Swing State Renters Earn 17% Less Than Needed To Afford A Typical Apartment

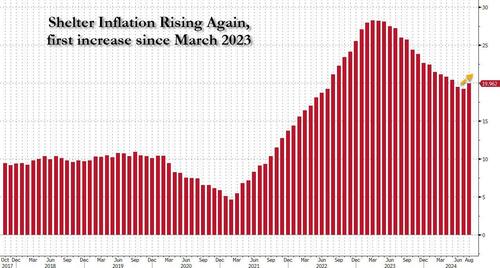

With shelter costs once again rising year over year for the first time since last March…

… our prediction that by the time housing CPI – which is lagged by as much as 18 months – catches up with “today”, real rents will be rising by double digits, thanks to the Fed’s rate cut.

The next paradox for the Fed: since Shelter/OER inflation lags by 18 months, housing inflation will decline well into 2025 even as actual rents are again starting to tick up.

By the time lagged CPI catches up with “today”, real rents will be rising double digits. pic.twitter.com/sHOWxN2OVQ

— zerohedge (@zerohedge) December 12, 2023

And while the countdown to double digit rent inflation officially began on Wednesday when the Fed cut rates by a jumbo 50bps, the first rate cut since March 2020, we now get to sit back and watch the public’s delighted response – especially vis-a-vis the November election – to the Fed launching an easing cycle with record high home prices and rents,

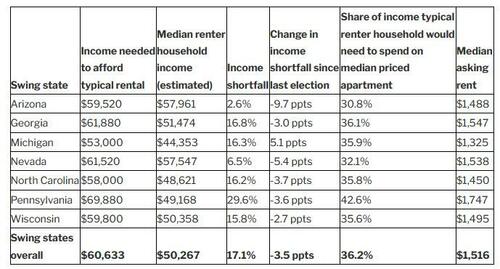

Case in point: according to real estate brokerage Redfin, the typical renter household in a swing state earns an estimated $50,267 per yea, $10,365 less than the $60,633 a renter must earn to afford rent for the median priced apartment in a swing state.

In other words, the typical swing state renter household earns 17.1% less than they need to afford the typical apartment. That’s a staggering shortfall, and one that will only grow now that Owner Equivalent Rent is once again starting to rise.

Redfin’s report focuses on swing states because voters in those states will decide the winner of the 2024 presidential election, and housing affordability – or lack thereof – is a crucial issue on voters’ minds. Redfin considers this year’s swing states to be Arizona, Nevada, Wisconsin, Michigan, Pennsylvania, Georgia and North Carolina. Indeed, as we said two months ago, this election will be decide not by not immigration, not crime, not equity, not abortion, not climate change, not guns, but just by one thing: inflation.

Only inflation matters: not immigration, not crime, not equity, not abortion, not climate change, not guns pic.twitter.com/eOQOyDE2zW

— zerohedge (@zerohedge) July 30, 2024

Rental affordability in swing states has deteriorated as income growth has failed to keep up with rising rents. The $50,267 estimated median renter household income in swing states is up doublt digits from the last election seasons but nowhere near enough to keep up with the national or growth in rent. Meanwhile, asking rents in swing states are flat from a year ago, but are up 23.8% from the last election cycle, and many renters struggle to afford their monthly housing costs.

The typical renter household in Arizona earns an estimated $57,961 per year—just 2.6% shy of the $59,520 they need to afford the median priced apartment. The second largest improvement was in Nevada, where the typical income shortfall is 6.5%. Next came Wisconsin, North Carolina, Georgia and Pennsylvania, perhaps the most important swing state of all: there, the income shortfall is a staggering 29.6%!

The typical renter household in Pennsylvania earns an estimated $49,168 per year. That’s 29.6% less than a renter must earn to afford the median priced Pennsylvania apartment—the biggest shortfall of any swing state by far. This is because Pennsylvania has a higher median asking rent ($1,747) than any other swing state. The typical renter household in Pennsylvania would now need to spend 42.6% of their income to rent the median priced apartment—a higher share than any other swing state, though down from both a year ago and the prior election.

“America’s swing state voters will decide the outcome of the next presidential election based on the candidates’ plans for tackling key issues including the housing affordability crisis,” said Redfin Chief Economist Daryl Fairweather. “While the economy has been improving on paper, that’s not what it feels like for a lot of U.S. families. Many renters—especially young people—still feel the rent is too damn high.”

The typical swing state renter is “rent burdened”—meaning they spend more than 30% of their income on housing—but less so than before. A swing state renter making the median income would now need to spend 36.2% of their income to rent the median priced apartment, down from 38.5% last year and 37.8% during the prior election cycle.

Tyler Durden

Fri, 09/20/2024 – 15:05

via ZeroHedge News https://ift.tt/mti58pS Tyler Durden