Gold Hits Another Record High On ‘Goldilocks’ Data

Micro topped macro on the day, according to Goldman Sachs trading desk, as volumes exploded but bear in mind that there is month-end pension rebalance with $11BN of equities for sale through tomorrow.

-

Internet names (GSTMTINT Index +100bps) outperformed after GOOGL, SNAP, RDDT results;

-

Semis broadly weaker (GSTMTSEM Index -280bps) after misses from both AMD & QRVO.

-

Obesity / GLP-1 names another big focus off LLY blowup this morning (stock is a max long for fast money community. (GSHLCGLP Index -170bps).

-

And SMCI shit the bed over its auditor quitting

But macro was not to be ignored…

ADP jobs soared (doubling expectations… definitely not dovish), GDP missed expectations (but nobody wanted to think about that because consumption soared), Core PCE hotter than expected (but also, no one wanted to think about that because it was down QoQ), Pending Home Sales soared (but mortgage rates have exploded higher since the data).

US Macro Surprise data continues to charge higher…

Source: Bloomberg

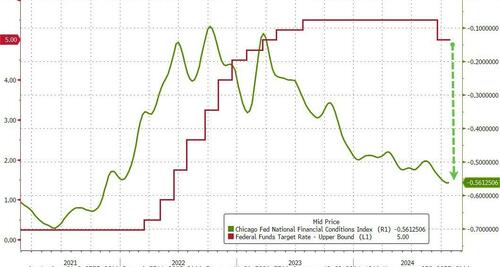

Forgive us but that does not look like ‘Goldilocks’ – it looks like ‘animal spirits’ ignited by a desperately dovish Fed’s 50bps cut prompting excessively easy financial conditions…

Source: Bloomberg

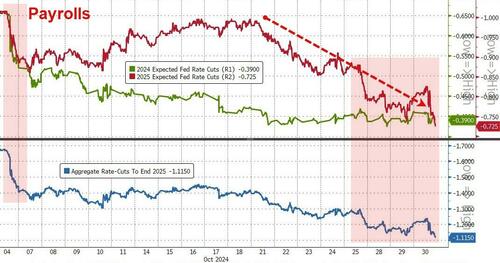

In fact, the market is day-by-day erasing the dovishness priced in after The Fed cut with 2025 expectations now down to less than 3 cuts (72.5bps)…

Source: Bloomberg

Goldilocks or not – Gold was bid again, hitting another new record nominal high…

Source: Bloomberg

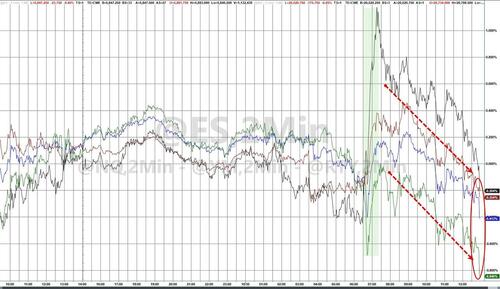

On the day, all the US majors shot higher on the (Goldilocks) GDP data… but that didn’t last as reality set in and by the close, everything was red (even Small Caps which had spiked over 1% at the open). Nasdaq was the biggest loser…

The S&P continues to tread water near the highs while VIX remains notably elevated into next week…

Source: Bloomberg

A chaotic day in bond-land that ended with yields very mixed as the long-end dramatically outperformed (30Y -1bps, 2Y +8bps). The belly is the big laggard this week as bonds seems to think The Fed made a policy error…

Source: Bloomberg

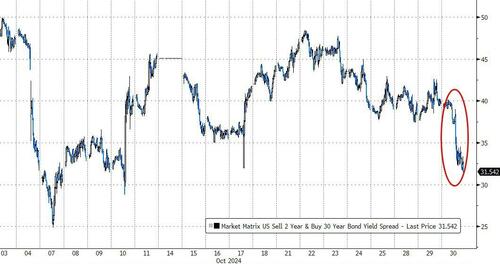

Which drove the yield curve (2s30s) down near recent lows…

Source: Bloomberg

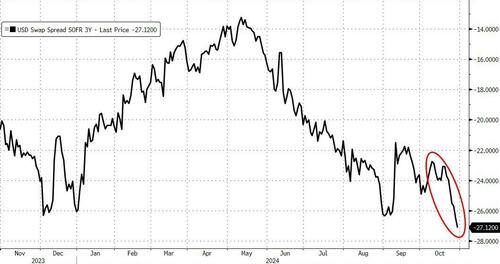

…and something big is building up behind the scenes…

Source: Bloomberg

The dollar broke down from its coiling flag pattern yesterday, but chopped around again today…

Source: Bloomberg

Bitcoin came off record highs but found support around $72,000…

Source: Bloomberg

Oil prices managed gains on the day but remain well down from before the “peace is here” collapse on Monday…

Source: Bloomberg

And finally, The Trump Trade continued to accelerate (hitting a record spread to Kamala)…

Source: Bloomberg

Running out of time for an October Surprise to actually bring “hitler” down? Or did Biden just self-immolate with his ‘garbage’ gobbledygook?

Tyler Durden

Wed, 10/30/2024 – 16:10

via ZeroHedge News https://ift.tt/AwIWkN7 Tyler Durden