Meta Jumps After Beating On Revenue And Earnings, But Misses On CapEx Despite Rosy Outlook

After 3 rather soggy Mag 7 earnings in the past week – with TSLA, GOOGL and MSFT all sliding on earnings – investors were hoping that at least one out of four would surprise positively when the ill-renamed Facebook (aka META) reported earnings after the close. And at least according to the kneejerk reaction, the reaction appears to indeed be favorable, with the stock jumping after the company beat on sales and earnings despite the all-important for AI CapEx print coming soft.

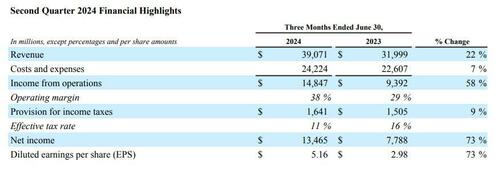

Here is what the company that has been investing aggressively in AI reported for Q2:

- Revenue $39.07 billion, +22% y/y, beating estimates of $38.34 billion

- Advertising rev. $38.33 billion, +22% y/y, beating estimates of $37.57 billion

- Family of Apps revenue $38.72 billion, +22% y/y, beating estimates of $37.76 billion

- Reality Labs revenue $353 million, +28% y/y, beating estimates of $376.9 million

- Other revenue $389 million, +73% y/y, beating estimates of $344.6 million

- Operating income $14.85 billion, beating estimates of $14.59 billion

- Family of Apps operating income $19.34 billion, +47% y/y, beating estimates of $18.69 billion

- Reality Labs operating loss $4.49 billion, +20% y/y, estimate loss $4.53 billion

- Operating margin 38% vs. 29% y/y, beating estimates of 37.7%

- EPS $5.16 vs. $2.98 y/y, beating estimates of $4.72

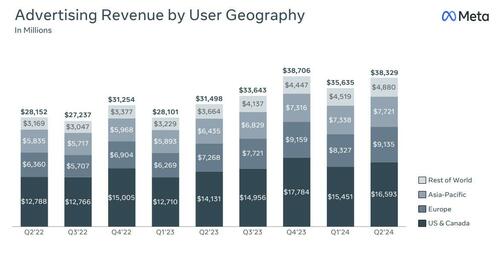

The ad revenue breakdown by geography shows that as usual the bulk of revenue came from the US and Canada, with Europe and Asia following.

Curiously while the total number of ad impressions both slowed and missed estimates, the amount Meta charged per impression not only rose double digits and reversed last year’s decline, but came in almost double the expected. Good luck keeping those rates up in the recession.

- Ad impressions +10% vs. +34% y/y, estimate +13%

- Average price per ad +10% vs. -16% y/y, estimate +5.96%

Oddly enough, the drop in ad impressions is taking place even as the company hsa said it is using AI to improve the way advertisements find interested users, “adding efficiency” to its most lucrative business. Judging by the actual results, efficiency is the last thing AI is adding.

The company which no longer disclosed DAUs is also investing in large language models, the technology behind AI chatbots. The company recently unveiled its largest model to date, which Zuckerberg said cost hundreds of millions of dollars in computing power to train. And while investors have been looking for signs of a positive impact on the business from all the spending, especially after Meta poured billions into another Zuckerberg passion project — a series of virtual worlds known as the metaverse — without generating much return, so far ad impressions are sucking wind.

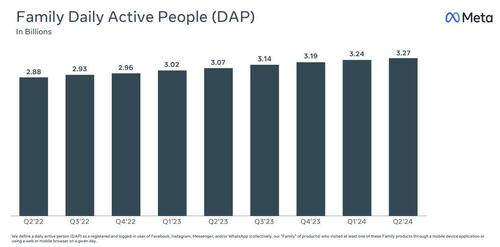

Turning to actual users, Facebook – which no longer reports Daily and Monthly Active Users since both have plateaued and are in the case of US and Europe decreasing – reported that its Family Daily Active People (or DAP, a made up category which the company can massage however it wants), rose to 3.27 billion, up 6.5%, and beating estimates of $3.22 billion. That’s right: we are supposed to believe that somehow half the entire world logs into Facebook every single day.

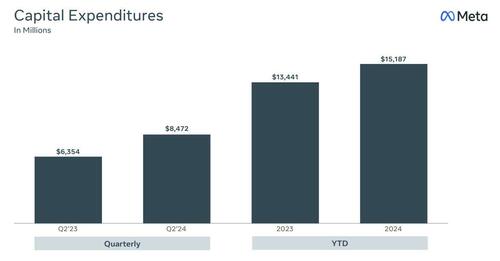

Yet while user metrics are easy to fudge, one place where META missed was Capex, which in Q2 rose to $8.173 billion, far below consensus of $9.4 billion, and a hint that spending on all those H100 or whatever Nvidia chips is starting to cool despite the company’s always cheerful guidance.

Besides spending on AI, an expense which clearly has yet to generate results, Meta has also been spending heavily on data centers and computing power, as Zuckerberg works to build a leading position in the industry-wide AI race. Despite the Q2 CapEx miss, Meta further hiked adjusted its full-year CapEx projections, setting a new range from $37 billion to $40 billion, raising the low end of the range by $2 billion. Needless to say, NVDA stock loved it.

Looking ahead, the CFO made the following forecasts:

- Expect third quarter 2024 total revenue to be in the range of $38.5-41 billion. Guidance assumes foreign currency is a 2% headwind to year-over-year total revenue growth

- Expect full-year 2024 total expenses to be in the range of $96-99 billion, unchanged from the prior outlook. For Reality Labs, continue to expect 2024 operating losses to increase meaningfully year-over-year due to our ongoing product development efforts and investments to further scale our ecosystem.

- While Meta does not intend to provide any quantitative guidance for 2025 until the fourth quarter call, it expects infrastructure costs will be a significant driver of expense growth next year as it recognizes depreciation and operating costs associated with the expanded infrastructure footprint.

- Anticipate our full-year 2024 capital expenditures will be in the range of $37-40 billion, updated from our prior range of $35-40 billion, which is funny since Q2 CapEx was actually below estimates; yet the ridiculous forecast was enough to send NVDA surging after hours, and on pace to gain half a trillion dollars in market cap from yesterday’s post MSFT lows. The company said that while it continues to refine our plans for next year, “we currently expect significant capital expenditures growth in 2025 as we invest to support our artificial intelligence research and product development efforts.”

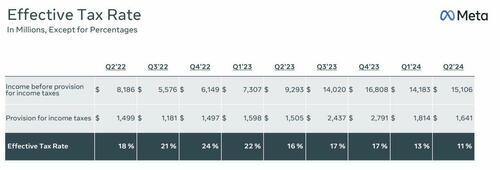

- Absent any changes to our tax landscape, Meta expect our full-year 2024 tax rate to be in the mid-teens.

Ah yes, speaking of taxes, the company – which has been very close to the Biden admin – just reported that its effective tax rate dropped to just 11%, the lowest since the covid crash quarter of Q2 2020. See, it literally pays to censor.

At the end of the day, the latest chatbot craze will blow up spectacularly when people get bored with the trope that has been tried many times before. But first, META stock will hit new all time highs allowing insiders to cash out.

“I think that there’s a meaningful chance that a lot of the companies are over-building now, and that you’ll look back and you’re like, ‘oh, we maybe all spent some number of billions of dollars more than we had to,’” Zuckerberg told Bloomberg earlier this month. “On the flip side, I actually think all the companies that are investing are making a rational decision, because the downside of being behind is that you’re out of position for like the most important technology for the next 10 to 15 years.”

Actually no, Mark, the real downside is that you are once again chasing a bubble. After all, just look at your ticker. Remember when that was all the rage?

Alas, for now it’s easy to fool all the people, and META stock jumped about 5% after hours.

Tyler Durden

Wed, 07/31/2024 – 17:04

via ZeroHedge News https://ift.tt/bGfNiOz Tyler Durden