Stock Fragility Is The Highest On Record

One way to describe the recent action in tech stocks (and Mag7 in particular) is one constant, unyielding meltup triggered by a short and gamma squeeze, record stock buybacks and FOMO among the momentum-chasing retail. Another way is to paraphrase what BofA’s derivatives team called it in its latest Equity Volatility note (available to pro subs in the usual place): unprecedented fragility.

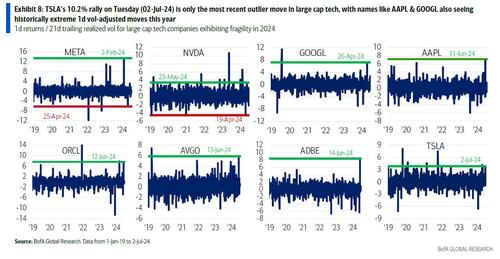

As BofA’s Benjamin Bowler writes, large cap tech continues to exhibit fragile price action, as last week saw positive delivery numbers from Tesla power it to a ~25% return in 3 days, which included a 10.2% 1-day rally (4x its trailing 1m realized vol). However, with the move on this known catalyst being twice as large as the straddle cost last week, options drastically underpriced the fragility risk.

This occurrence is not an isolated one, and was only the most recent outlier move in large cap tech, with the likes of Apple, Oracle and Alphabet recently seeing close to their most extreme 1d vol-adjusted moves over the last 5 years.

As BofA further notes, earnings moves in tech within the largest 50 S&P stocks have been more extreme than straddle costs over 60% of the time this year so far, especially so since May (with 8 of 10 earnings straddles breaking even).

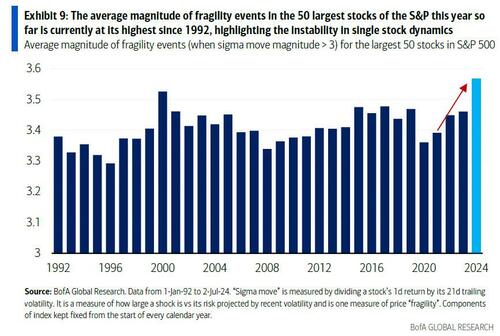

This continuation of unstable price action underscores a key observation that the bank’s generally cautious derivatives team has made in recent weeks: single stock fragility is rising, particularly around earnings & other events that provide some degree of forward guidance (see Volatility suggests AI isn’t a bubble…yet and 18-Jun-24 GEVI). Indeed, as the next chart shows, the average magnitude of fragility events in the largest stocks of the S&P is currently at its most extreme since 1992, which means the instability of single-stock dynamics is off the charts and once the current meltup fizzles, the hangover will be brutal.

Aside from this, and despite the repeated signs of fragility, options markets – particularly in large cap tech – continue to underprice fragility risk going into events. In the case of Tesla last week, its move on Tuesday (02-Jul-24) alone was almost twice as big as the cost of its straddles on the day prior to announcement (which was a pre-telegraphed catalyst).

More generally, as noted above, tech companies in the Top 50 largest stocks of the S&P have realized bigger moves on earnings than the cost of their respective weekly straddles more than 60% of the time this year, with the 10 largest tech companies seeing this hit rate reach 70%. These realized moves have been particularly extreme since May this year, with 8 out of 10 moves being larger than the straddle cost.

Hence, as the next earnings season approaches, and given the tendency to underprice risk, BofA’s derivatives desk is urging clients to use options directionally to navigate single stock risk over coming weeks. The combination of a rise in idiosyncratic risk and the highest large cap stock fragility in 30+ years makes using the limited risk and asymmetric profile of optionality especially prudent, in BofA’s view.

More in the full BofA’s note available to pro subs.

Tyler Durden

Wed, 07/10/2024 – 16:40

via ZeroHedge News https://ift.tt/X4il81R Tyler Durden