New Evidence Refutes FBI Testimony That Trump Shooter Is Far-Right, Anti-Immigrant

Authored by Debra Heine via American Greatness,

A top FBI official made a point of testifying that President Trump’s would-be assassin Thomas Matthew Crooks may have espoused far-right extremist viewpoints on an unnamed social media account five years ago, but forgot to mention that Crooks may have shared pro-Biden viewpoints on Gab more recently.

Both accounts have not yet been fully verified as belonging to Crooks.

FBI Deputy Director Paul Abbate told senators on Capitol Hill Tuesday that a social media account believed to be Crooks’ appears to have shared antisemitic, anti-immigrant, and “extreme in nature” posts in 2019 and 2020. Crooks would have been 14 to 15-years-old in that time frame.

“There were over 700 comments posted from this account,” Abbate testified before a joint Senate Judiciary Committee and Homeland Security Committee hearing entitled “Examination of the Security Failures Leading to the Assassination Attempt on Former President Trump.”

“Some of these comments, if ultimately attributable to the shooter, appear to reflect antisemitic and anti-immigration themes to espouse political violence and are described as extreme in nature,” Abbate added.

The deputy director said while the FBI was still verifying that the account belonged to Crooks, the Bureau felt it was important to detail the social account’s nature because of the “general absence of other information” establishing Crooks’ “motive and mindset.”

GAB CEO Andrew Torba, however, shared plenty of information on X last week about a GAB account the FBI appeared to believe was Crook’s, saying the content of the posts “UNEQUIVOCALLY” reflected a “pro-Biden and in particular pro-Biden immigration policy.”

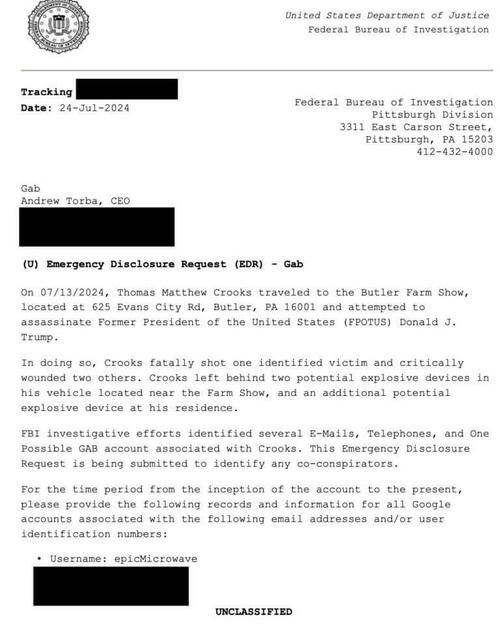

The Gab founder said on July 24, he received an Emergency Disclosure Request (EDR) from the FBI for the Gab account “EpicMicrowave,” and said based on the request, the FBI appeared to believe the account was associated with Crooks.

Torba said “as a courtesy to enforcement,” he would not post the contents of the entire request on social media, but did post the first page on X.

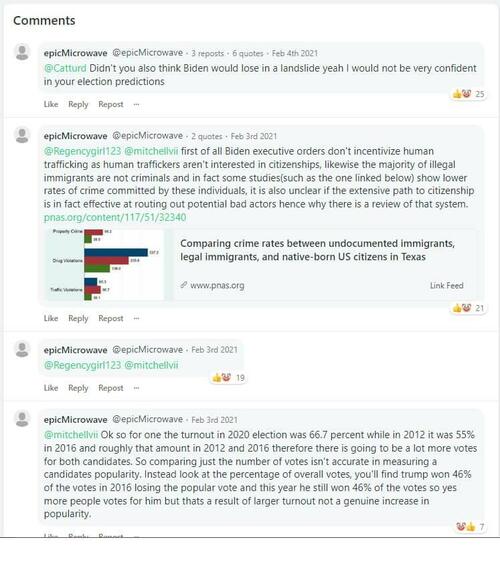

Torba said he was unable to confirm that the account in question, which posted a total of nine times on the site, actually belonged to Crooks. The account appeared to only be active for a short period of time in January and February of 2021.

“As far as we are aware, the account did not use the site to send any direct messages,” Torba wrote on X.

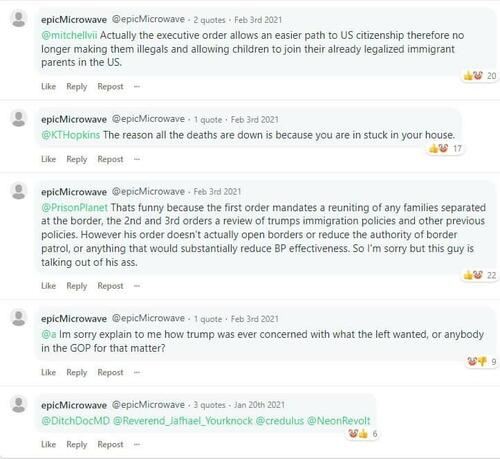

The majority of EpicMicrowave’s posts supported Joe Biden’s policies, particularly, his COVID lockdowns, border policies and executive orders. “To the best of Gab’s knowledge, as of 2021, Crooks was a pro-lockdown, pro-immigration, left-wing Joe Biden supporter,” Torba said.

“We are disclosing this information at significant personal and business risk,” Torba wrote on X when he posted the epicMicrowave comments last week. “If the past is any guide, defying the D.C. consensus by publishing the first definitive evidence that the shooter was a Biden supporter – something Democrats and their media allies have tried to cover up and deny at every turn – has a high probability of resulting in significant political and media backlash.”

In the past, we have been the target of politically motivated inquiries from both the House Oversight Committee and the Joint Committee on the January 6th Attacks, both of which sought to interfere with our mission of protecting free speech online. The enemies of freedom have the ability to impose significant present and future legal costs and any donations we receive will help to defray those costs.

Later during the hearing Tuesday, Senator Marsha Blackburn asked Abbate about the Gab account.

“We understand that the Gab account is pro-immigration, pro-lockdown, leftist views. Is that correct?” Blackburn asked.

“I haven’t seen it directly but I believe, from what I’ve been told, that is accurate,” Abbate conceded, while noting that the FBI is still working to verify whether the Gab account was Crooks’ as well.

“But it does have differing points of view it would appear,” Abbate said, without explaining why he had made a point of highlighting Crooks’ earlier alleged leanings.

Following the hearing, Blackburn told reporters that the deputy director had mentioned one account that painted Crooks as an anti-immigrant and anti-Semitic individual.

“That was an earlier social media account. We still don’t know the platform or the user name,” Blackburn noted.

Abbate has a reputation of being a Democrat partisan who crushes dissent within the Bureau.

In June of 2023, an FBI whistleblower came forward to accuse Abbate of improper intimidation.

According to an Empower Oversight affidavit, Abbate threatened agency employees concerned about the bureau’s overblown response to the Jan. 6 shortly after his appointment in February 2021.

During a secure video conference, Abbate allegedly called on agency staff with concerns about the bureau’s draconian approach to meet with him personally so he could, in the whistleblower’s words, “set them straight.”

“I have witnessed hundreds of Director [Secure Video Teleconference]s and have never seen a direct threat like that any other time,” the whistleblower said in the affidavit. “It was chilling and personal, communicating clearly that there would be consequences for anyone that questioned his direction.”

Tyler Durden

Wed, 07/31/2024 – 10:45

via ZeroHedge News https://ift.tt/1Ahd4tS Tyler Durden