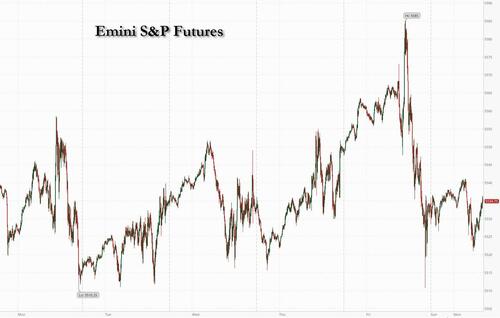

US equity futures are higher boosted by a relief rally in French stocks and European bonds, where the result of the French parliamentary election (no outright majority for Le Pen) was not as bad as some had feared. As of 8:00am ET, S&P futures are up 0.3, trading near session highs,while Nasdaq futures gained 0.2% with Nvidia dropping as much as 2.8%, but off the lows. Major European markets are higher led by France and Italy after Le Pen’s National Rally led the first round of snap polls but failed to secure an absolute majority as some polls had suggested; CAC +1.4%. On macro data, Germany regional CPI suggests some cooling. We will receive the national German CPI at 8am ET. In Asia, PBOC signals possible government bond sales to cool market rally which pushed Chinese bond yields to record lows. Meanwhile bond yields in the US are 1-2bp higher, the 10Y TSY trading at 4.41%, following higher EU yields; the USD is lower. Commodities are higher led by oil and base metals. Today, the macro focus will be June ISM-Mfg where consensus expects a modest increase to 49.1 vs. 48.7 prior.

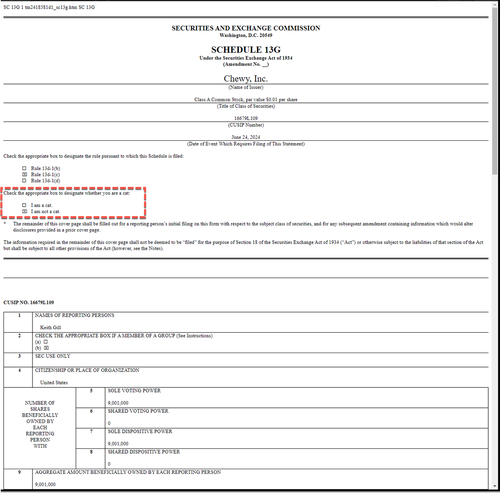

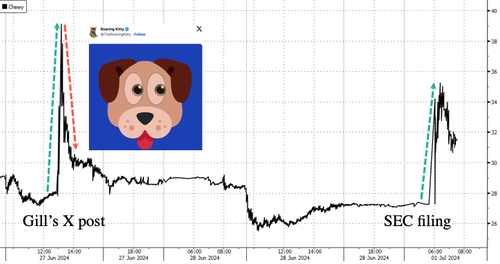

In premarket trading, Spirit AeroSystems rallied 6.3% after Boeing agreed to buy back the supplier in an all-stock deal that values it at $4.7 billion. Chewy shares soared 29% after influential investor Keith Gill disclosed a 6.6% passive stake in the online pet food and product retailer. Mega cap tech (ex. NVDA) are modestly higher: AMZN +39bp, GOOG/L +28bp, MSFT +26bp; Semis are weaker: NVDA -2.8%, MU -74bp, AMD -52bp. Her are some other notable premarket movers:

- Birkenstock rises 3% after UBS boosted its rating to buy, saying that the company can achieve stronger sales and margins over the long term.

- NIO ADRs climbs 4% after the Chinese EV maker reported a rise in June deliveries.

European stocks snapped a four-day losing streak and the euro rose as French election results suggested there’s a smaller probability of extreme policies coming from Le Pen’s RN. Traders interpreted the first round of legislative voting as an indication that Marine Le Pen’s party faces a tougher-than-expected road to overall victory, reducing the risks of spending plans that would rattle financial markets. The 10-year spread on French-German debt narrowed to a two-week low.

“Markets are quite content there’s no apparent absolute majority,” said Claudia Panseri, chief investment officer for France at UBS Wealth Management. “The most extreme scenarios for the spread have been excluded.”

France’s second round of voting will be held on July 7. The French political world is now embarking on a period of horse-trading. In constituencies where three people qualified for the runoffs, the third-placed candidate can withdraw to boost the chances of another mainstream party defeating the far right.

“It’s hard to argue that you’ve got a good outcome,” Sebastian Raedler, head of European equity strategy at Bank of America, said on Bloomberg Television. “Maybe you block a majority by the hard right. But in the best-case scenario, you get a hung parliament. That effectively means very little decision making, no ability to deal with a very wide budget deficit, and also the European integration story effectively put on hold.”

In any case, the kneejerk reaction was a clear relief rally as France’s CAC 40 Index jumped as much as 2.8% before retracing some gains. Banking stocks led the advance in Europe’s Stoxx 600 Index, as French lenders Societe Generale SA, BNP Paribas SA and Credit Agricole SA all surged by more than 5%. The euro climbed to its strongest level since mid June. Here are the biggest movers Monday:

- Renault rises as much as 4.1%, buoyed by Saudi Aramco’s decision to acquire a 10% stake in Horse Powertrain, the French carmaker’s joint venture with China’s Geely

- Zalando gains as much as 6.6%, the most since May 7, as JPMorgan (neutral) reiterates its positive catalyst watch on the German online clothing retailer, ahead of August’s quarterly results

- Aurubis shares rise as much as 6.4% after analysts at Bankhaus Metzler raised their price target for the German copper smelter to €91, the highest among analysts tracked by Bloomberg, citing higher metal prices

- Gubra jumps as much as 21% after the Danish pharmaceuticals firm announced it and partner Boehringer Ingelheim have started clinical testing of BI 3034701, a long-acting triple agonist peptide with a potential to become a next-generation and first-in-class obesity treatment

- Matas shares gain as much as 5.2%, the most since May 28, after Swedish business daily Dagens Industri recommends the Nordic cosmetics retailer in its stockpick-of-the-week column

- Clariant gains as much as 4.7% after Goldman Sachs raised its recommendation to buy from neutral, saying the Swiss chemical company’s new consumer-focused strategy should allow it to close its valuation gap with peers

- Aperam shares gain as much as 5.5% after Morgan Stanley says the steelmaker’s market update points to “modest upside” to the second quarter adjusted Ebitda on small inventory valuation gains

- Anglo American drops as much as 4% in London after a fire halts production at its Grosvenor site, the company’s biggest metallurgical coal project in Australia. The miner said it will take months for the blaze to be extinguished

- Bechtle shares fall as much as 5.7% to the lowest since October, after Exane downgraded the stock to underperform from neutral, saying the IT firm likely faces continued weak demand among small- and medium-sized firms in Germany

Meanwhile, back in the US, investors prepare for the second-quarter reporting season, Goldman Sachs strategists said Corporate America faces the highest earnings bar in almost three years. Single-stock analysts predict profits at S&P 500 firms rose 9% on average in the April-June period — the biggest year-over-year increase since the fourth quarter of 2021, Goldman strategists led by David Kostin wrote in a note.

“The magnitude of earnings-per-share beats is likely to diminish as consensus forecasts set a higher bar than in previous quarters,” Kostin said. “We expect the outperformance ‘reward’ for stocks beating estimates will be smaller than average again this quarter.”

Earlkier, Asian equities started the week on a positive note after a rally in Japanese stocks and as Chinese shares reversed earlier losses. The MSCI Asia Pacific Index climbed as much as 0.3%, with Hitachi, Mitsubishi Corp. and BHP Group contributing the most. Stock benchmarks gained in Taiwan and South Korea, while they fell in Australia. Japanese shares rallied as the decimation of the yen resumed. Financial companies were among big gainers in the country, boosted by bets on a Bank of Japan rate hike. Shares also were helped by survey data that showed confidence among the country’s large manufacturers rose from a quarter ago. The survey “confirmed that an inflationary trend is in place, with business sentiment strong and manufacturing passing on rising costs,” said Kohei Onishi, a senior investment strategist at Mitsubishi UFJ Morgan Stanley Securities Co. Companies’ yen exchange rate assumptions suggest earnings will likely be upgraded, he said. In China, mainland equities reversed earlier losses after a private gauge of factory activity rose to a three-year high, even as data showed that confidence among manufacturers is sagging. Hong Kong stock trading was closed for a holiday.

In emerging markets, South African assets rallied after President Cyril Ramaphosa announced a new cabinet that includes members of the opposition Democratic Alliance, considered business-friendly by investors.

In FX, the Bloomberg Spot Dollar Index was little changed while the euro outperformed most of its G10 peers on signs Marine Le Pen’s far-right party appeared to win the first round of France’s legislative election with a smaller margin of victory than some polls had indicated.

- EUR/USD climbed as much as 0.6% to 1.0776, the highest since June 12. One-month implied volatility in USD/JPY rises above 10% for the first time since May 6 as the tenor now captures the July 31 policy decisions by the Federal Reserve and the Bank of Japan.

- EUR/CHF rose as much as 0.5%, in a sign investors took heart in the French voting result. The franc is typically the preferred haven play for political risk in Europe

Treasuries slightly cheaper from belly out to long-end of the curve which underperforms, adding to Friday’s aggressive steepening that accelerated into the month-end close. European bonds lag significantly as haven demand is unwound with the first round of voting in France pointing to no single party gaining an absolute majority. US session highlights include ISM manufacturing gauge, while Fed Chair Powell is scheduled to speak in Sintra Tuesday.

In rates, US long-end yields cheaper on the day by about 1.5bp, steepening 2s10s, 5s30s spreads; 10-year yields around 4.41% with bunds and gilts lagging by 6bp and 3.5bp in the sector. French bonds outperform in Europe after Marine Le Pen’s National Rally failed to record a decisive win in the first round of France’s snap parliamentary elections. European bonds elsewhere lag significantly as haven demand is unwound with the first round of voting in France pointing to no single party gaining an absolute majority.

In commodities, oil rose as traders assessed economic outlook and geopolitical risks in Europe and the Middle East. Iron ore rose amid tentative signs of recovery in China’s steel-intensive property market, and speculation that Beijing could do more to support the sector.

Looking at today’s calendar, US economic data slate includes S&P Global June final manufacturing PMI (9:45am), May construction spending and June ISM manufacturing (10am). JOLTS, ADP employment change, ISM services gauge and June jobs report are ahead this week, No Fed speakers scheduled for the session; Powell talks Tuesday on a panel with ECB President Christine Lagarde and Brazil’s Roberto Campos Neto in Sintra

Market Snapshot

- S&P 500 futures up 0.2% to 5,532.75

- STOXX Europe 600 up 0.6% to 514.68

- MXAP up 0.2% to 180.89

- MXAPJ little changed at 567.36

- Nikkei up 0.1% to 39,631.06

- Topix up 0.5% to 2,824.28

- Hang Seng Index little changed at 17,718.61

- Shanghai Composite up 0.9% to 2,994.73

- Sensex up 0.5% to 79,457.06

- Australia S&P/ASX 200 down 0.2% to 7,750.74

- Kospi up 0.2% to 2,804.31

- Brent Futures up 0.7% to $85.60/bbl

- Gold spot down 0.1% to $2,324.93

- US Dollar Index down 0.34% to 105.51

- German 10Y yield little changed at 2.57%

- Euro up 0.5% to $1.0765

- Brent Futures up 0.7% to $85.60/bbl

Top Overnight News

- US President Biden’s family is urging him to stay in the race and keep fighting despite last week’s disastrous debate performance, according to NYT.

- European stocks and the euro rallied on speculation Marine Le Pen’s far-right party will struggle to win an outright majority in French elections, easing investor concern that the region’s second-largest economy was headed for a radical policy shift.

- French President Emmanuel Macron’s centrist alliance and the left-wing New Popular Front are weighing whether to pull candidates from the second round of the legislative election on Sunday to keep the ascendant far-right National Rally out of power.

- French markets rebounded after Marine Le Pen’s National Rally party finished with a smaller margin of victory than indicated by polls, spurring a relief rally across the nation’s assets.

- President Joe Biden’s campaign is going on the attack against a chorus of donors, consultants, officials and media voices calling on him to drop out of the 2024 race after his devastating debate performance.

- The growing prospect of a Trump presidential victory is making yield curve steepeners an attractive bet as growth will likely slow and inflation quicken under such a scenario, according to Morgan Stanley.

- The People’s Bank of China said it will borrow government bonds from primary dealers, a sign it may be contemplating selling securities to cool down a market rally.

- Boeing Co. agreed to buy back Spirit AeroSystems Holdings Inc. for $37.25 a share in an all-stock deal that values the supplier at $4.7 billion, unwinding a two-decade separation as the embattled US planemaker tries to fix is manufacturing defects.

- EU plans to charge Meta Platforms over its ‘pay or consent’ model, FT reports citing sources; regulators are concerned the model offers consumers a misleading choice, potentially forcing consent to personal data tracking for ads due to financial barriers. Penalties could reach 10% of global turnover, rising to 20% for repeat violations.

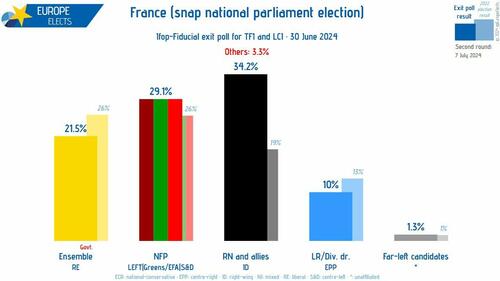

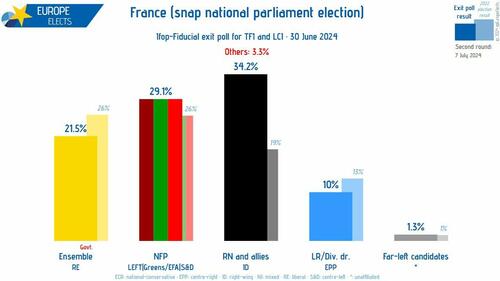

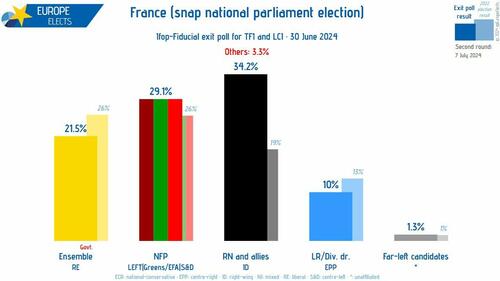

French Election

- French Election 1st Round: National Rally makes significant gains but the odds of another hung parliament have likely increased.

- Exit polls have National Rally (RN) on 34.5%, the New Popular Front (NFP) on 29%, Macron’s Ensemble (ENS) on 21-23% and Les Republicans (LR) on 10%. When extrapolated into seat projections, there is a slight discrepancy between vendors with the forecast range for RN not encapsulating the 289 majority mark via the IFOP survey and France Televisions-Radio’s calculations; however, estimates from Elabe have an RN majority within the forecast range.

- Immediately after the exit polls dropped, PM Attal outlined a broad call to the centre and left-wing. Calling for voters to prevent RN from winning a second-round majority, to facilitate this he has pledged to stand down ENS candidates who have no chance of winning in the second round to give the non-RN candidate the best chance of victory.

- Into the second round, there are now three main points to look for: Whether Macron shows any sign of wavering from his pledge to stay as President irrespective of the result; The reception of NFP to the call from ENS to cooperate to prevent an RN outright majority, i.e. if they demand the appointment of an ENS PM or similar; Any signs of the non-RN friendly contingent of LR wavering from their position and joining forces with RN, as the addition of their 41-61 projected seats could be enough to secure an outright RN majority.

- Reminder, the second round occurs on 7th July. Exit polls are to be released from 19:00BST/14:00ET with official results emerging from some constituencies immediately but the full picture will not be known until early-Monday.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the new quarter somewhat varied as participants digested key data releases and markets braced for a busy week ahead culminating in the latest NFP report on Friday. ASX 200 was led lower by underperformance in tech amid headwinds from firmer yields although the index was off worst levels owing to resilience in mining stocks. Nikkei 225 gained at the open amid initial currency weakness although some of the gains were then faded as participants digested a mixed BoJ Tankan survey. Shanghai Comp. swung between gains and losses with price action choppy in early trade after mixed PMI data from China which showed official Manufacturing PMI remained in contraction territory and Non-Manufacturing PMI missed estimates, but Chinese Caixin Manufacturing PMI topped forecasts to print its highest in three years. Meanwhile, Hong Kong markets were shut for a holiday which also meant the absence of Stock Connect flows.

Top Asian News

- Indonesia is to impose safeguard duties of 100% to 200% on imports ranging from footwear to ceramics, while it mainly imports apparel and clothing accessories from China, Vietnam and Bangladesh, according to Nikkei.

- India’s government source said it is monitoring cheap Chinese imports, while India’s steel ministry is in talks with the commerce ministry over rising imports and the industry has sought a probe.

- China’s Vice Premier is to hold a symposium related to foreign investments on Monday, according to State Media; says China will further expand market access and break unreasonable limit for foreign investments.

CAC 40 (+1.8%) is the marked outperformer after the 1st round of the French legislative election, with the rally coming despite marked RN gains as the projections potentially point to increased odds of another hung parliament i.e. no RN majority. Though, initial upside has trimmed somewhat given we have another week of political uncertainty ahead and the fiscal situation remains tense and unfavourable for France. Stoxx 600 (+0.3%) and European generally are firmer, but have also trimmed modestly off best levels with newsflow ex-France light or not having much impact. Sectors much the same with the breakdown largely a reflection of the respective weighting of French stocks within the sectors as opposed to a broad trend. Stateside, futures are generally in the green (ES +0.1%, NQ -0.1%, RTY +0.3%) as we began a holiday shortened week that is firmly weighted towards NFP on Friday; note, NQ has slipped just into the red amid relatively pronounced pre-market pressure in Nvidia (-2.5%) though seemingly without a fresh fundamental driver.

Top European News

- European Commission President von der Leyen said European companies are signing deals or MOUs worth over EUR 40bln at the Egypt-EU investment conference, according to Reuters.

- Austria’s far-right Freedom Party chief Kickl said they are forming a new political alliance with Orban’s Fidesz in Hungary and Babis’s Czech ANO party, according to Reuters.

- The Sunday Times newspaper endorsed the Labour Party for the upcoming UK election.

FX

- DXY weighed on by the firmer EUR. Index down to a 105.42 base, holding above the 25th June low at 105.37. Docket for today is features ISM Manufacturing PMI and Fed’s Williams, the pricing component from the PMI and any commentary from Williams on PCE will be keenly sought.

- EUR the outperformer, in a relief-rally after the weekends’ French results which show that the far-right may struggle to form a Parliamentary majority, EUR/USD at a 1.0776 peak ahead of the 1.08 figure, a point it has been below since 14th June. Hefty OpEx features on today’s NY Cut.

- Cable benefitting from the encouraging risk environment and strengthening to a 1.2689 peak into this week’s UK election; however, GBP is softer vs the EUR.

- USD/JPY holding just above 161.00 with havens generally struggling in the morning’s risk environment. Last week’s multi-year peak stands at 161.28.

- Antipodeans firmer continuing the upside seen in the tail-end of last week, no real follow-through from Chinese PMIs overnight.

- PBoC set USD/CNY mid-point at 7.1265 vs exp. 7.2558 (prev. 7.1268).

- South African President Ramaphosa reappointed Enoch Godongwana as Finance Minister, while he appointed John Steenhuisien as Agriculture Minister and Ronald Lamola as Minister of International Relations and Cooperation, according to Reuters.

Fixed Income

- OATs saw gains in excess of 20 ticks at best which alongside pressure in Bunds saw the OAT-Bund 10yr yield spread narrow to 72.4bps from an 80.1bp close on Friday. However, OATs have since come under pressure and are lower by around 20 ticks as the initial relief rally dissipates, a move which has re-widened the spread somewhat to 75bps.

- Bunds pressured as they trim recent strength seen into the French election, down to a 130.55 base. No real reaction to the numerous data points from Germany, with state CPIs broadly chiming with the mainland consensus.

- Gilts weighed on in-line with the above, at an initial low point of 97.14 which printed around the Final Manufacturing PMI that was revised lower and provided some support. Though, internal commentary factored on the hawkish side and has seen the benchmark slip to a fresh 97.07 base.

- US Treasuries are directionally in-fitting with other core players; just off a 109-15 base but remain towards the low-end of a 10 tick range

Commodities

- Crude bid across the board given the broader risk appetite and weaker USD. Crude-specific newsflow has been light this morning but as the US hurricane season nears, the desk is keeping an eye on Hurricane Beryl.

- WTI August trades within a USD 81.38-82.29/bbl range, Brent September sits in a USD 84.54-85.74/bbl parameter.

- Saudi Aramco’s strategic gas expansion reportedly progresses with USD 25bln of contract awards.

- Mixed trade across precious metals with spot gold biding time ahead of this week’s macro risk events whilst spot silver is underpinned by the softer Dollar.

- Base metals are mostly firmer, though off best, with the softer USD and risk tone assisting, though the magnitude of gains has trimmed alongside a moderation in broader risk appetite.

- NHC says Hurricane Beryl is taking aim at the windward islands, with life-threatening winds and storm surge expected to begin this morning.

Geopolitics – Middle East

- US proposed new language in an effort to reach a Gaza hostage-ceasefire deal, according to Reuters.

- Hamas officials said there is no progress in ceasefire talks with Israel but it is still ready to deal positively with any ceasefire proposal that ends the war in Gaza, according to Reuters.

- Iraq’s Islamic Resistance reportedly hit an Israeli port with a drone, according to IRNA.

- Israel’s Finance Minister extended the waiver allowing cooperation between Israeli and Palestinian banks in the West Bank for four months, according to a spokesperson cited by Reuters.

- Iran’s UN mission said an obliterating war will ensue if Israel attacks Lebanon and that all options including the full involvement of resistance fronts are on the table.

- Iran will hold a presidential election run-off on July 5th as no candidate secured 50% of votes.

- Israeli Media reports “The end of the war in its current form within 10 days”, via Sky News Arabia citing Channel 13.

Geopolitics – Other

- Russia took control of the settlement of Shumy in Ukraine, while Russian forces also took over Spirne and Novooleksandrivka in Ukraine’s Donetsk region, according to RIA citing the Defence Ministry. It was separately reported that a Ukrainian drone attack killed five people in Russia’s borderline Kursk region, while Russia’s Emergency Ministry said four of its employees were injured in Ukraine’s shelling of Donetsk.

- North Korea condemned ‘Freedom Edge’ joint military drills by the US, South Korea and Japan as provocation, while it said it will make an important announcement and will protect regional peace with an aggressive and overwhelming response, according to KCNA. It was also reported that North Korea conducted a missile launch of a short-range ballistic missile and another ballistic missile, according to Yonhap citing the South Korean military.

- US military raised the alert level of several bases in Europe to its second-highest level, according to the Times of Israel citing multiple American media outlets.

US Event Calendar

- 09:45: June S&P Global US Manufacturing PM, est. 51.7, prior 51.7

- 10:00: May Construction Spending MoM, est. 0.2%, prior -0.1%

- 10:00: June ISM Manufacturing, est. 49.1, prior 48.7

- June ISM Employment, est. 50.0, prior 51.1

- June ISM New Orders, est. 49.0, prior 45.4

- June ISM Prices Paid, est. 55.8, prior 57.0

DB’s Jim Reid concludes the overnight wrap

The biggest shock in Europe on Sunday, after a hugely anticipated battle, was that England football team managed to find a way of winning through to the last 16 in what was one of the most woeful and undeserved victories of all time. As this was unfolding the first round of the French elections perhaps delivered a slightly less convincing victory for the far-right than final polls suggested and with other parties now seemingly open to form alliances in the second round, this is likely to further reduce the far-right’s chance of an overall majority in parliament. This has helped the Euro to move +0.40% higher overnight to trade at 1.0756 against the dollar, with Euro Stoxx futures climbing +1.2% as I type.

To recap, Le Pen’s National Rally look set to win around 34.2% of the vote, slightly underperforming the final poll of polls which had them at 36.2%. The left-wing NPF coalition are expected to be at around 29% slightly outperforming their final poll of polls of 28.3%. Macron’s party is on track for around 21% also a bit above the final poll of polls of 20.4%.

In terms of what happens next, all those candidates that have an absolute majority of votes and a vote greater than 25% of the electorate is elected. For those not crossing the threshold, the second round this coming Sunday is a run-off between the top two candidates plus any other candidates who polled more than 12.5% of registered voters. Then the one with the most votes is elected.

The left alliance has said it will remove candidates that are in third place which will be problematic to the Far Right’s chances of a majority. Over half the 577 parliamentary seats, a historically very high number, are expected to go to the second round with lots of tactical voting now likely. The deadline for filing papers to accept the opportunity to be on Sunday’s second round is at 6pm tomorrow. So we’ll have a good idea of tactical alliances then.

Our economics and rates strategy teams, alongside our traders, will be doing a webinar this morning at 10am London time to discuss the implications of these election results. Register Here to watch.

Moving on and as it’s the start Q3 today, we’ll shortly be releasing our performance review for the quarter just gone. On the plus side, Q2 saw equities continue to advance, and the S&P 500 hit many more fresh new highs thanks to further gains for the Magnificent 7. But the gains remained narrow, with the equal-weighted S&P 500 actually losing ground in Q2. Meanwhile, sovereign bonds struggled in Q2 as investors generally priced in slower rate cuts, even as the ECB cut for the first time since the pandemic in a June that saw a more dovish pricing for rate expectations. Politics and geopolitics were also back in focus, not least in France where there was a notable selloff after the snap election announcement. See the full report in your inboxes shortly.

In terms of this week, it will be quite a busy one considering its a US holiday. Thursday is Independence Day which means Friday will likely see a skeleton staffing for the latest employment report with the all-important payrolls number.

Elsewhere on a day-by-day basis the main highlights are as follows. Today brings the US ISM and German CPI and the start of the annual ECB Sintra central bank conference with Lagarde speaking for the first amongst many appearances this week. Tomorrow brings the US JOLTS report, Eurozone CPI and both Powell and Lagarde on a panel at Sintra. Wednesday brings US services ISM, the ADP report, initial jobless claims a day earlier than usual and the trade balance data. The FOMC minutes are also released. We’ll also see China’s Caixin services PMI and the Eurozone PPI. Thursday sees the UK election and Swiss CPI with Friday seeing German and French IP, Eurozone and Italian retail sales and the Canadian job report to go alongside the US equivalent.

Previewing the US employment report on Friday, our economists expect headline (+225k forecast vs. +272k previously) and private (+195k vs. +229k) payrolls to be above the +190k and +163k expected by the consensus. The three-month averages are +249k and +206k, respectively. Our economists and consensus expect unemployment to stay at 4% although our economists think the risk is more skewed to rounding down to 3.9%. Remember last month saw the first print above 4% in nearly 2 and a half years but there is more uncertainty over the current accuracy of the household survey which the unemployment rate comes from than their establishment survey which payrolls comes from. Remember as ever that the JOLTS data (tomorrow) should be a better gauge of how tight the labour market is but as always is a month behind the employment report.

Asian equity markets are relatively quiet this morning after mixed Chinese PMIs. As I check my screens, the Nikkei (+0.18%), the KOSPI (+0.20%) and the Shanghai Composite (+0.30%) are seeing minor gains while the CSI (-0.19%) is edging lower. Hong Kong is closed for a public holiday. S&P 500 (+0.27%) and NASDAQ 100 (+0.35%) futures are trading higher, likely helped by news from the French election. Meanwhile, yields on the 10yr USTs are around a basis point lower, standing at 4.39% as we go to print, after a surprise month-end surge on Friday that we’ll discuss below.

Over the weekend, data showed that the official Chinese manufacturing PMI contracted for a second consecutive month at 49.5, flat with the figure in May and inline with expectations while the official non-manufacturing PMI came in at 50.5 in June (v/s 51.0 expected) as against a reading of 51.1 in May. But by contrast the private Caixin manufacturing PMI rose to 51.8 in June (v/s 51.5 expected) from 51.7 in May, the fastest pace for more than 3 years.

Before we review last week, Adrian Cox recently held a webinar on “how can you use AI and machine learning in financial decision-making?” This gave an overview on how to separate the fact from the hype, followed by our Equity Quantitative Investment Solutions team explaining how Deutsche Bank is putting AI and machine learning to work in systematic strategies. Watch the replay here. ***

Now recapping last week, new data on Friday added to the amassing evidence of inflation cooling in Q2. The headline PCE index moved sidewards in May (+0.0% as expected) month-on-month, bringing the year-on-year rate to +2.6% (as expected) from +2.7%. Core PCE decelerated to +0.1% on the month, in line with consensus but a soft +0.08% unrounded. The +2.6% year-on-year core PCE pace (also as expected) was the lowest since April 2021. The data also sent a mostly healthy signal on the US consumer, with the personal income indicator rising to 0.5% (vs 0.4% expected) while real personal spending rose from -0.1% to 0.3% (as expected).

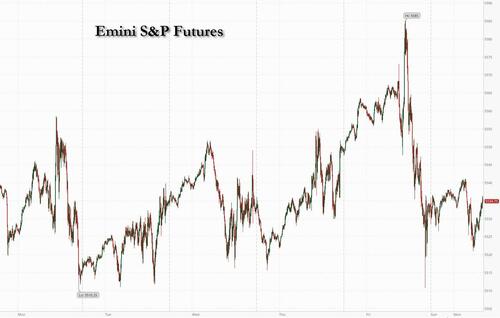

While markets initially rallied following Friday’s encouraging data, US Treasuries ended up seeing a sizeable month-end sell-off. 10yr yields were up +11.0bps to 4.40% (and +14.0bps over the week), while 30yr yields rose +13.3bps on Friday, their sharpest daily increase since November. The move was more muted on the front-end, with 2yr yields up +4.2bps (and +2.1bps on the week). So very much one of those unexplainable month-end moves.

Month-end moves also saw US equities end the week on a soft footing, with the S&P 500 sliding -0.41% (-0.08% on the week). This actually made Friday its worst day of June, a month in which the S&P 500 was still up +3.47%. Tech stocks led Friday’s correction, with the NASDAQ down -0.71% and the Magnificent 7 down -1.41%, but these were still +0.24% and +1.55% higher on the week respectively. Nvidia was -0.36% lower on Friday and -2.39% on the week.

In Europe, fixed income struggled in the lead up to the first round of the French election that took place Sunday. The 10yr French OAT yield was up +8.9bps (and +3.0bps on Friday) to 3.30%, its highest level since mid-November. Yields were up elsewhere in Europe, with yields on 10yr bunds and 10yr gilts also up by +8.9bps on the week (+4.9bps and +4.2bps on Friday respectively).

European equities underperformed over the week. The French CAC 40 fell -1.96% (and -0.68% on Friday) to its lowest level since late January. The selloff was not solely reserved for French stocks, as the STOXX 600 index also fell -0.72% (and -0.23% on Friday),though Germany’s DAX posted a gain of +0.40% (+0.14% Friday).