Bonds & Gold Soar In July Amid ‘DotCom-Style’ Collapse In Crowded-Trades

Bonds and bullion outperformed in July with the dollar down and oil getting hammered…

Source: Bloomberg

And while the broad S&P 500 managed very modest gains in July – there was a massive divergence between Small Caps (+12% in July) and Nasdaq (-1.5% in July)…

Source: Bloomberg

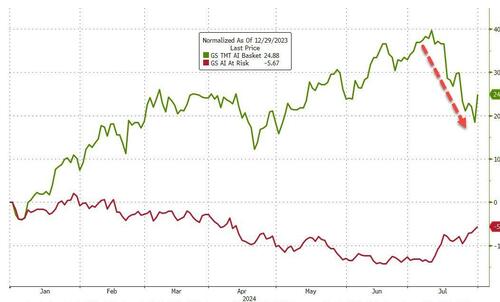

Crowded consensus trades suffered in July. e,g, A.I…

Source: Bloomberg

Thanks to a massive $440BN surge today (the biggest day since Feb), the market cap of Magnificent 7 stocks ended the month down only 2.5% (though admittedly down 10% from the highs)…

Source: Bloomberg

MSFT bounced back hard from its post-earnings plunge…

…and NVDA exploded (after touching $100)…

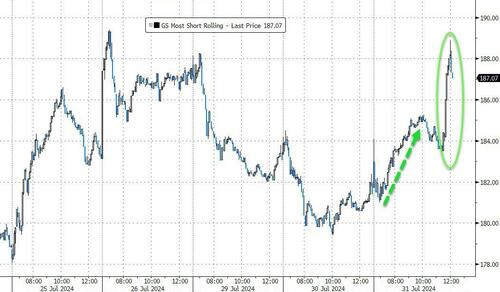

…as did ‘most shorted’ stocks…

Source: Bloomberg

For context, NVDA added a stunning $330BN in market cap today – its largest single-day gain ever…

Source: Bloomberg

The market’s initial reaction to the FOMC statement was muted to say the least as Powell reiterated that “We have made no decisions about future meetings and that includes the September meeting.”

But then Powell dropped the dovish hammer:

“I can imagine a scenario in which there would be everywhere from zero cuts to several cuts.”

…and stocks elevated, only to give it back after he stopped speaking…

Powell’s comments on the job market and inflation during the presser also sent yields and the dollar lower…

-

Job Mkt – Fed ready to move if easing in Labour mkt goes beyond ‘gradual’ and would not want to see ‘further material cooling’. This will likely heighten the focus on Friday’s print.

-

Inflation – very benign take from Powell re recent progress defined as ‘broader disinflation’ /high quality progress (including housing and non-housing services).

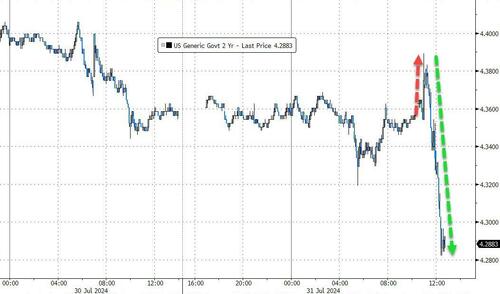

The kneejerk reaction (higher) in yields was reversed to the lows of the day…

Source: Bloomberg

…as rate-cut expectations initially dropped, then surged…

Source: Bloomberg

Treasury yields plunged in July with the short-end down 45bps, dramatically outperforming the long-end…

Source: Bloomberg

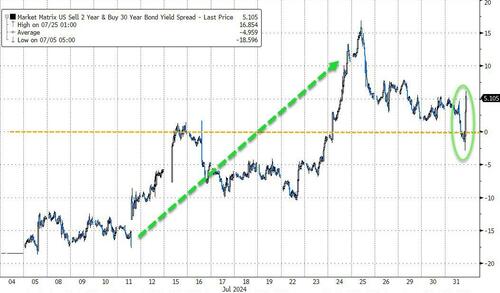

The yield curve steepened dramatically in July, dis-inverting at 2s30s…

Source: Bloomberg

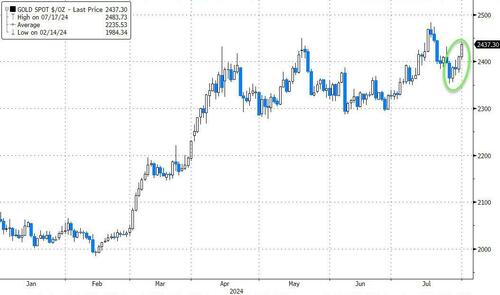

Gold soared to its highest monthly closing level ever, rebounding the last few days…

Source: Bloomberg

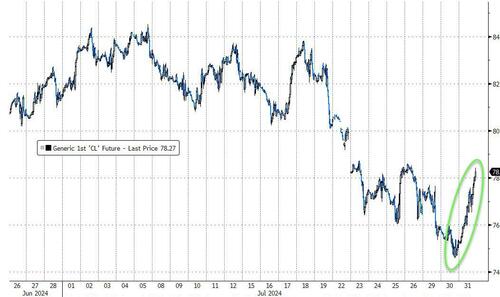

While crude had an ugly month overall, today saw a sizable bounce as MidEast tensions re-escalated…

Source: Bloomberg

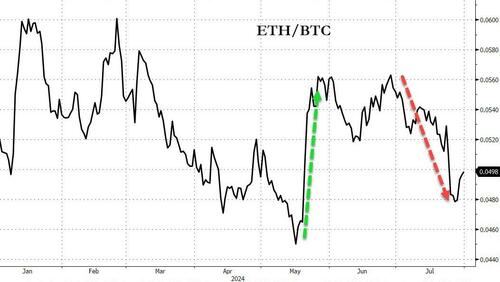

It was a mixed month for crypto with Bitcoin managing gains (+4.5%) but Ethereum dumped (-4.5%), despite the launch of the ETH ETFs…

Source: Bloomberg

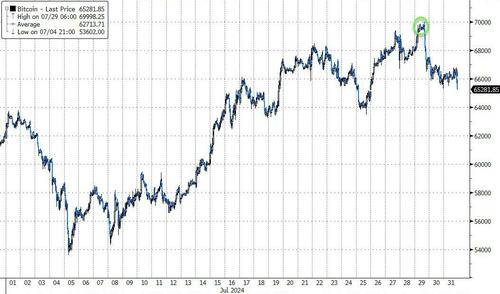

Bitcoin touched $70,000 intraday at its highs this month, but has fallen back since (testing $65k today)…

Source: Bloomberg

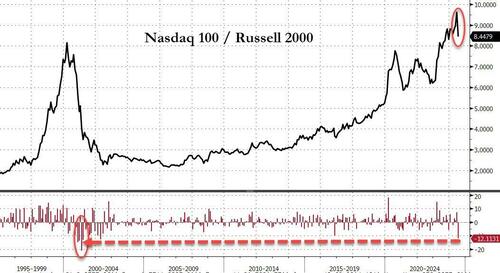

Finally, July saw the biggest Nasdaq underperformance of Russell 2000 since the peak of the DotCom bubble’s bursting…

Source: Bloomberg

Probably nothing, right?

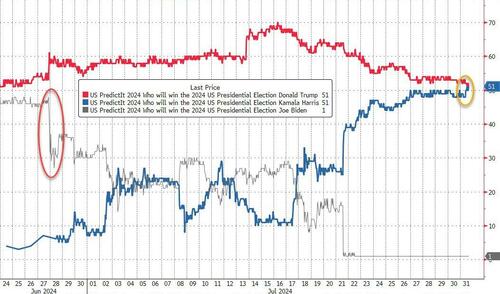

And, according to the prediction markets, Trump and Kamala are all tied up…

Source: Bloomberg

The market doesn’t feel like its 50-50.

Tyler Durden

Wed, 07/31/2024 – 16:00

via ZeroHedge News https://ift.tt/QTGs09j Tyler Durden