Szabo Or NSA? New Report Revisits Bitcoin Creator Mystery

Authored by John O’Sullivan via CoinTelegraph.com,

The debate over the identity of Bitcoin creator Satoshi Nakamoto is back in the spotlight with the upcoming release of an HBO documentary.

As part of the renewed interest, 10x Research has published a report revisiting two leading theories: one pointing to cryptographer Nick Szabo and the other suggesting involvement by the United States National Security Agency (NSA).

Both theories are part of a larger debate that has attracted renewed interest with the upcoming HBO documentary investigating the origins of the world’s first cryptocurrency.

Source: 10x Research

Szabo: The man behind smart contracts

Szabo is a prominent figure in crypto history due to his development of “smart contracts” in the 1990s and his proposal of “Bit Gold,” a precursor to Bitcoin.

10x Research highlights Szabo’s influence, noting his decentralized concept of Bit Gold closely aligns with the core architecture of Bitcoin.

Bit Gold introduced cryptographic puzzles, timestamps and public verification methods. These elements were later seen in BTC, which the world is steadily likening to gold.

Despite Szabo denying any involvement with Bitcoin, 10x Research points out similarities in writing style and philosophy between Szabo’s blog posts and Nakamoto’s 2008 white paper on Bitcoin.

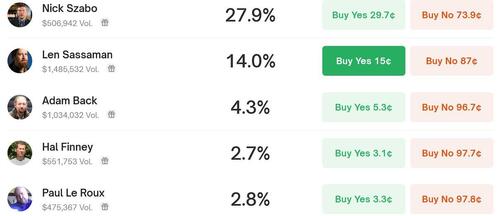

Szabo overtook cryptographer Len Sassaman as the frontrunner on Polymarket to be identified as Satoshi Nakamoto in HBO’s upcoming documentary that claims to reveal Bitcon’s creator.

Polymarket bettors have put 27.9% odds on Szabo, inventor of the failed crypto network Bit Gold, as the one HBO’s Money Electric: The Bitcoin Mystery will identify as Bitcoin’s pseudonymous creator, followed by Sassaman at 14% and Blockstream CEO Adam Back at 4.3%

Sassaman initially led with as high as 68% odds shortly after the betting platform opened the market on Oct. 4.

Those odds dropped when the documentary’s producer, Cullen Hoback, told CNN on Oct. 7 that he confronted the person he thinks is the real Satoshi Nakamoto, which would rule out Sassaman because he died in 2011.

NSA: Nakamoto’s Secret Alias?

The report also delves into the possibility that the NSA played a role in the creation of Bitcoin, citing the agency’s expertise in cryptography and related research.

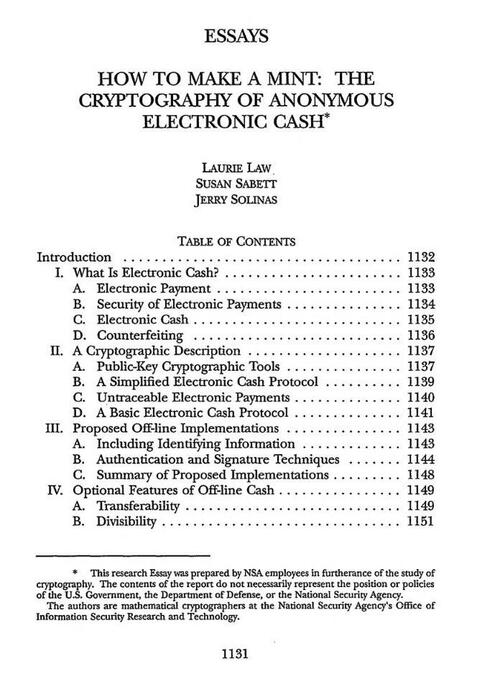

The NSA’s 1996 research paper “How to Make a Mint: The Cryptography of Anonymous Electronic Cash” outlined the basic framework for what eventually became BTC.

How to Make a Mint: The Cryptography of Anonymous Electronic Cash. Source: Archive.org

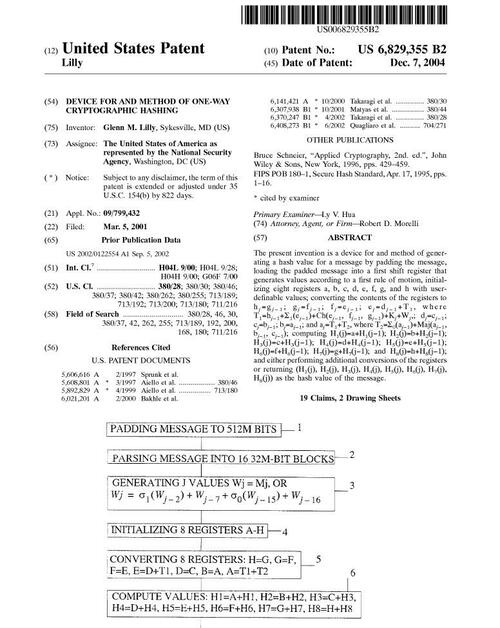

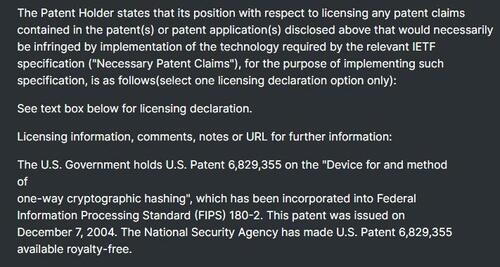

On March 5, 2001, cryptographer Glenn Lilly filed the “Device for and method of one-way cryptographic hashing” patent while working for the NSA.

The patent assignee is listed as “The United States of America as represented by the National Security Agency,” which means the patent is held by the US government — specifically, by the NSA.

Device for and Method of one-way cryptographic hashing. Source: United States Patent and Trademark Office

According to the 10x Research report, the patented technology was “the widely used secure hashing algorithm (SHA-256),” an algorithm used “in the hash function and mining algorithm for the Bitcoin protocol.”

It should be noted that the NSA has made the patent royalty-free, as confirmed by Datatracker.

Confirmation that the US Patent 6,829,355 is available royalty-free. Source: Datatracker

HBO big reveal or Szabo-tage?

Despite extensive research, no definite proof links the NSA or Szabo (or any other entity) directly to the creation of BTC, and the 10x Research report still leaves readers with questions.

Cointelegraph spoke with Markus Thielen, founder of 10x Research, who explained that “the real Satoshi might need to make a public statement, particularly if they decide to sell the Bitcoin they hold.”

“Many will likely assume HBO’s findings are true, even though the person behind Satoshi may avoid confirming this for as long as possible,” he added.

Thielen said the firm believes the HBO documentary will “likely fall short” of proving Nakamoto’s identity, leaving it up to the “true Satoshi” to step into the light and provide conclusive evidence.

One Satoshi pretender, Craig Wright, was recently found not to be the mastermind behind BTC and was instead found guilty of perjury by a United Kingdom High Court judge on July 16.

Tyler Durden

Tue, 10/08/2024 – 13:40

via ZeroHedge News https://ift.tt/OY7yFfa Tyler Durden