Payrolls Rise 206K After Huge Downward Revisions As Unemployment Rate Jumps To Three Year High

It appears that Biden’s apparatchiks refuse to give up on the myth of a “strong labor market” just yet even as they admit to anyone who reads between the lines just how ugly things are getting.

Moments ago the BLS reported that in June the US added 206K jobs, above the 190K expected.

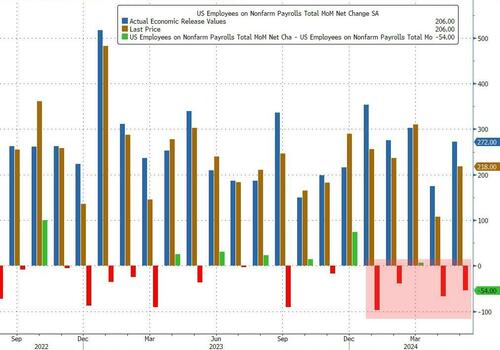

Not bad, especially with Goldman expecting 140K. Of course, a quick glance reveals where the “beat” came from: both previous months were revised sharply lower:

- May jobs revised from 272K, to 218K

- April jobs revised from 165K to 108K

With these revisions, employment in April and May combined is 111,000 lower than previously reported. So yes, it is easy to “beat” when you have a pool of 111K jobs that never existed to push into this month. And course, next month when the June data is revised lower, the 206K beat will be revised to a sub 190K miss but by then it will be too late. And as shown in the chart below, 4 of the past 5 months have seen payrolls revised lower.

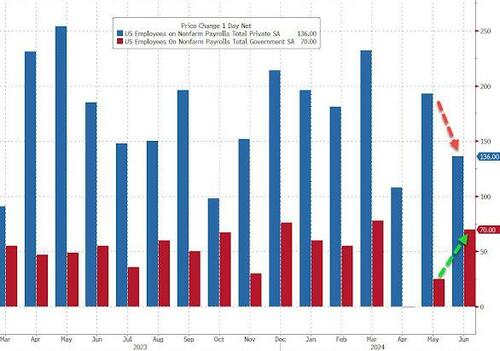

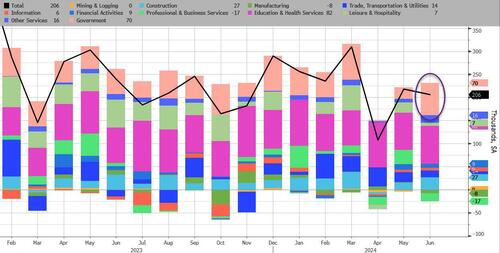

Not only that but the composition of jobs was once again dismal and followed the same gimmick the BLS used for its “strong” JOLTS report this week: private sector workers came in at 136K, well below the 160K expected and down from a downward revised 193K (was 229K). The gap was filled by – what else- deep stater and other government workers, as government payrolls jumped from 25K to 70K!

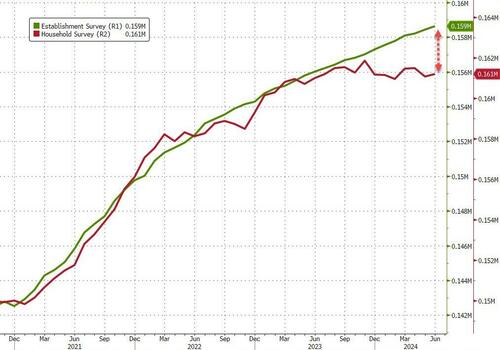

The good news is that unlike last month when the number of employed workers actually plunged again leading to a a record gap between the Establishment and Household Surveys, in June at least the number of employed workers rose by 116K. Which however means that the gap between the two series rose by another 90K!

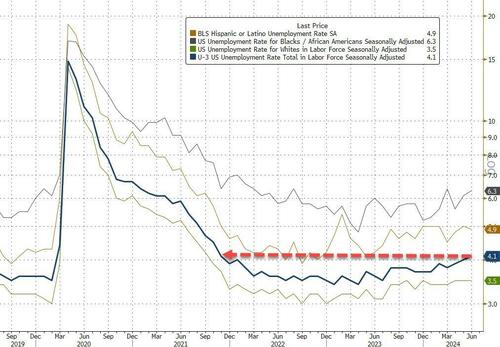

Turning to the unemployment rate, there was a big surprise here because contrary to expectations of a flat print, the number rose to 4.1%, up from 4.0% in May and the highest print since November 2021!

Among the major worker groups, the unemployment rates for adult women (3.7 percent) and Asians (4.1 percent) increased in June. The jobless rates for adult men (3.8 percent), teenagers (12.1 percent), Whites (3.5 percent), Blacks (6.3 percent), and Hispanics (4.9 percent) showed little or no change over the month.

Some more stats from the latest jobs report:

- The number of long-term unemployed (those jobless for 27 weeks or more) rose by 166,000 to 1.5 million in June. This measure is up from 1.1 million a year earlier. The long-term unemployed accounted for 22.2 percent of all unemployed people in June.

- The labor force participation rate changed little at 62.6 percent in June, and the employment-population ratio held at 60.1 percent. These measures showed little or no change over the year.

- The number of people employed part time for economic reasons, at 4.2 million, changed little in June.

- The number of people not in the labor force who currently want a job declined by 483,000 to 5.2 million in June. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of people marginally attached to the labor force, at 1.5 million, was essentially unchanged in June. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, edged down to 365,000 in June.

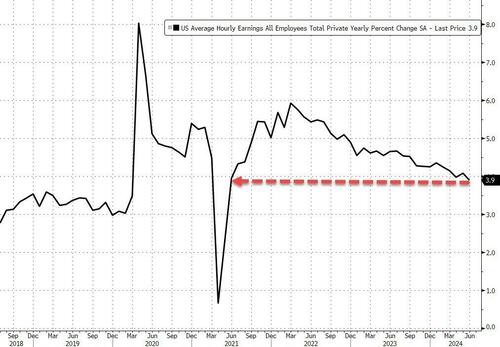

Turning to hourly earnings, here too there was continued slowing with the average hourly earnings number rising 3.9% YoY, down from 4.1% in May and in line with expectations. On a monthly basis, the print also slower to 0.3%, down from 0.4% in May.

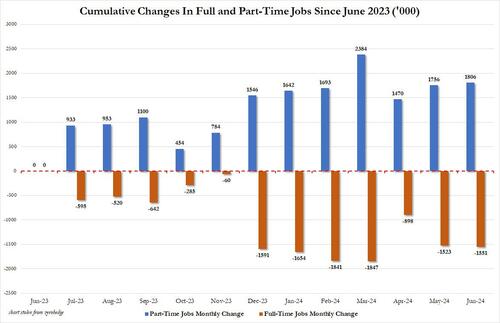

In keeping with the BLS’ other favorite gimmick of representing part-time jobs growth as the primary driver of the US labor market, in June, the number of part-time workers rose 50K to 28.1 million while full-time workers dropped by 28K. This means that since June 2023, the US has added 1.8 million part-time jobs and lost 1.6 million ful-time jobs.

Finally, looking at the various industries, we find that the bulk of jobs growth in June was on the back of government workers, which as is well-known, do not actually produce anything but are a drain of US wealth and merely serve to redistribute income. Here is the full breakdown:

- Government employment rose by 70,000 in June, higher than the average monthly gain of 49,000 over the prior 12 months. Over the month, employment increased in local government, excluding education (+34,000) and in state government (+26,000).

- Health care added 49,000 jobs in June, lower than the average monthly gain of 64,000 over the prior 12 months. In June, employment rose in ambulatory health care services (+22,000) and hospitals (+22,000).

- Employment in social assistance increased by 34,000 in June, primarily in individual and family services (+26,000). Over the prior 12 months, social assistance had added an average of 22,000 jobs per month.

- Construction added 27,000 jobs in June, higher than the average monthly gain of 20,000 over the prior 12 months.

- Retail trade employment changed little in June (-9,000), after trending up earlier in the year. Furniture, home furnishings, electronics, and appliance retailers lost 6,000 jobs over the month, while warehouse clubs, supercenters, and other general merchandise retailers gained 5,000 jobs.

- Employment in professional and business services changed little in June (-17,000) and has shown little change over the year. And the best leading indicator for jobs: temp-help services employment declined by 49,000 over the month and is down by 515,000 since reaching a peak in March 2022.

Commenting on the jobs report, Rubeela Farooqi, chief US economist at High Frequency Economics said that “Overall, a moderation in payrolls in Q2 coupled with a rise in the unemployment rate and a slower growth path suggested by recent data bolster the case for rate cuts this year. We think the Fed could certainly start the discussion about cutting rates at the upcoming FOMC meeting, and lower the policy rate in September, if the data continue to show moderation.”

And here is Seema Shah, chief global strategist at Principal Asset Management:“The equity market may be a little conflicted how to respond to today’s jobs report. On one hand, the downward revisions to prior months and the rise in the unemployment rate raises the odds of a September Fed rate cut – bond markets are certainly celebrating this. But those same figures cannot help but prompt a twinge of concern about the direction of the US economy. The broad host of economic data all point to a softening – today’s report adds to that picture.”

However, the bigger take home message here besides the timing of the next Fed cut which will come – just a matter of when – is that the Biden BLS is now clearly expecting to dump the mother of all disastrous job report realities on the Trump admin, which will come in just in time to have to revise the actual number of jobs lower by several million.

Tyler Durden

Fri, 07/05/2024 – 08:49

via ZeroHedge News https://ift.tt/mAMBkhT Tyler Durden