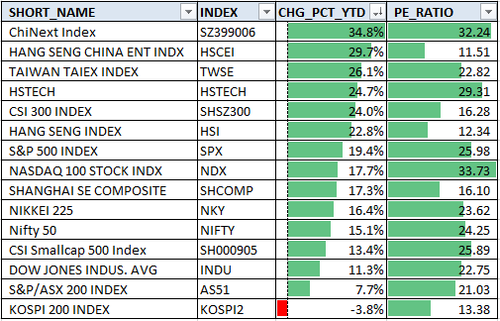

US equity futures are higher, even as Europe and Asia stumble after a horror show in Hong Kong as China’s record rally hit a brick wall. As of 8:00am ET, S&P futures are 0.4% higher, recovering about half of Monday’s drop which was the worst day since early September, while Nasdaq futures rise 0.5% led by the Mag 7 (NVDA +1.4%, MSFT +0.8% and GOOG +0.6%). Both indexes slid Monday after traders faded bets on rate rate cuts, pushing 10Y bond yields above 4.0% for the first time in 2 months. Taking a step back, US stocks remain unchanged since the Fed’s jumbo rate cut.

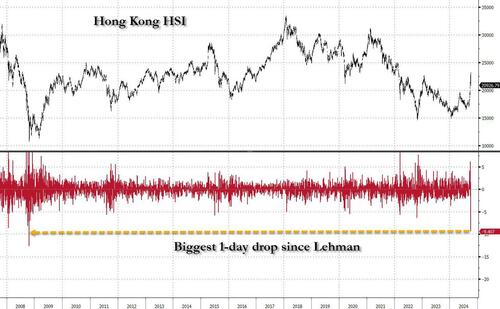

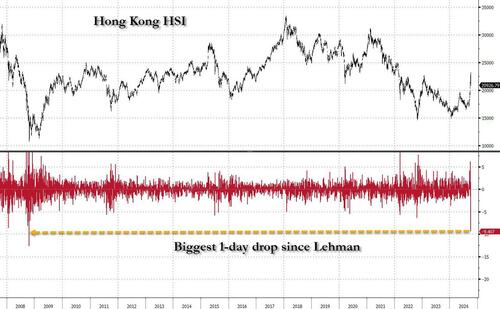

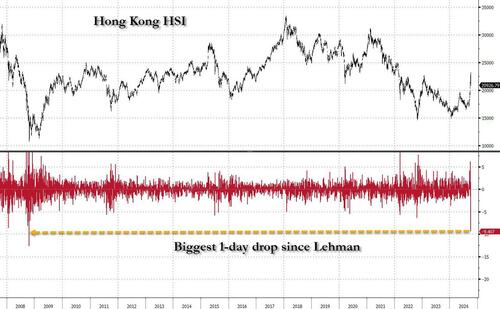

Chinese markets returned from a weeklong holiday and the country’s central planner said it was confident that it will hit its economic targets this year, but stopped short of unleashing more stimulus measures. That disappointed investors and though Chinese stocks kicked off the day with a bang – as they had one week of gains to catch up on – the rally fizzled with Hong Kong stocks crashing the most since Lehman.

Overnight moves today are a reversal of yesterday’s: yields falling with 2y and 10y declining 3bp and 1bp, respectively. The Bloomberg dollar index is flat for the second day in a row as the yen gains. Oil is -2.2% lower after disappointment from China’s NDRC press conference (no details on the structure rebalancing details nor stimulus announcement) and a NYT report saying Israel’s first retaliation will likely not target nuclear facilities (here). Today will be day 2 for the NVDA AI Summit and AMZN will kick off its 2-day Prime Day Sale. Macro calendar today contains NFIB Small Business Optimism at 6am ET (91.5, missing est of 92.0); PEP will report earnings pre-market.

In premarket trading, Super Micro Computer rose after shipment data suggested robust demand for its servers, while Honeywell gained as the Wall Street Journal reported the industrial company plans to spin off its advanced materials division. Here are some of the other notable premarket movers:

- US-listed Chinese stocks tumbled as Beijing stopped short of launching more major stimulus. Alibaba (BABA) -6%, Bilibili (BILI) -13%, NetEase (NTES) -7% US firms with high revenue exposure to greater China, or a high releince on Chinese consumers, also fall: Albemarle (ALB) -3%, Estee Lauder (EL) -2%, Las Vegas Sands (LVS) -3%

- DocuSign (DOCU) rises over 5% after S&P Dow Jones Indices said that the e-signature company will join the S&P Midcap 400 Index before trading opens Oct. 11.

- Honeywell (HON) gains 2% as the Wall Street Journal reported that the company is expected to unveil plans to spin off its advanced materials division.

- PepsiCo (PEP) slips 1% as the company trimmed its revenue outlook for the year as cash-strapped consumers, boycotts in the Middle East and a major recall hit volumes of its food and beverages.

- Sage Therapeutics (SAGE) drops 12% after posting disappointing results from a Phase 2 study for a drug candidate aimed at treating mild dementia in Alzheimer’s disease.

“Global risk appetite remains constructive overall,” said an optimistic Benoit Anne, investment director at MFS Investment Management. “The fundamental story remains strong, the US labor market is still in good shape. The direction of travel for interest rates is still going to be lower.”

Focus will now turn to the US consumer inflation data, which is forecast to slow to 2.3% year-on-year from the previous 2.5% reading. Traders are pricing a rate cut of less than a quarter-point at the Fed’s November meeting, though they still see about 48 basis points of policy easing by year-end. The inflation data is seen as especially key, given the possibility that the ongoing US hurricane season and workers’ strikes will impact this month’s jobs print.

“CPI data probably has more importance now than in prior months, as labor data is going to be more muddied going forward,” said Robert Dishner, senior portfolio manager at Neuberger Berman.

On the corporate front, big US banks kick off the earnings season in earnest from Friday, with companies’ guidance for the coming quarters seen as key. “Now most of investors will be looking to build a 2025 outlook and getting a steer from the corporate sector on how it is thinking about the earnings picture going into next year,” said Shaniel Ramjee, senior investment manager at Pictet Asset Management.

As noted above, US-listed Chinese shares dropped sharply after China’s latest pledge to support its economy disappointed investors who had hoped for a fresh wave of stimulus. That also weighed on Europe’s Stoxx 600 index, which fell 0.7% after China’s pledge to support its economy disappointed; Estoxx 50 was down 0.4%, and the FTSE 100 slide 1%. China-exposed names such as luxury firm Kering SA and Burberry Plc bearing the brunt; basic resources and consumer products also underperformed. Here are the top European movers:

- Imperial Brands rises as much as 4.8%, the most since May. The tobacco giant said trading has been in-line with expectations as it upped its dividend and switched to quarterly payouts, while lifting its buyback plan for FY25

- Greencore shares gain as much as 6.6%, to highest since April 2020, after the food manufacturer again lifted its annual guidance

- Vistry Group shares plummet as much as 36% to send the stock to a 2024-low, after the firm slashed its profit outlook. The housebuilder warned cost projections at some of its developments have been understated

- Senior shares fall as much as 18%, after the UK engineering company said it expects the performance of its Aerospace division to be lower in the second half than the first amid strikes at Boeing and supply chain challenges at Airbus

- VAT shares drop as much as 4.1% after the Swiss chipmaker warned that 3Q sales will come in below the low end of its guidance due to technical issues related to the implementation of new software

- Remy Cointreau shares slump, leading losses across European distillers, after China said it will start to collect anti-dumping duty deposits on EU brandy from Oct. 11

Earlier, Asian stocks slumped as gains in Chinese shares quickly evaporated after a strong open, and Hong Kong equities plunged. The MSCI Asia Pacific Index dropped as much as 2.7%, the most since an Aug. 5 rout, led by Chinese tech names including Tencent Holdings Ltd. and Meituan. A gauge of China’s stocks listed in Hong Kong tumbled as much as 11%, its biggest drop since the Lehman bankruptcy. Meanwhile, the onshore benchmark CSI 300 Index jumped 11% in early trading before paring its advance to 6%. Regional equities are coming under pressure as traders reassess the outlook for China’s growth recovery after a press briefing by the nation’s top economic planner yielded little by way of fresh stimulus. Hong Kong shares dived as mainland markets reopened after a holiday and investors rotated into onshore stocks.

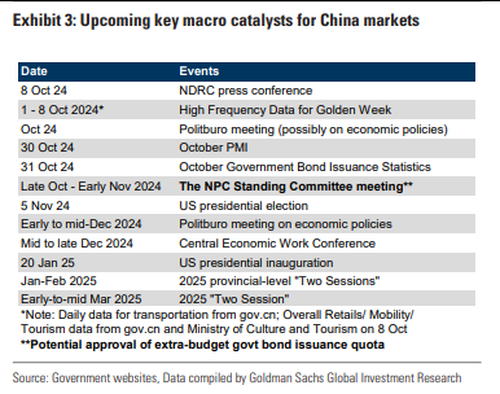

“The rhetoric was positive but the market was looking for some more concrete policies coming out,” said Stephanie Leung, Chief Investment Officer at StashAway Group. “NPC meeting at the end of October may be a more appropriate venue for announcing substantial plans.”

In FX, the Bloomberg Dollar Spot Index is little changed. The Aussie dollar is the weakest of the G-10’s, falling 0.5% against the greenback as optimism around China fades. The yen is the best performer with a 0.2% gain.

In rates, treasuries are mixed with the curve steeper as front-end outperforms, unwinding a portion of Monday’s losses. 2-year yields, still richer by more than 2bp on the day, are off session lows, while 20- and 30-year are slightly cheaper vs Monday’s closing levels. 10-year yields are little changed around 4.02%, outperforms bunds in the sector and trails gilts. US session includes three scheduled Fed speakers and the monthly 3-year note auction. The week’s Treasury auction cycle begins with $58b 3-year note sale at 1pm New York time. WI 3-year yield around 3.875% is ~43.5bp cheaper than September’s, which stopped 1.7bp through the WI level. Auction series also includes $39b 10-year and $22b 30-year reopenings Wednesday and Thursday

Commodity markets also felt the lack of fresh China stimulus, with Brent crude futures dropping about 2% to near $79 a barrel while iron ore slumped from a five-month high. Spot gold reversed earlier losses and was trading near session highs, at $2650.

Looking at today’s calendar, US economic data calendar includes August trade balance at 8:30am. Fed speakers scheduled include Bostic (12:45pm), Collins (4pm) and Jefferson (7:30pm)

Market Snapshot

- S&P 500 futures little changed at 5,749.00

- STOXX Europe 600 down 0.9% to 514.76

- MXAP down 2.1% to 192.40

- MXAPJ down 2.5% to 611.41

- Nikkei down 1.0% to 38,937.54

- Topix down 1.5% to 2,699.15

- Hang Seng Index down 9.4% to 20,926.79

- Shanghai Composite up 4.6% to 3,489.78

- Sensex up 0.8% to 81,691.66

- Australia S&P/ASX 200 down 0.3% to 8,176.95

- Kospi down 0.6% to 2,594.36

- German 10Y yield little changed at 2.25%

- Euro little changed at $1.0985

- Brent Futures down 1.9% to $79.40/bbl

- Gold spot down 0.2% to $2,637.38

- US Dollar Index down 0.14% to 102.39

Top overnight news

- China said it’s confident in reaching its economic targets this year and promised to further support growth, although it held back in unleashing more major stimulus in a disappointment to investors looking for more fuel for a world-beating stock rally.

- When Prime Minister Keir Starmer and Chancellor of the Exchequer Rachel Reeves plotted Labour’s path to power in the UK, they banked on eye-catching moves to hike taxes on private equity and ultra-rich “non-dom” residents to fund key spending plans. Now, those promises are meeting reality.

- Hurricane Milton is set to approach the Florida peninsula as a catastrophic Category 4 storm, bearing down on a region still struggling to recover from Helene’s devastation.

- Israel’s defense minister is traveling to Washington soon as the country continues to weigh how to respond to an Iranian missile attack and the US urges restraint.

- Brent oil dropped below $80 a barrel as China’s top economic planner ended a highly anticipated briefing on Tuesday without new stimulus measures, sparking a risk-off mood across markets.

- Fed’s Williams (voter) said the US economy is well positioned for a soft landing and the current monetary policy stance is well positioned to both keep maintaining strength in the economy and labour market. Willaims said the rate decision was right in September and right today, while he added that the half-point rate cut in September was not the rule of how we will act in the future, according to FT.

- Fed’s Musalem (2025 voter) said more rate cuts are likely given the economic outlook and his personal rate outlook is above the Fed’s median view, while he won’t predict the timing or size of future Fed easing. Musalem commented that the costs of easing too much outweigh easing too little and he supported the Fed’s decision last month to cut rates by 50bps. Furthermore, he said the September jobs report was very strong and the labour market is strong and healthy, as well as noted there is no emergency in the job market right now and the jobs report didn’t cause a change in the outlook

- Fed’s Kugler (voter) will support additional rate cuts if progress on inflation continues as expected; said policy will be data dependent. If downside risks to employment escalates, cutting rates more quickly may be appropriate. If incoming data does not provide confidence that inflation is moving to target, slowing normalisation may be appropriate. Kugler wants ‘balanced’ approach to inflation to avoid undesirable slowdown in labour market and economic growth. Adds that Hurricane Helene, and Middle East events could impact the US economic outlook. Last Friday’s job report was very welcome, showed healthy level of jobs. Labour market cooling has started; Fed is looking at trends, not single data. Have seen a decline in inflation.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed after the negative lead from Wall St amid firmer yields and higher oil prices, while geopolitical concerns lingered as participants braced for Israel’s response to Iran and China’s NDRC press conference was met with disappointment. ASX 200 slightly weakened amid losses in the commodity-related sectors but with downside limited by the improvement in consumer and business surveys. Nikkei 225 retreated amid a firmer currency while the data was varied as Household Spending topped forecast and Labour Cash earnings slowed. Hang Seng and Shanghai Comp diverged in which the Hong Kong benchmark suffered heavy losses as it took a back seat to the return of mainland bourses, while price action was volatile for the mainland index with a double-digit percentage gain seen at the open on return from the National Day Golden Week holiday. However, the index nearly gave back all of its gains after the NDRC press conference was met with disappointment with very little new announced regarding stimulus, although mainland stocks then caught a second wind again but are well off their opening highs.

Top Asian News

- China’s NDRC Chairman said China’s economy is largely stable but is facing a more complex internal and external environment, while he added that new policies will improve the health of economic actors and he is fully confident of achieving full-year economic and social development targets. The state planner head said they will promote a sustained, stable and healthy economic development in 2024 and 2025, as well as expand domestic demand and prioritise consumption, promote an economic rebound and quicken fiscal spending to support the economy. Furthermore, they will speed up the implementation of additional measures, release an updated foreign investment negative list, speed up local government special bond issuance and plan to issue CNY 200bln in advance budget spending and investment projects from next year.

- China’s regulator urged financial institutions to strengthen internal control over leverage and said Chinese bank loans are banned from entering China’s stock market, according to Financial News.

- RBA Minutes stated the Board discussed scenarios for lowering and raising interest rates in the future and members felt not enough had changed from the previous meetings that the current Cash Rate best balanced risks to inflation and the labour market, while it stated that future financial conditions might need to be tighter or looser than at present to achieve the board’s objectives and that scenarios lowering, holding and raising rates are all conceivable given the considerable uncertainty about the economic outlook. RBA noted that policy could be held restrictive if consumption growth picks up materially or could be tightened if present financial conditions are insufficiently restrictive to return inflation to target, while policy could be eased if the economy proves significantly weaker than expected and it is not necessary for the cash rate to evolve in line with policy rates in other economies. Furthermore, it stated that underlying inflation is still too high and policy will need to remain restrictive until board members are confident inflation is moving sustainably towards the target range, as well as noted that it is not possible to rule in or out future changes in the cash rate target at this time.

- China’s Commerce Ministry say China is studying measures such as raising tariffs on imported Large displacement fuel vehicles; also to make a fair and objective ruling based on the investigation results of EU pork and dairy. China will take all necessary measures to firmly safeguard the legitimate rights and interests of Chinese industries and enterprises, a spokesperson for the commerce ministry said.

- Hyundai Motor India IPO to open October 14th for institutional investors, October 15-17 for others – Company to be valued up to USD 19bln.

European bourses, Stoxx 600 (-0.8%) are subdued across the board to varying degrees as markets digest the losses from Wall Street yesterday alongside the disappointment from China’s NDRC overnight, who expressed confidence in economic stability but announced no new major stimulus measures. European sectors are mostly negative with a clear defensive bias amid the risk aversion. Basic Resources is the clear laggard following the hefty losses across base metals after China’s disappointing NDRC press conference, whilst Consumer Products and Services are dragged by the luxury sector. US Equity Futures (ES +0.3%, NQ +0.4%, RTY -0.1%) are mixed, but with the ES and NQ on a firmer footing, despite the losses seen across Europe. RBC Capital Markets Upgrades US healthcare sector to Overweight; downgrades utilities to market weight. Honeywell (HON) plans to spin off its advanced materials business, which could be worth more than USD 10bln as a separately traded public company; an announcement could be made today, via WSJ.

Top European News

- UK launched the Regulatory Innovation Office in an effort to speed up approvals for new technology, according to FT.

- UK homes are reported to be offered payments to reduce electricity use all year round, according to FT. In relevant news, Britain’s energy grid operators are confident of sufficient electricity and gas supply this winter, according to Reuters.

- Barclaycard said UK September consumer spending rose 1.2% Y/Y vs. prev. 1.0% growth in August and it cited a boost from discretionary spending but noted that essential spending fell 1.7% which was the steepest drop since April 2020.

- ECB’s Elderson said many indicators show that the risks of lower economic growth are materializing; ECB is open-minded ahead of the October 17th meeting, ECB decisions are made on a meeting by meeting basis, via local press Delo.

- ECB’s Kazaks said “The data points to October rate cut”.

- ECB’s Vasle said inflation risks abating but still some uncertainty, a rate cut in October is an option but this cut does not mean another in December; rates likely to be neutral by 2025 end.

- ECB’s Nagel says he is open to an October rate cut, via a podcast.

- Kantar UK Grocery Market Share: Grocery price inflation increased slightly to 2.0% during the four weeks to 29 September, up from 1.7% last month.

FX

- USD is net softer vs. peers after a recent run of gains that lifted DXY from a 100.17 low last week to a 102.68 post-NFP. Fed’s Williams speaking to the FT, noted that the US economy is well positioned for a soft landing; remarks which had little impact on the index. Next up, US NFIB and speak from Fed’s Bostic and Collins are due.

- EUR is marginally firmer vs. the broadly weaker USD but with EUR/USD unable to reclaim 1.10 status. If 1.10 does give way, last Friday’s high kicks in at 1.1039. If downside resumes, Monday’s low is at 1.0954.

- GBP is a touch firmer vs. the USD after what has been a tough run for the pound on account of last week’s dovish interjection by BoE Governor Bailey. For now, Cable is tucked within Monday’s 1.3060-1.3134 range, and awaiting commentary from BoE’s Breeden.

- JPY is the best performer across the majors. However, this appears to be more a case of scaling back recent losses rather than outright bullishness on the JPY.

- AUD is the laggard across the majors after the Chinese NDRC announcement disappointed lofty expectations heading into the event. NZD/USD is lower but to a lesser extent than its antipodean counterpart; ahead of the RBNZ announcement on Wednesday.

Fixed Income

- Dec’24 USTs are essentially flat, and taking a breather after four consecutive sessions of losses which were triggered by remarks from Powell guiding markets towards a 25bps rate cut and of course last Friday’s hot US NFP report. The US 10 yr yield is currently around the 4% mark but down from Monday’s peak at 4.03%.

- Bunds began the session on a firmer footing but has now edged lower and is unchanged on the session thus far; downticks from solid German Industrial output data proved to be fleeting given that the report is not enough to reassure markets about the Eurozone’s growth prospects. The German 10yr yield is currently tucked within Monday’s 2.212-2.26% range.

- Gilts are following suit to peers, initially holding a positive bias but now flat. However, Gilts may forge their own path later in the session with BoE’s Breeden due to speak at 11:30BST. The UK 10yr yield is currently towards the top end of Monday’s 4.153-4.212% range.

- UK sells GBP 1bln 0.125% 2039 I/L Gilt: b/c 3.14x (prev. 3.0x) & real yield 1.044% (prev. 1.053%).

- Germany sells EUR 0.95bln vs exp. EUR 1bln 2.30% 2033 Green Bund: b/c 2.4x (prev. 3.4x), average yield 2.16% (prev. 2.51%) & retention 5% (prev. 15.4%).

Commodities

- Softer price action across the crude complex as risk aversion in markets keeps prices subdued for now, but with geopolitics still very much in focus.

- Softer trade across the precious metals complex with hefty underperformance in spot palladium (-2.7%) whilst spot silver (-1.9%) also sees notable losses. XAU sits in a USD 2,631.23-2,649.26/oz range.

- Substantial losses across base metals after China’s NDRC expressed confidence in economic stability but announced no new major stimulus measures. 3M LME copper slipped from a USD 9,991/t intraday peak to a low of USD 9,705.50/t.

- India’s Oil Minister said India will be consuming 6mln bpd of crude oil in the foreseeable future from 5.4mln bpd now

Geopolitics: Middle East

- Iran’s Foreign Minister is to visit Saudi Arabia and other countries in the region, starting on Tuesday

- “Israel army said a fourth Division joins operations in Southern Lebanon”, according to Walla News’ Elster

- There was an initial unconfirmed report on X regarding explosions heard in Isfayah and Tehran in Iran. However, Iraqi Sabreen News, which is close to Iran, shortly denied that there was an attack on Iran and Iranian media also denied any violation of Iran’s airspace by hostile aircraft.

- Israel’s cabinet is in permanent session to discuss the response to Iran and choose the location, according to Al Jazeera citing an Israeli delegate to the UN.

- New York Times cited officials that stated Israel is likely to target Iranian military bases and possible intelligence sites in its response, while Israel seems to have postponed after a long discussion the targeting of Iranian nuclear sites to a later date, according to Al Jazeera.

- Israel’s army said their fighter jets bombed Hezbollah intelligence headquarters in Beirut, while it was later reported that Israel’s military said it eliminated Hezbollah HQ commander Suhail Hussein Husseini in Beirut.

- Israeli Home Front announced sirens sounded in western Galilee, while the IDF later stated that about 175 rockets were fired from Lebanon into Israel in the past 24 hours.

- Hezbollah announced that it shelled with rockets a gathering of enemy forces in the settlement of Shlomi and it targeted a military intelligence unit in the suburbs of Tel Aviv in a missile launch operation.

- Israel’s army issues an urgent warning to beachgoers and boat users from Lebanon’s Awali river southward and said it is easing some protective guidelines for residents in some areas of Galilee in northern Israel and Golan Heights.

- Israel’s military issued new evacuation warnings on specific buildings in Beirut’s southern suburbs on Monday evening.

Geopolitics: Ukraine

- Ukraine announced that a Russian missile hit a grain ship in the Odesa region which killed one person onboard the grain ship.

- Russian and Chinese ships conducted a joint practice of anti-submarine missions in Asia-Pacific, according to RIA.

- North Korean leader Kim said they are to speed up steps towards military superpower and strong nuclear power, while Kim also said they are to further strengthen Russia-North Korea cooperation in a birthday message to Russian President Putin, according to News1 and KCNA.

US Event Calendar

- 06:00: Sept. SMALL BUSINESS OPTIMISM 91.5, est. 92.0, prior 91.2

- 08:30: Aug. Trade Balance, est. -$70.5b, prior -$78.8b

Central Bank Speakers

- 03:00: Fed’s Kugler Speaks at ECB Event (Schnabel Chairs Session)

- 12:45: Fed’s Bostic Speaks on the Economic Outlook

- 16:00: Fed’s Collins Speaks at Community Banking Conference

- 19:30: Fed’s Jefferson Speaks on Discount Window

DB’s Jim Reid concludes the overnight wrap

Its been a challenging start to the week so far for risk assets as mounting geopolitical risks have collided with disappointment overnight that we haven’t heard any new information about the nature of China’s stimulus package as the nation returned from its week long holiday this morning.

Kicking off with Asia, comments from the head of China’s National Development and Reform Commission (NDRC) Zheng Shanjie did not provide any more details around the shape and size of the fiscal support that has been announced. This led to a loss of momentum in China’s equity rally, with the CSI seeing its initial gains being pare back from +11% to 2% before recovering to trade +6.31% higher. The Shanghai Composite also pared big post holiday early gains, now trading +4.54% higher. In contrast, the Hang Seng briefly dropped over -10% at the open before recovering to a smaller loss of -6.06% as I type. The Nikkei is down -1.20%, and the KOSPI -0.51%, following worse-than-expected third-quarter guidance from Samsung Electronics. US futures are flat after a tough session yesterday as we’ll see below.

Prior to this morning’s volatility, yesterday’s news were dominated by the risks in the Middle East, as Hamas launched a fresh rocket attack against Israel on the one year anniversary of the October 7th attacks, and speculation continued about how Israel might retaliate against last week’s missile strikes from Iran. This drove a fresh increase in oil prices yesterday, with Brent crude up (+3.69%) for a fifth consecutive session to $80.93/bbl by the close. In fact, the oil price gain over those 5 sessions (+12.76%) is the biggest since March 2022, shortly after Russia’s full-scale invasion of Ukraine, which just shows how investors are now reassessing the geopolitical outlook. Overnight oil has come off around -1.5%.

At the same time, there were clearly other signs of jitters, with the VIX index of volatility (+3.43pts) rising to 22.64pts, its highest level since early August. And with oil prices on the up and the US macro data strengthening, there were further signs that investors are pricing in more inflation risk. In fact, the US 2yr inflation swap (+5.0bps) was up to 2.39% yesterday, marking its highest level in nearly 3 months, and after having briefly fallen to below 2% this time last month.

That growing awareness of inflation risk helped drive a fresh bond selloff yesterday, as investors dialled back the likelihood of rapid rate cuts from central banks. Interestingly, there’s even started to be some initial doubt as to whether the Fed will cut at all at the next meeting in November, with futures now pricing in another rate cut as just an 88% probability. So it’ll be fascinating to see what the CPI print contains on Thursday and how that might influence the narrative. Looking further out to subsequent meetings, there was also a similar trend, and the rate priced in for the December 2025 meeting moved up another +8.2bps to 3.37%, the highest since August 15. That had been as low as 2.78% just three weeks earlier, so more than two rate cuts have been priced out over that period.

For bonds, this drove some pretty significant moves, and at one point intraday the US 2s10s curve became inverted again, before ending the session just outside inversion territory. That came as the US 2yr yield was up another +7.2bps to 4.00% (3.95% in Asia), building on last week when yields posted their largest weekly increase since June 2022. In the meantime, the 10yr yield (+5.9bps) was also up to 4.03%, closing back above the 4% mark for the first time since July. This morning they are back down a couple of basis point but holding just above 4% as I type. In Europe it was much the same story, with a similar move that saw investors dial back the chance of rapid ECB rate cuts, whilst yields on 10yr bunds (+4.5bps), OATs (+3.8bps) and BTPs (+6.4bps) all moved higher.

While the oil and bond moves were largely a continuation of those seen last week, yesterday also saw risk assets starting to come under more pressure. The S&P 500 (-0.96%) posted its largest decline in over a month, with every high-level sector group except for energy lower on the day. The Mag-7 (-1.86%) led the decline, in part following a US court ruling that Alphabet (-2.44%) must allow developers to set up rival android app stores. Nvidia (+2.24%) was the only of the Mag-7 to advance, again overtaking Microsoft (-1.57%) as the world’s second most valuable company. Credit spreads also came under a bit pressure, with US HY spreads widening by 6bps, though IG spreads were unchanged at their tightest since September 2021. Over in Europe, markets closed before the more negative mood took over, with the STOXX 600 (+0.18%) up for a second consecutive session and EUR IG credit spreads (-2bps) falling to their lowest since July.

Whether these signs of broader contagion from geopolitical risks for risk assets take further hold will clearly be crucial for investors. In a note yesterday (link here), Henry looked at the factors that have helped markets remain resilient despite the recent circumstances. For instance, unlike Russia’s invasion of Ukraine in 2022, which pushed oil prices up to multi-year highs, the recent rise in oil has still left prices beneath their 2024 average. So we haven’t yet seen a big inflationary wave as a result of events in the Middle East yet. The note also discusses some of the biggest historical selloffs driven by geopolitics, which have generally been stagflationary-type scenarios.

Coming back to Asia, early morning data showed that Japan’s real wages declined by -0.6% y/y in August (v/s -0.5% expected), marking the first drop in three months. It followed a downwardly revised +0.3% gain in July. Nominal wages rose for the 32nd consecutive month, increasing by +3.0% y/y, after rising +3.4% in the prior month. In other data, household spending fell -1.9% y/y in August (v/s +0.1% in July), but the decline was less severe than the market’s expected drop of -2.6%.

There was little data to speak of yesterday, although German factory orders fell by -5.8% in August (vs. -2.0% expected). In addition, Euro Area retail sales grew by +0.2% in August, in line with expectations.

To the day ahead, and US data releases include the NFIB’s small business optimism index for September, along with the trade balance for August. Elsewhere, there’s German industrial production for August. From central banks, we’ll hear from Fed Vice Chair Jefferson, and the Fed’s Kugler, Bostic and Collins, along with the ECB’s Centeno and Nagel.