Futures are higher and on the verge of another all time high with Tech leading: NVDA is up +2.5% pre-market as TSMC reported strong upside on margin, along with comments on “extremely robust AI related demand”. As of 8:00am, S&P futures rose 0.4% to 5,910, just shy of the 5,918 all time high; Nasdaq 100 futures climbed 0.9%, led by an advance in chip stocks after TSMC posted a better-than-projected 54% rise in quarterly earnings. That helped reverse the impact of ASML Holding NV’s lowered 2025 guidance, which halted a rally that had pushed US-traded shares to a three-month high. Europe’s Stoxx 600 index gained 0.7% ahead of the ECB’s second consecutive rate cut. China stocks extended their post-euphoria slump and erased gains on disappointment over the outcome of a joint ministry press briefing about the property market which again lacked critical details on the stimulus package. Iron ore tumbled to a three-week low ahead of data on Friday which is expected to show the economy grew at its weakest pace in six quarters. Bond yields are higher and USD is lower; 10-year yields are 2bp higher to 4.03%. Commodities are mixed: Oil and base metals are higher, while precious metals are lower.

In premarket trading, chip giant Taiwan Semiconductor jumped 8.5% after it gave a strong forecast and touted the sustainability of AI hardware demand as strong sales of Nvidia AI chips offset a sagging mobile industry. Margins were seen as a highlight, and the report helped to ease recent concerns about the chip space that followed ASML’s results. The company also raised its target for 2024 revenue growth. US chip were broadly higher on the report. Expedia shares jumped 6.7% after the Financial Times reported that Uber Technologies explored a possible bid for the online travel-booking company. Analysts were positive about a deal noting that Dara Khosrowshahi led Expedia for 12 years before taking the helm at Uber in 2017. CSX shares dropped 3.9% after the freight-transportation company reported third-quarter earnings per share and revenue that missed consensus estimates. Analysts flagged the impact of hurricane activity on the results. Here are some other notable premarket movers:

- Alcoa (AA) rises 5.9% premarket after the aluminum producer reported better-than-expected adjusted Ebitda for the third quarter. Results were aided by surging alumina prices, analysts said.

- Elevance (EXPE) shares tumble 13% after the health insurer slashed its forecast for adjusted full-year EPS as the firm reported third-quarter profits that fell short of expectations. The company also reported higher-than-expected medical expenses for the quarter.

- Fortinet Inc. (FTNT) shares fall 3.7% after Mizuho Securities downgraded the security software company to underperform from neutral.

- Lithium Americas (LAC) shares jump 7.9% in New York after the miner was upgraded to outperform from sector perform at National Bank Financial following the announcement of a joint venture with General Motors.

- Sealed Air (SEE) shares advance 3.1% after Raymond James upgraded the packaging company to strong buy from market perform.

- SolarEdge Technologies (SEDG) shares fall 3.3% after Guggenheim analyst Joseph Osha downgrades the solar company to sell from neutral.

- Topgolf Callaway Brands (MODG) shares fall 2.2% after B. Riley Securities downgraded the golf company to neutral from buy. Analyst Eric Wold expects weak trends at its namesake chain of high-tech driving ranges will weigh on the stock until the firm’s planned separation, anticipated in the second half of 2025.

“TSMC earnings were clearly a positive and that has allayed some of the worries around the chip sector after that dismal report from ASML,” said Michael Brown, strategist at Pepperstone Group Ltd. “The outlook for risk remains very positive particularly as central banks across both developed markets continue to remove policy restriction at a pretty rapid pace.”

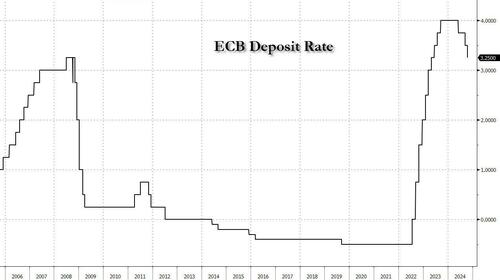

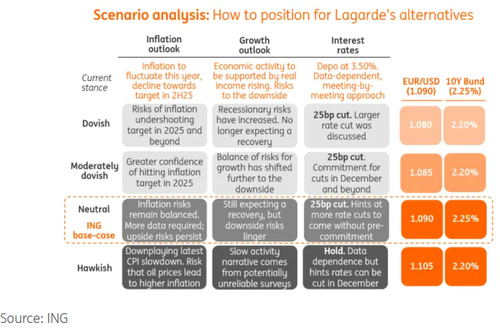

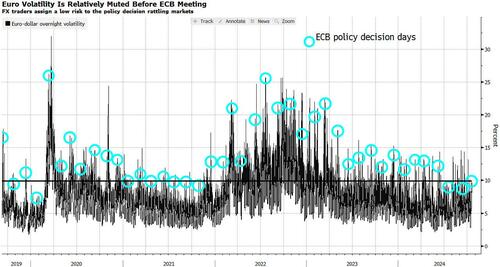

The European Central Bank’s policy decision is due later, where it’s expected to cut its benchmark rate by another quarter-point to 3.25% (our preview is here). Shortly after, the market will turn its attention to US retail sales and jobless figures for further evidence that the US consumer and labor market remain healthy, as investors seek confirmation of soft-landing bets. Traders also await results from tech bellwether Netflix which is set to report its third-quarter earnings after the close amid some concern its breakneck rally may be running out of steam.

In Europe, major markets are higher (Stoxx 600 +0.3%, UKX +0.2%, DAX +0.8%) ahead of the ECB’s second consecutive rate cut with banks leading gains after Nordea increased its outlook for the full year and outlined a new program of share buybacks, while mining and real estate stocks lagged. France and Italy markets outperformed while and Spain lagged. Thematically, Macro Recovery, French Exporters and Italian Banks are among the top outperformers, while Momentum sLong are lagging. ECB is expected to announce the second 25bp rate cut today. Here are the biggest movers Thursday:

- Nordea gains as much as 6.1%, after the Finnish lender announced a fresh €250 million buyback in its third-quarter report, outshining an otherwise in-line report.

- ABB shares rise as much as 2.4% after the company raised its margin guidance, boosted by performance of its electrification unit, which saw strong demand from data centers and utilities, outweighing weakness in its robotics and automation business

- Rentokil shares rise as much as 10%, the most since July, after the pest controller reported North America revenue for the third quarter that beat estimates

- Schindler gains as much as 3.4%, reaching the highest since Nov. 2021, after reporting results that are seen as strong overall by analysts, with improving margins a key positive

- Entain shares gain as much as 4.2% after the gambling group said it now expects full-year adjusted Ebitda to be toward the top end of the forecast range. Additionally, it reported third-quarter results that Citi and Morgan Stanley described as strong

- EQT gains as much as 1.7% after the Swedish asset manager reported robust investment performance, even as exit activity and fundraising remain muted in a challenging environment

- Deliveroo shares rise as much as 4.7% after the food delivery firm reported a 2% order increase in home market UK and Ireland during 3Q, outperforming key rival Just Eat Takeaway

- Nokia shares fall as much as 4.8% after the 5G gear maker trimmed full-year operating profit expectations, saying a recovery in sales is happening slower than expected

- Mondi shares sink as much as 9.5%, hitting their lowest level since 2016, after the paper and packaging company’s quarterly earnings came in way below estimates

- Man Group shares decline as much as 3.6% after the hedge fund firm reported net outflows in the latest quarter and lower assets under management. Citi expects mild consensus downgrades

Earlier in the session, Asian equities fell, on pace for its longest stretch of losses in nearly five months, as a rally in Chinese stocks faltered. The MSCI Asia Pacific Index declined as much as 0.4%. Tencent, Keyence and Tokyo Electron contributed the most to the index’s fourth-straight day of decline. Shares also fell in Japan and India, while they rose in Taiwan and Australia. Chinese stocks in mainland slid into correction territory, while those in Hong Kong fell more than 1%, as investors were underwhelmed by the property sector support measures announced at a government briefing. The country pledged to nearly double the loan quota for unfinished residential projects to 4 trillion yuan ($562 billion), which fell short of market expectations. A Bloomberg Intelligence gauge of Chinese developer stocks tumbled more than 12%.

In rates, treasuries are slightly cheaper across the curve in a mild bear-steepening move, similar to price action in European rates ahead of the European Central Bank’s monetary policy decision at 8:15am New York time. It’s expected to cut the deposit rate for a third time this cycle, to 3.25%, and President Christine Lagarde holds a presser thirty minutes later. US yields are higher by less than 2bp with long-end leading losses, leaving 2s10s and 5s30s spreads steeper by less than 1bp. 10-year around 4.03% is up 1.8bp from Wednesday’s close, keeping pace with bunds while gilts outperform by ~1bp. Bunds fall ahead of the European Central Bank decision although did trim losses after euro-area inflation was revised lower. German 10-year yields rise 3bps to 2.21%. US session has packed economic data slate including jobless claims and retail sales.

In FX, the Bloomberg Dollar Spot Index halted gains as markets awaited key data including jobless claims and remarks by Federal Reserve Bank of Chicago President Austan Goolsbee. The euro extended losses ahead of the European Central Bank policy meeting. The Aussie dollar is the strongest of the G-10 currencies, rising 0.2% against the greenback after stronger-than-expected jobs data.

In commodities basic resources underperform after Chinese stocks slid into a correction following another underwhelming policy briefing. Iron ore tumbled to a three-week low following China’s latest moves to shore up the property market, underscoring skepticism they will be enough to boost construction activity and steel demand. Oil prices advance, with WTI rising 0.3% to $70.60 a barrel after four days of declines, as traders weighed potential risks to production in the Middle East. Spot gold rises $4 having earlier hit a record high, as the increasingly tight presidential race drives demand for haven assets.

Looking at today’s calendar, US economic data calendar includes September retail sales, October Philadelphia Fed business outlook and weekly jobless claims (8:30am), September industrial production (9:15am), August business inventories, October NAHB housing market index (10am) and August TIC flows (4pm). Fed’s Goolsbee is scheduled to speak at 11am

Market Snapshot

- S&P 500 futures up 0.3% to 5,905.75

- STOXX Europe 600 up 0.4% to 521.64

- MXAP down 0.3% to 189.29

- MXAPJ down 0.4% to 601.88

- Nikkei down 0.7% to 38,911.19

- Topix down 0.1% to 2,687.83

- Hang Seng Index down 1.0% to 20,079.10

- Shanghai Composite down 1.0% to 3,169.38

- Sensex down 0.6% to 80,987.77

- Australia S&P/ASX 200 up 0.9% to 8,355.92

- Kospi little changed at 2,609.30

- German 10Y yield little changed at 2.22%

- Euro little changed at $1.0854

- Brent Futures up 0.4% to $74.48/bbl

- Gold spot up 0.4% to $2,683.40

- US Dollar Index little changed at 103.61

Top Overnight News

- China’s policymakers rolled out fresh stimulus aimed at boosting the country’s sluggish property sector, though the measures fell short of hopes for more specific liquidity support. Authorities plan to fast-track credit for struggling property developers, and aim to renovate 1 million apartments in so-called urban shantytowns, a strategy used during the prior real-estate slump, the housing ministry and other policymakers said. WSJ

- China’s show of force around Taiwan in a day of massive military exercises has fueled alarm in Taipei, which wants other democracies to push back harder against Beijing. FT

- Japan reported a modest shortfall in Sept trade numbers, with exports -1.7% Y/Y (vs. the Street +0.9%) and imports +2.1% (vs. the Street +2.8%). RTRS

- Trump’s tariff plan for a second term would be far broader than what he did before and threatens to “radically” reshape global trade (tariffs could rise to the highest level since the 1930s). WSJ

- Euro-area inflation slowed more last month than initially reported, cementing the case for a second consecutive 25-bp cut at today’s ECB meeting and adding to the case for another in December. The euro weakened. BBG

- The EU warned X that it may calculate fines against the social-media platform by including revenue from Elon Musk’s other businesses, including SpaceX and Neuralink, people familiar said. The approach would significantly increase the potential penalties for violating content moderation rules. BBG

- US gasoline inventories slumped again, dropping by 5.9 million barrels last week, the API is said to have reported. That would make total holdings the lowest in almost two years if confirmed by the EIA today. BBG

- TSMC – beat across the board saying capex would be up next year (that is in street). Most positive the comments of 2nm where they are actually seeing more demand from 2nm than they had seen for N3. GS GBM

- Elevance reported a shortfall on Q3 adjusted EPS at 8.37 (vs. the Street 9.66), and the full-year EPS guide is cut to ~$33 (down from the prior “at least $37.20” outlook). The earnings miss in Q2 was driven by a large shortfall on the MCR, which spiked 270bp to 89.5% (this is about 200bp worse than anticipated). This ELV report is the second underwhelming managed care release of the week (after UNH) and follows the recent HUM 2026 CMS blowup. RTRS

- Goldman Sachs expects the Fed to deliver consecutive 25bps cuts from November 2024 through June 2025 to a terminal rate range of 3.25%-3.50%, while it expects the ECB to deliver a 25bps cut at the upcoming meeting and then sequential 25bps of cuts until the policy rate reaches 2% in June 2025.

- BofA Institute Total Card Spending (w/e 12th Oct) +0.8% Y/Y (vs -0.9% average in Sep)

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly in the green following the rebound of equity markets stateside but with gains capped amid quiet macro catalysts and as China’s property sector briefing failed to rally local developers. ASX 200 climbed to a fresh record high led by strength in real estate, industrials and financials, while strong jobs data added to the upbeat mood but further lowered the odds of a rate cut this year. Nikkei 225 underperformed following disappointing trade data including a surprise contraction in exports. Hang Seng and Shanghai Comp advanced at the open with the help of tech strength and consumer-related stocks, although the mainland index briefly wiped out all of its gains amid weakness in property stocks as the press briefing by several Chinese government agencies and the PBoC failed to inspire a turnaround in the sector.

Top Asian News

- Japan Bankers Association Chair said “Personally, I think the Japanese economy is really at a tipping point with wage increases”

- China’s Housing Minister vowed to stabilise the property market from declining further in the press briefing and said the government has announced a raft of policies on housing, while he announced they will add 1mln village urbanisation projects, as well as expand the white list of projects and bank lending to CNY 4tln. Furthermore, they will adopt monetisation measures for urbanisation projects and cities will make their own decisions regarding property restrictions based on the economic situation and local property market conditions.

- PBoC Deputy Governor said regarding existing mortgage rate cuts that most stock of existing mortgage loans interest rates will be adjusted on October 25th and real estate development loans will be extended until end-2026, while interest rates on existing mortgages are expected to fall by an average 50bps, benefitting 50mln households and 150mln residents.

- China’s Assistant Finance Minister said regarding housing purchases that the use of special loans is to support the local government in accordance with the actual situation and they will further broaden local funding sources, while he said they will reduce the burden on developers and home buyers regarding property taxes.

- China NFRA Deputy Director said all commercial housing loans are to be included in the ‘whitelist’ and management of real estate projects are to be further standardised, while financing will be made more convenient and quicker. The official added that commercial banks should make full use of loans and they should optimise the allocation of loans and method of appropriation.

European bourses, Stoxx 600 (+0.4%) began the session modestly firmer and gradually edged to session highs as the morning progressed before coming off best levels. Sentiment across European futures improved following the release of TSMC’s earnings, with tech opening in the green but then faltering. European sectors hold a slight positive bias; Banks take the top spot, lifted by post-earning strength in Nordea Bank (+3.5%). The Basic Resources sector is found towards the bottom of the pile, hampered by broader weakness in the base metals complex. US Equity Futures (ES +0.3%, NQ +0.6%, RTY +0.2%) are modestly firmer across the board, ahead of key US data which includes US Initial Jobless Claims, Philly Fed Index, Retail Sales and Industrial Production. Earnings include: Nestle (revenue & guidance soft), Nokia (missed, maintained outlook), Pernod Ricard (Miss, China sales -26%). EU is weighing using Elon Musk’s empire revenue as a potential fine for X, according to Bloomberg sources; Tesla (TSLA) would be exempt as it is a publicly-traded company.

Top European News

- BoE’s Prudential Regulation Authority is to signal more rules can be relaxed to support growth, according to FT.

- UK Chancellor Reeves will use her Budget to increase capital gains tax on the sale of shares and other assets but will not change the rate for second homes, according to The Times. It was also reported that Reeves’s Budget is set to be the largest tax raiser in history in which she may look to increase fuel duty and faces backlash from Cabinet colleagues, according to The Telegraph.

FX

- USD is showing a mixed performance vs. peers, however, that could change later in the session amid a slew of US data points with retail sales being the standout highlight. To the upside for DXY, the 200DMA is at 103.77.

- EUR is trivially lower vs. the USD in the run-up to today’s ECB rate decision which is widely expected to see a 25bps reduction in the deposit rate. To the upside, Wednesday’s high lies at 1.0901. On the downside, there is clean air until 1.0800.

- GBP is flat vs. the USD following yesterday’s CPI-induced sell-off which saw Cable decline from a 1.3077 high to an overnight trough at 1.2974. However, if the downside resumes, the focus will be on a test of the 100DMA at 1.2954.

- JPY is a touch softer vs. the USD, however, USD/JPY remains unwilling to crack 150.00 to the upside after printing a high at 149.98 on Monday.

- Diverging fortunes for the antipodes with AUD boosted by strong jobs data overnight which has further heightened expectations that the RBA will delay commencing its rate-cutting cycle until next year. NZD is flat vs. the USD in quiet newsflow.

Fixed Income

- Bunds are on the back foot, holding around a 133.74 trough ahead of resistance at 133.68 from Wednesday before 133.40-42 before 133.00 itself. The Spanish auction was strong but was unable to stop the selling pressure.

- USTs are modestly lower and directionally in-fitting with peers but with magnitudes once again smaller; the docket today holds US Initial Jobless Claims, Philly Fed Index, Retail Sales and Industrial Production. At a 112-11 base, just below Wednesday’s 112-13 low. For Europe, focus on the ECB ahead of which Final EZ HICP was revised down.

- Gilts are the marginal laggard after Wednesday’s inflation-driven upside. Gilts gapped lower by 23 ticks and have since slipped by another 20 ticks to a 97.55 base.

- Spain sells EUR 5.115bln vs exp. EUR 4.5-5.5bln 3.10% 2031, 3.45% 2034, 2.70% 2048 Bonos

- France sells EUR 12bln vs EUR 10-12bln 2.50% 2027, 0.75% 2028, 2.75% 2029, and 2.75% 2030 OAT

Commodities

- Crude oil is choppy and trading on either side of the unchanged mark amid light catalysts thus far and following four back-to-back closes in the red. Brent Dec trades in a 73.89-74.92/bbl parameter.

- A mixed session for precious metals with spot palladium flat, silver subdued, and gold eking mild gains at the time of writing. Spot gold incrementally printed fresh record highs of USD 2,685.84/oz in today’s session.

- Base metals are mostly lower after being initially underpinned overnight alongside the mostly constructive risk tone in Asia but later faltered as participants were underwhelmed by Beijing’s latest press briefing on the property sector.

- Peru copper output rose 10.7% Y/Y in August to 246.6k tons.

Geopolitics: Middle East

- German naval ship reportedly brought down an unmanned flying object in an incident off the coast of Lebanon early Thursday, according to a German Defence Ministry spokesman.

- Israeli source cited by ABC said PM Netanyahu agreed to a set of targets to be hit inside of Iran without specifying a timeline for the attack, according to Al Jazeera.

- Israeli PM Netanyahu said he held an emergency discussion on increasing aid to Gaza, according to Reuters citing three Israeli officials.

- US President Biden’s envoy told aid groups that Israel is too close an ally for the US to suspend arms, according to POLITICO. It was separately reported that US Defence Secretary Austin spoke to his Israeli counterpart on Wednesday and reinforced the importance of taking all necessary measures to ensure the safety and security of UNIFIL forces and Lebanese armed forces, according to the Pentagon.

- Yemen’s Houthi Al Masirah TV reported US-British air strikes which targeted the capital of Sanaa and the city of Saada, while US Defence Secretary Austin said US forces targeted several Houthi underground facilities housing various weapons components in Yemen.

- Explosions were heard amid reported Israeli aggression targeting Syria’s Latakia, according to Syrian state media.

Geopolitics: Other

- China’s Coast Guard said a Japanese fishing boat illegally entered the territorial waters of Diaoyu Island and the Chinese Coast Guard drove away Japanese vessels on October 15th-16th in accordance with the law, according to state media.

- North Korea said roads and railways with South Korea were completely cut off under its constitution that defines the South as a hostile state, while it will continue to take measures to permanently fortify the border with South Korea, according to KCNA.

US Event Calendar

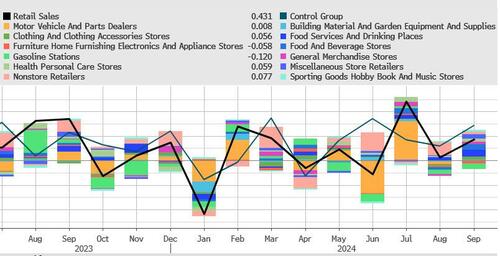

- 08:30: Sept. Retail Sales Advance MoM, est. 0.3%, prior 0.1%

- Sept. Retail Sales Ex Auto MoM, est. 0.1%, prior 0.1%

- Sept. Retail Sales Control Group, est. 0.3%, prior 0.3%

- Sept. Retail Sales Ex Auto and Gas, est. 0.3%, prior 0.2%

- 08:30: Oct. Initial Jobless Claims, est. 258,000, prior 258,000

- Oct. Continuing Claims, est. 1.87m, prior 1.86m

- 08:30: Oct. Philadelphia Fed Business Outl, est. 3.0, prior 1.7

- 09:15: Sept. Industrial Production MoM, est. -0.2%, prior 0.8%

- Sept. Manufacturing (SIC) Production, est. -0.1%, prior 0.9%

- Sept. Capacity Utilization, est. 77.8%, prior 78.0%

- 10:00: Aug. Business Inventories, est. 0.3%, prior 0.4%

- 10:00: Oct. NAHB Housing Market Index, est. 42, prior 41

- 16:00: Aug. Total Net TIC Flows, prior $156.5b

DB’s Jim Reid concludes the overnight wrap

Markets put in a solid performance yesterday, with investors remaining upbeat as they digested several earnings results and another modest decline in oil prices. This backdrop proved very supportive for risk assets, meaning that the S&P 500 (+0.47%) advanced to its second-highest ever closing level, whilst US IG spreads remained at their tightest since June 2021. Investors even grew more relaxed about inflation thanks to the decline in commodity prices and a downside surprise in the UK CPI release, which helped sovereign bonds to rally on both sides of the Atlantic. So it was a strong day overall, even as a few concerns remain in the background, not least around geopolitical tensions in the Middle East.

When it comes to the next 24 hours, central banks will be back in the spotlight today, as the ECB is widely expected to deliver another 25bp rate cut, taking their deposit rate down to 3.25%. Bear in mind that as recently as mid-September, markets were expecting that the ECB would probably stay on hold at this meeting, having only done quarterly cuts so far in June and September. But since then, we’ve had a weak batch of data, with the Euro Area composite PMI in contractionary territory for the first time in 7 months, whilst inflation has also continued to fall. In fact, Euro Area headline inflation was down to +1.8% in September, which is the first time it’s been beneath the ECB’s 2% target in over three years. So the backdrop has turned a lot more dovish in recent weeks.

DB’s economists also expect the ECB to cut by 25bps today, and they write that this would signal a pivot towards faster easing, as it would be the first back-to-back cut of the cycle. But given the high level of macro uncertainty, they don’t expect the ECB to move away from the ‘data dependent, meeting by meeting’ approach to policy. For more info, see their full preview here.

Ahead of the ECB’s decision, sovereign bonds rallied on both sides of the Atlantic. In part, that was because of the UK CPI print for September, which came in beneath expectations and helped to reassure investors about inflationary pressures, not least after Canada’s inflation data also surprised on the downside on Tuesday. The release showed UK headline inflation was down to +1.7% (vs. +1.9% expected), which is its lowest since April 2021. And even though core inflation was stronger at +3.2% (vs. +3.4% expected), that was also its weakest in three years.

That downside surprise in UK inflation led investors to dial up their expectations for Bank of England rate cuts. Indeed, overnight index swaps for the June 2025 meeting were pricing in 114bps of rate cuts by the close, up +9.8ps on the previous day. That pattern was echoed more broadly as well, with expectations for ECB cuts by June up +4.1bps on the day to 137bps. And over in the US, there were now 121bps cuts priced by June, up +2.8bps on the day. So that offered fresh momentum to sovereign bonds, which was also supported by the latest declines in commodity prices. So by the close, it meant that yields on 10yr gilts (-9.7bps) had seen a sharp decline, whilst those on 10yr bunds (-3.8bps), OATs (-3.4bps) and BTPs (-5.2bps) all moved lower as well.

Over in the US, the decline in yields was smaller, with those on 10yr Treasuries down -2.0bps to 4.01%. But in the meantime, we did get a fresh indication that the recent pickup in US yields has been filtering through to mortgages, with data from the Mortgage Bankers Association showing that the 30yr fixed rate was up to 6.52% in the week ending October 11, having been at 6.14% just a couple of weeks earlier. Moreover, that decline yesterday has since pulled back overnight, with the 10yr Treasury yield up +1.8bps this morning again to 4.03%.

When it came to equities, there were solid gains in the US which saw the S&P 500 rise +0.47%, leaving it less than -0.3% beneath its record high from Monday. The key theme was a rotation towards small-cap stocks, with the Russell 2000 (+1.64%) reaching its highest level since November 2021. A few other segments also did very well, with the KBW Bank Index (+1.71%) reaching its highest level since March 2022, and Morgan Stanley (+6.50%) was the strongest performer in the index after its earnings release. On the other hand, the megacap tech stocks underperformed, with the Magnificent 7 (+0.01%) little changed despite a +3.13% gain for Nvidia, amidst losses for Meta (-1.62%), Apple (-0.89%) and Microsoft (-0.63%).

In terms of the geopolitical situation, investors are still following the Middle East closely, including what form any retaliation from Israel might take against Iran. But in the meantime, oil prices continued to fall back modestly yesterday, with Brent crude (-0.04%) losing ground for a fourth consecutive day to end the session at $74.22/bbl.

Overnight in Asia, there’s been a mixed performance across the major equity indices, and US equity futures are also pointing lower this morning, with those on the S&P 500 down -0.23%. Initially, Chinese equities had posted strong gains overnight, with the CSI 300 up +1.32% at its intraday peak, but it’s since pared those back to only be up +0.08% at time of writing. That followed the news that China would almost double its loan quota for so-called “white-list” property projects, up to 4 trillion yuan, but this fell short of some expectations, and the CSI 300 Real Estate Index is down -4.95% this morning.

Elsewhere in the region, Australian government bond yields have risen after the country’s employment report for September was stronger than expected. It showed the unemployment rate falling to 4.1% (vs. 4.2% expected), while employment was up by +64.1k (vs. +25.0k expected), coming in above every economist’s estimate on Bloomberg. That’s seen investors dial back the likelihood of a near-term rate cut by the RBA, with the probability of a rate cut by the December meeting down to 36% overnight, from 49% at yesterday’s close.

Finally in Japan, the Nikkei has fallen by -0.65% this morning, which follows data showing that Japan’s exports were down -1.7% year-on-year in September. That’s the biggest decline since February 2021, and it fell short of estimates for a +0.9% gain.

To the day ahead now, and the main highlight will be the ECB’s policy decision, along with President Lagarde’s subsequent press conference. We’ll also hear from the Fed’s Goolsbee. Data releases from the US include retail sales, industrial production and capacity utilisation for September, the weekly initial jobless claims, and the NAHB’s housing market index for October. Finally, earnings releases include Netflix.