Financial System ‘Plumbing’ Starts To Show Signs Of Stress Again

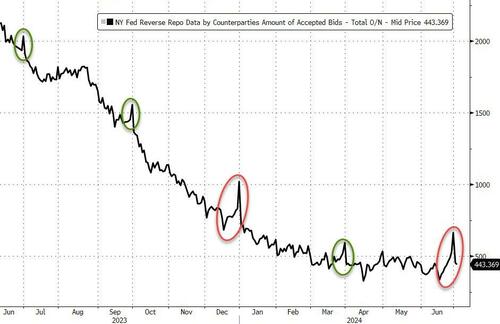

Usage of The Fed’s Reverse Repo facility is down $220 Billion in the last two days as the massive surge in demand across month- and quarter-end pulls back (mirroring December’s stress, and not the prior quarter-ends), but notably this pull back is far less than the $313 billion drop seen at 2023 year-end (suggesting banks are clinging to the liquidity a little more than normal)…

Source: Bloomberg

“that banks are in such dire need to window-dress their books is concerning.”

And now we get more to ‘concern’ ourselves with as a key measure of stress in the financial system’s plumbing is showing signs of cloggage…

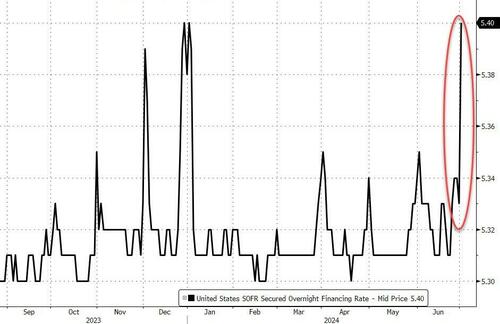

The Secured Overnight Financing Rate – A key rate tied to the day-to-day borrowing needs of the financial system – surged to its highest level ever (spiking 7bps to 5.40%) on July 1 as chunky Treasury auction settlements and clogged primary dealer balance sheets curbed lending capacity.

Source: Bloomberg

With The Fed still removing liquidity from the system via quantitative tightening (albeit having signaled this will be at a significantly slower rate as they taper QT), volatility underlying the financial system (which just got it clean bill of health from The Fed, remember) is starting to reignite in a replay of last year’s stress. This stress was exaggerated by crucial quarter-end funding periods as seen last week, when, as Bloomberg reports, banks tend to pare repo activity to shore up balance sheets for regulatory purposes and borrowers either find alternatives or pay up.

At the same time, the glut of government debt sales means more collateral needs financing from the repo market.

And so pay up they did…

“This might be the new normal and explains why the Fed reduced the cap on runoffs,” said Subadra Rajappa, head of US rates strategy at Societe Generale SA.

“Record coupon issuance sizes and bond settlements, primary dealer holdings near highs, so ultimately balance-sheet constraints.

This feels more like what we saw year-end and repo might take a few days to normalize.”

Source: Bloomberg

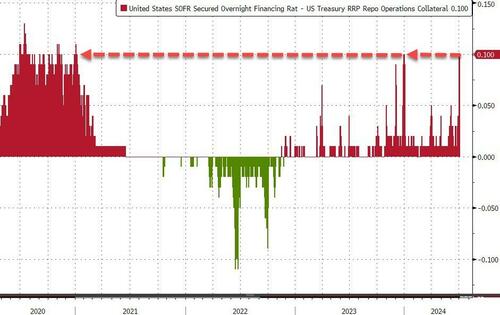

Admittedly this spike in the SOFR spread is far from the extremes we saw in March 2020 (COVID) and Sept 2019 (Repo crisis), but it is heading in the right (well, wrong) direction as Bloomberg highlights, the indicators that warned of strains in 2018-2019 have started to re-appear – dealer holdings of Treasuries are near all-time highs and overnight repo rates continue to creep up.

The Fed’s Standing Repo Facility has helped put a ceiling on repo rates, though questions remain on how it handles moments of stress.

Excluding The Fed’s now halted bank bailout facility, Small Banks appear to be at their reserve constraints and now the Discount Window is their only choice should all hell break loose again (and the de-stigamtization of that facility will, we are sure, pick up soon in Fed Speak)…

Source: Bloomberg

The Fed may have no choice to cut rates and/or reverse course to QE – but with Biden’s poll numbers now puking, that would look even more politicized…

“Stopping QT would help prevent the background from deteriorating further, but I don’t think stopping QT would materially improve the environment,” said Gennadiy Goldberg, head of US interest rate strategy at TD Securities.

“It’s really a function of the cost of cash starting to rise somewhat as we go from extreme abundance of liquidity to a more ‘normal’ environment.”

Finally, not everyone is fearful:

“This might be the new normal and explains why the Fed reduced the cap on runoffs,” said Subadra Rajappa, head of US rates strategy at Societe Generale SA.

“Record coupon issuance sizes and bond settlements, primary dealer holdings near highs, so ultimately balance-sheet constraints. This feels more like what we saw year-end and repo might take a few days to normalize.”

But, for now, we will be keeping an eye on reverse repo usage (and the SOFR spread) for any further signs of deterioration.

Tyler Durden

Tue, 07/02/2024 – 15:05

via ZeroHedge News https://ift.tt/CD1uvdr Tyler Durden