China New Credit Data Is A Disappointing Mess, Sparking Speculation Of QE

Two weeks ago, when the world was still enamored with Jim Cramer’s idiotic idea that Chinese stonks can magically double in just a few weeks simply because Beijing had some soothing words to say and because when it comes to greater fools, China has more than anyone else, and when Goldman laughably upgraded Chinese stocks after the 30% runup had already taken place,we warned that the party was about to end…

Cramer: “You have to come in China stocks right now”

That’s the top.

— zerohedge (@zerohedge) October 2, 2024

… for one simple reason: as we said in “Why China’s Rally Won’t Have Legs“, China would be unable to recreate previous reflationary episodes simply because Beijing would not be able to recreate the credit impulse explosion that rebooted the Chinese economy during previous downturns, in 2012, 2015 and 2020.

Specifically, this is what we said:

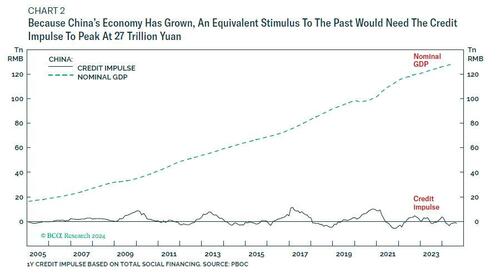

In the 2015 stimulus cycle, China’s credit impulse peaked at 13.5 trillion yuan, equivalent to over 15 percent of GDP. Given that China’s nominal economy is now twice as large, an equivalent stimulus would need the credit impulse to peak at 27 trillion yuan (Chart 2).

At its most recent peak though, China’s credit impulse did not even reach 5 trillion yuan! Meaning that to compare with the 2015 episode, the just-announced stimulus cycle would need an amplitude five times greater than the most recent peak.

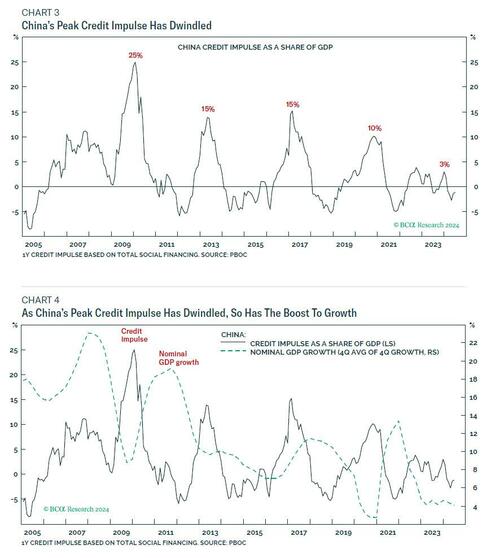

This would require a major reversal of the downtrend in stimulus cycles through the past two decades. After the credit impulse peaked at a monster 25 percent of GDP in 2009, subsequent peaks have reached 15 percent, 15 percent, 10 percent, and just 3 percent. This is significant because as the peak impulse has dwindled, so has the boost to growth (Chart 3 and Chart 4).

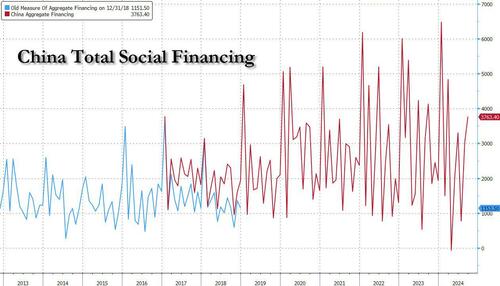

We bring this up because earlier today China published its latest, September, credit data, and it was a mess: the broadest credit aggregate, total social financing (TSF), as well as new RMB loans remained soft, in line with market expectations.

Here are the details:

- New RMB loans: RMB 1590bn in September (RMB loans to the real economy: RMB 1973bn) vs. Bloomberg consensus: RMB 1938bn.

- Outstanding RMB loan growth: 8.1% yoy in September; down from 8.5% yoy in August.

- New RMB loans missed market expectations and were much lower than a year ago. The outstanding RMB loan growth declined to 8.1% yoy in September (vs. 8.5% yoy in August). In addition, the composition of new loans suggested credit demand remained weak in September. After seasonal adjustment, household loans expanded mildly by 1.7% month-over-month annualized in September (vs. 2.1% in August), with accelerated short-term loans extension. Bill financing growth remained solid (31.6% month-over-month annualized in September vs. 34.4% in August), while corporate medium-to-long term loans growth moderated to 8.6% month-over-month annualized in September (vs. 10.1% in August).

- Total social financing: RMB 3760bn in September, in line with Bloomberg consensus: RMB 3575bn.

- TSF stock growth: 8.0% yoy in September, down from 8.1% in August. The implied month-on-month growth of TSF stock: 8.4% in September vs. 8.4% in August.

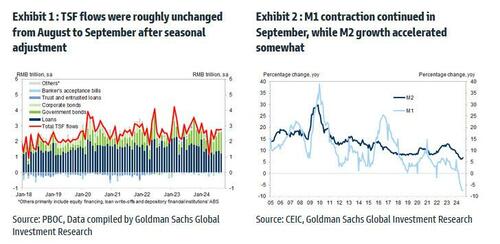

- TSF flows were broadly unchanged from August to September, as a rise of government bond issuance was offset by a decline of corporate bond issuance. Specifically, government bond net issuance rose to RMB 1349bn vs. RMB 1174bn in August after seasonal adjustment, while corporate bond net issuance fell to RMB -41bn in September after seasonal adjustment vs. RMB 85bn in August. In year-over-year terms, TSF stock growth edged down to 8.0% from 8.1% in August. The implied sequential growth of TSF stock was unchanged at 8.4% mom sa annualized in September.

- M2: 6.8% yoy in September vs. Bloomberg consensus: 6.4% yoy, August: 6.3% yoy; more ominously, M1 growth edged down to -7.4% yoy in September, vs. -7.3% yoy in August.

According to Goldman, the September credit data indicated credit demand of private sectors remained weak: household loan growth remained low, and corporate loan growth moderated. Money supply data were mixed: M1 stock still experienced a deep contraction, but M2 growth picked up in September (as a reminder, M1 has to surpass M2 for China to even have a hope of a successful reset). The Securities Times reported that the rise of M2 growth was driven by inflows into bank deposits and margin deposits, thanks to the stock market rally in late September; of course, the subsequent drop means that M2 will promptly reverse. More importantly, the deep M1 contraction still signals likely disinflationary pressures in the coming months.

China credit impulse remains depressionary. For all its talk, Beijing will need to unleash a new credit flood for markets to take it seriously. pic.twitter.com/U0tsQrRle3

— zerohedge (@zerohedge) October 14, 2024

Bottom line: this was a clear step in the wrong direction for China, and Beijing’s desire to reflate the economy, and reminds us of what we said one week ago, when we quoted a Goldman trader who cautioned that unless China does QE “now”, it will ned up in a much bigger hole in 12 months, as there is just one thing that matters for China: M1 vs M2 dynamics, to wit: “If the rally has legs you need to see M1 growing faster than M2 (demand for settlement balances above demand for saving balances) and you also need to see much steeper curve.”

Which brings us to this morning, because just hours after the latest dismal credit data was published, China’s Caixin reported that the first tentative step to full-blown QE, namely the imminent issuance of “6 trillion yuan from ultra-long special treasury bonds over three years as part of its efforts to buttress the slowing economy through fiscal stimulus.”

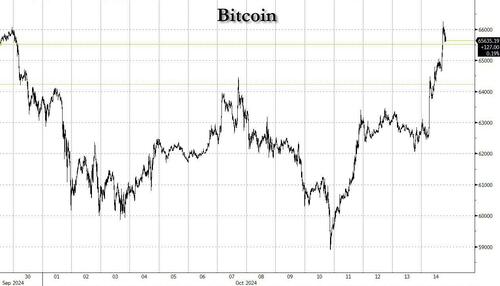

Naturally, with amounts that big, the central bank will have to backstop demand, hence QE. And, as a reminder, one week ago we also said that “if China does do QE, oil will soar, and bitcoin and gold will be orders of magnitude higher once Beijing triggers then next global reflationary tsunami.” That should explain why bitcoin surged today…

… and why it is well on its way to new all time highs again.

Tyler Durden

Mon, 10/14/2024 – 17:20

via ZeroHedge News https://ift.tt/QPhXfqa Tyler Durden