Expedia Jumps On FT Report That Uber Explored Takeover

Shares of Expedia Group surged in premarket trading in New York following a report from the Financial Times, which stated that Uber Technologies has been in talks with advisors in recent months to explore a potential takeover of the travel website. Wall Street analysts viewed the possible merger between the ride-hailing giant and the travel website as ‘positive.’

The FT report cites three individuals familiar with the talks between Uber and advisors:

Uber approached advisers in recent months after the idea of an Expedia acquisition was broached by a third party to examine whether such a deal would be possible and how it could be structured, according to three people familiar with the process.

The report noted that Uber chief executive Dara Khosrowshahi, who served as Expedia’s CEO between 2005-17 and remains a non-executive director on its board, may suggest that any deal would be ‘friendly’ instead of hostile in nature.

The people briefed on the matter said Uber’s discussions with advisors to determine how a deal could be structured with the travel website was in the “very early stage, and it was possible that a deal would not transpire.” Another person said Uber and Expedia have yet to discuss any deal formally.

Earlier this week, Uber chief executive Dara Khosrowshahi told FT, “Anywhere you want to go in your city and anything that you want to get, we want to empower you to do so.”

Combining ride-hailing services with Expedia and its booking technology under one platform would create a ‘super app’ such as those built by Chinese tech firms.

In August, Uber CEO Prashanth Mahendra-Rajah said that the ride-hailing firm’s “top priority” for deploying capital was investing in growth, including via acquisitions.

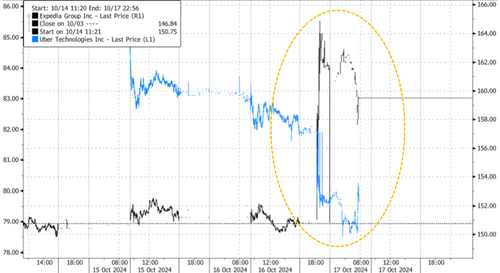

In markets, Uber shares fell about 3% in premarket trading, while Expedia shares were up about 6%.

Wall Street analysts provided commentary on FT’s report (courtesy of Bloomberg):

Bloomberg Intelligence analyst Mandeep Singh

- “Uber CEO Dara Khosrowshahi’s familiarity with Expedia as its former leader could help drive revenue and cost synergies”

- “Adding Expedia would likely have a better margin profile than Uber’s Delivery segment and could support ads and subscriptions scale over time”

TD Cowen analyst Kevin Kopelman

- A possible deal would offer synergies if Uber planned a broader rollout of Travel booking services

- Kopelman notes Uber UK rolled out Hotel bookings in 2022 and Flights in 2023

- “However, an acquisition of EXPE would also come with the challenges of managing EXPE’s existing brand portfolio in the face of difficult competition”

Bernstein analyst Nikhil Devnani

- Hoping that Uber makes forays into travel, but thought it would come via partnerships “and not outright M&A — particularly a potential deal of this size”

- “Despite Dara’s background, we think it would be the furthest step out of Uber’s core area of competency via M&A for the business at large — and that notion makes us nervous as Uber bulls”

Truist Securities analyst Gregory Miller

- The timing of Uber’s possible outreach is potentially opportunistic as Expedia “has largely completed its multi-year strategic transformation to simplify its business model”

Since 2019, Uber has expanded into food and beverage delivery, freight, and logistics, yet it has made very few large deals.

Tyler Durden

Thu, 10/17/2024 – 09:00

via ZeroHedge News https://ift.tt/iMgaScK Tyler Durden