Halloween Chocolate Candy Bar Prices May Scare Consumers

With Halloween just 13 days away, consumers should expect higher supermarket prices for candy bars from Hershey’s, Nestle, Mars, and Cadbury. Cocoa prices have doubled this year due to a supply crisis in West Africa, a top cocoa-producing region, which has already impacted global production.

Wells Fargo Agri-Food analyst David Branch recently told clients that consumers should see another price spike on chocolate candy bars this Halloween. He said crop conditions in West Africa are still plagued with disease and overall drier conditions, adding that this only indicates that harvest will remain low and candy bar manufacturing costs higher.

Branch said the 2025 cocoa harvests are projected to come up short for a third consecutive year; it’s “likely that cocoa prices will remain high at least through the next crop year ending September 2025.”

Cocoa futures in New York jumped from $4,000 per ton to as high as $12,000 earlier this year. Since April’s peak, prices have consolidated around $7,000, suggesting prices could head higher in the coming months if supplies remain low and grinding data high across the West and Asia.

“A lot of those issues remain, and there’s no quick fix to aging cocoa trees,” John Caruso, senior market strategist at RJO Futures, told MarketWatch in an interview.

Branch noted, “Warehouse stocks are at 50 year lows, they’ve been declining for the last 15 months. The lower production has the market in turmoil, and as a result, we’ve seen futures prices just skyrocket over the last two years because chocolate demand, for cocoa flavors and confectionery, is still going up year-over-year,” adding, “It’s gotten pretty dire.”

While harvest data remains dismal and supplies are low, grinds in Asia rose 2.6% in the third quarter compared to last year. In Europe, grinds were down 3.3%. In North America, grinds were up 12%. Traders monitor grinds as a proxy of demand.

“Consumers have not been willing to temper their insatiable chocolate appetite too much,” said Tracey Allen, an agricultural commodities strategist at JPMorgan, who was quoted by Bloomberg, adding, “Cocoa demand has been resilient in the face of historically high prices and a supply squeeze through the year.”

She pointed out that traders are now focused on the 2024-25 season outlook and the upcoming crop harvests.

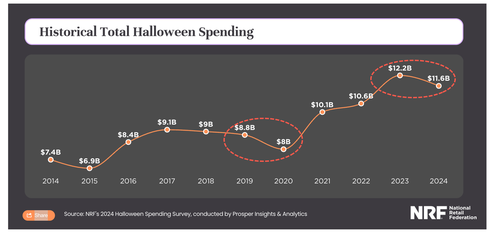

Earlier this week, we cited a National Retail Federation survey showing Americans are dialing back spending on Halloween because of Biden-Harris’ inflation storm. This is the first decline in consumer spending for the spooky holiday since right before Covid lockdowns.

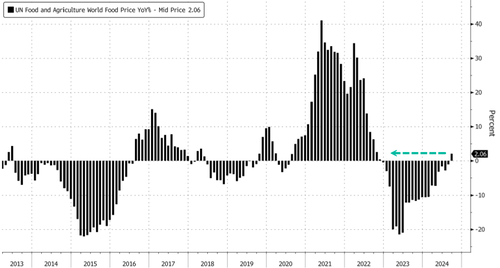

Food inflation is very sticky. Global prices just jumped the most in 18 months in September. Yet somehow, delusional Kamala Harris wants to solve food inflation with Communist price controls. Really, that’s the first thing that comes to mind?

The food inflation storm shows no signs of easing—in fact, it could get even worse. This means it’s time for people to start sourcing food locally or consider starting their own farms.

Tyler Durden

Fri, 10/18/2024 – 11:50

via ZeroHedge News https://ift.tt/QJsV3Zc Tyler Durden