Futures are mixed as chip stocks recover partially from Tuesday’s rout and as traders looked ahead to more major earnings. As of 8:00am ET, S&P futures are up 0.1%, a day after a profit warning from Dutch chip equipment maker ASML rattled sentiment, and boosted by an across the board beat from Morgan Stanley which jumps 3%, Nasdaq 100 futs are up 0.2% with Nvidia rising 0.8% after sinking nearly 5% on Tuesday. Global equities trade mostly lower on follow through after ASML’s booking miss weighed on Semis and in turn broader markets (ASML call 9am EST today // Tokyo Electron -9%/SK Hynix -2% etc/Taiwan Semi -2% overseas overnight // watch for TSM earnings tomorrow). FTSE +55bps/DAX -35bps/CAC -50bps/Shanghai +5bps/Hang Seng -16bps/Nikkei -1.83%. Bond yields are lower with the 10Y yield dropping to just above 4.00%, the Bloomberg dollar index is unchanged. Commodities are mixed: precious metals are higher, while base metals are lower; oil edged higher as Israel said it was keeping options open in how to attack Iran: UST10yr -3bps @ 4.00% // WTI -$0.35 @ $70.20 // Bitcoin +2.10% @ $68,055. Main event for now is still earnings with ABT, CFG, FHN, MS, PLD, SYF, USB reporting pre open // AA, CCI, CSX, DFS, FR, KMI, PPG, REXR, SLG, STLD post close. Focus today in US will be earnings (ABT, MS, PLD); ASML earnings call will be at 9am ET.

In premarket trading, Morgan Stanley shares jumped 3.4% after the bank beat expectations across the board. ASML slid another 4% on continued follow through of light 3q orders (NVDA +70bps, AMD +50bps recovering); UAL is down 0.6% after better revs/eps/$1.5bn buyback (call 10:30am); JB Hunt Transport shares rose 7% in US premarket trading, after the logistics company’s third-quarter profit topped the analyst estimates. Among the biggest laggards was Qualcomm Inc., which fell on reports that it will likely postpone its offer to buy Intel Corp. until after the US presidential election. CSCO rose 1.5% on u/g away; NVCR +32% on FDA approval of Optune Lua Treatment. Here are some other notable pre-market movers:

- Interactive Brokers slumped drops 3% after the trading platform reported adjusted earnings that trailed the average analyst estimates.

- JB Hunt (JBHT) gains 7% after the logistics company’s 3Q profit topped estimates. The company said demand for its biggest segment — intermodal service — improved throughout the quarter, supported by strong performance from its rail providers.

- Novocure (NVCR) soars 24% after the oncology company said the US Food and Drug Administration approved Optune Lua to treat metastatic non-small cell lung cancer in adults who have progressed on or after a platinum-based regimen.

- Penguin Solutions (PENG) slides 14% after the semiconductor devices firm’s fourth-quarter adjusted earnings per share missed consensus estimates.

- Synchrony Financial (SYF) rises 3% after reporting earnings per share for the 3Q that beat the average analyst estimate

ASML’s slide Tuesday sent ripples across the industry, resulting in more than $420 billion of market value loss for an index of US-traded chip stocks and the largest Asian peers. While the weakness in names like Nvidia and ASML has an impact on the broader market, Peter Fitzgerald, chief investment officer for macro and multi-asset at Aviva Investors, pointed to the strength of demand for artificial intelligence as well as supportive central bank policy.

“If the Federal Reserve is going to continue to ease and cut rates between now and the end of next year, we are in the soft landing,” Gerard Cassidy, head of US bank equity strategy at RBC Capital Markets, said on Bloomberg TV. That would be supportive for investment banking, especially initial public offerings and mergers and acquisitions, he said.

The pound fell 0.6% below $1.30 for the first time since August and money markets bolstered wagers on Bank of England rate cuts after UK inflation slipped below the BOE’s 2% target for the first time since April ’21 (YoY headline 1.7% vs 1.9% cons // market now pricing more rate cuts in ’24). London’s FTSE 100 outperformed European stock indexes and yields on UK gilts tumbled. China announced that their housing minister along with officials from the MOF and PBOC will hold a press conference tomorrow which will likely provide details on new property support measures

Europe’s Stoxx 600 index retreated 0.4% after ASML extended losses and fell another 3.5% after yesterday’s 15.6% decline. LVMH and Salvatore Ferragamo SpA led the retreat in luxury stocks after weak updates, both slumping as much as 7%. Major European markets are mixed: UK stocks outperform as a result of lower than expected CPI print (Core CPI prints 3.2% YoY vs. 3.4% survey vs. 3.6% prior), with the FTSE 100 rising 0.7% as most of its regional peers decline. European stocks have been hampered by a double-dose of negative earnings news from ASML and LVMH. EU Most Short and EU Defence are higher; Periphery Banks and China Exposed Consumer are among the underperforming baskets. Here are the biggest movers Wednesday:

- Teleperformance rises as much as 6.3%, outperforming amid a decline in French stocks, as Kepler Cheuvreux raises its recommendation on the customer-contact services firm to buy from hold

- Whitbread shares advance as much as 4.8% after the Premier Inn owner reported first-half revenue that met consensus estimates. The company also said it was making “excellent progress” on its five-year plan

- Rio Tinto’s London-listed shares edged about 0.9% higher after third-quarter earnings met analysts’ expectations. However, softer demand from China meant iron ore shipments rose only marginally, while analysts also noted ongoing issues at the miner’s Kennecott operation

- Quilter advances as much as 11%, to highest since April 2022, after the wealth-management firm delivered net flows significantly ahead of expectations in the third quarter

- ASML shares extend a decline on Wednesday, a day after the chip-equipment maker reduced 2025 guidance and reported weaker-than-expected quarterly bookings. A rout of its European peers also deepened

- LVMH shares dropped as much as 7.5% in Paris trading to its lowest level in over two years, after the luxury-goods company missed estimates for third-quarter organic sales in its important fashion & leather goods unit

- Adidas shares fall as much as 5.2% as a guidance upgrade from the German sportswear firm failed to impress investors, with the stock still up over 25% in 2024. Baader says the new numbers were already reflected in consensus estimates

- Ipsos falls as much as 12%, the most since July 2023, after the market and consumer analytics firm updated its guidance for 2024 and published preliminary 3Q revenue figures

- Kinnevik falls as much as 11%, the most since June, after the Swedish investment company reported its latest earnings, showing a 5% sequential drop in net asset values and a 14% decline year-on-year

- Nel shares drop as much as 6.6% as analysts highlight weak order intake for the hydrogen technology supplier, and commentary which suggests a cautious outlook for the market next year

Earlier in the session, a key Asian index declined to its lowest level in three weeks, driven by losses in chipmaker shares. Chinese stocks fell. The MSCI Asia Pacific Index fell as much as 1%, with TSMC, Tokyo Electron and Samsung Electronics among the biggest contributors to the decline. Their weakness weighed on the tech-heavy markets of South Korea, Taiwan and Japan. Semiconductor companies faced selling pressure after ASML Holding NV missed order estimates and cut its outlook for next year, sparking a global rout in the sector. A Bloomberg gauge of chipmakers in Asia fell as much as 3.6%.

Chinese stocks faced another day of big swings, with the benchmark CSI 300 Index ending lower for the second straight day and coming close to entering a correction. A lack of clarity over the extent of fiscal stimulus, as well as muted economic data, has cooled sentiment toward the market. On the other hand, a Bloomberg gauge of China’s property shares surged as much as 8.3% as markets prepared for a joint news conference to be held by government officials including the housing minister and central bank on Thursday.

“It’s mostly a wake up call to reality” for many investors in artificial intelligence stocks, Olivier d’Assier, head of investment research at SimCorp, told Bloomberg Radio. “Analysts or investors had outsized expectations for sales and earnings, so I think it’s a bit of a reality check but not yet a red flag for the global economy.”

In FX, the Bloomberg Dollar Spot Index was steady; the pound falls 0.4% and earlier dipped below $1.30 for the first time since Aug. 20 after UK inflation slowed more than expected in September. Traders were quick to increase bets on interest-rate cuts by the Bank of England, boosting gilts.

In rates, treasuries are richer across the curve amid steeper gains for gilts after UK inflation slowed more than expected in September. UK yield curve steepened as OIS contracts priced in a more aggressive path of rate cuts by the Bank of England this year and next year. Treasury yields are lower by 2bp-2.5bp across a slightly flatter curve as long-end outperforms; US 10-year is down ~2bp at 4.01% with gilts in the sector outperforming by 6bp; UK 10-year gilt yields fall 8 bps to 4.08%. The US session is expected to include more bank bond offerings following JPMorgan’s four-part transaction Tuesday.

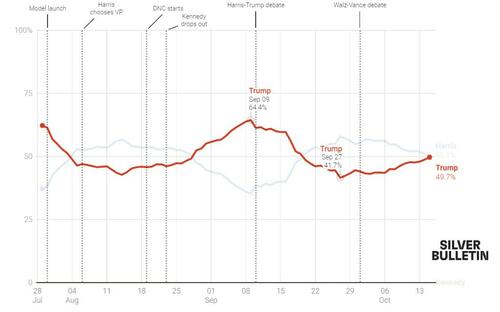

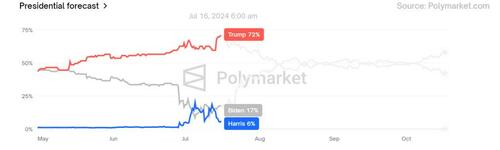

In commodities, oil prices advanced, with WTI rising 0.3% to $70.80 a barrel after slumping on Tuesday, as traders continued to monitor the risk of escalation in the Middle East and the outlook for next year. Gold surged $16 to a new all time high of $2,679/oz as investors turned their attention to the upcoming US election, with polls forecasting a razor-thin contest with less than three weeks to go. . Spot gold climbs

Looking at today’s calendar, US economic data calendar includes the latest MBA Mortgage Applications (which plunged 17.0% after sliding 5.1% the previous week) and the October New York Fed services business activity and September import/export prices (8:30am); no Fed members scheduled for Wednesday

Market Snapshot

- S&P 500 futures little changed at 5,862.25

- STOXX Europe 600 down 0.3% to 518.87

- MXAP down 0.9% to 190.10

- MXAPJ down 0.6% to 604.62

- Nikkei down 1.8% to 39,180.30

- Topix down 1.2% to 2,690.66

- Hang Seng Index down 0.2% to 20,286.85

- Shanghai Composite little changed at 3,202.95

- Sensex down 0.2% to 81,631.61

- Australia S&P/ASX 200 down 0.4% to 8,284.75

- Kospi down 0.9% to 2,610.36

- German 10Y yield down 3 bps at 2.20%

- Euro down 0.1% to $1.0880

- Brent Futures little changed at $74.23/bbl

- Gold spot up 0.6% to $2,677.53

- US Dollar Index up 0.11% to 103.38

Top Overnight News

- Chinese property-developer stocks rallied on speculation the government and central bank will announce new measures to boost the housing sector at a joint briefing scheduled for Thursday. BBG

- Adidas shares slide in European trading despite the company issuing a modest upside preannouncement on Q3 GMs/op. income and nudging up its full-year op. income guidance (they now see op. income of EU1.2B vs. the prior forecast of EU1B) as the revenue performance was approximately inline. RTRS

- Saudi Arabia is entering a new phase of austerity as the Kingdom dials back on aggressive spending amid a drop in oil revenue. FT

- UK inflation in Sept tumbled sharply, spurring calls for more aggressive BOE easing (the headline CPI sank to +1.7% in Sept, down 50bp from +2.2% in Aug and below the Street forecast of +1.9%). RTRS

- Indonesia is blocking sales of the iPhone 16 after Apple failed to meet its investment commitments in the country. SCMP

- Georgia judge blocks a new rule that would have required county election workers in the state to count ballots by hand (many worried this rule would have delayed the state reporting its results). WaPo

- Donald Trump has elevated his threat to impose sweeping tariffs on imported cars including from Mexico and the EU, placing increased US trade protectionism at the heart of his agenda if he wins a new White House term. FT

- Elon Musk has given nearly $75mn to help Donald Trump’s bid to win back the White House, as the world’s richest man tries to influence the outcome of next month’s US presidential election. FT

- Private equity investors are selling second-hand stakes in ageing funds at a blistering pace this year, as pensions and endowments find ways to get out of unlisted investments amid a slump in deal activity that has curtailed cash payouts. FT

- Fed’s Bostic (2024 voter) said the US economy is performing quite well and he is confident inflation will get back to the 2% target, while he doesn’t have a recession in his outlook but expects inflation to be choppy and employment to stay robust. Bostic also noted his dot was for 25bps more in 2024 beyond the 50bps September cut and is keeping his options open.

- JPMorgan sees good chances of a US economy soft landing; expects caution to Chinese stocks to continue; Fed is facing challenges managing the impact of supply chain and inflation from geopolitics.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed with early declines seen as the risk-off mood rolled over into the region after Wall St pulled back from record levels with global sentiment sapped by disappointing earnings updates from ASML and LVMH. ASX 200 was restrained as weakness in tech and consumer stocks overshadowed the gains in financials and real estate, while miners were also lacklustre with Rio Tinto shares pressured following its quarterly update. Nikkei 225 underperformed after slipping beneath the 40k level and amid disappointing Machinery Orders. Hang Seng and Shanghai Comp clawed back opening losses following the PBoC’s firm liquidity efforts and with China to hold a press briefing tomorrow on promoting the steady and healthy development of the property sector.

Top Asian News

- BoJ announces the continuation of relaxation of terms and conditions for securities lending facility for cheapest-to-deliver issues

- BoJ Governor Ueda to visit China from Oct 17-18; attending meeting of central bank governors from Japan, China, South Korea

- Chinese President Xi said China is willing to be a partner and friend with the US, while he added the success of China and the US is an opportunity for each other and both countries should boost each other’s development rather than be an obstacle, according to state media.

- Hong Kong Chief Executive Lee said in his annual policy address that they plan to reduce wait times for public housing and will streamline procedures for companies seeking to list in Hong Kong as they seek to attract international enterprises listings. Lee also announced to cut duties on liquor with an import price of more than HKD 200 to 10% from 100% for the amount above HKD 200, while it was later reported that Hong Kong is to relax mortgage rules for some homes.

- BoJ’s Adachi says the risk of upward pressure heightening from the bigger-than-expected JPY fall has reduced significantly. Markets have stabilised when compared to when there was huge volatility in August.

- BoJ Board Member Adachi said conditions are already in place for the BoJ to start normalising monetary policy and it must take rate hikes in several stages, but added they must avoid drastic policy change that could stoke fear of a return to deflation. Adachi said the BoJ will raise rates at a very moderate pace and maintain an accommodative financial environment until underlying inflation stably and sustainably hits 2%, while he also stated that hiking rates at a rapid pace after the inflation target is met could cause a big shock to economy and the BoJ should raise rates in several stages to achieve smooth policy normalisation. Furthermore, he said the BoJ must avoid a premature rate hike, which means it should use conservative estimates in gauging Japan’s natural rate of interest.

European bourses, Stoxx 600 (-0.3%) are mostly trading in negative territory, with sentiment hit after poor earnings from heavyweights ASML and LVMH. The FTSE 100 (+0.6%) is the European outperformer, assisted by the cooler-than-expected UK inflation report. European sectors hold a strong negative bias; Energy is towards the top of the pile, attempting to recoup some of the hefty losses seen in the prior session. Consumer Products is found at the foot of the pile, dragged down by post-earning losses in LVMH (-3.60%), whilst ASML (-3.8%) acts as a drag on Tech. US Equity Futures (ES U/C NQ +0.1% RTY +0.2%) are trading mixed, with the ES and NQ flat, taking a breather from the losses seen in the prior session, whilst the RTY sees very modest gains. China’s Cyberspace regulator has called for a systematic examination of the risks of Intel (INTC) products. Intel -4% pre-market. Google (GOOGL) says multiple Google Cloud products are impacted in the US-West2 Region, US-West2-A Zone. European sectors hold a strong negative bias; Energy is towards the top of the pile, attempting to recoup some of the hefty losses seen in the prior session. Consumer Products is found at the foot of the pile, dragged down by post-earning losses in LVMH (-3.60%), whilst ASML (-3.8%) acts as a drag on Tech.

Top European News

- Italy’s Economy Minister Giorgetti says the government has reached a deal with the EU over a seven year adjustment path for deficit and debt

FX

- USD is mixed vs. peers. DXY has traded near the upper-end of today’s 103.17-39 range, but in recent trade has pulled back from best levels to reside towards the mid-point of today’s confines. Docket ahead includes US import and export prices.

- EUR is ever so slightly firmer vs. the USD but with EUR/USD attempting to climb back above 1.09 in recent trade. Fresh macro drivers for the EZ remain light in the run up to Thursday’s ECB policy announcement. For now, EUR/USD is managing to hold above its 200DMA at 1.0872.

- GBP is the worst performer across the majors in the wake of soft UK inflation data which saw headline Y/Y CPI slip further below target and services inflation decline to 4.9% vs. the MPC forecast of 5.5%. Cable has slipped onto a 1.29 handle for the first time since August 20th; technicians flag the 100DMA at 1.2952.

- Despite an attempted recovery vs. the USD yesterday, JPY is once again struggling against the greenback. USD/JPY has ventured as high as 149.48.

- Antipodeans are both softer vs. the USD by similar magnitudes. NZD/USD was in focus overnight and saw some weakness following CPI metrics which saw a softer-than-expected outturn for Q/Q CPI.

Fixed Income

- Bunds are firmer in a continuation of the upside seen in Tuesday’s session. Initial upside stemmed from cooler-than-expected UK CPI and has since extended to a 134.12 peak.

- Gilts gapped higher by 68 ticks and then extended further to a 97.76 multi-week peak after softer-than-expected UK inflation. A release which has all but cemented a November cut and makes one in December very likely as well.

- USTs are holding in the green, taking the lead from the above but yet to extend much further with US specifics light. USTs are just off a 112-20 peak, resistance at 112-21 from last week and thereafter 112-24 and 112-28+.

- UK sells GBP 3.5bln 4.0% 2031 Gilt: b/c 3.42x (prev. 2.98x), average yield 3.988% (prev. 3.814%), tail 0.2bps (prev. 1.6bps)

- Germany sells EUR 0.822bln vs exp. EUR 1bln 2.50% 2054 and EUR 0.854bln vs. exp. EUR 1bln 0.0% 2050 Bund.

Commodities

- Crude began the European session on a firmer footing as the complex took a breather from recent pronounced pressure. However, as the morning progressed oil prices edged lower, with Brent’Dec now residing near session lows at USD 74/bbl.

- Spot gold is bid, holding around a USD 2677/oz peak with support coming from the generally tentative risk tone (influenced by earnings), soft yields and ongoing geopolitical concern.

- Base metals are firmer paring back some of the pressure seen in yesterday’s session which was driven by the performance of China and continued assessment of recent stimulus efforts.

- Indian Gold imports (Sep) USD 4.39bln vs. USD 10.06bln in August, according to the Trade Ministry.

- Qatar has set the December term price for Al-Shaheen oil at USD 1.93bbl above Dubai quotes which is down vs. November, according to Reuters sources

Geopolitics

- Israel’s plan to respond to Iran’s attack is ready, according to CNN sources.

- “An Israeli official says a letter received from senior US officials on Gaza and is being carefully reviewed by Israeli security officials”, via Sky News Arabia

- Israel’s army presented PM Netanyahu and Defence Minister Gallant with a list of targets for a possible attack on Iran, according to Israel’s Channel 12 cited by Al Jazeera.

- Israeli PM Netanyahu’s government began disabling GPS in Tel Aviv in anticipation of the Iranian response to a possible Israeli attack, according to Al Arabiya.

- IDF said it killed a large number of Hezbollah members in raids and exchanges of fire in southern Lebanon during the last day, while it added that it hit more than 140 targets in more than 50 locations including weapons stores.

- Israel targeted a site in the southern suburbs of Beirut for the first time since Friday.

-

- Israel’s army said about 50 rockets were detected from Lebanon towards the Upper Galilee, and a number of them were intercepted, according to Sky News Arabia.

- Iranian Foreign Minister Araqchi is to visit Jordan, Egypt and Turkey as part of a diplomatic reach out to countries in the region ‘to end genocide, atrocity and aggression’, according to Iran’s Foreign Ministry.

- Iran has told the UN that it is prepared for a decisive response if Israel attacks it, via journalist Elster.

US event calendar

- 07:00: Oct. MBA Mortgage Applications -17%, prior -5.1%

- 08:30: Sept. Import Price Index ex Petroleu, est. 0.1%, prior -0.1%

- 08:30: Sept. Import Price Index MoM, est. -0.3%, prior -0.3%

- 08:30: Sept. Import Price Index YoY, est. 0%, prior 0.8%

- 08:30: Oct. New York Fed Services Business, prior 0.5

- 08:30: Sept. Export Price Index MoM, est. -0.4%, prior -0.7%

- 08:30: Sept. Export Price Index YoY, prior -0.7%

DB’s Jim Reid concludes the overnight wrap

I went to a parent’s evening last night for 9-yr old Maisie and the Maths teacher flew through how they teach long division nowadays so we could help Maisie at home if needed. I must admit I didn’t have a clue what she was going on about, but given I’ve worked with numbers for nearly 30 years with many before that studying, I was too embarrassed to say and just nodded along. Then I accidentally spent most of the time with the English teacher, who is a Liverpool fan, speaking about the season so far. Fair to say I got a slight reprimand when I got home. I’m not looking forward to my domestic appraisal. Strengths: “sports”. Weaknesses: “everything else”.

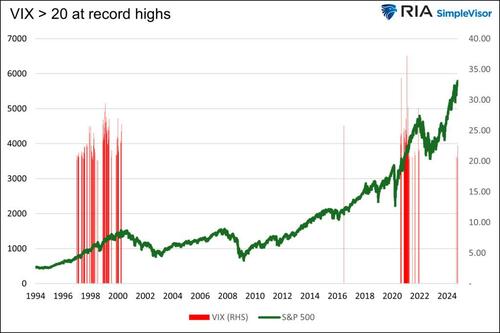

Some rare weakness has come through in risk over the last 24 hours, with the S&P 500 (-0.76%) falling back from its record high the previous day. That followed significant disappointment among chipmakers after ASML’s earnings (-15.64% and its worst day since June 1998) were beneath expectations, whilst energy stocks also took a hit from the latest decline in oil prices. Indeed, the Philadelphia Semiconductor Index fell -5.28% over the day, whilst Nvidia was down by a similar -4.69% partly also because of the previous night’s story that the US was mulling stricter chip export rules for certain countries.

Even with the tech sell-off, in some ways the most important move yesterday was the decline in oil prices, with Brent crude (-4.14%) down for a third consecutive day to $74.25/bbl. That followed the Washington Post report we mentioned yesterday, saying that Israel would strike military infrastructure in Iran, and not oil or nuclear facilities. So that took out some of the geopolitical risk premium from oil prices, but there remains significant concern about an escalatory spiral and the potential for a wider conflict, as Iran have said that they would respond to any Israeli attack.

That decline in oil prices meant investors became more relaxed about inflationary pressures, which have moved increasingly onto the radar over recent weeks. In fact, the 5yr US inflation swap fell by -4.1bps yesterday to 2.48%, marking its biggest daily decline in over a month. And in turn, investors dialled up the likelihood of rate cuts over the months ahead, with the rate priced in for the Fed’s June 2025 meeting falling -2.8bps to 3.62%. That also came as the New York Fed’s latest Survey of Consumer Expectations showed that debt delinquency expectations moved higher once again, with the mean probability of not being able to make a minimum debt payment over the next 3 months rising to 14.2%, which is the highest since April 2020 at the height of the pandemic.

With rate cut expectations moving higher again, that led to a sovereign bond rally on both sides of the Atlantic. In the US, that meant the 10yr Treasury fell -6.7bps to 4.03%, although the 2yr yield was down by a smaller -0.9bps to 3.95%. The decline was most pronounced at the long-end, with 30yr yields (-9.1bps) seeing their sharpest decline since the vol shock on August 2.

Over in Europe, bonds saw a similar rally, with yields on 10yr bunds (-5.2bps), OATs (-7.8bps) and BTPs (-8.4bps) all moving lower. This also meant that the spread of Italian yields over bunds tightened to just 124bps, which is the tightest since March when it fell to 122bps. This came ahead of the Italian government last night announcing its 2025 Budget Bill, which our European economists’ previewed in a note earlier yesterday. Meanwhile, in a separate report overnight ahead of tomorrow’s ECB meeting, they discuss what the recent oil market volatility may imply for ECB policy.

For equities, it was a tougher day that saw the major indices struggle on both sides of the Atlantic. In large part that was driven by the semiconductor drop mentioned above, and the Euro STOXX 50 (-1.87%) saw a major decline given ASML’s weighting in the index, which itself was down -15.64%. In fact, it was the worst day for the Euro STOXX 50 since early August, when the underwhelming jobs report led to significant market turmoil. The plunge in ASML’s share price came as the company reported Q3 bookings of EUR 2.6bn, around half that expected by analysts, and lowered its 2025 guidance. The stock is now -33% down from its July peak amid more cautious demand for its advanced chip-making equipment and more restrictions on where it can export.

After the European close, we also had disappointing results from luxury giant LVMH, as weaker demand in China saw the company’s key luxury unit post its weakest revenue growth since the early phase of the Covid pandemic. Its ADRs fell by -7.94% in US trading and looks set to give up all the gains (and more) made since China’s stimulus announcement. Elsewhere, it wasn’t quite as bad, but the STOXX 600 was still down -0.80%, and in the US the S&P 500 fell -0.76%. The tech underperformance saw the NASDAQ slip by -1.01%, though the Mag-7 (-0.58%) actually outperformed slightly as the mega caps were fairly stable aside from Nvidia’s -4.69% fall. Defensive sectors including consumer staples (+0.64%) and utilities (+0.45%) outperformed within the S&P 500.

US banks also outperformed amid amidst positive earnings results, with the KBW Bank Index (+0.28%) rising to its highest level since April 2022. The gains were more pronounced for smaller banks, as the KBW Regional Banking Index advanced +1.18%. By contrast, some of the larger banks reporting actually saw their share price fall, with Citigroup down -5.11% despite beating headline estimates.

Asian equity markets are mostly lower after ASML earnings with the Nikkei leading the losses (-2.05%), followed by the KOSPI (-0.43%), and the CSI (-0.24%). By contrast, the Hang Seng (+0.90%) and the Shanghai Composite (+0.40%) are higher. S&P 500 (+0.09%) and NASDAQ futures (+0.23%) are also rebounding a bit.

Early morning data revealed an unexpected decline in Japanese core machine orders for August, which fell by -1.9% month-on-month, compared to an expected increase of +0.1% and a previous month’s decline of -0.1%.

Here in the UK, the latest employment report was reasonably positive yesterday, with unemployment ticking down to 4.0% in the three months ending August (vs. 4.1% expected). It’s true that the number of payrolled employees was down -15k in September (vs. -3k expected), but the previous month was revised upwards to show a smaller -35k decline (vs. -59k previously). Separately in Germany, the ZEW survey for October showed a decline in the current situation reading to -86.9 (vs. -84.0 expected), which was the weakest since May 2020. However, the expectations measure picked up to 13.1 (vs. 10.0 expected) after three consecutive monthly declines. Finally, the ECB’s latest quarterly Bank Lending Survey pointed to some ongoing improvement in bank credit conditions, especially for housing loans.

To the day ahead now, and data releases include the UK CPI reading for September. From central banks, we’ll hear from ECB President Lagarde. Otherwise, today’s earnings releases include Morgan Stanley and Abbott Laboratories.