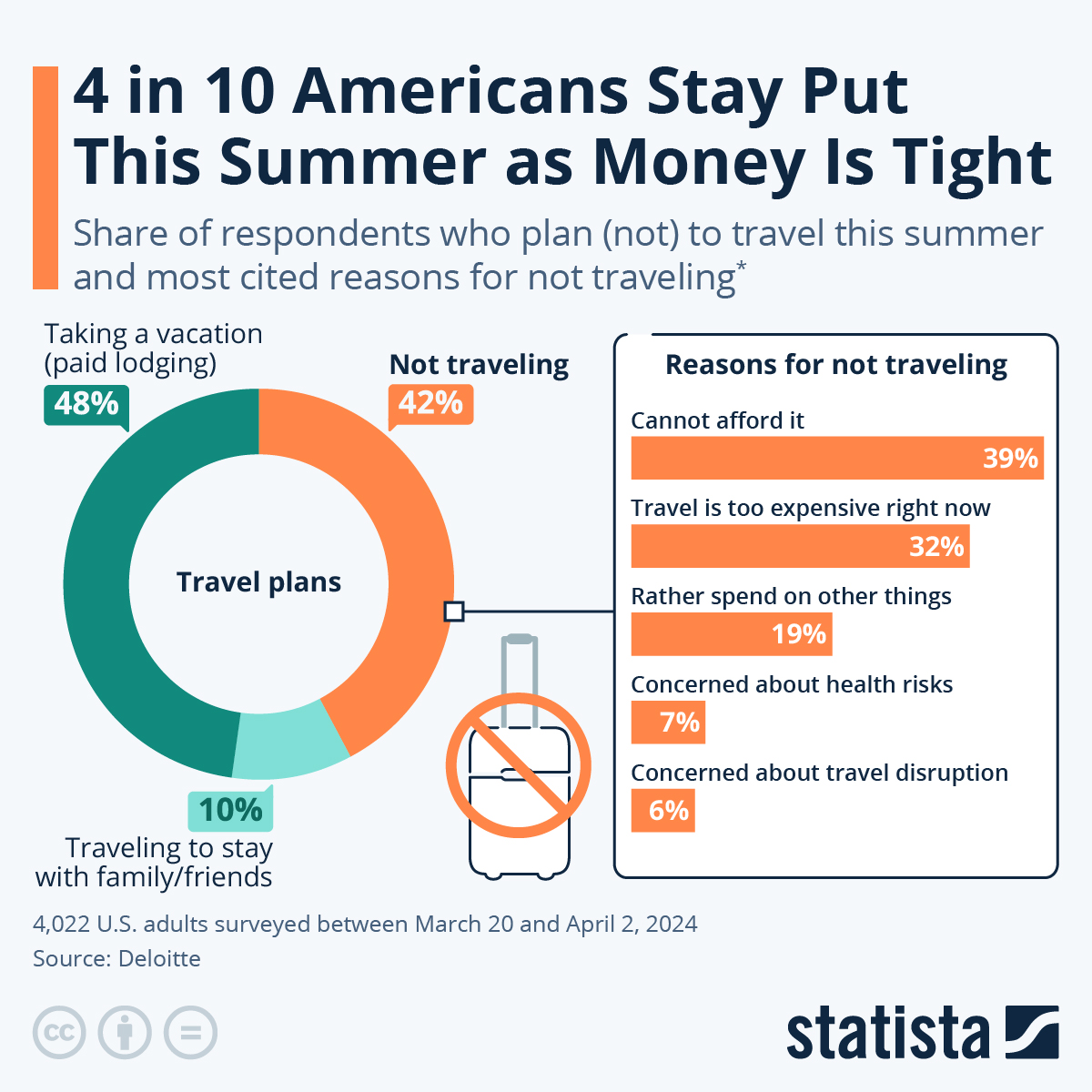

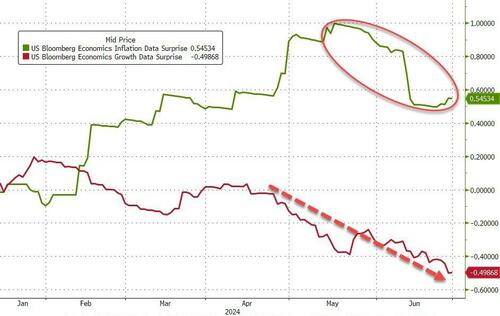

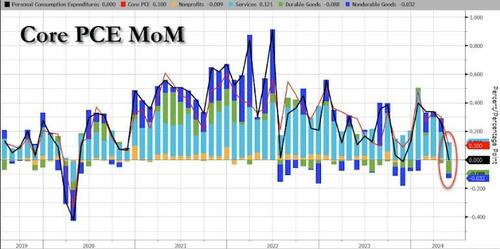

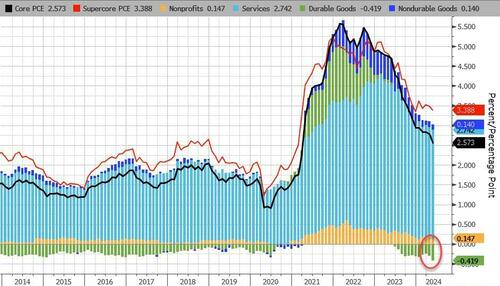

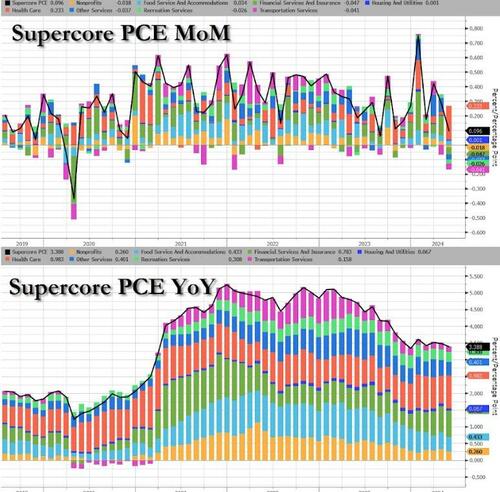

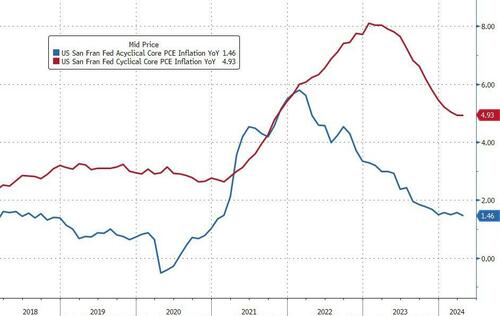

Futures are higher led by small caps with tech stocks also mostly higher, as markets start pricing in a Trump presidency following what even Bloomberg admitted was a “disastrous” debate performance by Biden which is making Democrats panic. As of 7:45am ET, S&P and Nasdaq 100 futures rose 0.4%, suggesting this week’s rally on Wall Street is set to continue, with both indexes on course for a third quarter of gains amid expectations that signs of more bad economic growth will give the Fed more room to ease policy this year. That said, not even a looming core PCE which will likely show continued easing in prices (May PCE est 0.0% MoM, down from 0.3%, 2.6% YoY, down from 2.7%) is having an impact on bond yields which are notably higher this morning as is the USD as markets take a long, hard look at what inflation will look like under Trump’s tariff-ridden regime (spoiler alert: higher). Commodities are mixed: oil and precious metals are higher; base metals are lower. Today’s macro focus will be the May PCE release to access the Goldilocks narrative. Survey expects a 0.1% MoM print vs. 0.2% prior; on YoY basis, survey sees the number dropping to 2.6% survey vs. 2.8% prior).

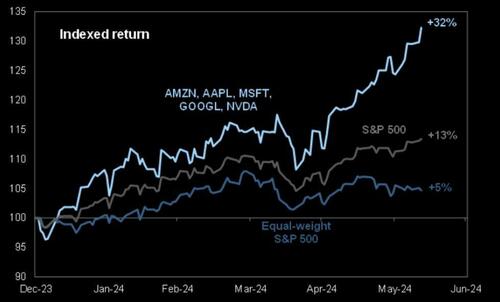

In premarket trading, Nike shares tumbled 15% after the sneaker maker’s Q1 sales outlook missed Wall Street expectations. Following the print, UBS downgraded its recommendation on the stock to neutral, saying the fundamental trends were much worse than analysts had realized. Morgan Stanley also moved to the sidelines, seeing the catalyst for their prior overweight thesis on the stock as “out of view.” Megacap tech are mostly outperforming: NVDA +65bp, AMZN +40bp, AAPL +54bp, GOOG/L +48bp. Here are some other notable premarket movers:

- Infinera shares soar 17% after Nokia agreed to buy the maker of digital optical telecommunications equipment for $2.3 billion.

- Trump Media & Technology Group shares jump 7.9% following Thursday’s presidential debate between President Joe Biden and Donald Trump, with the latter coming away looking stronger.

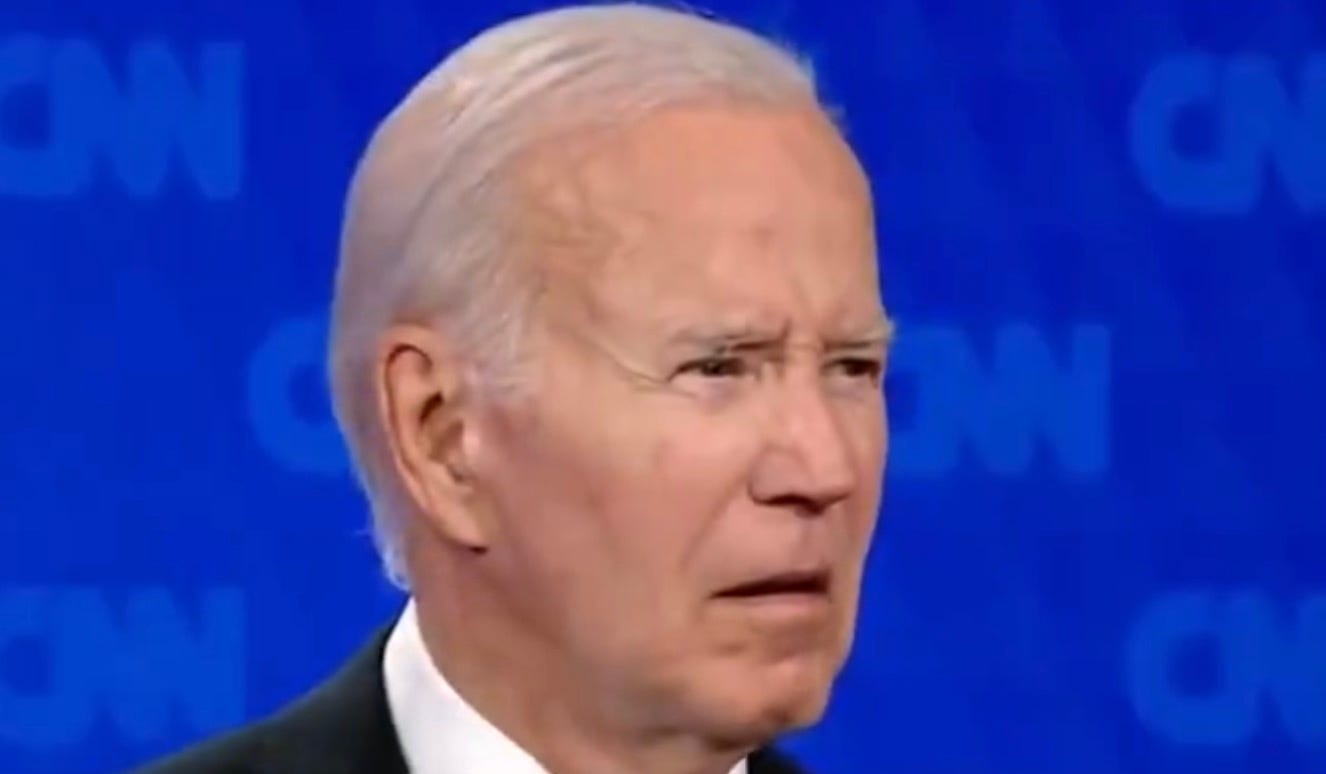

The elephant in the room, of course, was last night catastrophic debate by Joe Biden who ended his presidential campaign in less than 2 hours because as Bloomberg notes, “Biden failed to ameliorate concern about his age in the presidential debate, offering remarks in a hoarse voice and often misspeaking and meandering. A thousand-yard stare on the split screen didn’t help. Donald Trump won the debate, according to 67% of watchers polled by a CNN flash poll. Democrats expressed alarm about Biden’s candidacy, but the president told reporters he intends to stay on the ticket.”

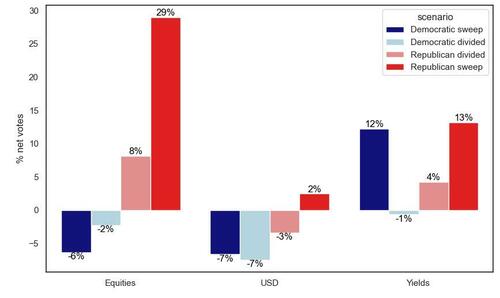

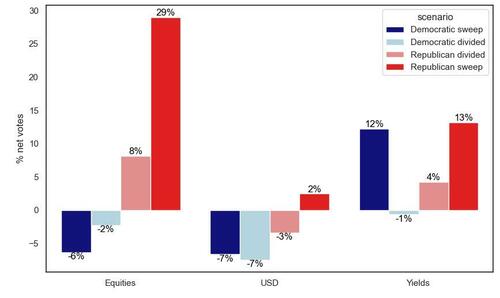

And now that the debate is in the history books, traders are scrambling to evaluate what the Trump presidency will look like; conveniently we just published a great primer yesterday.

Attention now turns to the week’s final event, the Fed’s preferred inflation print, the core PCE. “The fundamental question behind the PCE print is whether there will be at least one rate cut this year,” said Mabrouk Chetouane, head of global market strategy at Natixis Global Asset Management. “If it goes in a way the consensus and the Fed aren’t anticipating, then it will be problematic for equity and bond markets alike.”

European stocks pared an early gain, weighed down by a decline in France’s equity benchmark ahead of the weekend’s parliamentary election. Investors pulled the most money out of European equity funds in almost four months in the week through Wednesday, according to a Bank of America Corp. note citing EPFR Global data. France’s CAC 40 index dropped 0.5% to a five-month low, and the nation’s bonds underperformed, with the 10-year yield rising to the highest since November. The main concern for investors is that the new French government will drive the country deeper into debt. “We retain a cautious stance on French financial assets due to the high event risks and the slim chances of meaningful fiscal consolidation, regardless of the election result,” Bank J Safra Sarasin strategists led by Karsten Junius said in a note. L’Oreal SA fell after the French beauty-products maker said it expects slower growth in the overall beauty market this year. Puma SE and JD Sports Fashion Plc declined, tracking Nike’s slump. Nokia Oyj shares rose as much as 4.4% after the Finnish mobile-phone company agreed to buy US-listed optical transmission equipment maker Infinera. Here are the other notable European movers:

- Nokia shares rise as much as 4.6% after the Finnish company agrees to buy US-listed optical transmission equipment maker Infinera for $2.3 billion.

- Saab shares rise as much as 5.1% as the defense firm is to join Sweden’s main stock benchmark on July 1, following Nasdaq’s semi-annual changes.

- Keywords Studios shares gain as much as 6.5% to £23.20 after the video game services company said it’s likely to accept an updated offer from EQT Group of £24.50 per share in cash.

- Tyman shares rise as much as 4.6% after the UK construction firm and Quanex agreed on a revised proposal to increase the cash value received by Tyman shareholders through a special interim dividend of 15 pence/share.

- PKO Bank shares gain as much as 1.3% to a record high after shareholders of Poland’s biggest lender approve mgmt’s plan to pay 2.59 zloty/share as dividend from 2023 profit.

- Ercros shares climb as much as 13% to €3.93 after Esseco Industrial launched a voluntary, competing public tender offer for the shares in the industrial company.

- L’Oreal shares fall as much as 3.7%, declining for a second day after CEO Nicolas Hieronimus flagged slower growth for the beauty market this year as China weakness weighs on sales.

- Adidas shares hold steady in the face of Nike’s sales warning, with Warburg analysts citing a pre-close call held late Thursday by the German sportswear maker.

- Teamviewer shares fall as much as 8.2% on Friday. The firm detected an irregularity in the company’s internal corporate IT environment on June 26, according to a statement on Thursday.

- JD Sports shares slide as much as 6.6% after Nike issued a full-year outlook that missed expectations. Sports apparel retailer peer Puma falls as much as 3.4%.

- Air France-KLM shares drop as much as 7%, hitting a record low, after Barclays downgraded the stock to equal-weight from overweight, citing political instability in France.

- Safestore shares falls as much as 4.8% as Morgan Stanley downgrades the UK storage firm to equal-weight, citing cost pressures and delays to development plans.

Earlier, Asian equities rose, on track for a weekly gain, as the lack of hawkish comments in the US presidential debate offered some respite for Chinese stocks, with traders turning their focus to a key inflation data due Friday. The MSCI Asia Pacific Index gained as much as 0.6%, poised to post its first weekly advance in three. Japan’s Topix index reached its highest level since 1990 due to a rally in financial firms courtesy of the latest plunge in th eyen, while tech heavy-markets such as Taiwan and South Korea also advanced. Hong Kong stock benchmarks recouped early losses and edged away from technical correction territory as traders assessed the debate between President Joe Biden and former President Donald Trump.

In FX, the dollar hovered near an eight-month high, on track for a sixth weekly gain. The greenback initially rose as markets assessed Trump was the victor in the debate. It’s a foretaste of how markets might react to a second Trump presidency, and suggests the US currency could be a major beneficiary. Meanwhile, South Africa’s rand soared 1.5% on renewed optimism the country’s two largest parties are moving closer to a power-sharing deal.

“Markets likely extrapolated today’s debate outcome to the actual election outcome in November,” said Carol Kong, a strategist at Commonwealth Bank of Australia in Sydney. “Trump’s policies are likely to add to inflationary pressures and escalate trade tensions, thereby supporting US interest rates and the safe-haven US dollar.”

In rates, Treasuries retreated, paring gains from the prior session, when lackluster US economic data reinforced speculation the Federal Reserve will cut interest rates this year to prevent a bigger slowdown in the economy. Economists expect the Fed’s preferred inflation gauge, the core PCE Price Index, slowed to an annualized rate 2.6% last month from 2.8%. That would be the lowest reading since March 2021, though it remains above the central bank’s goal for 2% inflation. French bonds also drop, underperforming their German counterparts and widening the 10-year yield spread by 2bps to around 84bps. French, Spanish and Italian EU harmonized CPI rose inline with estimates and prompted little reaction.

In commodities, oil prices advance, with WTI rising 1% to trade near $82.60 a barrel. Spot gold is steady around $2,328/oz.

Looking at today’s calendar, the US economic data slate includes May personal income/spending, PCE price index (8:30am), June MNI Chicago PMI (9:45am), University of Michigan sentiment (10am) and Kansas City Fed services activity (11am). Fed speakers scheduled for the session include Daly (8:40am, 12:40pm) and Bowman (12pm

Market Snapshot

- S&P 500 futures up 0.3% to 5,561.00

- STOXX Europe 600 up 0.2% to 513.47

- MXAP up 0.3% to 180.38

- MXAPJ up 0.3% to 566.34

- Nikkei up 0.6% to 39,583.08

- Topix up 0.6% to 2,809.63

- Hang Seng Index little changed at 17,718.61

- Shanghai Composite up 0.7% to 2,967.40

- Sensex up 0.2% to 79,373.31

- Australia S&P/ASX 200 up 0.1% to 7,767.47

- Kospi up 0.5% to 2,797.82

- German 10Y yield little changed at 2.45%

- Euro little changed at $1.0694

- Brent Futures up 0.7% to $86.97/bbl

- Gold spot up 0.1% to $2,329.85

- US Dollar Index up 0.12% to 106.03

Top Overnight News

- The IMF has urged the US to “urgently” address its mounting fiscal burden, as it took aim at the tax plans of both presidential candidates just hours before their first electoral debate. FT

- Japan’s economic data has a (slightly) hawkish bias, with higher industrial production for May (+2.8% M/M vs. the Street +2%) and a slightly firmer core Tokyo CPI for June (+1.8% vs. the Street +1.7%). RTRS

- Apple’s China iPhone shipments rose 40% in May, off the previous month’s pace of growth despite steep discounts. BBG

- NKE down 15% pre mkt reported a miss on FQ4 sales and provided very weak guidance for F25. WSJ

- Argentina’s Congress approved President Javier Milei’s signature pro-business reforms in a final 147 to 107 vote. Lawmakers also approved the return of income taxes, reversing the Senate’s bid to undo the measure and giving the government breathing room to reach its fiscal targets. BBG

- France heads to the polls for its first round of voting on Sunday with Marine Le Pen’s far-right National Rally party continuing to widen its lead. President Emmanuel Macron’s group trails in third place. BBG

- European inflation expectations ticked down according to the latest ECB survey, including over the next 12 months (from 2.9% to 2.8%) and 36 months (from 2.4% to 2.3%). ECB

- Iran has expanded its most sensitive nuclear production site in recent weeks. And for the first time, some leaders are dropping their insistence that the nuclear program is for peaceful purposes. NYT

- The US, Israel and Ukraine are in talks to supply Kyiv with up to eight Patriot air defense systems, dramatically improving its ability to counter Russian air strikes. FT

US Presidential Debate

- US President Biden said during the first presidential debate that the US economy was falling when Trump came out of the presidency and that the Trump economy rewarded the rich and raised the deficit, while he said that Trump exaggerates and lies about border security in which everything he says is a lie.

- Former President Trump said they had the greatest economy in the history of the US under his administration and had the greatest economy in the world but Biden did something disastrous by encouraging illegal immigrants, while he added that immigrants from everywhere flock to the US because of Biden and are killing US citizens. Trump also said he achieved a lot in the field of economics and that inflation is currently killing the US which became a third-world country under the Biden administration, as well as noted that tariffs will reduce deficits and check countries like China. Furthermore, Trump said there was no terror under his administration and that the world is blowing up under Biden, while he added Iran was broke and Hamas would never attack Israel under his administration, as well as claimed that he would have the war between Russia and Ukraine settled before he takes office.

- CNN poll showed about 67% of debate followers saw Trump as the winner; 81% of registered voters who watched the debate said it had no effect on their choice for President, 5% said the debate made them change their mind on whom to vote for.

- Following the debate, Politico reports that some Democrats were so concerned by Biden’s performance that they are discussing replacing him on the ticket; however, the likes of Governor Newsom said that kind of talk is “unhelpful” and “unnecessary”. Additionally, advisors acknowledged that not much is possible unless Biden steps aside.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher heading to month-, quarter-, and half-year end following the positive bias stateside but with gains capped as participants digest a slew of data and await the Fed’s preferred inflation gauge. ASX 200 was led higher by tech strength but with upside limited by weakness in miners and materials. Nikkei 225 benefitted from recent currency weakness, while there was also a slew of data releases including mostly firmer-than-expected Tokyo inflation and a return to growth in Industrial Production. Hang Seng and Shanghai Comp. were positive in tandem with the gains in regional peers with catalysts light although there were comments from President Xi who reaffirmed the China opening up message.

Top Asian News

- Chinese President Xi said China will never leave the road of peaceful development and they will continue to expand the system which will become increasingly market-oriented. Xi added that China continues to expand opening up and its door will never close, while it is willing to discuss FTAs with additional developing countries.

- Japan’s Finance Ministry announced they are to replace its top currency diplomat Kanda with Atsushi Mimura and replace Vice Minister of Finance Chatani with Hirotsugu Shinkawa although the changes were said to be part of a normal personnel rotation, according to Nikkei and Bloomberg.

- Japanese Finance Minister Suzuki said he won’t comment on forex levels and it is important for currencies to move in a stable manner reflecting fundamentals. Suzuki reiterated he is closely watching FX moves with a high sense of urgency and is deeply concerned about excessive, one-sided moves on forex and repeated that rapid FX moves are undesirable.

- Geely Auto (0175 HK) Q1 2024 (CNY): revenue 52.315bln vs. prev. 33.506bln, profit attributable 1.561bln vs. prev. 714mln; Q1 sales volumes +49% Y/Y.

- PBoC says it is to step up the implementation of monetary policies already in place; will keep liquidity reasonably ample. Will guide a reasonable growth of credit.Will keep CNY basically stable. Will keep prices at a reasonable level. Will resolutely prevent overshooting risks. To firmly correct pro-cyclical behavior and prevent the formation and reinforcement of one-sided expectations. Deepen supply-side reform. Remarks which saw USD/CNH drop from 7.2985 to a test of 7.2900, a figure which held. Since, the move has pared marginally back to around 7.2930.

European bourses, Stoxx 600 (+0.3%) are mostly firmer, taking positive leads from a strong APAC session; price action in Europe has been choppy thus far. European sectors are mixed; Energy takes the spot, benefiting from the gains in the underlying crude complex. Consumer Products & Services is the clear laggard, with the likes of Puma (-2.5%) hit following poor Nike results. US Equity Futures (ES +0.2%, NQ +0.4%, RTY +0.6%) are entirely in the green, ahead of US PCE. Nike (-12%) has sunk in the pre-market after it reported a beat on EPS, a miss on Revenue, noted that quarterly sales will fall 10% and warned on weakness in China.

Top European News

- EU leaders agree on the top EU jobs with von der Leyen given a second term as European Commission President, while Portugal’s Antonio Costa is to be the new chairman of EU summits and Estonia’s Kaja Kallas is to be EU’s top diplomat. It was separately reported that French President Macron named Thierry Breton as the French EU commissioner.

FX

- DXY is currently just shy of the 106 mark within a 105.87-106.13 range. Some desks attribute overnight strength in the USD to Trump outperforming Biden in the first tv debate. However, it is likely that ongoing upside in USD/JPY also played a role.

- USD/JPY has printed another multi-decade high at 161.27 with jawboning from Japanese officials and personnel adjustments unable to stop the rot for the currency. Officials in Japan will be hoping for a soft outturn for US PCE data today after Tokyo CPI picked up on a headline and core basis overnight. Currently flat on the session and holds around 160.70.

- EUR/USD is slightly softer and back on a 1.06 handle but within yesterday’s 1.0676-1.0726 range. Asides from the fallout from the US PCE data, attention is increasingly turning towards the weekend risk associated with the French election.

- GBP is flat vs. the USD as the final release of Q1 UK GDP unable to instigate much in the way of price action. For now, Cable is tucked within yesterday’s 1.2612-70 range.

- Antipodeans are both falling victim to the broadly firmer USD. AUD/USD a touch softer but largely in consolidation mode having not strayed from a 0.66 handle since June 17th.

- PBoC set USD/CNY mid-point at 7.1268 vs exp. 7.2727 (prev. 7.1270).

Fixed Income

- USTs came under pressure in APAC hours as the US election debate got underway. A debate which saw Biden perform particularly poorly with the odds of a Trump presidency lifting. Currently trading around 110-05 ahead of US PCE.

- Bunds were initially lower in tandem with broader weakness in Treasuries, and was fairly unreactive to French/Spanish inflation metrics thereafter. Currently lower by around 16 ticks and trading within Thursday’s 131.68-132.19 bounds.

- OATs underperform ahead of Sunday’s legislative first round election which has caused the OAT-Bund yield spread to widen to above 84bps.

- Gilt price action has been following peers, within initial underperformance on the back of the upwardly revised UK Q1 GDP figures.

Commodities

- Crude continues to climb. Upside which is a continuation of Thursday’s marked gains for the complex, which began without clear or fresh fundamental catalysts. Brent higher by just under USD 1/bbl, and sitting above USD 86/bbl.

- Spot gold is flat, in what has been a rangebound and quiet session for the complex awaiting impetus from US PCE. XAU currently sits just under USD 2330/oz, with its 50 DMA at USD 2337/oz.

- Base metals are entirely in the green benefitting from the broadly positive risk tone, though with gains capped as participants await US PCE.

Geopolitics: Middle East

- “US Pentagon is moving military assets near Israel and Lebanon to be ready to evacuate Americans”, via Walla’s Elster citing NBC.

- US is to release part of suspended bomb shipment to Israel with the US and Israel discussing the release of a 500-pound bomb shipment to Israel, while the Biden administration is also reviewing another part of the shipment which includes 1,800 and 2,000-pound bombs, according to Axios.

- US official said the Pentagon is moving US military assets close to Israel and Lebanon as it prepares to evacuate Americans in Israel and Lebanon if the fighting intensifies, according to NBC.

Geopolitics: Other

- US Deputy Secretary of State Campbell raised serious concerns regarding China’s destabilising actions in the South Sea in a call with China’s Executive Vice Foreign Minister Ma Zhaoxu.

US Event Calendar

- 08:30: May PCE Price Index MoM, est. 0%, prior 0.3%

- May PCE Price Index YoY, est. 2.6%, prior 2.7%

- May Core PCE Price Index MoM, est. 0.1%, prior 0.2%

- May Core PCE Price Index YoY, est. 2.6%, prior 2.8%

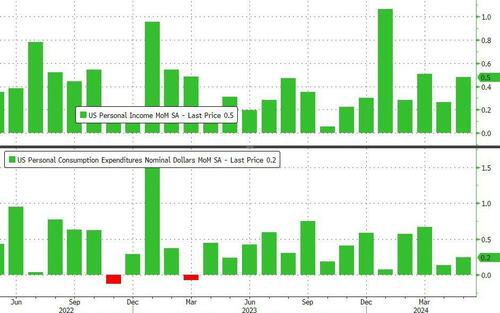

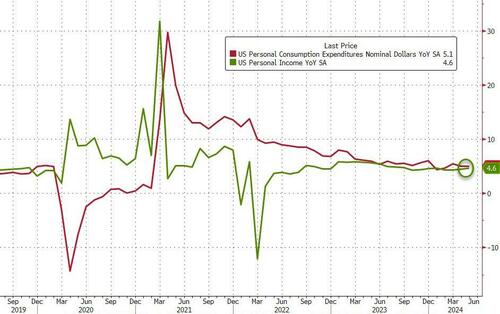

- 08:30: May Personal Income, est. 0.4%, prior 0.3%

- May Personal Spending, est. 0.3%, prior 0.2%

- May Real Personal Spending, est. 0.3%, prior -0.1%

- 09:45: June MNI Chicago PMI, est. 40.0, prior 35.4

- 10:00: June U. of Mich. Sentiment, est. 66.0, prior 65.6

- June U. of Mich. Current Conditions, est. 64.0, prior 62.5

- June U. of Mich. Expectations, est. 68.0, prior 67.6

- June U. of Mich. 1 Yr Inflation, est. 3.2%, prior 3.3%

- June U. of Mich. 5-10 Yr Inflation, est. 3.1%, prior 3.1%

- 11:00: June Kansas City Fed Services Activ, prior 11

Central Bank Speakers

- 06:00: Fed’s Barkin Gives Keynote Speech

- 08:40: Fed’s Daly on CNBC

- 12:00: Fed’s Bowman Speaks in Moderated Q&A

- 12:40: Fed’s Daly Speaks on AI, Workforce

DB’s Jim Reid concludes the overnight wrap

We go to press this morning just after the first US presidential debate of the election between Joe Biden and Donald Trump. The general consensus among pundits is that Trump had the better performance, and a CNN flash poll of registered voters watching the debate found viewers thought Trump won by a 67%-33% margin. There are just two debates scheduled in this campaign, with the second on September 10, ahead of the election on November 5. Going into the debate, the national polls were neck-and-neck, and Trump only had a 0.2pt lead in FiveThirtyEight’s polling average, so it’ll be interesting to see if the debate affects that.

Staying on politics, it’s going to be an important weekend for markets ahead, as the first round of the French legislative election is taking place on Sunday. Clearly we won’t know the full results until the second round on July 7, but it will offer a better sense of the likely outcomes in terms of who can reach a majority, if anyone. As it stands, the latest Ifop poll yesterday showed Marine Le Pen’s National Rally on 36%, ahead of the left-wing alliance on 29%, and President Macron’s centrist group on 21%. In terms of seats projected in the National Assembly, that poll suggests the National Rally and its allies would end up with 220-260 seats, falling short of the 289 necessary for a majority. Alongside that, the left-wing alliance would get 180-210 seats, and President Macron’s group would be on 75-110. As a reminder, my team published a two-part guide to the French elections running through the situation and the implications for Europe (links here and here).

Ahead of Sunday’s first round vote, French assets have continued to lose ground, with the 10yr Franco-German spread closing above the 80bp mark for the first time since 2012. And in absolute terms, the 10yr French OAT was up +3.8bps to 3.26%, which is its highest level since November. That came as Germany’s finance minister Lindner said that “A strong intervention by the ECB would raise some economic and constitutional questions”. Equities also fell back, with the CAC 40 down -1.03%, meaning it’s now less than 0.4% above its low point a couple of weeks ago.

The French election is likely to be the main focus by Monday, but before we get to that, today will bring several important inflation numbers. In particular, we’ve got the US PCE inflation report for May, which is the measure that the Fed officially target, and hence is closely followed in markets. Our US economists think that core PCE should increase by +0.17%, based on the CPI and PPI data that we’ve already got. In turn, that would cut the year-on-year rate to 2.63%, the lowest in over three years. So that would be very promising news from the Fed’s perspective, but it’s clear they remain cautious given the inflation spike we had back in Q1 of this year. Indeed, that was echoed by Atlanta Fed President Bostic, who said that “It’s going to be a much longer experience and that’s why I’m preaching patience”.

US Treasuries rallied ahead of that release, as we got another batch of underwhelming data, which is increasingly becoming a theme of late. For instance, the continuing jobless claims rose to 1.839m in the week ending June 15 (vs. 1.828m expected), which is their highest level since November 2021. Alongside that, the weekly initial jobless claims over the week ending June 22 came in at 233k (vs. 235k expected). That was a bit lower than last week, but it still pushed the 4-week moving average up to 236k, which is the highest it’s been since September. That adds to several metrics suggesting that the labour market could be weakening, not least given the unemployment rate was up to 4.0% in the May jobs report. So evidence of loosening in the labour market even if there are enough one-offs in the data to give it a pass for the moment. Staying with the weaker data theme, core capital goods orders for May disappointed, falling -0.6% (vs. +0.1% expected), while a gauge of pending home sales fell to its lowest level since the start of the series in 2001. The Atlanta Fed’s GDPNow estimate for Q2 was cut to an annualised rate of +2.7% yesterday, having been at +3.0% previously. This is still decent but US data is increasingly surprising on the downside, so economic momentum still seems to be rolling over a bit, albeit from high levels.

That backdrop cemented investors’ conviction that the Fed would cut rates by the end of the year, with the amount of cuts priced in by the December meeting up +2.0bps to 45bps. In turn, that meant 10yr Treasury yields fell -4.3bps to 4.29%, and the 2yr yield was also down -3.5bps to 4.71%. Over in Europe, yields were steadier for the most part, with the 10yr bund yield down just -0.3bps. However, the consistent theme was wider spreads, with yields on French OATs (+3.8bps) and Italian BTPs (+3.3bps) both seeing larger moves.

For equities, there was a similar divergence on either side of the Atlantic. In the US, that saw the S&P 500 (+0.09%) close just shy of its all-time high, with the Magnificent 7 (+0.41%) closing at a new record. Nvidia (-1.91%) underperformed again, weighed down after underwhelming projections from chipmaker Micron (-7.12%) the previous evening. Elsewhere, the small cap Russell 2000 rose +1.00%, moving back into the green for 2024 with a +0.56% YTD advance (vs. a +14.95% gain for the S&P 500). Meanwhile in Europe, the STOXX 600 (-0.43%) lost ground for a third consecutive session, with more pronounced losses among southern European countries, including the FTSE MIB (-1.06%) and the IBEX 35 (-0.72%).

Overnight in Asia, the Japanese Yen has continued to weaken, and is currently trading at 161.07 per US Dollar, which would be its highest closing level since 1986. In the meantime, equities have continued to advance, with gains for the Nikkei (+0.76%), the CSI 300 (+0.64%), the Shanghai Comp (+0.98%), the Hang Seng (+0.56%) and the KOSPI (+0.26%). In addition, the TOPIX (+0.72%) is currently on course to close at its highest level since 1990. Looking forward, US equity futures are also pointing higher, with those on the S&P 500 up +0.23%.

In other political news, Ursula von der Leyen was nominated by EU leaders for a second term as President of the European Commission. That was part of an agreement that saw former Portuguese PM Antonio Costa chosen as President of the European Council, and Estonia’s PM Kaja Kallas as the EU’s High Representative for Foreign Affairs and Security Policy. However, Von der Leyen will still need to win a majority of votes in the new European Parliament, which is held by secret ballot, and in 2019 she only exceeded that by nine votes. The High Representative also needs agreement from the President-elect of the European Commission, and later on the entire Commission as a whole (including the President, High Representative and other commissioners) face a vote of consent in the European Parliament.

Finally we also saw the third estimate of US Q1 GDP just as we hit the end of Q2 for markets today. This release had a few revisions. On the bright side, the Q1 reading was revised up a tenth, and now shows growth at an annualised +1.4%. However, both headline and core PCE were revised up a tenth as well, with core PCE inflation now seen at an annualised +3.7% in Q1.

To the day ahead now, and data releases from the US PCE inflation reading for May, the Canadian GDP report for April, the flash CPI releases for June from France and Italy, along with German unemployment for June. From central banks, we’ll hear from the Fed’s Barkin, Bowman and Daly, along with the ECB’s Villeroy.