Ugly, Dovish Beige Book Warns Of Manufacturing Decline In “Most Districts”, Greenlights Further Rate Cuts

Back in September, the otherwise sleepy and mostly boring report that is the Fed’s Beige Book report (which nobody otherwise reads due to its sheer size) got a sudden boost of notoriety and popularity when none other than Jerome Powell explained after the Fed’s 50bps rate cut, that he had been closely following the Beige Book which had emerged as a driving force behind the Fed’s unexpected “jumbo” 50bps rate cut. And unlike others, we actually do read the Beige Book, which is why two weeks before the FOMC rate cut we titled our analysis of the latest report as follows: “Ugly Beige Book Reveals Economic Activity “Flat Or Declining”, Consumer Spending Slowing In Most Districts.” So one can see why Powell panicked.

Fast forward to today when moments ago the Fed published its latest, October, Beige Book which indicated a continuation of the “ugly” sluggish conditions observed in September, and which on its own, will likely be sufficient to enable further rate cuts in coming months.

According to the Fed’s latest report, economic activity on balance was “little changed in nearly all Districts since early September, though two Districts reported modest growth.” Worse, “most Districts reported declining manufacturing activity.” Additionally, reports on consumer spending were mixed, “with some Districts noting shifts in the composition of purchases, mostly toward less expensive alternatives” indicating the Fed will likely have to ease further to boost the low-end income consumer.

It wasn’t all bad, as activity in the banking sector was “generally steady to up slightly, and loan demand was mixed, with some Districts noting an improvement in the outlook due to the decline in interest rates.” Also, housing market activity has generally held up: inventory continued to expand in much of the nation, “and home values largely held steady or rose slightly. Still, uncertainty about the path of mortgage rates kept some buyers on the sidelines, and the lack of affordable housing remained a persistent problem in many communities.” At the same time, commercial real estate markets were generally flat, “although data center and infrastructure projects boosted activity in a few Districts.”

Elsewhere, agricultural activity also called for easier conditions, as it was “flat to down modestly, with some crop prices remaining unprofitably low. Energy activity was also unchanged or down modestly, and lower energy prices reportedly compressed producers’ margins.” Despite elevated uncertainty, the Fed founds that its contacts were somewhat more optimistic about the longer-term outlook, surely the result of the recent easing cycle.

Turning to one-time items, the Fed wrote that “the short-lived dockworkers strike caused only minor temporary disruptions. Hurricane damage impacted crops and prompted pauses in business activity and tourism in the Southeast.”

Some more details from the Beige Book, starting with Labor Markets:

- Employment increased slightly during this reporting period, with more than half of the Districts reporting slight or modest growth and the remaining Districts reporting little or no change.

- Many Districts reported low worker turnover, and layoffs reportedly remained limited.

- Demand for workers eased somewhat, with hiring focused primarily on replacement rather than growth.

- Worker availability improved, as many contacts reported it had become easier to find the workers they need. However, contacts noted that it remained difficult to find workers with certain skills or in some industries, such as technology, manufacturing, and construction.

- Wages generally continued to rise at a modest to moderate pace. With the improvement in worker availability, contacts in multiple Districts pointed to a slowdown in the pace of wage increases. Still, larger than usual pay increases were reported for some workers, such as those in the skilled trades or in remote areas.

Turning to prices:

- Inflation continued to moderate with selling prices reportedly increasing at a slight or modest pace in most Districts.

- Still, the prices of some food products, such as eggs and dairy, were reported to have increased more sharply.

- Home prices edged up in many Districts, while rents were reported to be steady or down slightly.

- Many Districts noted increasing price sensitivity among consumers.

- Input prices generally rose moderately.

- Contacts across several industries noted more acute pressures from rising insurance and healthcare costs (which the Fed has no control over).

- Multiple Districts reported that input prices generally rose faster than selling prices, compressing firms’ profit margins.

Here are the main highlights by Fed District

- Boston: Economic activity was flat, as was employment, and prices increased slightly. International travel was a bright spot, and the summer tourism season on Cape Cod was described as strong. More broadly, consumers remained highly price conscious, and certain manufacturers had persistently weak sales. Home sales and home prices softened noticeably over the summer. Contacts were cautiously optimistic about the outlook for late 2024 and 2025.

- New York: On balance, regional economic activity was little changed. Employment increased slightly and wages continued to increase moderately. Housing markets remained solid, with home prices continuing to edge up. Selling price increases remained modest. Capital spending plans were strong, with some investments already underway.

- Philadelphia: Business activity continued to decline slightly in the current Beige Book period. Consumer spending fell modestly, and nonmanufacturing activity fell slightly. Employment appeared to rise slightly, after falling slightly last period. Wage growth continued at a modest pace, as did reported rises in input costs and prices. Expectations for future growth rose—becoming more widespread for both manufacturers and nonmanufacturers.

- Cleveland: Overall, Fourth District business activity was stable. Residential construction and real estate activity increased and demand for nonfinancial services remained strong. By contrast, consumer spending and demand for manufactured goods remained soft. Employment levels were stable. On balance, wages increased modestly, nonlabor costs grew moderately, and selling prices increased slightly.

- Richmond: The regional economy grew modestly this cycle. Consumer spending picked up, loan demand increased, manufacturing activity expanded, port activity rose, and employment grew slightly. Ports in the District were minimally impacted by the short-lived worker strike; however, parts of our District were heavily affected by Hurricane Helene; the full impacts of the loss of life and property were still being assessed.

- Atlanta: The economy of the Sixth District declined slightly. Employment was steady and wages grew slowly. Prices were little changed, and pricing power softened. Consumer spending slowed, and tourism decelerated. Demand for housing was flat. Transportation activity increased slightly. Loans grew modestly. Manufacturing declined and energy activity slowed. Agriculture conditions weakened.

- Chicago: Economic activity increased slightly. Consumer spending rose modestly; employment was up slightly; construction and real estate activity was flat; nonbusiness contacts saw little change in activity; and business spending and manufacturing activity edged down. Prices were up modestly, wages rose moderately, and financial conditions loosened slightly. Prospects for 2024 farm income were unchanged.

- St. Louis: Economic activity across the Eighth District has remained unchanged since our previous report, despite continuing to show some signs of slowing demand. Across the District, contacts expressed their intention to maintain employment levels in the upcoming months. Prices continued to increase modestly with some input costs remaining unchanged or decreasing. The outlook among contacts remains slightly pessimistic but has modestly improved for many.

- Minneapolis: Economic activity declined slightly since the last report. Employment grew but labor demand continued to soften. Prices increased slightly overall, with greater pressure on input prices, while wages increased moderately. Consumer spending was flat, with some contacts expressing concern for consumer financial health. Manufacturing decreased moderately. Commercial and residential construction declined slightly. Agricultural conditions were stable at low levels.

- Kansas City: District economic activity was steady as mild growth in consumer spending offset slower manufacturing and professional service activity. Employment levels remained flat on net, though more contacts reported reducing their staffing levels recently. Business contacts reported more delays in receiving payments, raising financial strains but not affecting their hiring plans.

- Dallas: Economic activity rose modestly over the reporting period, buoyed by a pickup in growth in nonfinancial services. Housing demand held steady, while retail sales, loan demand, and manufacturing output weakened. Employment increased, and wage growth was moderate. Outlooks were mixed, with domestic policy and economic uncertainty cited as key concerns.

- San Francisco: Economic activity was steady. Labor availability improved further, and wages grew slightly. Overall prices were largely stable. Retail sales and activity in manufacturing and consumer services softened. Demand for business services improved, while conditions in real estate, financial services, agriculture, and resource-related industries were largely unchanged.

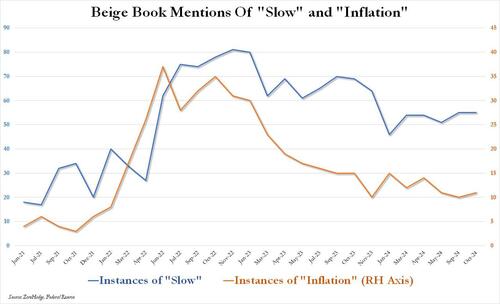

A quick semantic analysis finds that there were virtually no material changes across the two most important metrics tracked by the Fed: inflation and an economic slowdown, with terms discussing the former barely moving (from 11 to 12), while the latter was unchanged at 55.

Bottom line: if the September Beige Book is what ultimately tipped the scales for the Fed to cut 50bps, then the October Beige Book is really even more of the same (with the added kicker of a fullblown manufacturing recession), assuring more rate cuts in coming months.

Tyler Durden

Wed, 10/23/2024 – 14:54

via ZeroHedge News https://ift.tt/ih79wCz Tyler Durden