Authored by Lance Roberts via RealInvestmentAdvice.com,

The future of electricity demand for everything from electric cars to Bitcoin mining to artificial intelligence may also be the cure for our debt concerns.

Before you dismiss that statement, let me explain.

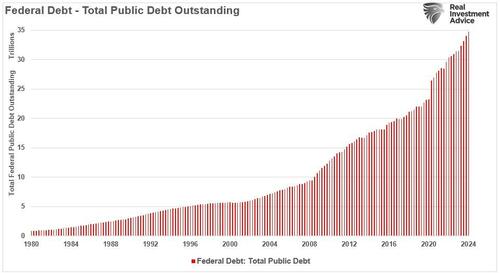

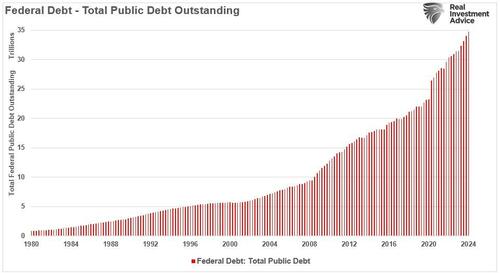

One of the bears’ primary arguments against the financial market and the economy’s health is what is perceived as the surging increase in Government debt. That increase in debt supports their frantic calls for the “end of the dollar,” economic disruption, and essentially the demise of the U.S. as a global power. Looking at the increased Government debt in a vacuum, you can understand the concern.

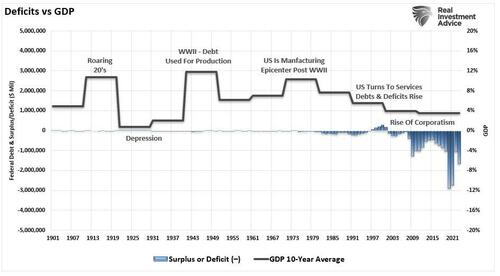

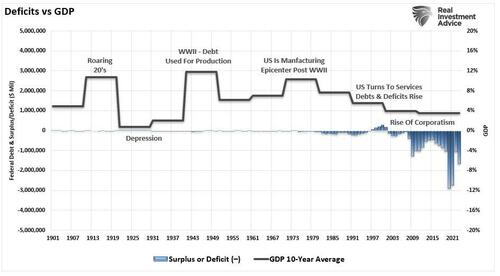

Of course, the increase in federal debt results from excess government spending, particularly since the pandemic-related shutdown. We see the surge in the federal deficit, the largest since the financial crisis and the most significant deficit outside of a wartime economy.

It is also notable that economic growth has slowed markedly as both debts and deficits have increased. That decrease in economic growth is an essential point of our discussion.

In “40-Years Of Economic Erosion,” we discussed the difference between productive and unproductive debt. To wit:

“The problem is that these progressive programs lack an essential component of what is required for ‘deficit’ spending to be beneficial – a ‘return on investment.’

Country A spends $4 Trillion with receipts of $3 Trillion. This leaves Country A with a $1 Trillion deficit. In order to make up the difference between the spending and the income, the Treasury must issue $1 Trillion in new debt. That new debt is used to cover the excess expenditures but generates no income leaving a future hole that must be filled.

Country B spends $4 Trillion and receives $3 Trillion income. However, the $1 Trillion of excess, which was financed by debt, was invested into projects, infrastructure, that produced a positive rate of return. There is no deficit as the rate of return on the investment funds the “deficit” over time.

There is no disagreement about the need for government spending. The disagreement is with the abuse and waste of it.

John Maynard Keynes’ was correct in his theory that in order for government ‘deficit’ spending to be effective, the ‘payback’ from investments being made through debt must yield a higher rate of return than the debt used to fund it.

Currently, the U.S. is ‘Country A.”‘

Read that carefully, as electricity demand may provide that needed change to the debt dynamic.

Electricity Demand To Surge

As noted, the United States power grid has lacked sufficient investment to handle the increasing burdens of electricity demand in previous years. It isn’t just a growing population that needs more housing, mobile phones, laptops, and computers. However, adding electric vehicles, bitcoin mining, and artificial intelligence will overwhelm the current electricity supply in the U.S.

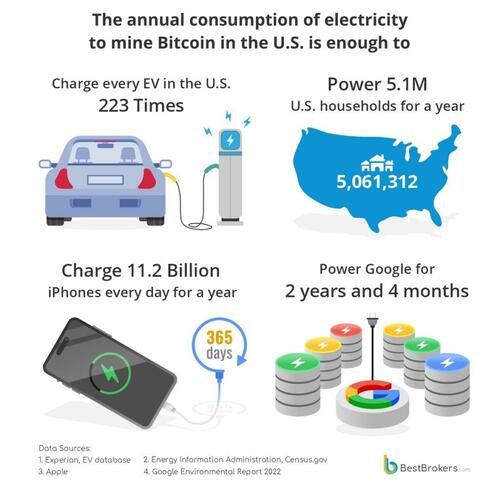

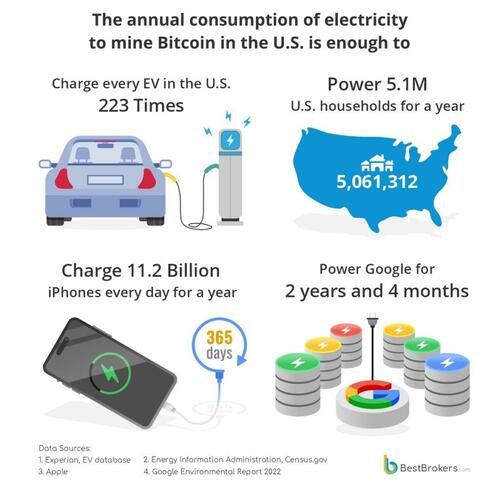

For example, bitcoin mining demands an extreme amount of electricity. As noted by Paul Hoffman in Bitcoin Power Dynamics:

“The daily consumption of 145.6 GWh for Bitcoin mining in the U.S. is about 1.34% of the total daily power consumption in the country. Despite the small percentage this is still an enormous amount of electricity, keeping in mind that the U.S. is a heavily-industrialized country consuming a lot. When we extrapolate this daily consumption to a year, we get 53,144 GWh.”

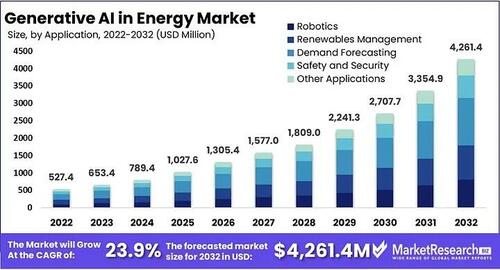

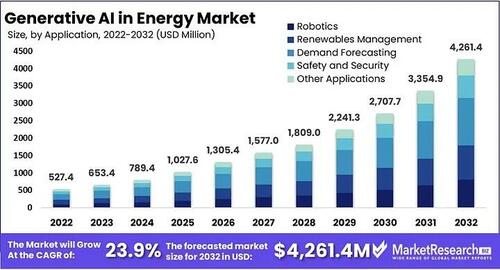

Bitcoin mining is a relatively small industry with a large footprint on electricity demand. However, “generative artificial intelligence (AI)” is a different beast. According to S&P Global Commodity Insights, the electricity needed for AI remains unclear, but the technology will lead to a significant net increase in US power consumption. Medium recently had some charts detailing that growth.

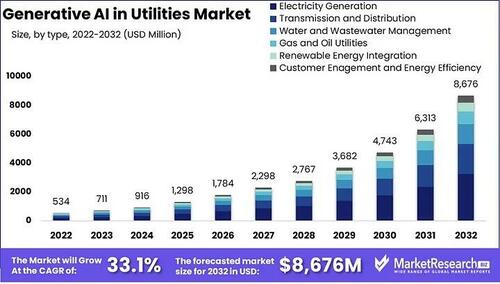

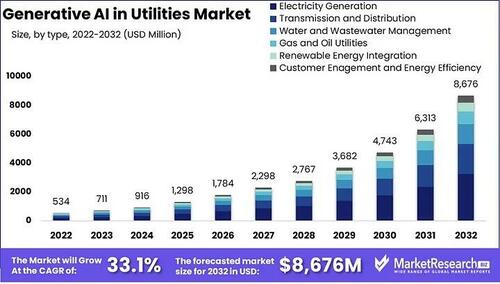

“AI energy demand is projected to surge from approximately $527.4 million in 2022 to a substantial $4,261.4 million by 2032, with a robust compound annual growth rate (CAGR) of 23.9% from 2023 to 2032.” – Medium.

“Simultaneously, the Utility Market is expected to experience even more significant expansion, increasing from $534 million in 2022 to a substantial $8,676 million by 2032, driven by a remarkable CAGR of 33.1% from 2023 to 2032.”

As S&P points out:

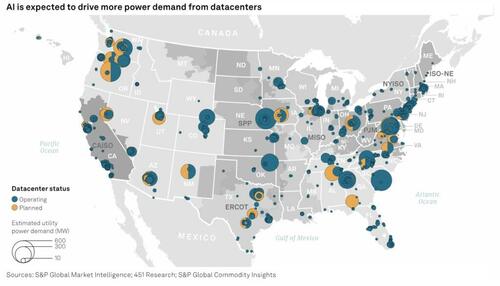

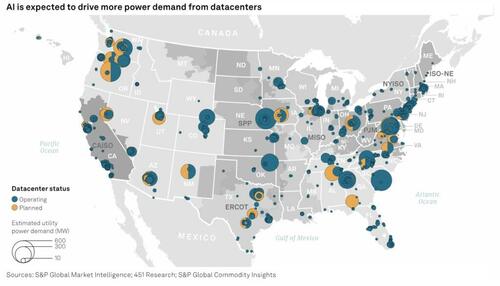

“Power demand from operational and currently planned datacenters in US power markets is expected to total about 30,694 MW once all the planned datacenters are operational, according to analysis of data from 451 Research, which is part of S&P Global Market Intelligence. Investor-owned utilities are set to supply 20,619 MW of that capacity. To put those numbers into perspective, consider that US Lower 48 power demand is forecast to total about 473 GW in 2023, and rise to about 482 GW in 2027.”

So, what does this have to do with the debt?

Growing Our Way Out

We have used deficit spending for decades to fund social welfare programs. Those programs have a long-term negative multiplier on economic growth. However, the future requires building an electricity infrastructure, which is a different dynamic. However, using deficit spending for projects with a “return on investment,” such as power production (geothermal, nuclear, tidal) or broadband, which users pay a fee to consume, is valid. This is because the long-term revenue generated by these projects repays the debt over time. Furthermore, these projects are labor intensive, creating demand for jobs, commodities, and capital expenditures.

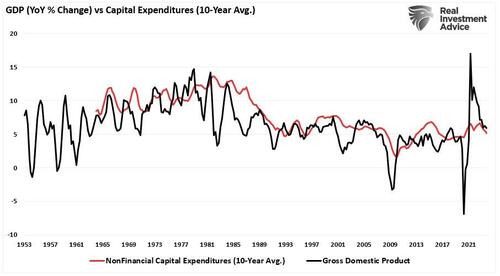

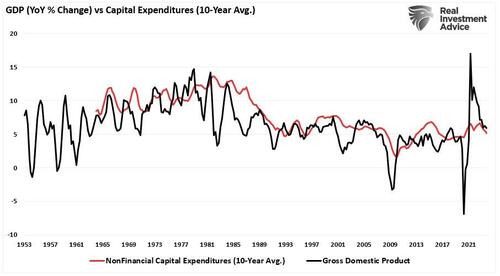

Since 1980, capital expenditures (CapEx) have dropped as economic growth slowed. The chart shows the 10-year average annual change in CapEx vs. GDP. If economic growth (primarily consumption) is slowing, then the demand to expend CapEx is also reduced. This is because corporations seek out cheaper alternatives such as offshoring, productivity increases, and wage suppression.

However, building infrastructure is very labor-intensive, and CapEx is labor—and investment-intensive. Those dynamics change the economic growth dynamic.

While corporations increase capital investment to build the power supply, the Government will likely enter the fray with further infrastructure-focused spending bills. This is because AI is a critical component of ensuring the defense and national security of the United States. However, instead of issuing debt to spend on domestic welfare programs, the debt used in infrastructure will create economic growth through labor creation.

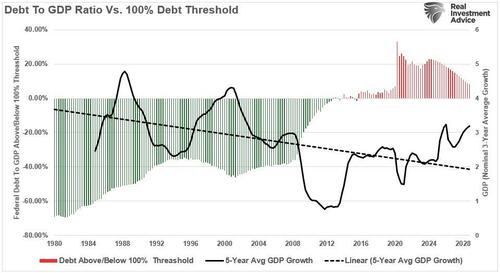

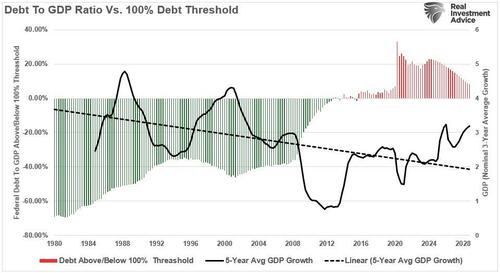

The chart below assumes we will continue to issue debt at the average quarterly pace since 2021. However, instead of wasting money, we focus on productive investments while maintaining all current spending programs and obligations. Assuming some conservative growth estimates resulting from the investments, the “debt to GDP” ratio will begin declining in 2026 and revert to more sustainable levels by 2030.

Conclusion

While the bears constantly ring the alarm bell about the current level of debt and deficits, the more dire economic consequences they forecast may fail to come to fruition.

As noted by Goldman Sachs:

“Generative artificial intelligence has the potential to automate many work tasks and eventually boost global economic growth. AI will start having a measurable impact on US GDP in 2027 and begin affecting growth in other economies worldwide in the following years. The foundation of the forecast is the finding that AI could ultimately automate around 25% of labor tasks in advanced economies and 10-20% of work in emerging economies.”

They currently estimate a growth boost to GDP from AI of 0.4 percentage points in the US.

Increases in productivity, productive capital investment, and increased labor demand for the infrastructure buildout (which will also result in higher wages) should provide the economic boost needed.

Will it solve all of the current socio-economic ills facing the U.S.? No. However, it may provide the growth boost necessary to revitalize economic growth and prosperity in the U.S., which we have not seen since the 1970s.

It may also just be enough to keep the demise of the U.S. from occurring any time soon.