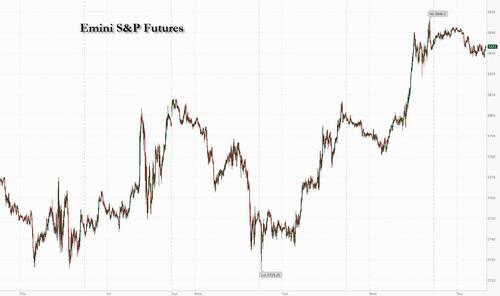

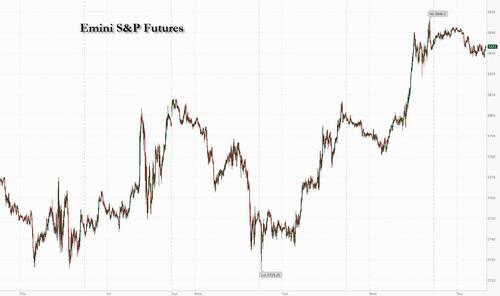

US equity futures are lower as traders awaited the latest inflation data that will determine if the Fed opts for a slower pace of interest-rate cuts. As of 8:00am, S&P 500 futures are down 0.2% after hitting a record high on Wednesday; Nasdaq futures are down by the same amount with most Mag7 stocks flat; TSLA is leading with a +1.1% pre-market move ahead of its Robotaxi unveil event tonight. Delta Air Lines Inc. kicked off the third-quarter earnings season, with profit and sales forecasts falling short of expectations. JPMorgan Chase & Co. and Wells Fargo & Co. are scheduled to report on Friday. Ten-year Treasury yields held above 4%, near the highest levels since end-July. Bloomberg’s dollar index was steady after an eight-day streak of gains, its longest since April 2022. Commodities are mixed with Oil higher, Base Metals lower, and Precious Metals higher. Today, key macro focus will be CPI, along with AMD (Advancing AI) and TSLA (Robotaxi) events.

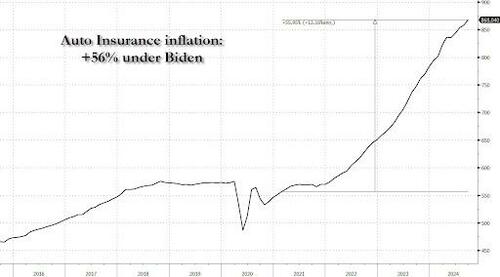

In premarket trading, Delta Air Lines fell 5% after management forecast profit and sales that are short of Wall Street’s estimates for the final months of the year, suggesting a slow recovery from a challenging summer travel season. US insurance stocks rallied in premarket trading after Hurricane Milton weakened to a Category 3 storm, and supply-chain services provider GXO Logistics rose on the news of a potential sale. Here are some other premarket movers:

- 10X Genomics (TXG) plunges 26% after the company posted preliminary 3Q revenue that fell short of its expectations, citing hesitant capital spending by customers.

- Domino’s Pizza Inc. (DPZ) slips about 1% after the company trimmed its 2024 projection for sales growth and new locations as slower consumer spending hits the restaurant industry.

- GXO Logistics (GXO) rises 12% as Bloomberg reports the supply-chain services provider is exploring a sale, citing a person familiar with the matter.

- Pfizer (PFE) falls 1% after its former executives Ian Read and Frank D’Amelio decided “not to be involved” in Starboard Value’s activist campaign against the drug company.

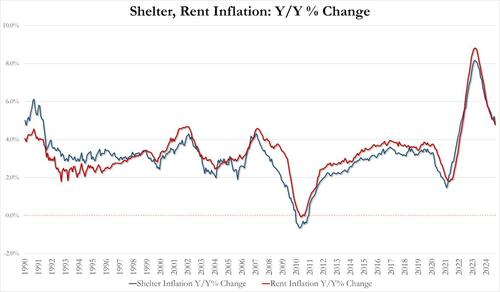

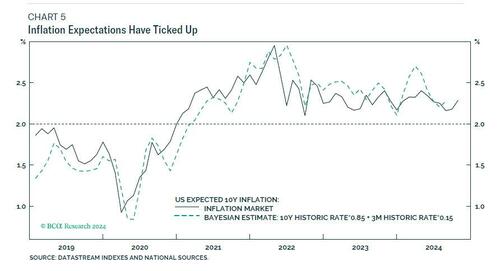

US CPI data is expected to show inflation moderating further in September, supporting the view that the Fed will continue easing policy in the coming months. However, as noted in our preview, the surprisingly strong jobs print for last month has forced traders to dial back rate-cut bets, with many expecting a 25-basis-points reduction in November. Meanwhile, CPI “whisper numbers” are higher than consensus and Goldman traders warn that a hotter than expected number would slam stocks (full preview here).

A strong inflation reading could change the reaction function from the Fed, Bénédicte Lowe, a strategist at BNP Paribas Markets 360, said on Bloomberg TV. “Given that equities are near all-time high in the US, close to multi-year highs in Europe, the risks are more skewed to the downside if we get a pick-up in inflation from here,” Lowe said.

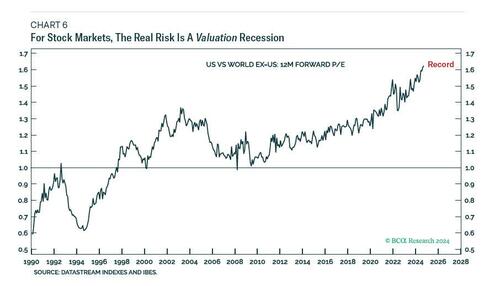

Elsewhere, investors will want to see if profits are robust enough to sustain this year’s roughly 20% rally in the S&P 500. Companies in the index are expected to report a 4.7% increase in quarterly earnings from a year ago, according to data compiled by Bloomberg Intelligence, down from the 7.9% growth projected on July 12. Invesco Global Market Strategist Brian Levitt expects companies to surpass the pared-back expectations, keeping the rally going.

“It is a good nominal growth backdrop, investors are sitting there, looking at equity markets saying: all-time highs on the equity market, can I invest?” Levitt told Bloomberg TV. “Peak inflation, peak tightening, peak rates should be good for equities.”

European stocks edged lower ahead of the CPI report; the Stoxx Europe 600 Index was down 0.1% by 11:47 a.m. in London. Technology and mining stocks lagged, while insurers outperformed as analysts said costs related to Hurricane Milton may be less than initially feared. Spanish stocks were also underperformers as utilities firms weighed. The benchmark gave up early gains as investors weighed multiple risks, including the war in Ukraine, escalating tensions in the Middle East and uncertainty over further Chinese stimulus. Investors are also bracing themselves for the third-quarter earnings season. In individual movers, GSK Plc was among the biggest gainers after it said it will pay as much as $2.2 billion to resolve US court cases related to it Zantac medication. Shares in Italy’s BPER Banca SpA jumped after the lender gave new targets for earnings and dividends. Chip stocks including Soitec and BE Semiconductor Industries NV fell after analysts cut price targets ahead of the earnings season.

Earlier in the session, Asian equities rose, helped by a rebound in Chinese shares amid hopes that the country’s finance ministry will announce fresh stimulus during a briefing Saturday. The MSCI AC Asia Pacific Index jumped as much as 1.1%, snapping a two-day decline, as Chinese tech names including Tencent Holdings Ltd. and Meituan advanced. An index of Chinese stocks listed in Hong Kong climbed 3.4% and the onshore CSI 300 Index rose 1.1% in volatile trading. Shares in Japan, South Korea and Australia posted modest gains.

Two key events loom large for investors in the near term. China’s finance ministry briefing this weekend is a key focus, but traders are also awaiting US inflation data due Thursday, which may provide hints on the pace of the Federal Reserve’s interest-rate cuts in the coming months. “It does appear to be a cautious lift filtering through from Wall Street for Asia but ahead of US CPI, caution may rule the roost,” said Vishnu Varathan, head of economics and strategy at Mizuho Bank in Singapore. He said the mentality among many onshore investors regarding more fiscal stimulus in China is “I’ll believe it when I see.”

In FX, the Bloomberg dollar index traded little changed after rising for eight straight sessions through Wednesday close, its longest winning streak since April 2022. The yen reversed losses after earlier falling to its weakest since early August. USD/JPY slips 0.2% to 149.02; earlier, pair rose to 149.55, a fresh cycle high and strongest since Aug. 2. EUR/USD down 0.1% to 1.0930; GBP/USD little changed at 1.3074. Loonie leads G-10 losses against dollar; USD/CAD up 0.3% to 1.3751, the strongest since Aug. 8

In rates, Treasuries are marginally cheaper across the curve, following wider losses across core European rates. The long-end are cheaper by 1bp-2bp with 10-year around 4.09%, outperforming bunds and gilts in the sector by 1bp and 4bp; curve spreads are slightly steeper on the day, within 1bp of Wednesday’s closing levels. The week’s auctions conclude with $22 billion 30-year reopening, following average results for 3- and 10-year note sales which both tailed. The 30-year bond reopening at 1pm follows 0.4bp tail for Wednesday’s 10-year sale; WI 30-year yield near 4.36% sits ~34bp cheaper than September auction, which tailed by 1.4bp. Ahead of CPI and weekly jobless claims data, Fed swaps price in around 18bp of easing for the November meeting and a combined 42bp over the two remaining meetings this year. Gilts lead a selloff in European government bonds, with UK 10-year yields rising 4 bps to 4.22%. French bonds fall ahead of the budget announcement.

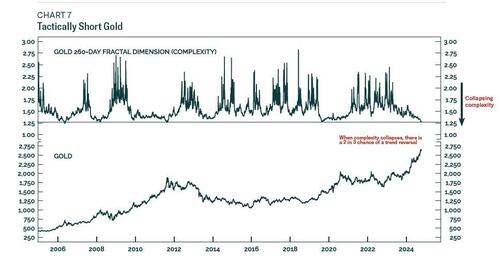

In commodities, oil prices advance after a two-day fall, with WTI climbing 1.4% to $74.30 a barrel and Brent futures strengthened above $77 a barrel, on fear that Israeli retaliation against Iran for its recent missile strikes will trigger all-out war in the Middle East. Spot gold rises $10 to around $2,618/oz.

Looking at today’s data, US economic data calendar includes September CPI and jobless claims (8:30am). Fed speakers scheduled include Cook (9:15am), Barkin (10:30am) and Williams (11am).

Market Snapshot

- S&P 500 futures down 0.1% to 5,833.25

- STOXX Europe 600 down 0.2% to 519.26

- MXAP up 0.6% to 192.35

- MXAPJ up 0.8% to 611.99

- Nikkei up 0.3% to 39,380.89

- Topix up 0.2% to 2,712.67

- Hang Seng Index up 3.0% to 21,251.98

- Shanghai Composite up 1.3% to 3,301.93

- Sensex up 0.3% to 81,675.05

- Australia S&P/ASX 200 up 0.4% to 8,222.98

- Kospi up 0.2% to 2,599.16

- German 10Y yield little changed at 2.27%

- Euro little changed at $1.0934

- Brent Futures up 0.8% to $77.22/bbl

- Gold spot up 0.3% to $2,616.09

- US Dollar Index little changed at 102.92

Top overnight news

- Chinese equities rebound after the PBOC unveiled a liquidity swap facility aimed at bolstering the stock market and investors prepare for the Sat finance minister press briefing. FT

- China proceeds with plans to create a CNY500B swap facility aimed at providing firms with liquidity for stock purchases (this facility is consistent w/plans outlined by the PBOC last month). WSJ

- Four Taiwanese employees at Chinese facilities that make products for Apple have been detained by local authorities, Taiwanese officials said, the latest example of corporate detentions that have hurt business confidence. The employees worked at a complex run by Taiwan’s Foxconn Technology Group in Zhengzhou, China, said Taiwanese agencies responsible for managing relations with China. One of the agencies said the employees were accused of an offense akin to breach of trust, although the exact nature of the allegations couldn’t be determined. WSJ

- Japan’s improving economic conditions and receding U.S. recession worries are likely to bring prospects of a December or January interest rate hike back into view, even as a new government complicates the politics around monetary policy. RTRS

- Donald Trump said he’d end US income taxes on American expats. The pledge, which would require congressional approval, would reduce paperwork and, potentially, the tax bills for the roughly 9 million Americans living overseas. BBG

- Harris sees her poll numbers slip in the critical Rust Belt states according to a new Quinnipiac poll (Harris is up 3 points in PA, but down 3 in MI and down 2 in WI). Quinnipiac

- Alexandria Ocasio-Cortez has warned the Democratic party’s Wall Street donors of an “out and out brawl” if Lina Khan, the antitrust progressive who chairs the Federal Trade Commission, is removed from her post. FT

- BlackRock Inc. is among firms exploring a purchase of HPS Investment Partners, according to people with knowledge of the matter, in a deal that would push the world’s biggest asset manager into the top ranks of the private-credit market. BBG

- In Manhattan, the median rent on new leases fell 3.4% from a year earlier to $4,200, brokerage Douglas Elliman Real Estate and appraiser Miller Samuel Inc. reported Thursday. Prices also slipped in Brooklyn and Queens. Rents in Manhattan have declined gradually in four of the past five months. But the median is still just $200 shy of the record high, reached in summer of 2023, and is 20% more than in September 2019, before the pandemic. BBG

- Fed’s Daly (voter) said she fully supported a half-point rate cut and is quite confident they are on the path to 2% inflation, while she added that they are at full employment and will watch the data, as well as monitor the labour market and inflation. Furthermore, Daly said the size of the September rate cut does not say anything about the pace or size of the next cuts and noted that one or two more cuts this year are likely.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were higher following the record closes on Wall Street despite light macro catalysts as the latest Fed rhetoric and FOMC Minutes did little to spur a reaction, while the attention now shifts to looming US CPI data. ASX 200 mildly gained amid strength in real estate and the mining-related industries with the latter helped by M&A news after Rio Tinto announced a definitive agreement to acquire Arcadium Lithium. Nikkei 225 was underpinned at the open but with gains capped amid quiet newsflow and firmer-than-expected PPI data. Hang Seng and Shanghai Comp rallied with significant outperformance in the Hong Kong benchmark after returning to above the 21,000 level, while the mainland conformed to the broad upbeat mood which also followed the PBoC’s announcement to establish a securities and funds swap facility of CNY 500bln to enhance the internal stability of the capital market.

Top Asian news

- PBoC announced to establish a securities and funds swap facility of CNY 500bln to enhance the internal stability of the capital market, while it started accepting applications from securities firms, funds and insurers to join the swap scheme.

- Fast Retailing (9983 JT) FY (JPY) Op Profit 500.9bln (exp. 478.26bln), Pretax Profit 557.2bln (exp. 546.65bln); sees FY op. income 520bln.

- BoJ Deputy Governor Himino says “We are witnessing record high corporate profits and record high wage increase in Japan”; If the outlook for economic activity and prices presented in July report is achieved, BoJ will accordingly raise interest rates. The policy board is going to look at the totality of the data as it makes decisions meeting by meeting. “We have many real interest rates and they vary significantly but all of them are negative”. Later in the year, “we will have more data on the pass through of wage hikes on prices, and next year’s wage negotiations”. “We will also now more about pass through of YEN – Dollar rate on inflation via import prices”. Course is not pre-set. BoJ will consider adjusting degree of monetary conditions if the board has greater confidence in the outlook. “The data to focus on shifts as it comes in, today US employment and consumption and Chinese consumption may deserve more attention than before”. “We monitor data to detect developments that are not already covered in our risk scenarios, looking at data outside of the priority is equally important”. There is no clear consensus among the board members about future approaches on better communication.

- Japan’s Former FX Diplomat Kanda says heightened FX volatility has a largely adverse impact on Japan

- China’s State Planner publishes draft guidelines on private economy promotion law. Will be improving investment and the financing environment while reducing transaction costs.

- China prelim auto sales September, PCA: +2% Y/Y, +8% M/M. NEV: +51% Y/Y, +9% M/M.

European bourses, Stoxx 600 (-0.2%) began the session on a modestly firmer footing, but as the morning progressed, indices generally edged lower. As it stands, indices are mostly in negative territory and to varying degrees. European sectors hold a negative bias vs initially mixed at the cash open. Healthcare tops the pile, a beneficiary of the significant gains in GSK (+5.4%) after it settled its Zantac litigation case. Tech is found towards the foot of the pile. US Equity Futures (ES -0.2%, NQ -0.2%, RTY -0.1%) are softer across the board, in a slight paring to some of the gains seen in the prior session; traders are also very mindful of the upcoming US CPI result. AMD (+0.2%) will host its AI event and Tesla (+0.8%) is firmer ahead of its Robotaxi event. Huawei smartphone sales within China surpassed Apple’s (AAPL) in August 2024, via CINNO Research; for the first time in almost four-years. Four Taiwanese employees at a Foxconn (2354 TW) run facility in China which makes products for Apple (AAPL) have been detained by local authorities, via WSJ citing Taiwanese officials; said to have been accused of offenses similar to a breach of trust.

Top European news

- Institute for Fiscal Studies sees risk of a large UK tax increase to ease the spending squeeze and said UK Chancellor Reeves may need to announce a GBP 25bln tax rise in her first Budget on October 30th to shore up public services, while the think-tank also noted that past governments have raised taxes sharply after elections.

- Fortum (FORTUM FH) CEO says they have spotted drones and suspicious people around their Finnish energy assets on a monthly basis. Being targeted by cyber attacks.

FX

- Dollar is essentially flat and trading within a very tight 102.83-96 range, with the best for today just shy of Wednesday’s peak. Today’s US CPI release will be the next inflection point for the index.

- EUR is incrementally lower but within recent ranges; today’s low is just beneath its 100 DMA at 1.0933. Today sees the ECB Minutes release for the September meeting, but will likely have little impact on pricing given the developments of survery data and inflation metrics.

- GBP follows peers, and trades within a very tight 1.3063-1.3089 range; the high for today is a little shy of its 50 DMA at 1.3093. UK-specifics light, but focus is on the upcoming UK Budget; think tank IFS, writes that Chancellor Reeves “must find billions more” in time for the Budget.

- JPY is firmer vs the Dollar with USD/JPY trading within a 148.84-149.54 range. The pair saw some downside after BoJ’s Himino said “we are witnessing record high corporate profits and record high wage increase in Japan… if the outlook for economic activity and prices presented in July report is achieved, BoJ will accordingly raise interest rates”.

- The Antipodeans started the European session on a firmer footing and remained as the marginal G10 outperformers throughout the morning; largely a factor of a slight paring of the losses seen in the prior session.

Fixed Income

- USTs are pressured with the FOMC minutes potentially weighing alongside a mixed 10yr auction and concession into the 30yr. Thus far, USTs at a 112-01+ trough, a couple of ticks below Wednesday’s base to a fresh WTD low. US CPI is also on the docket, which is expected to cool slightly from the prior pace.

- Bunds are in the red; the paper saw some brief two-way action on account of German Retail Sales, which was much firmer than expected. Focus for EGBs later in the day will be on the French PM and his Budget/Finance Ministers where they are set to present the budget to other cabinet members.

- Gilts are lagging down to a 96.19 trough which marks a fresh WTD and multi-week low, next point of support potentially at 95.47 from early-July. UK-specific newsflow light ahead of the UK Budget on Oct 30th; Institute for Fiscal Studies report ahead of this cautions that an additional GBP 20bln, or more, could be required to meet the ‘no return to austerity’ pledge.

Commodities

- A firmer session for crude benchmarks. Hurricane Milton made landfall overnight as a Category 3 storm, details on the damage to energy infrastructure light thus far. As for geopols, Guy Elster reported that the Israel security cabinet will be meeting tonight to discuss the potential attack. Brent’Dec currently trading around USD 77.50/bbl.

- Spot gold is firmer and sitting comfortably above the USD 2600/oz mark and extending as high as USD 2617/oz, though the yellow metal has lost a little bit of its shine as the session progresses

- Base metals performed well in APAC trade, bolstered by outperformance in China on the latest support measures. However, this narrative has faded in the European session somewhat with copper now unchanged as the European risk tone tempers.

- Fortum (FORTUM FH) CEO says they have spotted drones and suspicious people around their Finnish energy assets on a monthly basis. Being targeted by cyber attacks.

- UBS says “we forecast Gold to reach USD 2850/oz by mid-2025”.

Geopolitics: Middle East

- “Israel security cabinet will meet this evening to discuss on the planned attack on Iran”, via journalist Elster

- Israel PM Netanyahu will ask the security cabinet to give him and Defence Secretary Galant the mandate to decide on the attack on Iran, according to Israeli press. It was also previously reported that PM Netanyahu asked to understand the American position and get support, according to Israel’s Channel 12.

- Israeli Defence Minister said the attack on Iran will be fatal, accurate and surprising, according to Al Arabiya.

- Israeli and US officials believe that tit-for-tat exchanges of fire will continue between Iran and Israel, even after the Israeli retaliatory strike soon against Iran, according to OSINTDefender on X.

- Israel conducted a new raid on Haret Hreik in the southern suburbs of Beirut and conducted a raid on the heights of the town of Jinta near the Lebanese-Syrian border, while it was also reported that a large force of Israeli soldiers raided the town of Idna, west of Hebron, in the southern West Bank.

- Israeli aggression was reported on Hasiya Industrial City in Syria’s Homs countryside, according to Syrian state TV.

- US warplanes flew over areas controlled by Iranian militias in Deir Ezzor, Syria, according to Sky News Arabia. It was later reported by media loyal to the Syrian regime that there was a bombing believed to be American on the city of Albu Kamal in the countryside of Deir Ezzor, according to Al Jazeera.

Geopolitics: Other

- Ukrainian Presidential Advisor Lytvyn has denied earlier reports in Corriere della Sera that Zelensky would be “willing to accept a ceasefire along the current line – without recognizing a new official border – in exchange for certain Western commitments”.

- Russian ballistic missile strike on port infrastructure in Ukraine’s southern Odesa region killed six people and wounded 11 others on Wednesday, according to AFP News Agency.

- Taiwan President Lai said China has no right to represent Taiwan and he will uphold the commitment to resist annexation or encroachment, while he added that Taiwan is resolved in commitment to upholding peace and stability in the Taiwan Strait and achieving global security and prosperity. Taiwan will become more calm, more confident, and stronger, as well as noted that the determination to defend their national sovereignty remains unchanged.

US Event Calendar

- 08:30: Sept. CPI MoM, est. 0.1%, prior 0.2%

- Sept. CPI YoY, est. 2.3%, prior 2.5%

- Sept. CPI Ex Food and Energy MoM, est. 0.2%, prior 0.3%

- Sept. CPI Ex Food and Energy YoY, est. 3.2%, prior 3.2%

- Sept. Real Avg Hourly Earning YoY, prior 1.3%, revised 1.4%

- Sept. Real Avg Weekly Earnings YoY, prior 0.9%, revised 1.0%

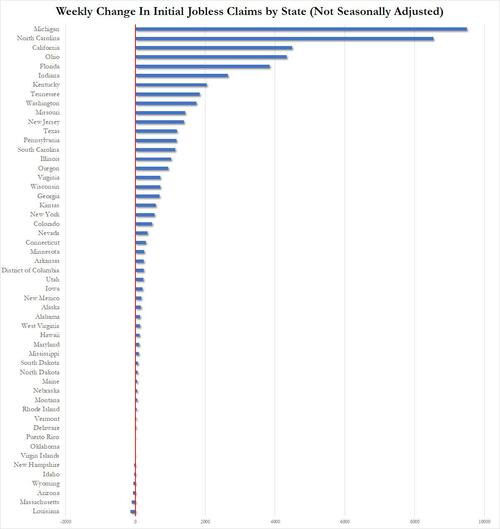

- 08:30: Oct. Initial Jobless Claims, est. 230,000, prior 225,000

- Sept. Continuing Claims, est. 1.83m, prior 1.83m

Central Bank Speakers

- 09:15: Fed’s Cook Speaks on Entrepreneurship

- 10:30: Fed’s Barkin Speaks in Fireside Chat

- 11:00: Fed’s Williams Gives Keynote Remarks

DB’s Jim Reid concludes the overnight wrap

Markets have put in another strong performance over the last 24 hours, as optimism about the near-term economic outlook continues to build. That helped the S&P 500 (+0.71%) to reach its 44th record high this year, whilst US IG spreads closed at their tightest levels since September 2021 as well. That strength means that the S&P 500 is now up +21.43% on a year-to-date basis, meaning that this is its strongest performance at this point of the year since 1997. And in turn, as optimism grew on the economy, investors continued to dial back the likelihood of rapid rate cuts from the Fed, lifting the 10yr Treasury yield (+6.1ps) to its highest level since July, at 4.07%. This backdrop also saw the dollar index (+0.37%) extend its winning run to eight sessions, its longest since April 2022.

Those risk-on moves happened despite the ongoing geopolitical tensions in the Middle East, where attention is still focused on how Israel might respond to Iran’s missile strikes last week. In terms of the latest, Israeli PM Netanyahu spoke with US President Biden yesterday, although the White House readout did not directly mention Israel’s potential retaliation against Iran. According to Bloomberg reporting, the Biden administration is pressing Israel to limit its retaliation to military targets, while Axios reported that Netanyahu will convene Israel’s security cabinet today. In the meantime, oil prices came down for a second day running, with Brent crude falling -0.78% to $76.58/bbl.

Aside from the geopolitical situation, attention today will be on the US CPI release for September, which is coming out at 13:30 London time. This is in particular focus after the strong jobs report last Friday, as there’s been growing speculation that the Fed might not cut at all at their next meeting in November. Indeed, yesterday saw futures lower the chance of a rate cut down to 83%, so the prospect of a hold at the next meeting is increasingly being considered, even if it’s not the base case for investors.

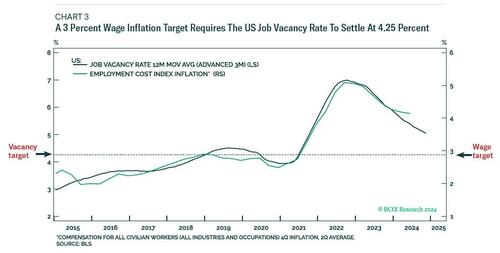

In terms of what to expect, our US economists are forecasting that headline CPI will likely come in at a monthly +0.10% in September. That should bring the year-on-year number down to +2.3%, which would be the lowest since February 2021. Then for core inflation, they see that at a stronger +0.27% for the month, keeping the year-on-year number at +3.2%. Remember as well that tomorrow’s PPI data will also be in focus, as that will give a better idea of some of the categories included in the PCE measure, which is what the Fed officially target. For more info, you can read our economists’ full preview and how to sign up for their subsequent webinar here.

Ahead of the CPI release, investors continued to dial back the likelihood of rapid rate cuts from the Fed, and Treasury yields rose across the curve. For instance, the rate priced in for the December 2025 meeting moved up +6.6bps to 3.425%, the highest since mid-August. So the 2yr Treasury yield was up +6.5bps on the day to 4.02%, and the 10yr yield (+6.1bps) moved up to 4.07%. In part that followed comments from Dallas Fed President Logan, who said that “a more gradual path back to a normal policy stance will likely be appropriate from here”, which also pointed away from a faster pace of cuts.

Later in the session, we then got the FOMC minutes from the September meeting, where the Fed delivered their recent 50bp rate cut. These said that “some participants observed that they would have preferred a 25bp” cut and “a few others indicated that they could have supported such a decision”. So while Fed Governor Bowman was the only dissenting vote in favour of a 25bp cut in the end, the accounts confirm that the 50bp decision saw some pushback within the FOMC.

For equities, it was another strong day, and the S&P 500 (+0.71%) powered forward to another record high. The advance was a broad-based one, and banks put in a particularly strong performance, with the KBW Bank Index (+1.26%) reaching its highest level since June 2022 yesterday. By contrast, the Magnificent 7 (-0.00%) was flat on the day, with Alphabet down -1.53% following the previous day’s news after the close that the US Justice Department was considering the breakup of Google. But in general, it was a strong day, and the VIX index of volatility also came down -0.56pts to 20.86pts by the close. That strength was echoed in Europe too, where the STOXX 600 was up +0.66%.

Elsewhere today, France’s budget for 2025 is being presented this evening. It follows new PM Barnier’s speech last week, in which he said that the target to reach the EU’s deficit limit of 3% of GDP would be delayed by two years to 2029. Ahead of that, the Franco-German 10yr spread remained steady at 77bps, with yields on 10yr bunds and OATs both rising by +1.5bps yesterday.

Overnight in Asia, the risk-on tone has continued, and there’s been a fresh rally in Chinese stocks after the PBOC released details of a 500bn yuan swap facility, which will provide liquidity to institutional investors to buy shares. That’s helped support a sizeable rally, with the CSI 300 (+2.85%) and the Shanghai Comp (+2.95%) both posting a strong advance, and the Hang Seng has seen an even larger gain of +4.22%. Elsewhere in Asia the gains have been more muted by comparison, with the KOSPI up +0.64%, and the Nikkei up +0.21%. In the meantime, US equity futures are basically flat, with those on the S&P 500 down just -0.01%.

Finally, it’s been another light day on the data side, although Japan’s PPI inflation has surpassed expectations overnight, coming in at +2.8% in September (vs. +2.3% expected). Otherwise yesterday, weekly data from the Mortgage Bankers Association data in the US showed the contract rate on a 30yr mortgage was up 22bps to 6.36% over the week ending October 4, which is its biggest weekly jump in over a year. Nevertheless, that still leaves rates well beneath their levels earlier in the year, having been at 7% as recently as early July.

To the day ahead now, and data releases include the US CPI reading for September, along with the weekly initial jobless claims. Meanwhile in Europe, we’ll get German retail sales and Italian industrial production for August. From central banks, we’ll get the account of the ECB’s September meeting, and speakers include the Fed’s Cook, Barkin and Williams.