McDonald’s Meal Deal Extends Into December As Core Customers Under Pressure

McDonald’s is set to extend its $5 meal deal, originally a summer promotion launched in June, through December across all US markets. This move signals the fast-food giant’s acknowledgment that its core customers are struggling to afford Big Macs in a period of elevated inflation and high interest rates, thanks to failed Bidenomics. Recent data shows that broader low- and middle-income consumers are experiencing the financially devastating combination of insurmountable debts and depleted personal savings.

Value wars among fast-food chains are heating up and now extending: MCD rolled out the $5 meal deal in June, allowing customers to pick the following items: a McDouble or McChicken sandwich or 4-piece Chicken McNuggets, a small fry, and a small soft drink. Now, the promotion runs through December.

“Together with our franchisees, we’re committed to keeping our prices as affordable as possible, which is why we’re doubling down with even more ways to save,” Joe Erlinger, President of McDonald’s USA, wrote in a statement.

Erlinger said, “The extension of the $5 Meal Deal, and the other offerings we’re announcing for our fall line-up, are just a few of the ways we’re working hard to offer great meals at a fair price.”

Value wars are heating up:

-

McDonald’s Admits Consumers Are Broke With Planned Reintroduction Of $5 Meal Deal

-

KFC Unveils’ Finger-Lickin Good’ Meal Deal As Value Wars Heat Up

The proliferation of meal deals by fast-food companies early this summer marks the moment low/mid-tier consumers hit a financial brick wall in the eyes of management teams. The weight of inflation and high interest rates has led to a consumer pullback in spending.

Even Dollar Tree and Dollar General have warned in recent weeks about mounting consumer pressures.

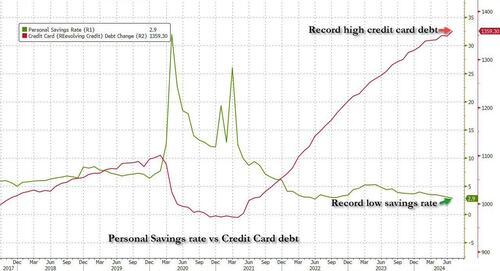

The latest consumer data shows that people have maxed out their credit cards and drained their personal savings to a record low. All of this is an ominous sign as storm clouds gather overhead.

Meanwhile, auto delinquencies have soared this summer as some consumers with those $1,000 monthly payments, likely drowning in negative equity, must choose between paying bills or putting food on the table.

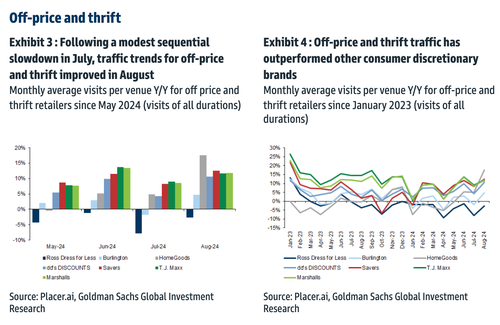

Earlier this week, Goldman cited new high-frequency data that analyzed foot traffic at brick-and-mortar stores, which only showed ‘thrift trends outperforming.’

The lingering theme in the second half of this year is that low/mid-tier consumers are severely under pressure as the labor market cools and economic momentum trends in the wrong direction.

Tyler Durden

Thu, 09/12/2024 – 20:00

via ZeroHedge News https://ift.tt/SbcWePu Tyler Durden