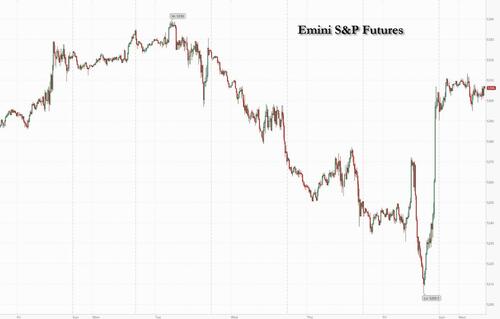

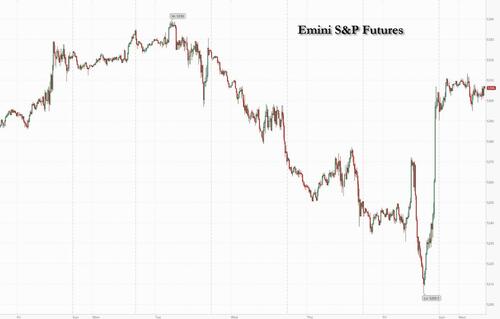

After closing the month of May on the front-foot when a last minute rebalancing spike in the S&P reversed two days of losses, US stock futures are ticking higher to start the month of June following the lead of broad gains across European equity markets and a jump in Asia. As Bloomberg notes, “a degree of extra optimism about the prospect for interest-rate cuts by the Fed following last week’s PCE data, along with better manufacturing figures from China, filtered through markets.”

As of 7:50am, S&P futures traded 0.2% higher with both Tech and Small-Caps outperforming as bond yields start the day lower amid bull flattening, while Nasdaq futures gained 0.4% signaling a recovery after last week’s 1.4% selloff which was driven by investors pulling out of expensive tech leaders, as NVDA jumped 3% after CEO Jensen Huang announced at the Computex conference that the group plans to update its AI accelerators every year, underlining its bullish outlook on the demand for chips and announced a Blackwell Ultra chip for 2025, along with a next-generation platform in development called Rubin for 2026. 10Y Treasury yields dropped 4bps to 4.46% after closing at 4.50% on Friday; the Bloomberg dollar index jumped while oil was volatile after the OPEC+ group announced an extension of output cuts while setting out a plan to gradually restore some production as early as October. Commodities ex-energy are weaker with natgas the standout +5%. Today’s macro data focus is on ISM-Mfg, vehicle sales, and construction spending. This is an important macro data week with the narrative gradually moving to lower growth; NFP may help frame the Fed’s reaction function.

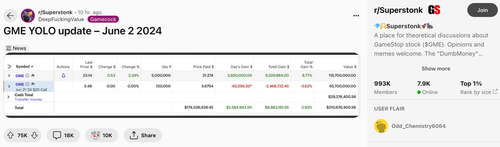

Pre-market, NVDA is +3% and AMD up 1.6% helping both Mag7 and Semis, after the CEOs of the chipmakers made artificial intelligence announcements in Taiwan. More notable, GME is +75% and AMC +25% after the Reddit account that drove the mania in 2021 posted what appeared to be a $116 million position in GameStop. A screenshot by Keith Gill known as Roaring Kitty, which also included 120,000 call options, couldn’t be verified. Still, that didn’t prevent GameStop shares from more than doubling in premarket trading, or as JPM put it, “It appears the optimism in the last hour of Friday’s trading has resumed.“

Here are some other notable premarket movers:

- Autodesk rose 6% after the software company said no financial statements will be restated or adjusted following the results of an investigation by the board’s audit committee.

- Boston Beer slips 11% after Suntory Holdings said it is not in talks to buy the company.

- Edwards Lifesciences climbs 1% after Becton, Dickinson & Co. agreed to buy the company’s critical care unit.

- MarineMax gains 18% after Bloomberg News reported that OneWater Marine Inc. is in talks to acquire the company, citing people with knowledge of the matter.

- Paramount Global climbs 6% after Bloomberg reported Skydance Media CEO David Ellison’s latest offer for the company includes an option for non-voting shareholders to cash out a portion of their stock for about $15 a share

- Stericycle soars 16% after agreeing to be purchased by Waste Management Inc.

- Summit Therapeutics rises 16% after the drug developer said it raised about $200 million while also expanding its license territories with Akeso for the drug ivonescimab.

Elections dominated the newsflow on Monday with results from Mexico and India swaying local markets. India’s Sensex jumped more than 3% and the rupee strengthened the most in a year on speculation a decisive victory would allow Modi to push through policies to spur growth. In Mexico, the peso tumbled after Claudia Sheinbaum became the country’s first female leader in a landslide victory.

- South Africa’s ANC lost its 30-year majority and won 159 out of 400 seats (prev. 230 seats) in South Africa’s National Assembly, according to the electoral commission. South African President Ramaphosa said the election results represent a victory for democracy in South Africa, according to Reuters. South Africa’s biggest opposition party, the Democratic Alliance, has appointed a negotiating team to speak with other political parties about forming a majority coalition, according to Reuters.

- Indian PM Modi’s BJP alliance is projected to win a majority in the general election, according to CNN-News18 exit poll; projected to win 355 to 370 seats in the general election.

- Mexico’s Claudia Sheinbaum is seen winning the presidency with a landslide 56% effective vote vs 30% for Galvez, according to Parametria exit polls. Mexico’s Morena Party Chief said Claudia Sheinbaum has won the presidency. Mexico’s Morena Party is projected to have a simple majority in Congress, according to party head Mario Delgado speaking to Milenio TV.

After the S&P 500 posted gains in six of the past seven months, there’s a split among some of the top Wall Street strategists over whether the rally can continue. Investors betting on more US gains over the coming months will be disappointed, according to strategists at JPMorgan. On the opposing end, Morgan Stanley’s Michael Wilson says his bull case is in play for now.

“We see the market upside capped during summer due to the inconsistency between the consensus call for disinflation, and at the same time, the belief in no landing and in earnings acceleration,” a JPMorgan team of strategists led by Mislav Matejka wrote in a note to clients.

Elsewhere, online fashion retailer Shein is set to file for an initial public offering in London as soon as this week that could value the company at about £50 billion ($64 billion), according to a person familiar with the matter. Shein’s offering could become one of the UK’s biggest ever IPOs, clawing back a chunk of the market value London has lost from companies shifting their primary listings to New York.

European stocks also gained, led by construction and material names, after a broadly positive Asian session. Estoxx 50 higher by 0.7% in early London session with construction and retail shares leading gains, while health care and mining stocks are the biggest laggards. Here are the biggest movers Monday:

- Genmab shares rise as much as 4.4%, the most in a month, after analysts were impressed by the Danish biotechnology company’s presentation on its acasunlimab therapy in patients with previously treated metastatic non-small cell lung cancer

- National Grid advances as much as 2.8% after Citi upgrades to buy, saying in note the energy infrastructure operator offers an attractive set-up on factors including a more constructive political and regulatory outlook

- Pets at Home gains as much as 5.9% after Liberum upgrades its recommendation on the stock to buy from hold, citing the launch of a new digital platform and the easing of cost pressures as reasons to be optimistic about the pet retailer

- Hollywood Bowl rises as much as 5.1% following first-half results, which Berenberg says were solid despite tough comps. The company also raised its interim dividend by more than 20%

- Hunting jumps as much as 9.2% after the oil field services provider won a follow-on order from the Kuwait Oil Company valued at $86m, which analysts at Cannacord said has added more firepower to its backlog

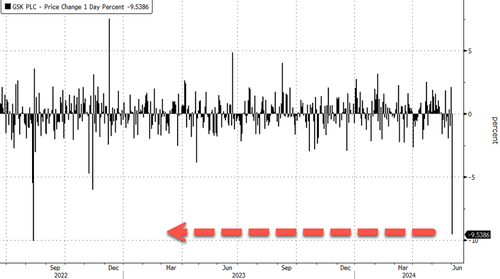

- GSK plunges as much as 10%, the most since August 2022, following a Delaware court ruling that GSK, Pfizer and other drugmakers must face trials

- Borussia Dortmund shares fall as much as 8.1%, the most in almost a year, after the German football club lost the Champions League final to Real Madrid on Saturday

Earlier in the session, technology stocks led a rally in Asia on Monday, as renewed rate-cut hopes and Nvidia’s new chip plans fueled risk-on sentiment. The MSCI Asia Pacific Index climbed 1.7%, with TSMC and Tencent among stocks giving the biggest boost to the benchmark. Onshore Chinese equities traded higher after two days of losses. Concerns over the economy’s strength linger even as a private survey showed China’s manufacturing activity expanded at the fastest pace in almost two years in May. Risk sentiment returned to Asia as moderating inflation in the US revived bets that the Federal Reserve will cut interest rates. The region also got an added boost from India, where stocks surged to an all-time-high as exit polls predicted a sweeping victory for Prime Minister Narendra Modi in the general election.

Equity markets displayed some anxiety recently around the impending political uncertainty and “with this clear verdict, markets will heave a sigh of relief,” Motilal Oswal strategists led by Gautam Duggad wrote in a note. The anticipated win by Modi’s party “provides stability and continuity in policy making with a single-party majority government,” which is expected to continue pushing its economic agenda, they said.

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The pound is the weakest of the G-10 currencies, falling 0.3% against the greenback. The Mexican Peso falls 1.5% after preliminary election results spooked investors.

In rates, treasuries gained across the curve led by long-end, following similar gains in gilts and bunds over early London session. 10Y Treasury yields richer by up to 4bp across long-end of the curve with 2s10s, 5s30s spreads flatter by 2bp and 1bp on the day; 10-year yields around 4.465%, richer by 4bp on the day with bunds and gilts outperforming by 1bp each in the sector. Bunds and gilts also gain. With no coupon supply scheduled for this week and Fed officials in self-imposed quiet period, economic data culminating with Friday’s May jobs report are focal points. Meanwhile, ECB is viewed as almost certain to lower interest rates by 25 basis points at its next meeting on Thursday.

In commodities, oil prices advance after OPEC+ set out a timetable for gradually unwinding some of its oil production cuts. WTI rises 0.2% to trade near $77.20 a barrel. Spot gold is little changed around 2,325/oz.

In crypto, bitcoin saw modest gains overnight but remains within recent ranges of around $68,000.

Looking at today’s calendar, US economic data includes May S&P Global US manufacturing PMI (9:45am), April construction spending and May ISM manufacturing (10am); this week also includes JOLTS, factory orders, ADP employment change, services PMIs and May jobs report. Fed officials are expected to refrain from commenting until after their June 12 policy announcement.

Market Snapshot

- S&P 500 futures up 0.2% to 5,306.75

- STOXX Europe 600 up 0.6% to 521.13

- MXAP up 1.7% to 179.78

- MXAPJ up 1.9% to 558.17

- Nikkei up 1.1% to 38,923.03

- Topix up 0.9% to 2,798.07

- Hang Seng Index up 1.8% to 18,403.04

- Shanghai Composite down 0.3% to 3,078.49

- Sensex up 3.2% to 76,333.05

- Australia S&P/ASX 200 up 0.8% to 7,761.03

- Kospi up 1.7% to 2,682.52

- German 10Y yield little changed at 2.63%

- Euro little changed at $1.0841

- Brent Futures up 0.1% to $81.22/bbl

- Gold spot up 0.0% to $2,328.29

- US Dollar Index little changed at 104.69

Top Overnight News

- Two of China’s biggest cities saw improvements in homebuyer sentiment last weekend after relaxing property restrictions, the first positive signs in months for the embattled real estate sector. In Shanghai, about 90% of the more than 300 units offered at a new project over the weekend were sold, beating the sales-through rate for the same development in March. In Shenzhen, some developers saw buyer interest surge so much they rescinded discount offers. Existing-home sales recovered in both cities. BBG

- Russia’s attempts to conclude a major gas pipeline deal with China have run aground over what Moscow sees as Beijing’s unreasonable demands on price and supply levels. Beijing’s tough stance on the Power of Siberia 2 pipeline underscores how Russia’s invasion of Ukraine has left President Vladimir Putin increasingly dependent on Chinese leader Xi Jinping for economic support. FT

- Exit polls in India point to a landslide election win for PM Modi (Modi’s party and its allies could secure a 2/3 majority in the lower house of parliament, clearing a threshold needed for constitutional changes). Modi is planning a wave of business-friendly reforms during his upcoming third term as he aims to turn India into a manufacturing hub rivaling China. FT / RTRS

- Claudia Sheinbaum is set to become Mexico’s first female leader after preliminary results showed her on course to win an overwhelming election victory. The leftwing former Mexico City mayor, a close ally of President Andrés Manuel López Obrador, was leading by nearly 30 percentage points, according to a partial official count early on Monday. FT

- The Gaza peace plan talked about on Fri by Biden seems unlikely to be adopted (at least in the near-term) as Israel insists it will push ahead to achieve its full war objectives (two of Netanyahu’s far-right coalition partners threatened to quit his gov’t if the plan was adopted). NYT

- The U.S. economy continues to lose momentum. Growth hasn’t yet slowed to the point that it would be a concern to policymakers, but it might soon if current trends continue. WSJ

- The US housing market — long crippled by an inventory drought — is finally starting to see listings rise. But now, in many places, the buyers just aren’t showing up. Sellers are grappling with the fact that higher-for-longer rates are choking off demand during what’s typically the key season for the market. And more of those owners are cutting asking prices than any time since November 2022 as inventory grows stale, according to Redfin Corp. BBG

- Consumers have reached their limit following years of aggressive price hikes, and companies will be forced to become more promotional as a result. NYT

- 10% of registered Republicans were less likely to vote for Trump after the felony conviction (that same poll showed Biden with a 2-point lead among registered voters, up from a tie earlier in the month). RTRS

- MSCI said due to the significant size of Saudi Aramco’s secondary offering, MSCI intends to implement changes in MSCI indexes resulting from the offering, according to Reuters.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks opened higher and then extended on gains as the region reacted to the softer-than-expected US Core PCE data on Friday alongside the prospect of a potential Israel-Hamas deal brokered by the US. The broader chip sector in the region was supported by NVIDIA CEO Huang stating the Co. is to upgrade its AI accelerators every year, later followed by an update from AMD at the Computex event in Taipei. ASX 200 saw its upside led by a broader strength across energy and financials, whilst Australia’s Final Manufacturing PMI saw a modest revision higher from the prelim. Nikkei 225 briefly rose back above 39,000 with the upside also led by energy and financials, whilst capex data showed company profits surprisingly accelerated in Q1. India’s Nifty 50 opened sharply higher by almost 3.5% at a record high after exit polls pointed to a landslide win by PM Modi. Hang Seng and Shanghai Comp were mixed as the former soared at the open with heavyweight stocks Alibaba and Tencent among the top gainers, whilst the latter initially bucked the regional trend and lagged despite any major headlines aside from China stating it will not join the Swiss peace conference on Ukraine, although losses were briefly trimmed after the Chinese Final Manufacturing PMI was revised higher than expected.

Top Asian News

- Moody’s Ratings has raised China’s growth forecast to 4.5% (prev. 4.0%) for 2024, according to Reuters.

- PBoC injected CNY 2bln via 7-day reverse repos with the rate at 1.80%.

- China has allocated CNY 6.44bln for vehicle trade-in subsidies, according to CCTV.

- BoJ Executive Director Kato said BoJ has no plan to immediately unload its ETF holdings; and hopes to spend time examining how to unload BoJ’s ETF holdings in the future.

- Japanese MOF official said capex data reflects moderate economic recovery but attention is needed on corporate situation amid risks of global slowdown rising.

- Japanese Economy Minister Shindo states that real economic growth of 1.3% in FY 2025 is not so unrealistic, according to Reuters.

- Australia’s minimum wage and award wages will increase by 3.75% from July 1st, the Fair Work Commission has announced, via ABC.

- BoJ Quarterly Bond Markey Survey: index gauging bond market function at -24 (prev. -29), fifth consecutive quarter of improvement

European bourses, Stoxx 600 (+0.5%) are entirely in the green, continuing the price action seen in APAC trade overnight. Indices came under some slight selling pressure in the early portion of the morning, and has been choppy within today’s range. European sectors hold a strong positive tilt; Construction & Materials takes the top spot, joined closely by Retail, which is lifted by significant strength in JD Sports (+7.5%). Healthcare is the clear laggard, dragged down by GSK (-9.4%) on Zantac-related lawsuits. US Equity Futures (ES +0.2%, NQ +0.2%, RTY +0.9%) are modestly firmer, though with price action fairly contained thus far. In terms of pre-market movers, AMD (+1.3%) gains after unveiling a new MI325X accelerator chip, whilst Nvidia (+2.2%) benefits after its CEO said the Co. is to upgrade its AI accelerators every year. GameStop (+66.4%) surges pre-market after Roaring Kitty reveals a USD 116mln position in the Co.

Top European News

- Fed’s Kashkari (non-voter) said rates to stay on hold for an “extended” time, and added that the US economy is strong, the labour market is strong, and inflation is coming down, via an FT interview from May 27th (ahead of the blackout period) but published on Monday.

- NVIDIA (NVDA) CEO Huang stated the Co. to upgrade its AI accelerators every year. CEO said on Sunday that the Co. next-generation artificial intelligence chip platform, called Rubin, would be rolled out in 2026, according to Reuters.

- AMD (AMD) CEO unveiled new MI325X accelerator chip at Computex event in Taipei, to be available in Q4 2024, AMD CEO said the Co. is aiming for an annual cadence for AI chips.

FX

- DXY is incrementally firmer and within a tight 104.50-75 range as the index took a breather from Friday’s post-PCE volatility as it looks ahead to this week’s risk events, starting with US ISM Manufacturing later today.

- EUR is softer vs. the USD as we enter into ECB week, which is set to see the central bank deliver its first rate cut since September 2019. EUR/USD is yet to approach Friday’s 1.0811 low amid a potential lack in conviction for positioning ahead of upcoming risk events.

- GBP is a touch softer vs. both USD and EUR with not much in the way of pertinent UK newsflow as the BoE remains quiet in the run up to next month’s election. Cable is managing to hold above the 1.27 mark which coincides with Friday’s low.

- JPY is marginally outmuscling the USD with Japanese fundamentals not seeing much in the way of developments over the weekend. USD/JPY ran into support around the 157 mark.

- Antipodeans are both a touch softer vs. the USD with AUD unable to benefit from an upward revision to Chinese Caixin Manufacturing PMI. AUD/USD is currently in consolidation mode, respecting Friday’s 0.6626-0.6672 range and sitting just above its 10 and 21DMAs which both sit at 0.6635.

- EM FX: South Africa’s ANC lost its 30-year majority and as such, will now look to form a coalition (USD/ZAR -0.1%). Exit polls point to landslide victories for India’s Modi (USD/INR -0.4%) and Mexico’s Sheinbaum (USD/MXN +1.0%) with focus on whether the latter will be able to obtain a super-majority and enact policies which could be deemed as less market friendly.

- PBoC sets USD/CNY mid-point at 7.1086 vs exp. 7.2378 (prev. 7.1111)

Fixed Income

- USTs are firmer as Friday’s PCE momentum remains in the driving seat into the ISM Manufacturing PMI. Within this, the Prices Paid metric will draw scrutiny following the jump to 60.9 (prev. 55.8) which took it into strong expansion territory.

- A relatively contained start for Bunds holding onto Friday’s PCE-induced upside while APAC-session updates were unable to significantly move the dial; JGB action essentially just catch up to Friday.

- Gilts are in-fitting with peers but marginally outperforming EGBs, despite the lack of UK-specific newsflow, with the region’s final PMIs unable to spark any real reaction. Gilts as high as 96.61 with last week’s 97.13 high the next point of resistance.

- OAT price action follows the broader complex though with the magnitude of gains shy of its German-peer, likely a follow through from S&P downgrading France on Friday.

Commodities

- Crude prices headed lower in the aftermath of the of the OPEC+ meeting which outlined a future roadmap for the restoration of the supply from the voluntary cuts. In the European session, WTI/Brent have bounced off worst levels, albeit marginally so; Brent currently around USD 81.30/bbl.

- Precious metals are flat as the haven metals are torn between the stronger USD/constructive risk tone and a post-PMI downtick in yields. As it stands, XAU is unchanged at the mid-point of USD 2314-2331/oz parameters.

- Base metals are a touch firmer after the last 8/9 sessions have ended in the red. Albeit, upside is very modest thus far as the broader macro backdrop for the metal has not changed this morning despite two potentially bullish updates.

- JP Morgan is of the view that current oil prices are USD 8bbl too cheap and continues to make the bullish case for oil in Q3 amid its demand outlook. Anticipates global oil demand accelerating by 2.5mln BPD from end of April to the end of August. This would raise global refinery runs by 4mln BPD over the same period.

- Russia-China gas pipeline deal reportedly stalls over Beijing’s price demands, according to the FT. China is said to have asked to pay prices close to Russia’s subsidised domestic prices and would only commit to purchasing a smaller fraction of the Siberia 2 pipeline’s annual capacity, sources said.

- An oil refinery in northwest Russia near the city of Ukhta was operating normally after a fire broke out on Sunday, according to Reuters.

- South Korean President Yoon said a vast amount of oil and gas reserve possibly undersea off South Korea’s east coast; has approved exploration of possible oil and gas reserve; reserves could amount to up to 14bln barrels of oil and gas, according to Reuters.

- Magnitude 5.7 earthquake hit Antofagasta, Chile region, according to EMSC.

- Copper miners Freeport Indonesia has not received copper concentrate export permit extension, according to a spokesperson.

OPEC+

- OPEC+ has agreed to extend its collective production cuts, which total around 3.6mln BPD, until the end of 2025 (prev. until the end of 2024). Additionally, the eight states that implemented voluntary cuts of 2.2mln BPD will extend these cuts until the end of Q3 2024 (prev. Q2 2024, exp. at least Q3 2024), after which they will gradually increase production from October 2024 to September 2025, contingent on market conditions.

- Additionally, the UAE has been permitted to increase its production by 0.3mln BPD from 2025, according to Reuters.

- Baseline revisions have been pushed back a year to 2026. “That’s because some countries like Russia are under embargo and the independent companies are not able to have access to data to support the assessment process.”, according to Energy Intel’s Bakr.

- “Under the agreement today there are no barrels that are immediately going to be added to the market. The partial return of the voluntary cuts in q4 this year is subject to market conditions. The agreement also does not stray away from the cautious path the group has been following. Even the possible return of the voluntary cuts is being done cautiously.”, according to Energy Intel’s Bakr.

- Saudi Energy Ministry said 2.2mln bpd voluntary oil cuts are to be extended till September and to be gradually phased out on a monthly basis till Sept 2025, according to Reuters citing a statement. Saudi Energy Ministry said the gradual monthly phase-out may be reversed according to market conditions, and added OPEC meeting welcomes Iraq, Russia, and Kazakhstan’s renewed commitment to adhere to OPEC production cuts. Saudi Energy Ministry said the OPEC meeting also welcomes Iraq, Russia, and Kazakhstan’s plan to resubmit their updated compensation for overproduction since January 2024 before the end of June, the statement said.

- Saudi Energy Minister said discussions among eight countries implementing voluntary cuts started two or three weeks ago, and “we are waiting for interest rates to come down, better trajectory of global growth, that would probably cause demand to increase with a clear path”, according to Reuters. Saudi Energy Minister said some ministers gathered in Riyadh to make sure they interacted with each other and the message was comprehensively understood and agreed upon.

Bank commentary on OPEC+

- Barclays says the OPEC+ outcome was mildly negative on net relative to their baseline balances view; given recent compliance numbers Barclays’ oil balances would be 500k/BPD tighter in H2 and looser by 550k/BPD in 2025.

- UBS says OPEC+ announcement “could be seen as slightly bearish oil for very near term but decisions taken also reduce downside risk in the medium-term”. Announcement does not change near-term outlook for oil. Sees oil supply deficit of 1.2 MB/D in Q3’24, expect it to support prices over the next few weeks; lifting Bren to “mid to high USD 80s”.

Geopolitics: Middle East

- Israel PM Netanyahu’s office reportedly conveyed to Ben Gvir a message that contrary to President Biden’s words, there is no clause in the draft agreement that includes stopping the war, and that the other clauses will not constitute a “surrender deal.

- Israeli PM aide confirmed on Sunday that Israel had accepted a framework deal for winding down the Gaza war being advanced by US President Biden, according to Reuters. The aid however described the plan as flawed and in need of much more work. The aide added that Israeli conditions, including “the release of the hostages and the destruction of Hamas” have not changed.

- Hamas said they view US President Biden’s latest proposal for a ceasefire as ‘positive’ and affirmed its readiness to deal positively with any proposal that offers a permanent ceasefire, complete withdrawal of Israeli forces from Gaza, reconstruction of the strip, return of displaced and a ‘serious’ hostage exchange, according to Reuters.

- Axios’ Ravid posts “Israeli officials told me the Israeli hostage deal proposal President Biden presented in his speech exhausted Israel’s manoeuvring space. There will not be a better one. If Hamas rejects it, the conflict will likely escalate.”

- Qatar, the US, and Egypt jointly called on Hamas and Israel to finalise the agreement embodying the principles outlined by US President Biden, according to a joint statement.

- Israeli Defence Minister said in any process to bring about the end of the war, Israel will not accept the rule of Hamas in Gaza, according to Reuters.

- Israeli Finance Minister Smotrich called for the Gaza offensive to be pursued until Hamas is destroyed and all hostages are rescued, saying he would not stay in government otherwise, according to a post on X.

- Israeli National Security Minister Ben-Gvir threatened to bring down the coalition government if PM Netanyahu agreed to a deal that would include ending the war without eliminating Hamas, according to a post on X.

- US National Security spokesperson Kirby said the US has every expectation that if Hamas agrees to the proposal, then Israel will say yes, according to an ABC News interview.

- Yemen’s Houthis said they conducted six military operations including targeting a US aircraft carrier and destroyer, and added they targeted ‘Maina ship, Aloraiq ship and Abliani ship’, according to Reuters.

- US CENTCOM said On June 1, it destroyed one Iranian-backed Houthi uncrewed aerial system (UAS) in the southern Red Sea, and also observed two other UAS crash into the Red Sea. No injuries or damage were reported. Additionally, USCENTCOM forces successfully engaged two Houthi anti-ship ballistic missiles in the southern Red Sea, according to Reuters.

- Israeli PM Netanyahu has accepted an invitation to address both houses of the US Congress, according to Reuters.

- Airstrikes said to hit a copper factory in Aleppo, Syria, according to Times of Israel; cites a post showing at least three explosions in quick succession; cites another post noting “This area has a huge presence for the Iranian militias and Hezbollah”. “Al-Arabiya sources: Raids likely to be Israeli targeting northern Aleppo”, according to Al-Arabiya

RUSSIA-UKRAINE

- Ukrainian President Zelenskiy said he received a signal from China they will not take part in the peace summit, according to Reuters.

- Russian Defence Ministry said Russia struck Ukraine’s energy facilities working for the military-industrial complex, and hit depots with Western weapons, according to RIA.

- Russia has announced plans to raise taxes on businesses and the wealthy amid the need for additional revenue to fund the war in Ukraine, according to Sky News.

CHINA-TAIWAN

- Chinese Defence Minister, at the Shangri-La dialogue, said China will take resolute actions to curb Taiwan’s independence and make sure such a plot never succeeds, and anyone who dares to separate Taiwan from China will only end up in self-destruction. He added China stays committed to peaceful reunification, however, this prospect is increasingly being eroded by separatists for Taiwan’s independence and foreign forces, according to Reuters.

- Taiwan government reiterated Taiwan has never been a part of the People’s Republic of China and added that China has repeatedly openly threatened Taiwan with force at international events, whilst maintaining peace in the Taiwan Strait is the common responsibility of both sides of the strait, according to Reuters.

OTHERS

- China State Security Ministry alleges British Secret Intelligence Service MI6 turned two staff members of Chinese central state organs to spy for the British government, according to a ministry statement.

- North Korea is to temporarily suspend sending balloons carrying trash, but will resume if South Korea sends anti-North Korea leaflets, according to KCNA citing the North Korean Vice Defence Minister.

US Event Calendar

- 09:45: May S&P Global US Manufacturing PM, est. 50.9, prior 50.9

- 10:00: April Construction Spending MoM, est. 0.2%, prior -0.2%

- 10:00: May ISM Manufacturing, est. 49.6, prior 49.2

- 10:00: May ISM Employment, prior 48.6

- 10:00: May ISM New Orders, prior 49.1

- 10:00: May ISM Prices Paid, est. 59.5, prior 60.9

- May Wards Total Vehicle Sales, est. 15.8m, prior 15.7m

DB’s Jim Reid concludes the overnight wrap

It’s a busy morning for the EMR with DB Research launching our latest World Outlook and with the start of the month bringing us our usual performance review which Henry has just published. With regards to the World Outlook “Optimism with uncertainties ahead”, the tone is optimistic across economies and asset markets. Like most others we thought the US would experience a recession last year and when it didn’t happen, we upgraded our US growth numbers considerably in January to the top end of street forecasts for the next couple of years. Nearly 6 months on and our US forecasts remain similar, but we’ve upgraded Euro Area GDP for 2024 by half a percent to 0.9% for 2024. The big uncertainty is the US election with plenty of risks to the growth, inflation, and Fed outlook from the results. In China, our economists upgraded 2024 growth to 5.2% in April which remains unchanged while in Japan growth should stay above trend for the next couple of years which helps us be more hawkish on the BoJ than the market. India continues to be the standout with a minimum of 6-6.5% real GDP growth and 10-11% nominal growth over the next several years. The report also includes all our strategist latest forecasts for YE 24 and into 2025. See the piece here.

Since it’s the start of the month, we’ve also just released our monthly performance review for May and YTD. Most assets rebounded after a weak April with the S&P 500 and STOXX 600 reaching new records during the month. A late surge in the last 20 minutes of month-end trading on Friday helped the S&P 500 regain some poise after a more challenging last week of the month. See the performance review here.

Moving forward, it’s another payrolls week with DB (+200k) and consensus (+190k) expecting job gains to pick up from last month’s +175k number with unemployment widely expected to stay at 3.9%. Our economists think the risks are biased to it rounding down a tenth rather than up. The JOLTS data tomorrow is many people’s preferred employment measure but it’s always a month lagged to payrolls which reduces the impact. The employment components of May’s ISM indices (today for manufacturing and Wednesday for services) will also help fine tune expectations for payrolls. At the index level, our US economists see the manufacturing gauge moving from 49.2 to 49.4 in May and the services one expanding to 50.4 from 49.4 in April. See the week ahead at the end for the rest of the US data releases.

In Europe, all eyes will be on the ECB decision on Thursday, where our European economists expect a 25bps cut with markets pricing in a 96% probability. Their preview is here with all eyes on how they signal the path after this meeting. The Bank of Canada meet beforehand on Wednesday with expectations that they stay on hold for now. In terms of European data, various final PMIs are out this week alongside Germany factory orders (Thursday), industrial production (Friday), and the trade balance (Friday). Elsewhere, there will be the French trade balance data (Friday) and industrial production (Wednesday), Swiss CPI (tomorrow), as well as retail sales for the Eurozone and Italy (Thursday).

Elsewhere we have the presidential elections result in Mexico after yesterday’s election with Sheinbaum set for a landslide victory according to exit polls (BBG) just released. Staying with elections we have the important European Parliamentary elections between June 6-9 (see our econ preview here) and the results of India’s general elections will be counted tomorrow. Exit polls show a resounding win with a predicted seat range of 350-400 for Narendra Modi’s BJP-led NDA coalition which would likely be seen as supportive for the current policy regime after Indian assets had underperformed over the last month. They need 272 for a majority and more than 352 to better the 2019 outcome. See DB’s exit poll reaction piece here. As I type Indian equities have opened around +2.75% higher.

It will be interesting to see the reaction in French bond markets this morning after S&P downgraded from AA to AA- on Friday night due to the Government’s failure to restrain the deficit post Covid. This also may impact the European Parliamentary elections as National Rally’s Le Pen has already seized on it over weekend campaigning.

Asian equity markets are mostly rallying as we start a new month helped by the upbeat manufacturing PMI data coming from the region’s top economies. The Hang Seng (+2.18%), KOSPI (+2.01%) and Nikkei (+0.94%) are all higher but with mainland Chinese stocks lagging with the CSI (-0.15%) and the Shanghai Composite (-0.51%) edging lower. S&P 500 (+0.22%) and NASDAQ 100 (+0.27%) futures are higher and yields on 10yr USTs are -1.5bps lower at 4.48% as I type.

Coming back to the region’s PMI data, China’s Caixin S&P manufacturing PMI rose from 51.4 in April to 51.7 in May (51.6 expected), recording the fastest pace since June 2022. Meanwhile, South Korea’s PMI also rose to 51.6 in May, its highest reading since May 2022 and entering expansionary territory after staying below 50 for the past two months.

Yesterday OPEC+ announced that it would be extending production cuts into 2025 and laid out plans for phasing out voluntary cuts towards the end of the year. Oil is broadly unchanged this morning.

Looking back on last week now and it was another a big week for inflation data, with the US April PCE data on Friday the star of the show. Headline PCE came in line with expectations at +0.3% month-on-month, and +2.7% year-on-year. Similarly, core PCE posted at +0.2% month-on-month, and +2.8%, as expected. On the other hand, real personal spending unexpectedly contracted, falling -0.1% (vs +0.1% expected), down from +0.5% in March, potentially indicating a flagging US consumer.

Despite the weak personal spending data, the PCE inflation numbers helped raise the amount of rate cuts expected this year, with an additional +2.9bps of cuts expected by year-end on the week (and +1.8bps Friday). The prospect of more rate cuts lent support to US fixed income, as 2yr yields fell -7.3bps last week (and -5.2bps on Friday). 10yr yields likewise slipped on Friday, down -4.8bps, but failed to fully erase earlier losses (+3.4bps last week).

Over in Europe, the inflation story was a touch more concerning. The May flash HICP came in above expectations at +2.6% year-on-year (vs +2.5% expected). The core number also surprised to the upside at +2.9% (vs +2.7% expected). In response, markets casted some doubt on how aggressively the ECB will cut over the next months. As such, the amount of rate cuts priced in by overnight index swaps by December fell -7.3bps on Friday, leaving the expected rate -3.3bps lower in weekly terms. This saw yields on 10yr bunds rise +1.2 bps on Friday, adding to the selloff earlier in the week that followed on from a hotter than expected German inflation print last Wednesday, which sent yields up +8.1bps on the week.

US Equities staged a very late month-end comeback on Friday after trading lower much of the day as the personal spending data hinted at a weakening US consumer. In the final hour of trading the S&P 500 rallied nearly a full percentage point to finish +0.80 higher on the day. This made up for some of the week’s earlier losses, leaving the index down -0.51% in weekly terms. The NASDAQ saw a similar rebound, having been down -1.75% near the European close before rallying to finish just below unchanged (-0.01%) on the day and -1.10% on the week. Indeed, tech was dragged down by weakness in the cloud software sector, with the likes of Salesforce slipping -15.78% following a weak earnings report. The Russell 2000 index of small cap stocks fared somewhat better than both the S&P 500 and the NASDAQ, outperforming on Friday (+0.66%), and gaining marginally (+0.02%) last week. In Europe, the STOXX 600 fell -0.46% but retraced some losses on Friday after rising +0.32%.