Judge Denies Deadspin’s Bid To Dismiss Defamation Suit Involving 9-Year-Old Chiefs Fan

Authored by Bill Pan via The Epoch Times,

A Delaware judge has refused to dismiss a defamation lawsuit against online sports magazine Deadspin over an article accusing a 9-year-old boy of wearing “blackface” to a football game.

In an Oct. 7 ruling, Judge Sean Lugg of the Superior Court of Delaware rejected Deadspin’s argument that the article in question was opinion and thus protected from defamation liability.

“Deadspin published an image of a child displaying his passionate fandom as a backdrop for its critique of the NFL’s diversity efforts and, in its description of the child, crossed the fine line protecting its speech from defamation claims,” Lugg wrote.

The lawsuit was filed by Raul Armenta Jr. and his wife, Shannon, on behalf of themselves and their son, Holden, who is of Chumash Indian descent.

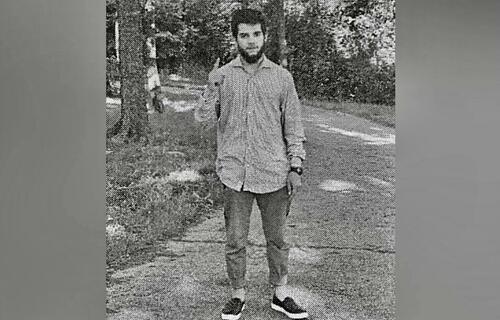

According to the complaint, Holden painted his face black and red – two of the colors used in the Kansas City Chiefs logo – and wore a Native American headdress during a Nov. 26, 2023, game between the Chiefs and the Las Vegas Raiders. He was shown briefly during the television broadcast of the game, with his red-and-black face paint visible.

The next day, Deadspin writer Carron Phillips published an article calling out the boy’s attire, with a featured image of the child that showed only the side of his face covered in black paint.

“It takes a lot to disrespect two groups of people at once,” he wrote in the column.

“But on Sunday afternoon in Las Vegas, a Kansas City Chiefs fan found a way to hate Black people and the Native Americans at the same time.”

The author then questioned the NFL’s commitment to its “social justice initiatives,” saying that the organization has not been doing enough to foster a more “sensitive” culture among fans.

Specifically, Phillips argued that the NFL should have been more “aggressive” in pressing the Kansas City football team to drop its “Chiefs” name, which he deemed as culturally insensitive as “Redskins,” a name bore by Washington Commanders for decades until its rebranding in 2020 amid nationwide unrest and debate over racism.

“This is what happens when you ban books, stand against Critical Race Theory, and try to erase centuries of hate,” he wrote.

“You give future generations the ammunition they need to evolve and recreate racism better than before.”

The article, according to the lawsuit, drew hateful messages and even death threats to the Armenta family. In December last year, the family demanded a formal apology and retraction from Deadspin, which the magazine declined, prompting the lawsuit.

In defense, Deadspin argued that Phillips’ statements were expressions of opinion and therefore not subject to defamation claims. However, Judge Lugg disagreed, stating that the article portrayed Holden as someone who intentionally used “blackface” to “hate Black people,” which amounted to a provably false assertion of fact.

“The court concludes that Deadspin’s statements accusing [Holden] of wearing black face and Native headdress ’to hate black people and the Native American at the same time,’ and that he was taught this hatred by his parents, are provable false assertions of fact and are therefore actionable,” Lugg wrote.

Of course, the full picture showed that Armenta had the other half of his face painted in red paint – the Chiefs colors. It also turns out that he is Native American.

Indeed, his grandfather is serving on the Santa Ynez Band of Chumash Indians.

Deadspin also sought dismissal based on jurisdiction, arguing that the case should be filed in California, where the Armentas reside, rather than Delaware, where Deadspin’s former parent company, G/O Media, is incorporated. The judge rejected this argument as well.

In March, just one month after the Armentas filed their lawsuit, G/O Media sold Deadspin to Lineup Publishing, a European company that decided to not retain any of the website’s staff members.

As of this publication, the article in question is still up on Deadspin’s website but has been updated to remove photos and identifying details about the boy. The headline has also been revised “to better reflect the substance of the story.”

“We regret any suggestion that we were attacking the fan or his family,” Deadspin’s editors wrote in a note.

The Armentas are represented by Clare Locke, a firm specialized in defamation cases.

“The Armenta family is looking forward to taking depositions and presenting this case to a jury at trial,” Elizabeth Locke, an attorney for the Armentas, said in a statement.

A spokesperson for G/O Media said the company had no comment.

Tyler Durden

Wed, 10/09/2024 – 13:00

via ZeroHedge News https://ift.tt/Kd8yPj1 Tyler Durden