Walgreens Jumps Most In Years After Better-Than-Expected Earnings, Outlook, & Widespread Store Closures

Walgreens shares in New York surged the most in 16 years on Tuesday after the struggling pharmacy chain delivered an unexpectedly optimistic forecast for 2025. Simultaneously, Walgreens announced plans to shutter over a thousand stores nationwide as its turnaround plan gains steam.

Fourth-quarter earnings were 39 cents, beating the Bloomberg consensus of 36 cents. This indicates that the struggling drugstore chain is executing on its aggressive cost-cutting measures in an ambitious turnaround plan after years of pain.

Here’s a snapshot of the quarterly results (courtesy of Bloomberg):

- Adjusted EPS 39c vs. 67c y/y, estimate 36c

- International sales $5.97 billion, +3.2% y/y, estimate $5.84 billion

- Sales $37.55 billion, +6% y/y, estimate $35.56 billion

- Adjusted gross margin 16.9% vs. 18.6% y/y, estimate 17.6%

- US Retail Pharmacy Sales $29.47 billion, +6.5% y/y, estimate $27.48 billion

- US Healthcare Sales $2.11 billion, +7.2% y/y, estimate $2.15 billion

- Adjusted gross profit $6.33 billion, -4% y/y, estimate $6.24 billion

- Adjusted operating income $424 million, -38% y/y, estimate $396 million

With the fourth quarter print not so bad, Walgreens issued profit guidance for 2025 that was in line with the average analysts tracked by Bloomberg:

- Sees adjusted EPS $1.40 to $1.80, estimate $1.73 (Bloomberg Consensus)

- Sees sales $147 billion to $151 billion, estimate $146.9 billion

- Sees adjusted operating income $1.6 billion to $2.0 billion, estimate $1.89 billion

CEO Tim Wentworth wrote that the “turnaround will take time, but we are confident it will yield significant financial and consumer benefits over the long term.”

Walgreens also announced that 14% of its US stores, or around 1,200 locations, will close over the next three years. About 500 of those stores will close in 2025.

In June, the drugstore chain announced that 300 underperforming locations would close as part of the turnaround plan. It also noted about a quarter of all stores were unprofitable and would usher in “imminent” changes.

Here’s analyst commentary about Walgreens’s ER and turnaround plan:

Leerink Partners, Michael Cherny (market perform, PT $9)

- Says WBA’s FY25 guidance “needs more details from the upcoming deck on the full breakdown from revenue guidance to EPS guidance”

- The updated commentary on the store closure plan is a start, although further visibility into the makeup of the closures is going to be another focus

- “All-in, the FY4Q’24 print and FY25 guidance was not as bad as it could have been, which is somewhat of a positive relative to recent trends”

Evercore ISI, Elizabeth Anderson (in line, PT $7.50)

- Says WBA finished its FY24 on a relative high note, with strong pharmacy comp sales

- “US Healthcare adj op margin was also positive (first time!) as the company continued to make progress on both GMs and OpEx”

Barclays, Stephanie Davis (underweight, PT $7)

- Calls the 2025 guidance “better than feared”

Jonathan Palmer, an analyst with Bloomberg Intelligence

- “The decisive decision to shutter a large cohort of underperforming stores is a positive in a narrative where the expectations are exceedingly low.”

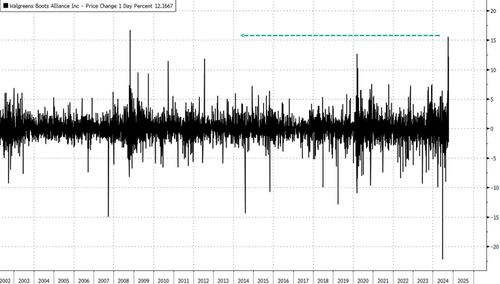

WBA shares jumped as much as 15% in markets—the most in 16 years. Shares peaked at the $96 handle in August 2015 and have since tumbled 91%. The latest downward pressure comes from budget-conscious consumers.

We wonder how many of the Walgreens stores slated to close next are in lawless progressive cities.

Brazen theft at @Walgreens. Yet @Flo4Sacramento is against @YesOn36Now and said cut @TheCityofSac police by -20%. pic.twitter.com/sa5bZW96Oi

— BetterSacNow (@SunnySacParks) October 13, 2024

In San Francisco, we went to the Walgreens that is the #1 spot for theft in all the 9000 US stores, per Walgreens. This is where chains once shut the freezer section. And we saw 3 thefts right in front of us. But across SF, coffee, mustard, nail polish– are all locked up: pic.twitter.com/IfYBVgpeI2

— Kyung Lah (@KyungLahCNN) July 25, 2023

Unchecked theft in Portland

Guy with sleeping bag was stealing through Walgreens, walked behind the counter and stole from the cigarette section, and left while the poor beaten down checker asked him to stop. Thief knows there’s no consequences

Checker didn’t even notice the… pic.twitter.com/wOCqT6H9EN

— garbage ghost Tara Faul⚡️ (@tarafaul503) January 15, 2024

Here’s what @annamajaCNN & I saw at San Francisco’s Richmond area Walgreens, the worst spot of all 9000 US Walgreens for theft, per the co. We watched 3– and grabbed video of this shoplifter walk out right in front of us. pic.twitter.com/XJJxNcJ8Yj

— Kyung Lah (@KyungLahCNN) July 25, 2023

Group of thieves steal cash registers from Walgreens in Oakland, California pic.twitter.com/s70gUKdMLN

— BAY AREA STATE OF MIND (@YayAreaNews) November 3, 2023

Sigh.

Tyler Durden

Tue, 10/15/2024 – 13:40

via ZeroHedge News https://ift.tt/iBe7CkF Tyler Durden