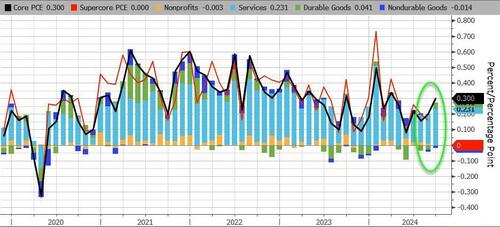

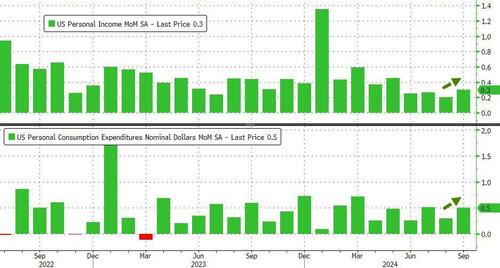

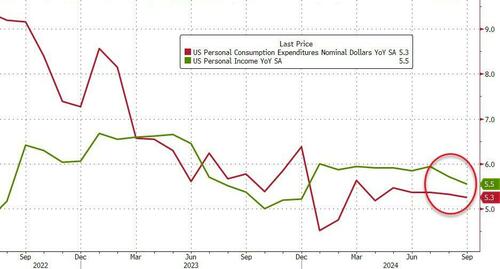

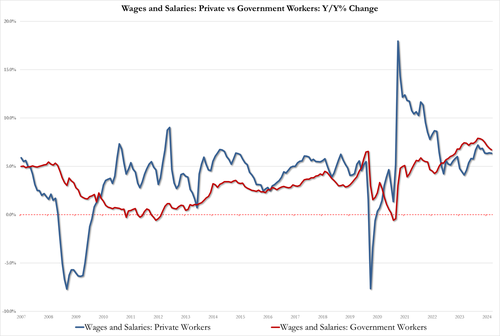

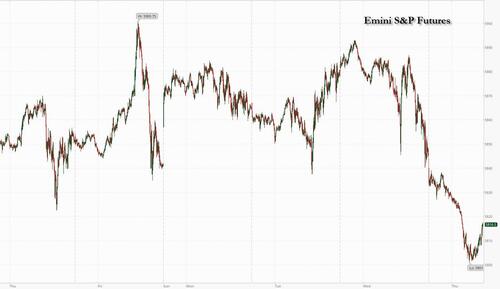

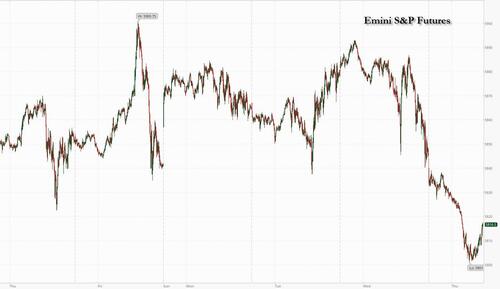

Futures fell ahead of the busiest day of the earnings season, dragged down by META and MSFT which are both down about 4% following last night’s earnings releases. As of 8:00am ET S&P futures are down 0.6%, but off session lows; Nasdaq futures retreat about 0.7% after Microsoft and Meta growth outlooks fail to impress investors, with the pair together representing half of the losses in Nasdaq futures. The rest of Mag7 is also lower: AMZN, GOOG, NVDA are all down 1% – 1.4%. AAPL, which had been used as a funding source is -33bps. Bond yields are flat to down 1bps; the USD is flat. Cmdtys are getting hit with the global risk-off tone, but WTI is higher while Brent is lower. The macro data focus today is on ECI, Income/Spending, jobless claims, and the monthly PCE numbers. Mag7 earnings conclude (ex-NVDA which is Nov 20) with AAPL and AMZN.

In premarket trading, Microsoft shares dropped 3.6% after the software giant forecast slower quarterly cloud revenue growth. Morgan Stanley notes that supply constraints are continuing to limit growth in the GenAI-related businesses. Meta Platforms shares fall 2.6% after the Facebook parent reported third-quarter results. Analysts are broadly positive, but note that capital expenditure plans did raise concerns. Among other premarket stock movers, Uber slumped following a muted holiday forecast for the ride-hail service. Estee Lauder Cos. Inc. tumbled 18% after the cosmetics maker pulled its guidance for the year. EBay Inc. dropped after missing revenue forecasts. Comcast Corp. jumped after a profit beat. Here are all the notable premarket movers:

- US-listed shares Arm Holdings (ARM) fell 4.47% after Bernstein lowered its view on the chip-design company — one of the biggest winners of this year’s artificial intelligence spending boom.

- Biogen (BIIB) shares slip 1.2% after Morgan Stanley downgraded the drugmaker to equalweight from overweight saying the launch of its Alzheimer’s drug, Leqembi “has tracked below our expectations.”

- Carvana (CVNA) shares soar 20% after the used car retailer reported another strong quarter as sales growth coupled with cost-cutting measures helped boost profits. Analysts note strong retail unit sales growth and encouraging earnings trends.

- Coinbase (COIN) shares fall 2.7% after the cryptocurrency platform operator’s earnings fell short of expectations, with analysts pointing to an impact from weaker crypto asset prices during the quarter. The update prompted some brokers to question Coinbase’s competitive advantage going forward.

- DoorDash (DASH) shares rise 3.5% after the food delivery company reported earnings that surpassed analyst expectations and issued strong guidance for the fourth quarter as its market share grows. Brokers said the update bodes well for next year and profitability going forward.

- EBay (EBAY) shares drop 7.9% after the e-commerce company’s projections for the fourth quarter fell short of analyst expectations. Baird said the outlook reflected the decision to move to a no-fee model in the UK for consumer-to-consumer (C2C) transactions.

- Etsy (ETSY) rises 5.2% after the retailer reported third-quarter results in which revenue, and marketplace revenue, beat estimates. Analysts are generally positive on take rate and profitability but see guidance as mixed

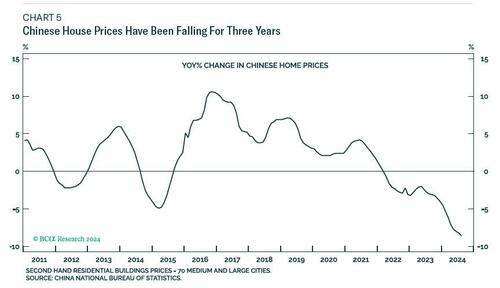

- Estée Lauder (EL) shares fell 20% after the beauty company pulled its guidance for the year, citing uncertainty over a new chief executive and weak demand in China.

- Meta Platforms (META) shares fall 2.6% after the Facebook parent reported third-quarter results. Analysts are broadly positive, but note that capital expenditure plans did raise concerns.

- Merck & Co. (MRK) fell 1.3% after the company lowered the top end of its full-year sales guidance after demand for its HPV vaccine fell for a second straight quarter in China.

- Microsoft (MSFT) shares drop 3.6% after the software giant forecast slower quarterly cloud revenue growth. Morgan Stanley notes that supply constraints are continuing to limit growth in the GenAI-related businesses.

- Robinhood (HOOD) shares fall 11% after failing to meet high revenue expectations. While analysts point to disappointing key metrics for 3Q, they are generally encouraged by management commentary and October trading conditions.

- Root (ROOT) shares soar 81% after the auto insurance platform said it reached net income profitability for the first time as third-quarter revenue topped estimates.

- Starbucks (SBUX) rose 0.4% after the coffee chain reported fourth-quarter earnings. Since the company preannounced the results last week, analysts were focused on strategic changes that were laid out by new CEO Brian Niccol. Morgan Stanley said Niccol’s vision was “aspirational, like the Starbucks brand when at its best,” while TD Cowen said Niccol had succeeded in diagnosing the challenges faced by the company.

- Twilio (TWLO) shares jump 13% after the cloud communications firm showed continued improvement in its operating margins, spurring Morgan Stanley and JPMorgan to raise their price targets on the stock. Twilio also upgraded its organic revenue growth guidance for the full year.

The disappointing set of results from Microsoft and Meta was hurting sentiment, said Marija Veitmane, a senior multi-asset strategist at State Street Global Markets. Investors are questioning whether the companies can sustain profit growth while ramping up spending on artificial intelligence and cloud services.

“The market is concerned with the continued increase in investments, and that is likely to weigh on stocks in the short term,” she said. “In the medium term, however, we still see weakness in tech stocks as a buying opportunity. It’s a very crowded position, so it is getting sold on any sign of disappointment, but we always see investors coming back as there’s no other alternative if you want quality.”

The dollar and treasuries were steady (more below) , with the two-year Treasury yield, which is most sensitive to interest-rate moves, hovering at a three-month high. In addition to the resilient US economy, investors are worried that a resurgence in inflation after the US election may delay or prevent interest-rate cuts.

“Who becomes president changes the perspective of the investment cycle,” Daniel Yoo, head of asset allocation, Yuanta Securities, said on Bloomberg Television, highlighting the potential effects of higher tariffs and lower corporate taxes under a potential Donald Trump presidency. “That will probably accelerate the process of inflation pressure and therefore the lowering of interest rates may be taken at a slower pace or not even happen.”

In Europe, the Stoxx 600 retreated for a third day after its worst day since September and on track for its biggest monthly decline in a year. French lender BNP Paribas SA was the biggest drag on the index, plunging more than 7% after reporting third-quarter earnings. Peers BBVA SA, Banco Sabadell SA and ING Groep NV also dropped after their results. Societe Generale SA stood out among lenders, soaring 11% after beating estimates. Here are some of the biggest movers on Thursday:

- SocGen shares advanced as much as 11%, most since March 2022, after beating 3Q estimates on the back of higher trading income and a rebound in the French retail business.

- Jeronimo Martins shares rise as much as 10% after the operator of Polish grocery chain Biedronka reported a third-quarter earnings beat, providing signs of recovery in sales and margins.

- Geberit shares jumped as much as 7.1%, most in nearly a year, after the Swiss maker of building materials boosted its guidance for the full year as management expects more robust development in the renovations business.

- Erste shares gain as much as 5.8% to the highest level since 2007 after the bank raised its forecast for net interest income growth this year.

- Airbus gains as much as 3.8%, the most since Oct. 17, after the planemaker reported third-quarter results that topped analysts’ expectations.

- Maersk shares rise as much as 3.3% after the Danish shipping company’s results showed improvement in the logistics division, while the ocean division’s higher rates drove revenue and Ebitda.

- Stellantis shares rise as much as 1.6% as analysts say the carmaker’s European revenue helped offset woes in North America, thanks to stronger-than-expected mix.

- SoftwareOne shares tumbled as much as 28%, to a new record low after the Swiss IT service provider cut its margin guidance for the full year – the second downgrade in the space of a few months.

- Smith & Nephew shares plunge as much as 14%, after the medical devices company reported results for the third quarter that disappointed analysts and cut its outlook for the year.

- BNP shares fall as much as 7.5% with analysts pointing to disappointment in the lender’s retail banking trends, especially in France and Belgium, while its capital was weak.

- AB InBev slides as much as 4.5% after reporting a sharper drop in organic volumes than anticipated in the last quarter, leading to sales and Ebitda growing less than expected.

- AXA shares fall as much as 2.2% after nine-month results, with the French insurer’s solvency ratio a small disappointment for analysts.

Earlier in the session, shares in Japan, Australia and South Korea declined, weighing on an index of the region’s equities, which headed for its worst monthly performance since August 2023. Mainland Chinese shares were mixed and those in Hong Kong rose, after a report showing monthly Chinese manufacturing data registered its first expansionary reading since April. Kospi drops almost 1% after Samsung chip profit disappoints. Hang Seng climbs 0.5% and mainland indexes advance after Chinese factory activity unexpectedly expands. The BOJ kept its benchmark interest rate unchanged after uncertainties increased over the outlook of the economy and the stability of the government after the ruling coalition suffered its worst electoral result since 2009. The yen strengthened below 153 per dollar.

In rates, treasuries advance across the curve in a moderate bull-flattening move, with 5s30s spread back to tightest level since July. US yields richer by as much as 3bp across the curve with 2s10s, 5s30s spreads flatter by 1bp and 2bp on the day; 10-year near 4.28% is ~2.5bp richer on the day with UK 10-year underperforming by around 8bp. European bonds dipped after data showed euro-area inflation accelerated more than expected in October — matching the ECB’s target and boosting arguments for interest rates to be lowered gradually. Treasuries also sharply outperform gilts as UK financial markets absorb Labour government’s plans for increased borrowing and fiscal stimulus. UK front-end yields are up about 10bp in an aggressive bear-flattening move as money markets unwind the extent of Bank of England interest-rate cuts expected in 2025. UK 10-year yields rose another 6 bps to 4.41% – the highest since November 2023. Bunds also fall, albeit to a lesser extent. German 10-year yields rise 2 bp to 2.40% with little reaction to an upside surprise in euro-area headline and core inflation for October. US session includes employment cost index, weekly jobless claims and PCE price indexes.

In FX, the dollar slipped, though it remains on pace for its best month in more than two years as investors trimmed bets on Fed policy easing after robust economic-growth and jobs data Wednesday. One-week implied volatility on the Bloomberg Dollar Spot Index rose to the highest since December 2022, indicating that traders expect wild swings in the greenback over the US presidential election. The Japanese yen topped the G-10 FX leader board, rising 0.7% against the greenback after the BOJ left rates on hold and maintained it’s on track to achieve its inflation target.

In commodities, oil edged higher, extending its gains from the previous session; WTI rose 0.7% to $69.10. Gold dropped after touching a fresh record in the prior session; spot traded down $6 to $2,781/oz. Demand for the precious metal was partly supported by the uncertainty posed by next week’s vote.

Looking at today’s calendar, US economic data calendar includes October Challenger job cuts (7:30am), 3Q employment cost index, September personal income and spending with embedded PCE price indexes, jobless claims (8:30am) and October MNI Chicago PMI (9:45am, several minutes earlier to subscribers). Fed officials are in self-imposed quiet period ahead of Nov. 7 policy announcement.

Market Snapshot

- S&P 500 futures down 0.8% to 5,803.75

- STOXX Europe 600 down 0.6% to 508.62

- MXAP down 0.2% to 186.49

- MXAPJ down 0.4% to 591.63

- Nikkei down 0.5% to 39,081.25

- Topix down 0.3% to 2,695.51

- Hang Seng Index down 0.3% to 20,317.33

- Shanghai Composite up 0.4% to 3,279.82

- Sensex down 0.7% to 79,416.69

- Australia S&P/ASX 200 down 0.2% to 8,160.03

- Kospi down 1.5% to 2,556.15

- German 10Y yield little changed at 2.40%

- Euro little changed at $1.0857

- Brent Futures down 0.2% to $72.38/bbl

- Gold spot down 0.3% to $2,778.56

- US Dollar Index little changed at 103.96

Top Overnight News

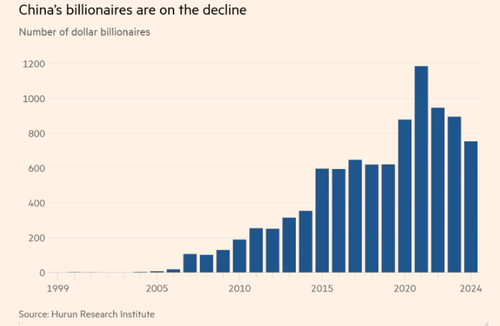

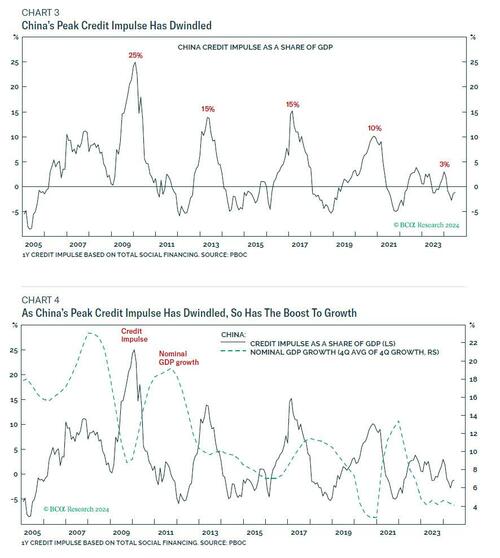

- China’s NBS manufacturing PMI for Oct came in at 50.1, above the Street’s 49.9 forecast, up from 49.8 in Sept, and higher than the 50 expansion/contraction demarcation point for the first time in 6 months as the government’s stimulus measures show signs of bolstering activity. China’s NBS non-manufacturing PMI for Oct came in at 50.2, up from 50 in Sept but a tiny bit below the consensus forecast of 50.3 RTRS

- China tells its auto makers to halt major investments in Eurozone countries that support higher EV tariffs. RTRS

- The yen climbed after BOJ Governor Kazuo Ueda said currency movements are having a major impact on the economy and price trends. Policymakers kept rates unchanged, as expected, and signaled the central bank’s on track for further rate hikes. BBG

- France’s CPI for Oct came in at +1.5%, up 10bp from Sept and inline w/the Street (the +1.5% remains far below the ECB’s 2% target). BBG

- Lebanon’s PM said Israel and Hezbollah could agree to a ceasefire agreement within days. RTRS

- OPEC+ could delay its planned production hike beyond Dec as it looks to bolster oil prices. RTRS

- BNP shares dropped as its largest operating business continued to suffer headwinds including ill-timed hedges. BBG

- Uber fell premarket after it reported weaker-than-expected ride bookings and issued a middling forecast for the holiday quarter. BBG

- Microsoft shares fell premarket after a disappointing forecast for its Azure cloud-computing business, though Bloomberg Intelligence sees growth picking up in the second half. Meta also declined after warning of worsening AI losses. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed albeit with most major indices subdued following the negative handover from the US and heading into month-end, while participants also digested a slew of data releases including somewhat mixed Chinese PMIs. ASX 200 declined amid losses in utilities and consumer stocks with retailer Coles pressured after its quarterly update. Nikkei 225 briefly dipped beneath the 39,000 level after mixed data and cautiousness heading into the BoJ announcement which lacked any major fireworks as the central bank kept rates unchanged as expected and refrained from any fresh policy clues. Hang Seng and Shanghai Comp were underpinned with earnings in focus and strength in Chinese banks after the Big 4 registered profit growth, although the upside was limited in the mainland after the mixed PMI data which showed manufacturing activity topped estimates and printed at a surprise expansion although non-manufacturing missed forecasts.

BOJ/Top Asian News

- BoJ kept its short-term policy rate unchanged at 0.25%, as expected, through a unanimous decision and said it will conduct monetary policy from perspective of sustainably and stably achieving the 2% price target, while it stated given that real interest rates are at very low levels, the BoJ will continue to raise the policy rate if the economy and prices move in line with its forecast. BoJ said Japan’s economy is recovering moderately although some weaknesses are observed and underlying consumer inflation is likely to be at a level generally consistent with the 2% target in the second half of the projection period through fiscal 2026. BoJ also stated that risks to prices are skewed to the upside for FY 2025 and noted uncertainty surrounding Japan’s economy and prices remains high. Furthermore, it must be vigilant to financial and FX market moves and their impact on the economy and prices, as well as scrutinise US and overseas economic developments, while it added that financial conditions remain accommodative and it mostly maintained its forecasts in the Outlook Report.

- BoJ’s Ueda says the domestic economy is recovering moderately, though some weak moves are seen. Did not need to use the language at this meeting that they can afford to spend time scrutinising risks. Uncertainties remain but markets have slowly regains stability. Can’t currently say how much wages would need to increase for them to hike further; if wage hikes are similar to this year’s Spring negotiations that would be a “positive development”, but that does not mean we decide to hike with only that

European bourses, Stoxx 600 (-0.7%) began the European session entirely in the red, and continued to traverse worse levels throughout the morning. European sectors hold a strong negative bias; Construction & Materials takes the top spot whilst Retail is found at the foot of the pile. US Equity Futures (ES -0.8% NQ -1.1% RTY -0.4%) are entirely in the red, with sentiment hit following post-earning losses tech heavyweights Meta (-3.8%) and Microsoft (-3.8%).

Top European News

- UK Chancellor Reeves says there will be more plans to boost growth. Is not going to come back for more money in the spring. Commenting on yesterday’s budget, says “will not have to do anything like that ever again”.

- ECB President Lagarde said the inflation goal is in sight but cannot say inflation is completely under control, while they will base the size and order of cuts on economic data. Lagarde added that no Euro area recession is expected in 2024-2026 and she reaffirmed commitment to a continued interest rate reduction, according to Le Monde.

- German engineering orders -8% Y/Y in September (Domestic -15%; Foreign Orders -5%); Jun-Sept-4% Y/Y (Domestic -16%, Foreign Orders Unch.), according to VDMA.

- ECB’s Panetta says rates need to come down; inflation is easing and need to pay attention to weakness of the economy. ECB needs to avoid the risk of pushing inflation below target.

Earnings

- Meta Platforms Inc (META) Q3 2024 (USD): EPS 6.03 (exp. 5.24), Revenue 40.59bln (exp. 40.27bln). Expects Q4 total revenue to be in the range of USD 45bln-48bln (exp. 46.3bln). Co. shares were lower by 3.1% after-hours with some desks questioning the Co.’s growth outlook amid potential AI-related losses

- Microsoft Corp (MSFT) Q1 2025 (USD): EPS 3.30 (exp. 3.10), Revenue 65.6bln (exp. 64.51bln). Microsoft Cloud revenue 38.9bln (exp. 38.11bln). Co. shares were lower by 3.7% after-hours following its disappointing cloud growth forecast

- Amgen Inc (AMGN) Q3 2024 (USD): Adj. EPS 5.58 (exp. 5.11), Revenue 8.50bln (exp. 8.52bln)

- Shell (SHEL LN) Q3 (USD): Adj. Profit 6.03bln (exp. 5.39bln), Adj. EBITDA 16bln (exp. 15.40bln); plans a share buyback program of USD 3.5bln; Cuts FY24 Capex “less than” 22bln (prev. guided 22-25bln). Shares +1.1%

- Stellantis (STLAM IM/STLAP FP) Q3 (EUR) Revenue 33bln (exp. 33.1bln); notes it is clear the Chinese rivals are coming into Europe and taking a “very aggressive stance”; affirms guidance. Shares +2.4%

- STMicroelectronics (STM FP) Q3 (USD): EPS 0.37 (exp. 0.33), Revenue 3.25bln (exp. 3.22bln). Guides Q4 Revenue 3.32bln (exp. 3.38bln). Trims FY24 revenue 13.3bln (exp. 13.3bln, prev. guided 13.2-13.7bln). Launches new company-wide program to restore manufacturing footprint; “based on our current customer order backlog and demand visibility, we anticipate a revenue decline between Q4’24 and Q1’25 well above seasonality.”(Newswires) Shares -2.4%

- TotalEnergies (TTE FP) Q3 (USD): adj. Net Income 4.07bln (exp. 4.27bln), adj. EBITDA 10bln (exp. 10.06bln); confirms investment guidance for 2024; interim dividend of EUR 0.79/shr for FY, +7% Y/Y; to execute a USD 2bln share buyback in Q4. Shares -7.2%

- Maersk (MAERSKB DC) Q3 (USD): Revenue 15.7bln (exp. 14.78bln), PBT 3.25bln (exp. 2.3bln), EBIT 3.3bln (exp. 2.99bln), EBITDA 4.8bln (exp. 4.4bln), EPS 193 (ex. 178). Lifted guidance. Shares +2.1%

FX

- DXY is lower as JPY strength acts as a drag on the index. Today sees core PCE metrics and weekly jobless claims, ahead of NFP on Friday. DXY is currently just below the 104 mark after briefly dipping below Wednesday’s trough at 103.97.

- Little follow-through for the EUR from above-expected EZ CPI given that regional releases had suggested such an outcome. EUR/USD is currently in close proximity to its 200DMA at 1.0869 and yesterday’s high at 1.0871.

- GBP is attempting to claw back Wednesday’s post-budget losses, whereby concerns around borrowing forecasts from the OBR have subsequently embedded more of a fiscal risk premium into the GBP. Cable has been unable to make its way back onto a 1.30 handle and is currently stuck below its 100DMA at 1.2976.

- JPY has strengthened in the wake of the BoJ policy decision. The announcement itself provided little in the way of surprises. However, the JPY began to pick up steam as Governor Ueda spoke and downplayed concerns over financial stability risks acting as an impediment to further policy tightening. USD/JPY briefly made its way onto a 151 handle but has since stabilised around the 152.50 mark.

- Antipodeans are both broadly steady vs. the USD. No real follow through seen for AUD from mixed Australian Retail Sales, nor mixed Chinese PMI metrics.

Fixed Income

- Gilts gapped lower from Wednesday’s 94.92 close, briefly stabilised and attempted a rebound but remained around 24 ticks shy of that mark at best. Benchmark down to a 94.05 base, 28 ticks below Wednesday’s trough and at a fresh contract low; UK paper then lifted off worst levels after a relatively strong Green 2053 outing.

- Bunds were weighed on, in-fitting with Gilts into Flash HICP for October. The pan-EZ figure came in hotter-than-expected, but given the skew from data earlier in the week this had no real impact. Bunds down to 131.32 at worst this morning, since picked up modestly and erring back towards opening levels but remain well into the red overall.

- USTs are softer as Gilts weigh on the complex generally and as we look ahead to today’s monthly PCE number before tomorrow’s NFP print, a payrolls report which has the potential to print sub-zero. At a 110-14 trough, half a tick below Wednesday’s base.

- UK sells GBP 2.25bln 1.50% 2053 Green: b/c 3.15x (prev. 3.26x), average yield 4.831% (prev. 4.545%), tail 0.5bps (prev. 0.6bps)

Commodities

- Crude is in the green but only modestly so. Action which comes amidst a soft USD and as the geopolitical environment remains tense. Brent Jan’25 currently holding around USD 72.50/bbl.

- Spot gold is softer while the correlation has broken down, ongoing UK-led yield upside is likely weighing. The yellow metal awaits key US data today and tomorrow, currently towards session lows around USD 2773/oz.

- Base metals are mixed. LME Copper essentially unchanged as we await key US events over the next few days/week which will help determine the near/medium-term macro direction. Furthermore, leads from China were mixed with Manufacturing PMI making its way just back into expansionary territory though non-manufacturing missed consensus slightly.

- Energy Intel’s Bakr says, re. recent OPEC+ source reports, that “they didn’t even talk about this yet”.

Geopolitics: Middle East

- Lebanon’s Prime Minister said they hope for a ceasefire with Israel in the coming hours or days.

- Cypriot President said he is optimistic that a ceasefire in Lebanon could be reached in the next 1-2 weeks.

- Israeli military said it attacked fuel reservoirs in Lebanon’s Bekaa region located in military complexes of Hezbollah’s logistical empowerment unit, while it added that Iran is behind supplying Hezbollah with fuel as part of its military support and it targeted oil depots belonging to Hezbollah’s 4400 Logistics Armament Unit in the Bekaa.

- Hezbollah bombed gatherings of Israeli enemy soldiers in the settlement of Kiryat Shmona with a rocket barrage.

- CNN cited a senior source familiar with Iran’s intentions who stated that the Israeli attack would be met with a “decisive and painful response”, while the source did not provide a date but said it would “likely take place before the US election”.

- Israel Broadcasting Corporation reported that Tel Aviv is considering launching a large-scale pre-emptive attack against Iran, according to Sky News Arabia.

- White House said the US will support Israel if Iran does respond.

Geopolitics: Other

- North Korea launched a ballistic missile towards the East Sea which set a new record, while North Korean leader Kim said the missile test was appropriate military activity as their enemies’ dangerous moves have emphasised the need to strengthen the nuclear force and North Korea will never change its stance of strengthening its nuclear arsenal, via KCNA.

- South Korea’s National Security Council plans to designate new sanctions on North Korea and South Korea’s military said the US is to respond to North Korea’s missile test by deploying strategic assets for drills, according to Yonhap.

- South Korean Defence Minister said Russia could aid North Korea with technology for tactical nuclear weapons and ICBMs in exchange for North Korean troops.

- White House said the US condemns North Korea’s intercontinental ballistic missile test, but noted North Korea’s intercontinental ballistic missile test did not pose an immediate threat to US personnel, territory, or its allies.

- Japanese PM Ishiba will hold a national security council meeting and Defence Minister Nakatani said they will closely cooperate with the US and South Korea over North Korea’s missile launch.

US Event Calendar

- 07:30: Oct. Challenger Job Cuts YoY 50.9%, prior 53.4%

- 08:30: Oct. Initial Jobless Claims, est. 230,000, prior 227,000

- Oct. Continuing Claims, est. 1.88m, prior 1.9m

- 08:30: Sept. Personal Income, est. 0.3%, prior 0.2%

- Sept. Personal Spending, est. 0.4%, prior 0.2%

- Sept. Real Personal Spending, est. 0.3%, prior 0.1%

- Sept. PCE Price Index MoM, est. 0.2%, prior 0.1%

- Sept. PCE Price Index YoY, est. 2.1%, prior 2.2%

- Sept. Core PCE Price Index MoM, est. 0.3%, prior 0.1%

- Sept. Core PCE Price Index YoY, est. 2.6%, prior 2.7%

- 08:30: 3Q Employment Cost Index, est. 0.9%, prior 0.9%

- 09:45: Oct. MNI Chicago PMI, est. 47.0, prior 46.6

DB’s Jim Reid concludes the overnight wrap

Happy Halloween to you all. If you want to be scared I’m going to a Halloween themed fancy dress party tomorrow night as Marilyn Manson. The PVC trousers have arrived from Amazon and my wife is licking her lips at applying make-up to me! There’s been lots of tricks and treats for markets over the last 24 hours with some of the highlights being a -22.3% drop for the Trump Media and Technology group, a 10-13bps rise in 2yr European yields and a 15bps climb in Gilt yields off the lows for the day across the curve after the budget. Just as it looked like US moves were going to be tame by comparison a late sell-off encouraged US 2yr yields +8.6bps on the day. It’s a big day today with US PCE inflation, a continuation of European inflation numbers that helped move markets yesterday, and Apple and Amazon reporting after the closing bell.

The big move in Trump’s media group was partly down to fresh CNN polls which showed Harris with sizeable +5pt and +6pt leads in the swing states of Michigan and Wisconsin, although still tied with Trump in Pennsylvania. These stronger polls saw the FiveThirtyEight model’s probability of a Trump victory decline to 51% from 54% the day before, while the odds on Polymarket fell from 67% to 64%. To be fair, much of the decline in Trump Media may have reflected its sharp recent rise (+324% from the low in late September), with a large correction always possible after such a run up in a short space of time. The reversal in other Trump proxy trades was more modest, with Bitcoin down -1.14%.

Over in Europe, the big moves followed stronger-than-expected GDP and inflation data. The first showed euro area GDP growing by a solid +0.4% quarter-on-quarter in Q3 (vs. +0.2% expected), with upside surprises in Germany (+0.2% vs -0.1% expected), France (+0.4% vs +0.3%) and Spain (+0.8% vs +0.6%) outweighing the downside in Italy (0.0% vs. +0.2% expected). On the inflation side, Germany’s flash inflation print for October saw the harmonised HICP measure come in at +2.4% yoy (vs. +2.1% expected). Following this upside surprise, our European economists see today’s euro area release tracking at 1.96% yoy for headline HICP and 2.69% yoy for core, nearly a tenth higher than they expected prior to yesterday.

The stronger data saw hawkish-leaning ECB officials speak in favour of only gradual easing, with Schnabel saying that “a gradual approach to removing policy restriction remains appropriate”, while Nagel commented that “my advice is to remain cautious and not to rush”. Market pricing of a 50bps rate cut by the ECB in December fell from 41% to 20% yesterday, with -11.2bps of cuts priced out over the next three meetings in total. 2yr bund yields (+11.5bps) posted their largest increase in over three weeks, with OATs (+11.0bps) and BTPs (+12.5bps) seeing similar moves. At the long-end, 10yr bund yields (+5.1bps) rose to their highest in three months at 2.39%, while 10yr BTPs (+7.5bps) underperformed after the weak GDP data there.

Stronger data also helped to put upward pressure on US yields, albeit after an initial false start. 2yr and 10yr Treasury yields ended the day +8.6bps and +4.6bps higher, respectively, with the 10yr reaching 4.30% for the first time since early July. It’s dipped back to 4.276% this morning in Asia. The highlight of the data was a strong rise in the ADP employment survey (+233k vs +111k expected) ahead of Friday’s payrolls release. We also had Q3 GDP, which came in a touch beneath expectations (+2.9% vs +2.8%) but with strong growth in personal consumption (+3.7% vs +3.3% expected), and the September pending home sales print, which saw the strongest monthly jump since the first post-Covid lockdown rebound in summer 2020 (+7.4% vs. +1.9% expected).

Here in the UK, gilts actually outperformed the euro area and the US with yields ‘only’ 3-5bps higher across the curve. That was mostly thanks to a decline early in the day before the budget announcement. However, 2yr yields then rose as much as 24bps off the lows at one point, with long-end yields rising only slightly less. This came as the market digested a post-budget announcement from the UK Debt Management Office that gross financing needs for 2024/25 would be GBP 23bn higher than projected back in April, with a further GBP 145bn cumulative increase over the following 4 years. Yields settled back down 5 to 10bps from the highs before the close but it was certainly a volatile session. In terms of implications for the BoE, the market takeaway was that it would likely keep rates higher for longer with the June 2025 pricing rising by +15.9bps on the day.

Our UK economist Sanjay Raja notes that this is very much a historic budget in its scale, with announced net spending measures adding up to GBP 70bn a year on average over the next five years, partially offset by GBP 36bn a year in net tax increases. All up, this marks one of the largest fiscal loosening of any UK fiscal event in decades. See Sanjay’s full reaction piece here.

Equities had a relatively challenging session, amid a rout for chipmakers that saw the Philadelphia semiconductor index fall by -3.35%. That had some specific drivers, with Advanced Micro Devices falling -10.62% after its underwhelming results the previous evening, while server maker Super Micro Computer fell by -32.7% after its auditor resigned from its role, citing “integrity” concerns. The NASDAQ fell by -0.56%, though the Mag-7 (-0.02%) was essentially unchanged, helped by Alphabet’s +2.82% rise after its results. And US equities did not fare too badly otherwise, with 49% of the S&P 500 stocks higher on the day, as financials (+0.42%) and real estate (+0.39%) outperformed amid the stronger data. Over in Europe, tech losses led more substantial declines, with the Stoxx 600 (-1.25%) seeing its weakest session in over a month as all of its 25 industry groups fell on the day.

After the US market close, earnings reports from Microsoft and Meta added to the more negative tech mood. Microsoft delivered an upbeat Q3 performance, but announced a weaker forecast for cloud revenue growth, while Meta’s narrow beat was overshadowed by its warning of still rising losses from its Reality Labs division that focuses on AI and augmented reality. Both stocks fell by between -3% and -4% in after-hours trading. This morning, the Nasdaq 100 futures are -0.71%, underperforming S&P 500 (-0.50%).

In the commodity space oil prices rose by more than 2% yesterday following a Reuters report that OPEC+ could delay the oil output hike planned for December and EIA data showing a decline in US stockpiles of crude and refined products.

Overnight in Asia, most main equity indices are struggling with the Nikkei 225 (-0.43%) and the Kospi (-1.16%) trailing Chinese markets as the CSI 300 (-0.03%) and the Hang Seng (+0.15%) manage to slightly outperform. In terms of macro events, there was a hold from the BoJ overnight, with the yen subsequently strengthening, as well as an upbeat official manufacturing PMI print from China, with the gauge moving back above 50 (50.1 vs 49.9 expected) for the first time since April, while the non-manufacturing index showed a small miss (50.2 vs 50.3 expected).

Looking to the day ahead, in terms of US data we will have the personal income and spending data for September, including the PCE inflation print, as well as the Q3 employment cost indicator and the weekly jobless claims. In Europe, we get the October inflation prints for France, Italy and the euro area, while ECB’s Panetta and BoE’s Breeden are due to speak. In earnings, Apple and Amazon will round off this week’s Mag-7 releases, with Mastercard, Uber, Merck and Intel other highlights in the US. In Europe, earnings include AB Inbev, TotalEnergies and AP Moller – Maersk.