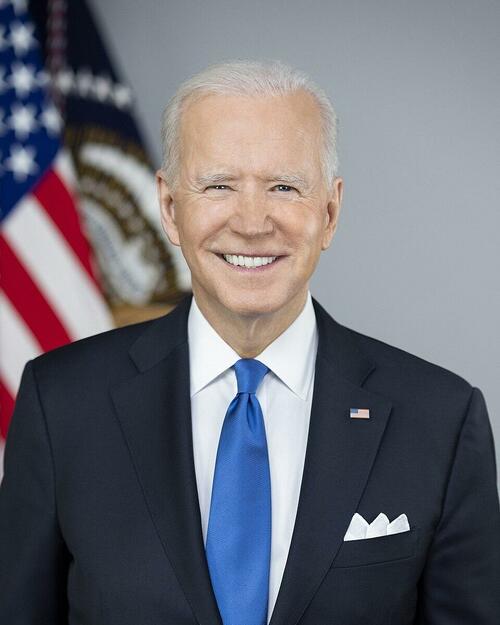

“No Kidding! No Joke!” Liberals Call On Biden To Commit Unconstitutional Acts In His Final Days

With the end of the Biden Administration in sight, liberal pundits seem to be striving to prove that the only difference between a lawbreaker and a law-abiding citizen is the ability to get away with the crime. Popular figures on the left from Michael Moore to Keith Olbermann are calling on President Joe Biden to commit overtly unlawful acts in his final 100 days in office, including targeting his political opponents. In one of the few statements of Moore with which I agree, he stated that this is “no joke.” It certainly is not.

It is the same logic used by looters that they have a license for illegality. However, this constitutional looting would endanger not just the Constitution but the country as a whole if Biden were to heed this advice.

In a posting on Substack, Moore told Biden that it was time to yield to temptation and check off a liberal 13-item “bucket list” of demands, tossing aside questions of legality or constitutionality in the process.

“You’re not done. You’ve still got 100 days left in office! And the Supreme Court has just granted you super powers — AND immunity! You don’t answer to anyone. For the first time in over 50 years, you don’t have to campaign for anything…“You have full immunity! No kidding! No joke! That’s not hyperbole! You can get away with anything! And what if anything means everything to the people?”

The list includes emptying death row, canceling all student and medical debt, halting weapons shipments to Israel, ending the death penalty, declaring the Equal Rights Amendment a constitutional amendment, and granting clemency to nonviolent drug offenders.

Other pundits have pushed Biden and Democrats to take some of the actions on Moore’s list before the end of the administration.

Many of these items could only be fulfilled by knowingly gutting the Constitution and assuming the powers of a monarch. That includes just canceling all student and medical debt in defiance of both the courts and Congress.

As discussed in my most recent column, others have added to that bucket list.

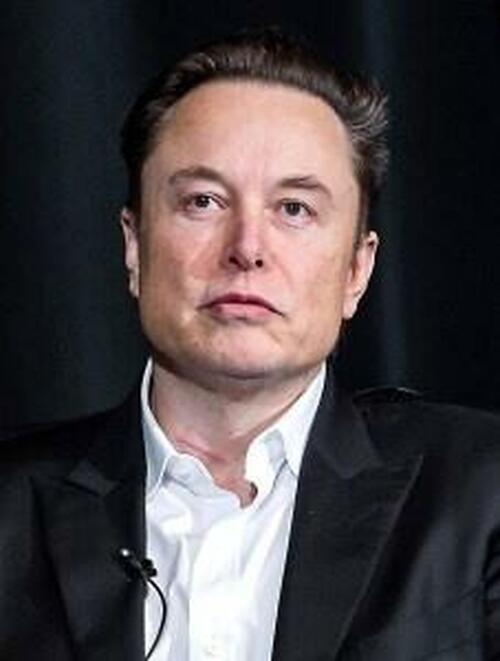

Take Olbermann who, while insisting that he is fighting to “save democracy,” has called upon Biden to target political opponents like Elon Musk with deportation: “If we can’t do that by conventional means, President Biden, you have presidential immunity. Get Elon Musk the F out of our country and do it now.”

These calls come in the midst of a counter-constitutional movement led by law professors. Moreover, the disregard for such legal authority has been voiced by liberal academics like Harvard Professor Lawrence Tribe. Indeed, his past “just do it” approach was not dissimilar in advice to Biden.

For example, the Biden administration was found to have violated the Constitution in its imposition of a nationwide eviction moratorium through the Centers for Disease Control and Prevention (CDC). Biden admitted that his White House counsel and most legal experts told him the move was unconstitutional. But he ignored their advice and went with that of Harvard University Professor Laurence Tribe, the one person who would tell him what he wanted to hear. It was, of course, then quickly found to be unconstitutional.

The false premise of the recent calls is that the Court removed all limits on the presidency in its recent ruling on presidential immunity. The fact that law professors are repeating this clearly erroneous claim is a measure of the triumph of rage over reason today.

As I have previously written, I am not someone who has favored expansive presidential powers. As a Madisonian scholar, I favor Congress in most disputes with presidents. However, I saw good-faith arguments on both sides of this case and the Court adopted a middle road on immunity — rejecting the extreme positions of both the Trump team and the lower court.

As I previously wrote, the Court followed a familiar approach:

The Court found that there was absolute immunity for actions that fall within their “exclusive sphere of constitutional authority” while they enjoy presumptive immunity for other official acts. They do not enjoy immunity for unofficial, or private, actions.

The Court has often adopted tiered approaches in balancing the powers of the branches. For example, in his famous concurrence to Youngstown Sheet & Tube Co. v. Sawyer, 343 U.S. 579 (1952), Justice Robert Jackson broke down the line of authority between Congress and the White House into three groups where the President is acting with express or implied authority from Congress; where Congress is silent (“the zone of twilight” area); and where the President is acting in defiance of Congress.

The Court separated cases into actions taken in core areas of executive authority, official actions taken outside those core areas, and unofficial actions. Actions deemed personal or unofficial are not protected under this ruling.

It is certainly true that the case affords considerable immunity, including for conversations with subordinates. However, as Chief Justice John Roberts lays out in the majority opinion, there has long been robust protections afforded to presidents.

There are also a host of checks and balances on executive authority in our constitutional system. This includes judicial intervention to prevent violations of the law as well as impeachment for high crimes and misdemeanors.

What is interesting is not just what is stated but implied. Courts would quickly enjoin such efforts, but figures like Moore suggest that it would not matter. If so, Biden would not only flagrantly violate the Constitution, but then defy the authority of the federal courts. That includes unilaterally declaring an unratified amendment as ratified based on a meritless claim by the far left.

So President Biden would violate the Constitution, refuse to yield to the courts, and pursue his “bucket list” of priorities without any legal restraints. All would be done in defense of democracy. It shows how the line between tyranny and democracy can be lost in an age of rage.

* * *

Jonathan Turley is the Shapiro Professor of Public Interest Law at George Washington University and the author of “The Indispensable Right: Free Speech in an Age of Rage.”

Tyler Durden

Mon, 10/14/2024 – 11:15

via ZeroHedge News https://ift.tt/5UGAkcr Tyler Durden