WeightWatchers Squeezes Higher After Unveiling New Low-Cost GLP-1 Treatment

Shares of heavily shorted WW International, also known as WeightWatchers, jumped as much as 27% on Tuesday morning after the weight-management company announced a new low-cost weight-loss drug offering, which is essentially a copycat of Novo Nordisk A/S’s Ozempic and Wegovy.

WW announced the addition of a new compounded semaglutide to its lineup to beat America’s obesity crisis sparked by the processed foods industrial complex. The new treatment starts at $129 per month, and each additional month will cost $189. This is significantly less than GLP-1 obesity treatments from big pharma, which cost north of $1,000 a month.

“At WeightWatchers, we have always combined proven science and personalized support to help our members achieve meaningful, lasting results. With the addition of compounded semaglutide, we are expanding our offering to include a clinical weight management solution that is both accessible and affordable,” Tara Comonte, Interim CEO of WW, wrote in a statement, adding, “This launch is the culmination of extensive research and rigorous work by our team to ensure that we are offering the highest quality care — reaffirming the trust we’ve built over six decades as the leader in weight management.”

WW’s pursuit of a low-cost GLP-1 obesity treatment comes as the company pointed out continued shortages of Wegovy and Ozempic produced by Novo Nordisk.

Comonte continued, “Given the ongoing shortages of branded medications such as Ozempic and Wegovy, WeightWatchers is committed to ensuring our members still have access to effective alternatives and the support they need to achieve the health outcomes they deserve.”

Food and Drug Administration rules note that compounding pharmacies can produce drugs in short supply. WW contracted with an FDA-registered 503B facility to make its compounded semaglutide.

“We know that compounded semaglutide can be an important option for those seeking weight loss support, given its greater availability and affordability,” said Dr. Jamil Alkhaddo, Medical Director of WW.

WW noted that about 45% of its members prescribed GLP-1 medications in the past six months have been denied insurance coverage after three prior authorization attempts. With fewer than 40% of insurers covering GLP-1s for weight loss, many individuals with obesity in today’s elevated inflation and high interest rates environment can’t afford Novo’s $ 1,000-a-month treatment.

Last week, Eli Lilly’s diabetes and obesity drugs Mounjaro and Zepbound were removed from the FDA’s shortage list, freeing the company from competing with compounding pharmacies. Tirzepatide’s shortage designation lasted 22 months.

WW shares rose 27% by late morning, though they remain down 88% on the year after disappointing quarterly results and the announcement of a restructuring plan.

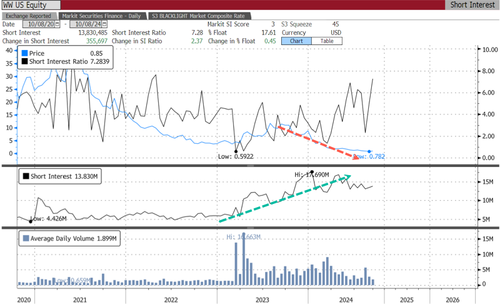

A large bear position has been built in WW since early 2023. The float is 18% short, equivalent to about 13.8 million shares.

Is it time for a squeeze?

Tyler Durden

Tue, 10/08/2024 – 14:00

via ZeroHedge News https://ift.tt/KBP8tTq Tyler Durden