Pepsi Warns US Snack Demand “Subdued” As Consumer Slowdown Worsens

PepsiCo reported weaker-than-expected revenue growth in the second quarter on Thursday as consumers dialed back snack spending. The junk food giant tempered its full-year outlook on a more challenged consumer. This reflects a broader consumer slowdown trend, particularly impacting working-poor households amid elevated inflation and high interest rates.

CEO Ramon Laguarta wrote in a filing that the company’s North American snack demand was “subdued” during the second quarter and noted sales volumes declined.

On a call with investors, Laguarta said customers across all income brackets are reducing snack spend and trading down to store brands.

“In the US, there is clearly a consumer that is that is more challenged,” the CEO said. This suggests the cumulative impact of several years of price hike has pushed consumers over the edge.

The maker of Lay’s chips and Gatorade reported organic revenue of 1.9% in the second quarter, missing the 2.9% average estimate of analysts tracked by Bloomberg.

The volume of food products sold in the quarter fell 2% from a year earlier, including sizeable drops in Frito-Lay and Quaker Foods businesses in the North American market.

Here’s a snapshot of the second quarter results (courtesy of Bloomberg):

Core EPS $2.28 vs. $2.09 y/y, estimate $2.15 (Bloomberg Consensus)

Net revenue $22.50 billion, +0.8% y/y, estimate $22.59 billion

Revenue by region in the quarter:

Frito-Lay North America revenue $5.87 billion, -0.5% y/y, estimate $5.94 billion

Quaker Foods North America revenue $561 million, -18% y/y, estimate $588.2 million

PepsiCo Beverages North America revenue $6.81 billion vs. $6.76 billion y/y, estimate $6.86 billion

Europe revenue $3.52 billion, +2.5% y/y, estimate $3.47 billion

Latin America revenue $3.05 billion, +6.6% y/y, estimate $3.08 billion

Africa, Middle East & South Asia revenue $1.59 billion, +1.5% y/y, estimate $1.55 billion

Asia Pacific, Australia, New Zealand & China revenue $1.10 billion, -2.1% y/y, estimate $1.1 billion

Organic revenue growth by region:

Organic revenue growth +1.9%, estimate +2.89%

Quaker Foods North America organic revenue -18%, estimate -14.1%

PepsiCo Beverages N. America organic revenue change +1%, estimate +1.61%

Latin America organic revenue +2%, estimate +7.04%

Europe organic revenue +7%, estimate +7.77%

Asia Pacific, Australia and New Zealand and China Region organic revenue +1% vs. +7% y/y, estimate +3.14%

Africa, Middle East and South Asia organic revenue +12%, estimate +6.28%

Food volumes:

Total convenient foods volume -2%

Frito-Lay North America volume -4%

Quaker Foods North America volume -17%

Latin America convenient foods volume -6%

Europe convenient foods volume +5%

Africa, Middle East and South Asia convenient foods volume +1%

Asia Pacific, Australia and New Zealand and China region convenient foods volume -1%

Beverages:

PepsiCo Beverages North America volume -3%

Latin America beverages volume +2%

Europe beverages volume +1%

Africa, Middle East and South Asia beverages volume +2%

Asia Pacific, Australia and New Zealand and China Region beverages volume +1%

EPS $2.23 vs. $1.99 y/y, estimate $2.14

For the full-year outlook, forecasts were tempered. Execs now expect organic revenue growth of around 4% for the year compared with “at least 4%” in previous forecasts.

-

Sees organic revenue +4%, saw at least +4%, estimate +3.91%

-

Still sees core EPS at least $8.15, estimate $8.16

Shares of PepsiCo dropped as much as 3.4% but have since clawed back some losses. Prices earlier were at the lowest intraday level since October. The stock has fallen 4% year-to-date.

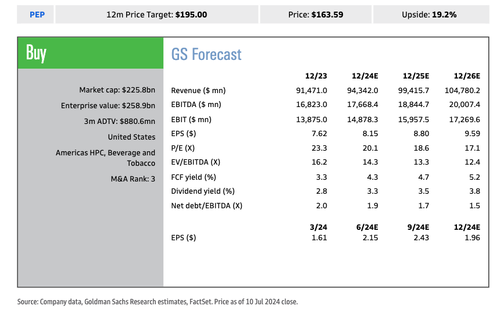

For a more in-depth analysis of PepsiCo’s earnings, Bonnie Herzog from Goldman offers her take:

PEP delivered mixed Q2 results, with softer than expected organic revenue growth that was more than offset by strong gross margin expansion, leading to a nice EPS beat. Given the slightly softer than expected topline, mgmt updated its FY24 organic sales growth guidance range to ~4% (vs prior of at least 4%) – which we believe was broadly anticipated based on conversations with investors ahead of the print, and should be viewed as more realistic given the tough first half. Mgmt’s updated guidance implies a step up in 2H organic sales growth to ~5.5% (vs ~2.5% in 1H), although the y/y compares in 2H are easier (particularly on vols) – which gives us confidence that this should be doable especially considering mgmt’s initiatives to reaccelerate growth. Overall, we expect the stock to trade down modestly today, but are optimistic that trends should improve in the back half – and therefore maintain our Buy rating.

Meanwhile, Bernstein analysts told clients that these results signify an “abrupt end to the strong period of growth enjoyed during the Covid-19 era.”

Here’s what other Wall Street analysts are saying about the second-quarter earnings (courtesy of Bloomberg):

JPMorgan (neutral)

“While the setup into the print was negative and investors we spoke seemed to be expecting a weak top line, the organic sales growth performance came in worse than anticipated in key regions, in particular in FLNA and Latin America,” analyst Andrea Teixeira writes

Lowered organic sales annual guidance now seems “doable,” as year-over-year comparisons ease, but Teixeira thinks investors will remain concerned with volume declines in key divisions

“We are confident in PEP’s ability to meet the EPS number with ample productivity opportunities across the P&L, but we believe the key driver for the stock (and Staples as whole) is volume growth which remains challenging,” she adds

Bernstein (market perform)

2Q report and slightly lowered annual guidance organic growth target are unlikely to be the “clearing event that long-term shareholders were looking for,” and worries of further cuts probably persist throught 3Q, writes analyst Callum Elliott

Expects some questions about “need to right-size” some of the pricing (adjust prices lower) given recent trade-down to private label and market share losses for Frito

Separately, Goldman’s Natasha de la Grense provided clients this AM additional color on the mounting pressures impacting consumers:

We hosted a “subprime consumer” field trip in the US earlier this week, including meetings with FICO, Dollar General, QuickChek and Circle K. The key takeaways are that credit card delinquency rates are rising (now above long-run averages) with a decline in average FICO scores across the past year due to the subprime category (lower income). Companies called out accelerating trade down from national brands to private label, increased pomo activity and stable traffic trends at discount store. The risk from here is that a slowing labor market would disproportionately weigh on spending for lower income households.

A number of mega corps have been warning about the consumer slowdown, earlier this week, shares of consumer products company Helen of Troy crashed after missing earnings expectations and slashed its full-year outlook on “softer consumer demand” and “shifts in consumer spending.”

We’ve detailed for months about the onset of a consumer slowdown:

-

Goldman Tells Top Clients To Start “Shorting The Middle-Income Consumer”

-

“Did Something Change?”: Goldman Trading Desk Warns Hedge Funds Are Suddenly Dumping Consumer Stocks

And note Tuesday how the S&P 1500 Restaurants Index (S15REST) has been sliding as Mag7 and AI stocks power the Nasdaq index to new heights.

With today’s deflationary June CPI print, mounting economic uncertainties are leading rate traders to bet that the first interest rate cuts could occur as early as September.

Tyler Durden

Thu, 07/11/2024 – 12:25

via ZeroHedge News https://ift.tt/8ukhdoM Tyler Durden