US equity futures are lower for the third day in a row on a busy earnings day with yield and the dollar both extending gains as the prospect of a Trump presidency sparking more inflation and leading to less aggressive rate cuts continued to weigh on markets. As of 8:00am ET S&P and Nasdaq futures are down 0.3%, with megacap tech names mostly lower: NVDA -0.4% and TSLA -0.6%. SBUX fell -5.3% as it missed revenue expectation; MCD is -6.0% lower given the E. Coli headlines. Global stocks trade mostly lower ex China with attention remaining on the micro before NFP next week and the Election/FOMC the week after. Bond yields are 2bp higher pushing the 10Y as high as 4.24%, the highest since July 26. USD surges while the yen plunges as low as 153 as yields on Japan’s 40-year notes reached the highest in 16 years. Commodities are mixed: base metals are higher, oil and precious metals are lower: oil fell 1.0%. Today, key macro data includes Existing Home Sales and Fed Beige Book. We will have a busy earnings schedule across sectors, including BA, IBM, KO, T, TMUS, TSLA, and VRT.

In premarket trading, Tesla was down 0.6% ahead of earnings this afternoon, while Boeing shares were trading marginally higher after another disastrous quarter. In other single stocks, Enphase Energy was down more than 12% as the solar equipment maker forecast disappointing revenue for the fourth quarter. McDonald’s (MCD) drops 6% after a severe E. coli outbreak tied to the restaurant chain’s Quarter Pounders sickened dozens of people in the US and killed one. Vertiv (VRT) fall 7% after the electrical power equipment company issued a fourth-quarter sales forecast that trailed Wall Street expectations. The company also reported a slowdown in order growth from the previous quarter. Starbucks (SBUX) drops 4% after pulling guidance for 2025 after sales plunged for a third consecutive quarter. Here are the other notable premarket movers:

- Alto Neuroscience (ANRO) slides 63% after saying a Phase 2b study of its treatment in patients with major depressive disorder didn’t meet the primary endpoint.

- AT&T (T) rises 2% after the company gained more mobile subscribers in the third quarter than analysts expected.

- CoStar (CSGP) drops 5% after the real estate services company cut its full-year sales forecast.

- Enphase Energy (ENPH) drops 15% after the solar-equipment maker’s 4Q revenue forecast and 3Q disappointed. Analysts flagged weakness in Europe, with Piper Sandler describing demand there as “dismal.”

- JinkoSolar (JKS) rises 6% along with other US-listed Chinese solar names after news that the US Commerce Department is considering reducing tariffs on the sector circulated in local media.

- Qualcomm (QCOM) declines 3% as Arm Holdings is canceling a license that allowed Qualcomm to use Arm’s intellectual property to design chips

- Stride (LRN) soars 27% after the company’s first-quarter revenue and forecast for the second quarter surpassed estimates.

- Texas Instruments (TXN) rises 3% after the chipmaker reported third-quarter results that beat expectations.

The broader risk-off tone comes as investors pare back bets on rapid policy easing, given signs that the US economy remains robust and concerns about higher inflation as a Republican sweep looks increasingly likely. Most Fed officials speaking earlier this week signaled they favor a slower tempo of rate reductions.

The bond moves have made earnings seem like a “bit of a sideshow,” said James Athey, a portfolio manager at Marlborough. “Shifting growth, the Fed and election expectations have created a bit of a perfect storm for a Treasury market which was a little over its skis in terms of rate cut expectations just a month or so ago.”

The debate about the speed and scale of the Fed’s monetary easing continued, with Bank of America Corp. Chief Executive Officer Brian Moynihan urging Fed policymakers to be measured in the magnitude of interest-rate reductions.

The International Monetary Fund, meanwhile, lowered its global growth forecast for next year and warned of accelerating risks ranging from wars to trade protectionism, even as it credited central banks for taming inflation without sending nations into recession.

“Of course Tesla is still one of those stocks which has the potential to get people off their seats,” Athey said. “Discounting any volatility even at the index level after they report would be foolish. Boeing remains in a bad way and so it’s hard to see material good news coming there.”

In Europe, the Stoxx 600 was down 0.2% as losses in consumer products and basic resources are offset by gains in autos and personal care names. Personal care stocks outperform, led by Reckitt Benckiser’s gains after reporting a smaller drop in like-for-like sales than feared. Consumer products are among lagging sectors, weighed down by L’Oreal’s post-earnings rout which tumbled on lower organic sales growth/China challenges. Among individual moves, Deutsche Bank dropped as analysts noted higher-than-expected provisions. Volvo Cars (-3.5%) beat but cut guide and Heineken (+2%) organic sales in-line w/ Americas region o/p. Here are the other notable European movers:

- Spanish energy stocks rise after Expansion reports that Spain’s government is considering a reduction of the 1.2% windfall tax on domestic revenue of large energy firms.

- Lloyds shares rise as much as 2%, hitting their highest level since January 2020, after the UK bank posted pretax profit that beat expectations in the third quarter.

- Heineken shares advance as much as 2% after the brewer reported third-quarter organic sales growth that analysts said was in line with company-compiled consensus.

- Reckitt Benckiser shares rise as much as 2.1% after the personal care products maker reported a milder drop in like-for-like sales than feared.

- European chipmakers gain as Texas Instruments says demand for automotive chips remains strong in China, and some end markets like personal electronics are seeing a continued cyclical recovery.

- Handelsbanken shares rise as much as 6.6% after the Swedish lender reported strong results for the third quarter, according to analysts, including a beat in net interest income.

- DWS shares gain as much as 2.4% after the German asset manager’s net inflows and profit beat estimates thanks to drivers such as reduced costs and higher management fees.

- L’Oreal shares fall as much as 3.6% after the beauty firm’s third-quarter sales growth disappointed amid weakness in China and a significant miss in the dermatological segment.

- Deutsche Bank shares decline 3% after the German lender reported earnings that analysts say are underwhelming with provisions seen as the “weak spot.”

- Akzo Nobel shares fall as much as 5.7%, the most since April, after the paint producer lowered its profit forecast for the full year due to rising costs and weaker demand.

- Telecom Italia shares fall as much as 3.2%. The Italian finance police executed a search warrant at the office of one of its managers earlier for alleged bribery between private individuals.

- U-Blox shares slump as much as 10% to the lowest level since March 2022 after the Swiss semiconductor company reported third-quarter results at the lower end of guidance and slightly below market expectations, according to Vontobel.

Earlier in the session, Asian stocks hit their lowest level in a month as a weakness in tech heavyweight TSMC and the dollar’s strength offset a rally in Hong Kong shares. The MSCI Asia Pacific Index moved in a narrow range before retreating 0.4%, as TSMC dragged while Meituan and Toyota advanced. The cautious trade comes as some key US companies’ downbeat news led to flat trading in US stocks and the prospect of a slower pace of Federal Reserve rate cuts weighs on risk sentiment. “Asian markets are lacking direction at the moment,” said Matthew Haupt, a fund manager at Wilson Asset Management. Investors are “watching for any clues to the health of the US labor market and likely Fed policy settings later in the week,” he said.

In FX, the dollar also adds to its recent gains with the Bloomberg Dollar Spot Index climbing 0.2%. The yen is the clear underperformer among in the G-10 space, falling more than 1% against the greenback and taking USDJPY to 153 and above the 200 DMA in the process.

In rates, treasuries are cheaper again across the curve, underperforming bunds where German 2-year yields are richer by 7bp on the day. US yields are 1bp-2bp cheaper across maturities, with 10-year around 4.22%, the highest since July and trailing bunds in the sector by 2.5bp; Canadian yields are little changed ahead of the rate decision Euro-zone front-end shifts to lower yields as swaps price in around 45% chance of a 50bp rate cut at ECB’s final meeting this year on Dec. 12. Bank of Canada rate decision at 9:45am New York time is expected be a 50bp rate cut to 3.75%. Gilts are also under pressure but there has been a bid in German shorter-dated bonds as traders add to their ECB rate cut bets. German 2-year yields are down 6 bps. Yields on Japan’s 40-year notes reached the highest in 16 years.

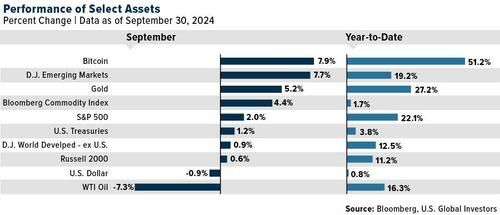

In commodities, oil prices decline, with WTI falling 1% to $71 a barrel as a US industry group signaled a rise in nationwide crude inventories, and the Biden administration renewed efforts to secure a cease-fire in the Middle East. Gold was steady after climbing to a fresh record. Gold hit another record high, rising above $2750 as traders seek safety amid jitters over the US election and ongoing conflict in the Middle East. Speaking of, Secretary of State Antony Blinken headed to Saudi Arabia to push for a broad truce after urging Israel to avoid creating “greater escalation.”

Looking at today’s calendar, we get September existing home sales at 10am and the Fed Beige book at 2pm. Fed speaker slate includes Bowman (9am) and Barkin (12pm)

Market Snapshot

- S&P 500 futures little changed at 5,887.50

- STOXX Europe 600 down 0.1% to 519.66

- MXAP down 0.2% to 187.87

- MXAPJ up 0.3% to 604.88

- Nikkei down 0.8% to 38,104.86

- Topix down 0.5% to 2,636.96

- Hang Seng Index up 1.3% to 20,760.15

- Shanghai Composite up 0.5% to 3,302.80

- Sensex up 0.2% to 80,353.83

- Australia S&P/ASX 200 up 0.1% to 8,216.01

- Kospi up 1.1% to 2,599.62

- German 10Y yield little changed at 2.32%

- Euro down 0.1% to $1.0784

- Brent Futures down 0.8% to $75.44/bbl

- Brent Futures down 0.8% to $75.44/bbl

- Gold spot up 0.3% to $2,757.17

- US Dollar Index up 0.25% to 104.33

Top Overnight News

- China’s stimulus efforts aren’t enough to bolster domestic demand according to Treasury Sec Yellen and the IMF. RTRS

- Arm will end a license that allowed Qualcomm to use its IP to design chips, escalating a legal dispute. Qualcomm shares fell. BBG

- Bill Gates privately said he has backed VP Harris with a USD 50mln donation: NYT.

- European Central Bank policymakers have begun to debate whether interest rates need to be lowered enough to start stimulating the economy, ending years of economic restriction, conversations this week with half a dozen sources indicate. RTRS

- Volvo Car shares dip in Eurozone trading after the company trimmed its sales guidance for the year given “accelerating weakness in the market” (it now sees sales up 7-8% vs. the prior 12-15%). RTRS

- Blackstone CEO Steve Schwarzman said the US is likely to avoid a recession regardless of who wins the presidential election, as both candidates have policy proposals that appeal to growth. BBG

- Paul Tudor Jones warns of a large slump in bond markets after the election due to massive fiscal risks. CNBC

- Walmart will start offering home prescription deliveries in as little as 30 minutes as it and Amazon take aim at CVS and Walgreens. FT

- Amazon is shutting down a service dubbed Amazon Today that offered same-day delivery from brick-and-mortar retailers. CNBC

- McDonald’s plunged premarket after an E. coli outbreak tied to its Quarter Pounders killed one person and sickened dozens, mainly in Colorado and Nebraska. It said slivered onions may be the cause. Starbucks slid after it pulled next year’s guidance following another slump in same-store sales. BBG

- Fed’s Daly (voter) commented on X that the economy is in a better place, inflation has fallen substantially and the labour market has returned to a more sustainable path, while she added that risks to goals are now balanced which is a significant improvement from two years ago. Furthermore, she stated that work to achieve a soft landing is not fully done and they are resolute to finish that job, but noted it cannot be all they are after and ultimately must strive for a world where people aren’t worried about inflation or the economy.

- Former President Trump said he would make car interest payments fully tax deductible if they are domestically built.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed with the upside capped following the inconclusive performance on Wall St amid a lack of fresh macro drivers, recent upside in yields and ongoing geopolitical tensions. ASX 200 traded rangebound with strength in consumer stocks offsetting the underperformance in tech and energy. Nikkei 225 was the laggard as it failed to benefit from a weaker currency and a surge in Tokyo Metro shares on its debut. Hang Seng and Shanghai Comp advanced with risk appetite supported as participants digested earnings releases and after the PBoC upped its liquidity effort, while a Chinese policy think tank called for the issuance of CNY 2tln in special treasury bonds to establish a stock market stabilisation fund.

Top Asian News

- Chinese policy think tank CASS called for Beijing to issue CNY 2tln of special treasury bonds to set up a stock market stabilisation fund, according to 21st Century Business Herald.

European bourses, Stoxx 600 (-0.1%) began the session on a mixed footing, but sentiment continued to slip as the morning progressed, with almost the entirety of European indices in modest negative territory. European sectors are mixed; Optimised Personal Care tops the pile, assisted by post-earning strength in Reckitt Benckiser. Consumer Products is weighed on by poor earnings in L’Oreal. Key European earnings: Volvo Car (-3.2%) Q3 Revenue (SEK) 93bln (exp. 89.65bln), Adj. EBIT 5.7bln (exp. 4.78bln); sees FY Retail Sales +7-8% (prev. guided +12-15%). Roche (+0.1%) Q3 (CHF): Sales 15.14bln (exp. 14.93bln). FY Outlook confirmed. Deutsche Bank (-2.8%) Q3 (EUR) PBT 2.26bln (exp. 2.1bln), Revenue 7.5bln (exp. 7.3bln). FY Guidance: Confident in Revenue guide of “around” 30bln (exp. 29.44bln).

Top European News

- ECB policymakers are beginning to debate whether rates will have to go below neutral level in the current easing cycle, according to sources cited by Reuters.

- UK Chancellor Reeves is expected to impose national insurance on employer’s pension contribution in the Budget, according to The Times.

FX

- USD is continuing to out-muscle peers as the US yield environment in the run-up to next month’s Presidential election continues to provide support. Accordingly, the DXY has gained a firmer footing on a 104 handle and ventured as high as 104.36.

- EUR is softer vs. the USD with EUR/USD extending its move onto a 1.07 handle in the wake of dovish ECB source reporting which has raised the possibility of the Bank aiming for a terminal rate below neutral.

- GBP is flat vs. the USD with Cable stuck below the 1.30 mark. BoE Governor Bailey & Breeden are due to speak today, though remarks from members on Tuesday failed to materially move the Pound.

- JPY’s bruising run has continued into today’s session with US yields and domestic Japanese political risks continuing to drag USD/JPY higher. Currently sitting well above 152.00 at a 152.72 peak.

- Antipodeans are both softer vs. the USD after Tuesday’s attempted recovery with antipodeans remaining at risk of a Republican clean sweep.

- CAD is relatively steady vs. the USD and tucked within Tuesday’s 1.3813-38 range in the run-up to today’s BoC rate decision. Expectations are for a 50bps rate cut, and with markets pricing a 50bps cut at 97%.

Fixed Income

- Bunds are lower by a handful of ticks, but ultimately reside within a contained range, holding around 20 ticks above Tuesday’s 132.58 WTD trough. Potential support could also be attributed to reports that officials are debating whether rates will need to go below the neutral level this cycle. German paper was unreactive to a well-received 10yr auction.

- Gilts are softer than EGBs and were ultimately unmoved by a fairly well-received 2027 outing. Gilts are currently at a 96.40 WTD trough, matching the Oct. 15th low ahead of speak from BoE’s Bailey.

- USTs are trading somewhere between Bunds and Gilts in terms of magnitudes, with USTs finding themselves under modest pressure ahead of 20yr supply though as it stands action is relatively even across the curve. At a 111-03+ trough which marks a marginal new WTD base.

- UK sells GBP 4bln 3.75% 2027 Gilt Auction: b/c 3.29x (prev. 3.33x) & average yield 4.082% (prev. 4.068%), tail 0.6bps (prev. 0.3bps).

- Germany sells EUR 3.303bln vs exp. EUR 4bln 2.60% 2034 Bund Auction: b/c 2.30x (prev. 2.0x), average yield 2.31% (prev. 2.08%) & retention 17.43% (prev. 17.69%).

Crude

- Crude is trading on the backfoot, amid a lack of catalysts but as eyes remain on Israel regarding its retaliation against Iran, in which the focus will fall on the targets and the magnitude of the attack for its escalation factor. Brent’Dec trades towards the bottom of a narrow USD 75.47-76.05/bbl parameter.

- Precious metals are mixed. Spot gold continues to print fresh all-time highs against the backdrop of a tense geopolitical landscape whilst silver trims some of Tuesday’s gains.

- Base metals are mostly lower and giving back some of yesterday’s upside. 3M LME copper just about remains above USD 9,500/t.

- Kazakhstan’s Kaztransoil shipped 145,000T oil to Germany; plans to supply 133,000T to Germany in October.

- Private inventory data (bbls): Crude +1.6mln (exp. +0.3mln), Distillate -1.5mln (exp. -1.7mln), Gasoline -2mln (exp. -1.2mln), Cushing -0.2mln.

Geopolitics

- Israel begins strikes on Lebanese port city of Tyre, via Reuters citing witnesses.

- “Sources for Sky News Arabia: Russia will help Iran to counter the planned Israeli strike in some form”, according to Sky News Arabia; “Russia will help Iran without risking harm to its relations with Israel”. “Israeli sources to Sky News Arabia: We do not rule out the idea of Russia helping Iran in countering the Israeli strike”. “Israeli sources to Sky News Arabia: Russian assistance may be by giving Iran early warning and instructions to protect potential targets.”. “Israeli sources to Sky News Arabia: Russian assistance to Iran may include the detection of attacking aircraft and electronic jamming”

- “US asked European countries to develop a vision to support the Palestinian Authority”, according to Sky News Arabia sources; “Arab countries hold new talks on ensuring the implementation of the new peace plan”. “Arab countries hold new talks on ensuring the implementation of the new peace plan”

- Israel’s army completed its preparations to attack Iran and it seems that it will be within days, according to Israel’s Channel 12 citing two sources.

- Israeli PM Netanyahu said in a meeting with US Secretary of State Blinken that there is a need to lead to a security and political change in the north, which would allow Israel to return its residents safely to their homes. Netanyahu added that the killing of Hamas leader Sinwar may have a positive effect on the return of Israeli hostages, the achievement of all the goals of the war, and the day after.

- US Secretary of State Blinken, in meeting with Israeli PM Netanyahu, underscored the need to capitalise on Israel’s action to bring Sinwar to justice by securing a hostage release and ending the conflict in Gaza. Furthermore, Blinken sought during his meeting with Israeli PM Netanyahu to soften the response to Iran, according to Al Jazeera citing Israel’s Channel 13.

- US Secretary of State Blinken and Israeli PM Netanyahu discussed the concrete steps to capitalise on the death of Hamas leader Sinwar, a senior US official told Reuters. Blinken made it clear that Israel’s humanitarian aid steps so far have not been sufficient and Israeli leaders committed to act upon US requests laid out in Blinken’s letter on the need for more humanitarian aid. Furthermore, Blinken will no longer go to Jordan on Wednesday but he will be traveling to Saudi Arabia.

- White House said Israel must respond to the Iranian attack and it will not review what they will do, according to Al Jazeera.

- Pentagon said it cannot provide information regarding the Israeli attack on Iran and it is consulting with partners in the region in order to de-escalate, according to Al Jazeera.

- Israel’s army confirmed the killing of late Hezbollah leader Nasrallah’s presumed successor Hashem Safieddine.

- Israel will continue to attack Hezbollah even after the end of the operation in Lebanon until it withdraws behind the Litani, according to Sky News Arabia citing comments by Galant to Blinken.

- IDF spokesman said the Israeli Air Force intercepted a drone in Syrian airspace launched from the east. It was also reported that Israeli military said it intercepted two UAVs that crossed into Israel’s waters in the area of Eilat, while Islamic Resistance in Iraq announced it targeted Israel’s Eilat with drones.

- Palestinian media reported continuous aerial and artillery shelling on different areas in the northern Gaza Strip, as well as heavy Israeli shelling on Rafah in the southern Gaza Strip, according to Asharq News.

- Iranian President says they seek to prevent the expansion of conflict within the region, while Israel has shown “it is only looking for conflict”, via Al Arabiya.

- Iraqi media reports that the US’ air defence system and radar in the Koniko gas field, Syria, were hit by a missile attack on Tuesday night, via IRNA.

- US Secretary of State Blinken says they fully reject any Israeli reoccupation of Gaza.

- North Korean leader Kim inspected strategic missile bases, according to KCNA.

US Event Calendar

- 07:00: Oct. MBA Mortgage Applications, prior -17.0%

- 10:00: Sept. Existing Home Sales MoM, est. 0.5%, prior -2.5%

- 10:00: Sept. Home Resales with Condos, est. 3.88m, prior 3.86m

- 14:00: Federal Reserve Releases Beige Book

Central Bank speakers

- 09:00: Fed’s Bowman Gives Opening Remarks

- 12:00: Fed’s Barkin Speaks About Community Colleges

- 14:00: Federal Reserve Releases Beige Book

DB’s JIm Reid concludes the overnight wrap

Only two weeks until the big day. One that I’ve been looking forward to for what seems an exceptionally long time. Yes, the kids will go back to school after an extended 2-week half-term. As predicted last week my wife was already fed up with them last night after one day of holiday yesterday. The twins are so noisy! I’m off to Center Parcs with them all for a long weekend on Friday so I won’t be spared.

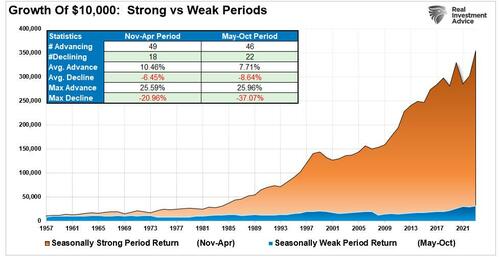

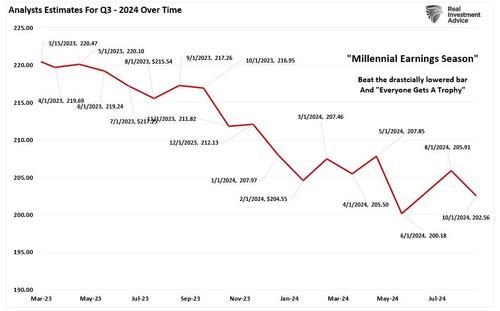

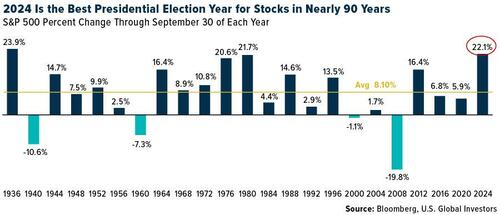

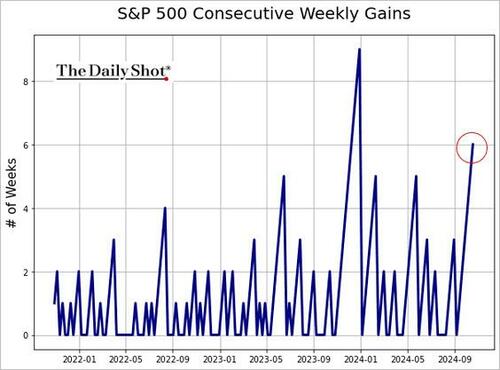

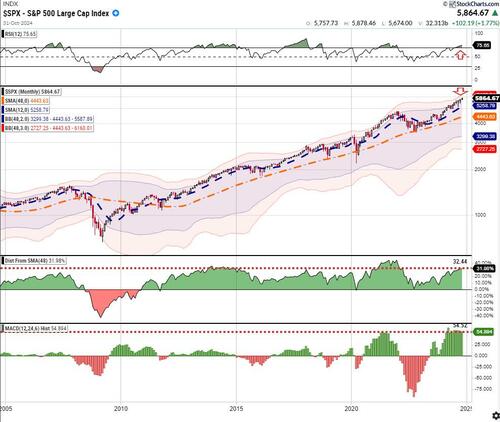

With two weeks to go today until the election, markets have started the week a bit more nervously than during the last 6 where the the S&P 500 has gone up each week for only the second time since the pandemic. Yesterday it started the week -0.18% but with bigger sell-offs elsewhere and extending into the Asian session this morning. The sell-off was much more pronounced among sovereign bonds though, with the 10yr Treasury yield (+11.3bps) reaching its highest level (4.20%) since late July, shortly before the weak payroll report, the Japanese mini-crash and the associated brief market turmoil. Moreover, the move was primarily driven by higher real yields, with the 10yr real yield (+10.2bps) moving up to 1.88%, which is its highest level since the end of July. Overnight, 10yr USTs are another +1.4bps higher as we go to print.

There were several factors behind the move but none that particularly dominated yesterday. In the background there has been a rising concern about debts and deficits, particularly ahead of the US election. Indeed, the IMF pointed out in their recent Fiscal Monitor that global public debt is forecast to exceed $100 trillion this year, and rise further in the medium term, so this is a growing issue as policymakers gather for the IMF/World Bank Annual Meetings in Washington this week. Moreover, our US economists have pointed out that irrespective of who wins the presidency or congress, they could see deficits in the 7-9% area over 2026-28, which is a level unprecedented outside of major wars or massive economic shocks like the GFC and Covid-19.

In addition to the long-end moves, expectations of Fed easing continue to drift lower, with Fed funds pricing for next March (+8.0bps to 4.05%) moving back above 4% for the first time since the start of August, after having fallen to below 3.4% in late September. This came as Fed speakers continued to express preference for gradual easing moving forward, with Kansas City President Schmid favouring “modest” reductions while Minneapolis Fed President Kashkari was “forecasting some more modest cuts”.

Another factor behind the bond selloff were growing inflation risks, and yesterday saw Brent crude oil prices (+1.68%) pick up again to $74.29/bbl. That comes amidst growing focus on Israel’s expected retaliation against Iran’s missile strikes earlier this month, which is still yet to materialise. But oil prices were reacting to several weekend developments, including the drone strike on the private home of Israeli PM Netanyahu that we mentioned yesterday. Indeed, foreign minister Israel Katz said over the weekend that there was “no doubt that another red line has been crossed here”. Meanwhile, although the classic safe haven of gold (-0.06%) closed marginally lower, after posting four consecutive session ATHs, this morning its +0.43% higher as I type and back at what would be record closing levels again.

Over in Europe, the bond selloff was even more aggressive, with yields on 10yr bunds (+9.9bps), OATs (+12.1bps) and BTPs (+15.3bps) all seeing large moves higher. In part, that’s because investors have pared back their expectations for a larger 50bp rate cut at the ECB’s December meeting, and we had a lot of commentary from several officials to digest as well. For instance, Lithuania’s Simkus said that he didn’t see the need for cuts bigger than 25bps, and Slovakia’s Kazimir said that the December meeting was “wide open”.

Back to the US election, the general consensus across polls, betting averages and forecasting models is that Trump has gained ground on Harris, but the race is still within the margin of error across the key battleground states. Now clearly that could change, but from a market perspective, the Trump bump has meant that beneficiaries of the “Trump trade” have continued to do well in recent sessions. Most notably, Trump Media & Technology Group (+5.81%) was up to its highest since July yesterday just after Biden pulled out of the Presidential race.

Returning to yesterday, equities struggled, particularly as bond yields kept on rising. The S&P 500 (-0.18%) posted a modest decline, but it was a broad-based one, with the equal weighted version of the index seeing its worst day in more than six weeks (-0.85%). Small-caps struggled in particular as the Russell 2000 (-1.60%) saw its worst day since early September. Information technology (+0.93%) was the only major sector within the S&P 500 to post a gain. The Mag-7 (+0.64%) advanced as Nvidia (+4.14%) hit a new record high, while the NASDAQ (+0.27%) moved to within half a percent of its all-time high from July. Over in Europe, markets closed around the intra-day lows of the US session, with the STOXX 600 (-0.66%) and the DAX (-1.00%) both losing significant ground.

Whilst there were several short-term catalysts for the selloff, it’s also worth bearing in mind that the market performance has been pretty incredible over recent months. Only last week, we saw US IG credit spreads reach their tightest level since 2005, and the S&P 500 is up for 37 of the last 51 weeks, which is a joint record back to 1989. This means that traditional valuation metrics are now looking increasingly stretched by historic standards, at a time when geopolitical risks are elevated and the soft landing is now increasingly priced in as the likely outcome, so it should in theory get harder from here. Henry took a look at some of these reasons for caution yesterday here.

Asian equity markets are mostly lower this morning. The S&P/ASX 200 (-1.68%) is the biggest underperformer in the region, followed by the Nikkei (-1.43%), the Topix (-1.14%), and the KOSPI (-1.17%). However, Chinese equities are defying the regional trend, with the Hang Seng (+0.41%) and the CSI 300 (+0.47%) posting gains. S&P 500 (-0.18%) and NASDAQ 100 (-0.26%) futures are edging lower. Aussie 10yr yields are +14.5bps with JGBs +2.6bps.

Early morning data showed that South Korea’s producer prices declined by -0.2% in September, matching the decline from the previous month.

There was very little data to speak of yesterday, although we did get the Conference Board’s leading index from the US. That showed a decline of -0.5% in September (vs. -0.3% expected). In level terms, that also left the index at its lowest level since May 2016. The monthly reading hasn’t been positive since February 2022 so the release has lost some of its shock value recently given how well growth as performed over the last few quarters. Separately in Germany, producer prices remained in deflationary territory in September, at -1.4% year-on-year (vs. -1.1% expected).

To the day ahead now, and central bank speakers include ECB President Lagarde, the ECB’s Centeno, Knot, Holzmann, Villeroy, Rehn and Panetta, the Fed’s Harker, BoE Governor Bailey, and the BoE’s Greene and Breeden. Otherwise, earnings releases include General Electric, General Motors and Verizon.