After a brief burst of hope that Beijing had finally learned its lesson to not parade with fake “big bazookas” meant to simply boost its stock market for a few days (allowing members of the nomenklatura to sell their holdings into the spike) but to follow through forcefully and with resolve, we regret to inform readers that nothing at all has changed, and China has fallen into the old pattern of pretending it is stimulating the economy, and traders pretending they are willing to invest in its stock market.

The latest example of this toxic loop was on exhibit earlier today when China’s policymakers rolled out the latest stimulus aimed at boosting the country’s sluggish property sector, and yet just like all recent previous ones, the measures fell far short of hopes for more specific liquidity support.

In today’s highly-anticipated press conference from MOHURD, jointly with MOF, MNR, PBOC and NFRA, authorities unveiled plans to fast-track credit for struggling property developers, and aim to renovate 1 million apartments in so-called urban shantytowns, a strategy used during the prior real-estate slump.

Additionally, China will deploy more funds for housing projects on the government’s “white list,” with 4 trillion yuan ($550 billion) in loans to be available by the end of this year, Minister of Housing and Urban-Rural Development Ni Hong said, urging banks to lend to as many projects as possible. Projects on Beijing’s “white list” are eligible for government-backed financing to complete unfinished apartments and ensure delivery of homes.

Alas, analysts weren’t enthused by the latest moves, which echoed previous efforts by policymakers to aid the property sector. And unfortunately for Xi, who is desperate to launch a market meltup-driven “wealth effect” only without spending much money to get it, just as with all recent stimulus announcements, this one too was a dud and markets shrugged off the news, which was milder than what many expected after an aggressive round of economic stimulus last month. In fact, the market top was proclaimed by none other than Jim Cramer, who pronouncement we correctly identified as the market top.

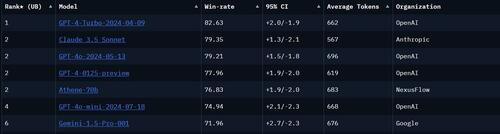

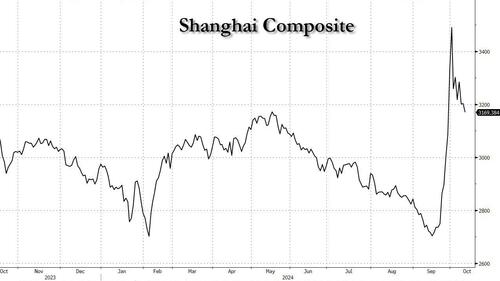

Chinese property stocks led losses in Shanghai and Shenzhen. China Vanke closed 7.9% lower in Shenzhen, while sector losses dragged the benchmark Shanghai Composite Index down 1.05% to close below the key 3200 level, finishing the day at 3169.38.

In Hong Kong, the Hang Seng Mainland Properties Index, which tracks the performance of Chinese property companies, gave up gains made earlier during the day, and closed 6.7% lower Thursday. Shares of developers Sunac China and China Vanke crashed 27% and 17%, respectively.

As the WSJ reminds us, China launched a similar state-financed slum redevelopment program in 2015. Back then, local governments compensated the residents of demolished homes with cash or new housing, and state policy banks provided loans to local governments to finance the program. Eventually, it worked because China’s overall credit impulse was in far better shape compared to the record plunge in the M1 currently.

Zerlina Zeng, senior director at CreditSights, said the expanded “white list” and the loan-disbursement target sound encouraging, but as with other recently announced “stimulus programs”, will provide little additional funding to the sector or boost home-buying sentiment.

“This is because the proceeds of the loans will be parked at the escrow accounts and cannot be used to service debt or fund new projects,” she said. “The aim of the white list is to accelerate the construction of pre-sold but incomplete homes,” so its expansion won’t help reduce China’s excess property inventory or lift expectations about home prices, she added.

On Thursday, Ni said state banks will offer the same sort of financing support as before, and that local governments can issue special-purpose bonds to fund redevelopment. Commercial banks can extend loans to these projects too, the minister added. But banks might be reluctant to extend new loans to developers due to the credit risk entailed, Zeng said.

The urban-renewal project is also smaller than the previous reconstruction program in 2015-2018, and may take much longer to implement due to developers’ strained liquidity and local governments’ squeezed wallets, she added.

If the latest measures are implemented swiftly, there’s a reasonable chance of success in managing supply and shoring up developers’ finances, said Erica Tay, an economist at Maybank Investment Banking Group.

“Homebuyers’ demand is tougher to control,” she said. “The government can roll out favorable policies, but whether households bite depends on a lot of factors.”

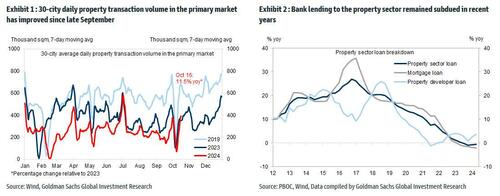

Given the many structural challenges facing the sector and limited policy details, Goldman Sachs maintains its view that there will be no quick fix for the property downturn.

Commenting on the presser, Goldman’s Saira Ansari said that it was generally neutral vs market expectations:

- Upside stems from the likely multi-year plan of cash-backed settlement for urban village renovation and dilapidated/aging housing renovation, though there is still a lack of detail on the size of funding support and time horizon for implementation.

- Downside is related to little mention on incremental policy support to facilitate housing destocking (especially on the funding and implementation strategy), which is crucial for rebalancing the property sector.

- Releveraging As Real Estate Downturn Bites : Goldman estimates China’s non-financial debt to GDP ratio will reach 307% at the end of this year, up from 297% last year, and heightened uncertainites for 2025.

To be sure, policymakers are taking steps in the right direction, analysts say, including the finance ministry’s announcement last Saturday that local government can use proceeds from special government bonds to buy up housing inventory. They just aren’t doing it as rapidly, or as forcefully as the market wants: there have been scant details on further support to facilitate destocking of excess housing inventory in terms of funding and implementation, Goldman Sachs economist Lisheng Wang wrote in a note (available to professional subs in the usual place).

China’s central bank on Thursday said it is also mulling property-sector measures. It’s considering allowing policy banks and commercial lenders to provide loans to property developers to buy land, and could tap relending facilities to offer banks these loans, said Tao Ling, a vice governor at the People’s Bank of China.

Analysts are watching to see what supplementary lending quota the central bank will set for 2025. It earmarked 500 billion yuan in lending for 2024.

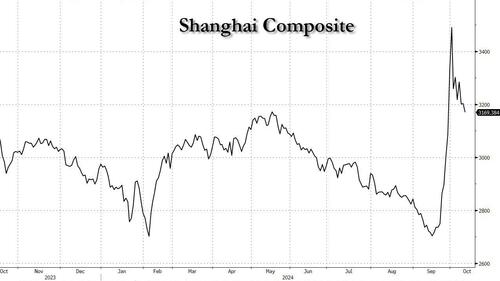

Ni said at Thursday’s briefing that property data in October is expected to show “positive and optimistic results.”

After the unprecedented stimulus package in September, sales of new homes in China rose 3% from a year earlier during Oct. 8 to Oct. 16—the first increase since late June, Macquarie economists Larry Hu and Yuxiao Zhang wrote in a note. That momentum may persist near term, but there are question marks over its sustainability, they said.

“Each round of policy easing can stabilize the housing market for a while, but the effect can fade away later,” the Macquarie economists said.

Bottom line, according to Goldman, is that the announced measures could improve to some degree the supply-demand dynamic of the property market in the near term, yet they haven’t fully addressed how the lumpy backlog of construction in progress (not-yet-saleable) and its associated liabilities (est. Rmb16tn out of total Rmb57tn by end-23E) will be resolved, beyond the government’s land buyback initiatives. In our view, this will also be critical for a more sustainable macro and property market recovery.

And in keeping with the recent pattern of disappointing pressers coupled with expectations for bigger and better stimulus to be unveiled at some future occasion, investor focus now shifts towards the next National People’s Congress of China session, which is emerging as the last chance Hail Mary for Beijing to unveil something truly market moving (as the alternative is an economic debacle and much more stimulus including QE eventually). Goldman remains hopeful predicting that “further policy initiatives are likely in order, as regulators seem keen to find the right balance and support the market”; the market however is once again selling first and asking questions later.