Consumers Crack: Credit Card Debt Suddenly Plunges Most Since Covid As APRs Hit Record High

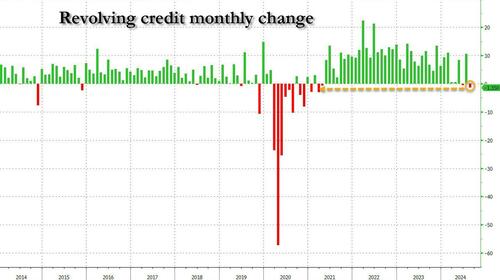

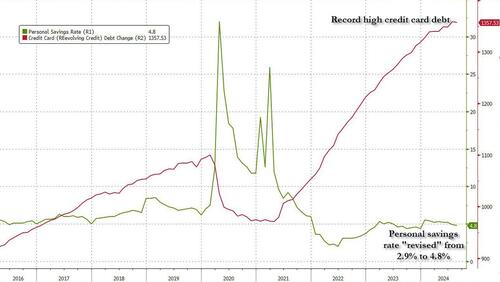

Last month, we – and many others – were stunned when after several months of progressively declining revolving credit growth, in July credit card debt unexpectedly soared by the most since January, sending total consumer credit growth surging by just under $27 billion, the single biggest monthly increase since 2022. We called it a “Last Hurrah” moment (literally “In “Last Hurrah”, Credit Card Debt Unexpectedly Soars Despite Record High APRs As Savings Rate Hits Record Low“) and said that “with consumers ever more strapped for actual cash and equity, as the personal savings rate in the US collapses from over 5% to 2.9% – the lowest since the Lehman bankruptcy – in just one year, as all the excess savings from covid are long gone there is only so much more credit card maxing out that can take place before reality finally sets in.“

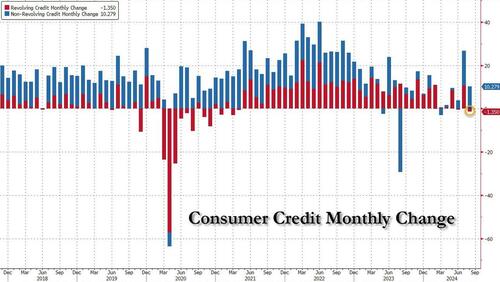

One month later, reality has set in with a bang, because just a month after a bizarre surge in revolving credit, the Fed reported that in August, total consumer credit growth plunged by more than half to just $8.9 billion, below the $12 billion estimate…

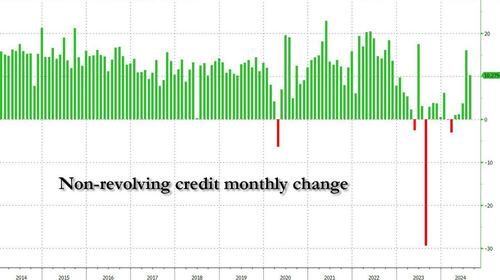

… but while non-revolving credit which is far less volatile and much more stable, grew $10.3 billion, a big drop from the previous month’s $16 billion, if still the 2nd highest monthly increase of 2024 …

… the punchline is that the much more consumer-outlook sensitive revolving credit reversed all of its July surge and then some, as August saw the biggest revolving credit drop since the covid crash!

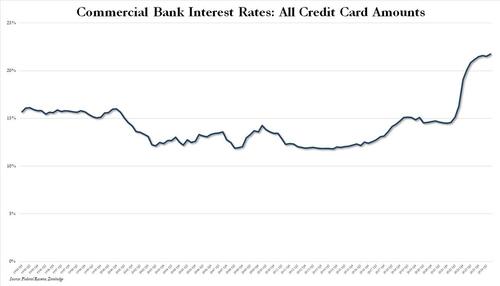

And what is especially notable is that just days before the Fed’s first rate cut since the covid crash, where Powell telegraphed an econ panic with his “jumbo” rate cut, the average rate on all credit cards in the US just hit a new high of 21.76%, up from 21.51%.

It will be very interesting to see if APRs drop next month when we get the update for September, after the Fed’s rate cut, because one month ago we made a prediction that while deposits and savings rates immediately dropped, interest rates on debt – such as credit card APRs – will barely budge (if not keep rising).

Here’s what happens next: savjngs account rates drop by 0.5% instantly while credit card APRs remain unchanged

— zerohedge (@zerohedge) September 18, 2024

Finally, in light of the collapse in credit card funded spending, we can stop pretending that the government’s recent fabrication of savings data, which was upwardly “revised” from a record low 2.9% to a nice and balmy 4.8%, is even remotely credble.

Tyler Durden

Mon, 10/07/2024 – 15:49

via ZeroHedge News https://ift.tt/yCO2EAM Tyler Durden