5 Reasons For A New Gold Playbook

Authored by Ronni Stoeferle via VonGreyerz.gold,

The rise in the gold price this spring was undoubtedly spectacular. In just a few weeks, the gold price rose by almost 20% in USD terms, with a gain of 21.7% for the first half of the year alone. In EUR terms, gold increased 16.4% in the year’s first six months.

The showdown in the gold price we predicted in the In Gold We Trust Report 2023 has passed. What is remarkable is that all of this is happening in an environment where, according to the previous playbook, the gold price should have fallen. The collapse of the correlation between the gold price and actual interest rates raises many questions. In the old paradigm, it was unthinkable that the gold price would trend firmer during sharply rising real interest rates. Gold and gold investors are now entering terra incognita.

Traditional correlations are breaking down

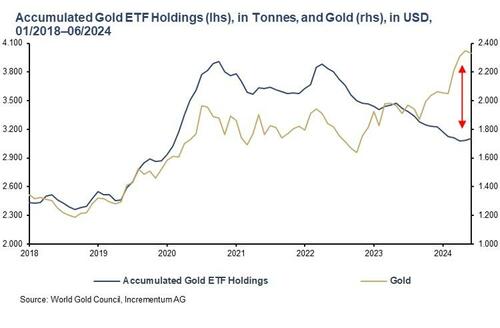

In addition to the high negative correlation between the gold price and US actual interest rates, the once strong link between investor demand from the West and the gold price has dissolved in recent quarters. Given gold’s record run, one would have expected ETFs to register record inflows. First, things turn out differently, and second, they unfold contrary to expectations: from April 2022 to June 2024, there was a net outflow of almost 780 tons or 20% from gold ETFs. The old gold playbook shows gold should be around USD 1,700, given the fall in ETF holdings.

Consequently, a vital element of the new gold playbook is that the Western financial investor is no longer the marginal buyer or seller of gold. The significant demand from central banks and private Asian investors is the main reason why the price of gold has thrived even in an environment of rising real interest rates.

A reduction in gold ETF holdings when actual interest rates rise is undoubtedly a rational decision from the point of view of the players in the West, provided they assume that:

-

They are not exposed to increased counterparty risks and, therefore, do not need a default-proof asset;

-

Actual interest rates will remain positive in the future, and a second wave of inflation will not occur;

-

They suffer opportunity costs if they underweight traditional asset classes such as equities and bonds or even “concrete gold” (=real estate) at the expense of gold.

In our opinion, all three assumptions should be questioned – and that sooner rather than later.

The marginal actor in the gold market moves from West to East

The global East, on the other hand, is becoming increasingly important. This is hardly surprising given that the West’s share of global GDP continues to decline due to weakening growth and an ageing population.

In addition, many Asian countries have a historical affinity for gold (India and the Gulf States, mainly, are worth mentioning). Still, China is increasingly discovering its preference for gold.

In 2023, demand for gold jewellery totalled 2,092 tonnes. China accounted for 630 tonnes, India for 562 tonnes, and the Middle East for 171 tonnes. Together, these amounts to almost two-thirds of the total demand. Of the nearly 1,200 tonnes of gold bars and coins that were in demand in 2023, almost half went to China (279 tonnes), India (185 tonnes), and the Middle East (114 tonnes).

Gold is also benefiting from other developments. China is discovering gold as an alternative retirement provision precisely because of the structural problems in the real estate market. Gold in beans is currently trendy, especially among China’s youth. The strong demand for gold from Asian central banks is another pillar of this epochal change. These changes are also why certainties, such as the close correlation between the gold price and actual US interest rates, are disintegrating.

Central banks are becoming increasingly crucial for gold demand

Central bank demand accelerated significantly in the wake of the freezing of Russian currency reserves immediately after the Ukraine war outbreak. As a result, central bank demand for gold reached a new record high of over 1,000 tons in 2022, which was only narrowly missed in 2023. Q1/2024 was then the strongest first quarter since records began. It is, therefore, hardly surprising that the share of central bank demand in total gold demand has increased significantly: from 2011 to 2021, the share of central banks fluctuated around the 10% mark, whereas in 2022 and 2023, the share amounted to almost 25%.

The profound distortions triggered by the sanctioning of Russian currency reserves will keep central bank demand for gold high for some time. This is also shown by the recently published World Gold Survey 2024 by the World Gold Council (WGC). According to the survey, 70 central banks assume that central bank gold reserves will continue to grow. Geopolitical instability is the third most crucial reason for central banks’ investment decisions. And geopolitical instability will undoubtedly be with us for some time to come.

The debt bomb is ticking – also increasingly in the West

We are entering a new era, particularly evident from developments in the countries with the highest total debt (government, non-financial corporations & households).

Japan occupies the inglorious top spot with just over 400%. The dramatic fall in the value of the Japanese yen -12.3% in the first half of 2024, -32.6% in the past five years and even around 50% compared to the almost all-time high in 2012 – is a symptom of Japan’s increasing imbalance. Accordingly, the economic thermometer in the form of gold prices in the Japanese yen is beating intensely. At the end of June, the gold price had risen by 28.7% since the beginning of the year. Since 2023, it has increased by just over 50% and around 165% since 2019.

France is in second place worldwide and first place in Europe with 330%, making it a much bigger problem child than Italy, which is much maligned in the media. Italy’s total debt is around 80 percentage points lower. The unclear political situation following the surprising election victory of the far-left New Popular Front in the new elections to the National Assembly unexpectedly called by the French President will further exacerbate France’s debt situation.

In addition to the continued, highly loose fiscal policy, the US is in an increasingly tricky domestic political situation just four months before the presidential elections, following the disastrous performance of US President Joe Biden in his first TV debate with his predecessor and challenger – Donald Trump. This will also make solving the US debt problem more difficult, especially as Donald Trump, who is leading in the polls, described himself as the “king of debt” a few years ago. An easing of the situation is, therefore, not to be expected. On the contrary, the next major debt crisis could affect some leading industrialized nations.

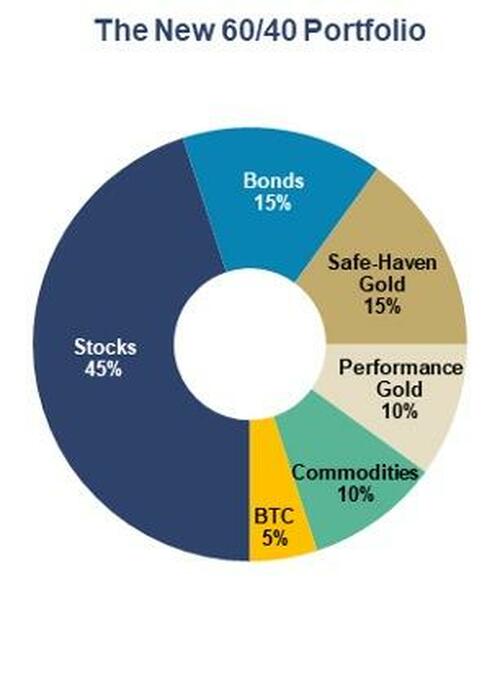

The new 60/40 portfolio

The investment environment for gold investors has fundamentally changed. The reorganization of the global economic and political order, the dominant influence of emerging markets on the gold market, the reaching of the limits of debt sustainability, and possibly multiple waves of inflation are causing gold to appreciate. It is, therefore, also time to adapt the traditional 60/40 portfolio to these new realities.

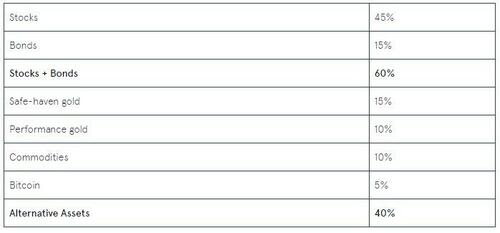

Aside from gold, we also see other alternative asset classes, such as commodities and Bitcoin, as beneficiaries of the new gold playbook. Therefore, we are convinced these two asset classes are indispensable in preparing a portfolio for the new playbook. A suitable portfolio comprises 60% equities and bonds + 40% alternative asset classes.

Our interpretation of the new 60/40 portfolio for long-term investors provides for the following allocation:

Source: Incrementum AG

This marks a clear departure from traditional 60/40 portfolios. Of course, this positioning is not a rule set in stone but rather a guideline based on current market conditions and will evolve with time and changes in the currency environment. The new playbook applies as long as we are in a period of currency instability characterized by vast debt burdens and above-average inflation volatility. In other words, a higher proportion of hard currencies seems necessary until we return to an environment with a stable hard currency – be it a sovereign hard currency or a gold/Bitcoin standard.

Conclusion

We are currently witnessing a fundamental transformation. Old certainties are fading; established strategies are failing. The willingness to question established patterns of thought and break new ground often requires courage, but for those who recognize the signs of the times and dare to change, implementing the new gold playbook opens the door to growth and stability.

In principle, the new gold playbook suggests that the portfolio’s allocation to alternative asset classes should be higher to align appropriately with changes in the investment environment.

Tyler Durden

Mon, 07/15/2024 – 05:00

via ZeroHedge News https://ift.tt/ZWYLkNP Tyler Durden