Prediction Markets Like Polymarket A “Public Good”, More Accurate Than Polls

Authored by Daniel Ramirez-Escudero via CoinTelegraph.com,

While some say that prediction markets are a risk to democracy, others think they could serve the public by offering valuable insights and risk management tools.

Despite recent confrontations with regulators, election markets can provide more accurate insights into public sentiment than polls, according to industry observers.

In May 2024, the United States Commodity Futures Trading Commission (CFTC) proposed a rule to ban derivatives used to bet on the outcome of US elections and other major real-world events.

The CFTC’s proposal drove US-based regulated prediction market platform Kalshi to take the commission to court. Columbia District Judge Jia Cobb rejected the CFTCs proposal, stating that “Kalshi’s contracts do not involve unlawful activity or gaming. They involve elections, which are neither.”

The CFTC attempted to appeal the decision, with an appellate court even imposing a temporary block on the market, but the court denied the CFTC proposal on Oct 2, and the platform has resumed trading.

Regulators’ initial concern was over the potential for manipulation, but some industry observers state that prediction markets may make better metrics of public opinion than traditional polls.

Harry Crane, a statistics professor at Rutgers University, commented on the CFTC portal’s proposal by claiming that “event contract markets are a valuable public good for which there is no evidence of significant manipulation or widespread use for any nefarious purposes that the Commission alleges.”

Crane told Cointelegraph that the US government trying to severely limit the availability of election and other betting markets to US citizens is “acting against the interests of its own people in favor of limited freedoms and censorship.”

The statistics professor believes US regulators operate with “overly restrictive regulations” that lead to “perverse incentives and market distortions” that interfere with the market’s natural price discovery mechanism.

He explained that the information contained in the market prices cannot be as easily controlled as polls and media narratives close to elections and other political events. He believes “there is a desire to control the public’s access to this information.”

Crane claimed that prediction markets for elections, such as Kalshi or the decentralized crypto-betting platform Polymarket, should be legal and widespread as they can offer several valuable aspects for the public.

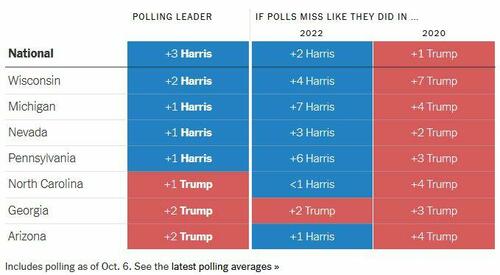

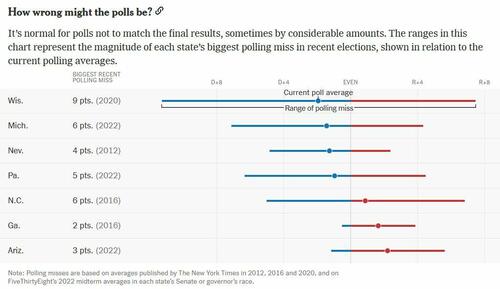

Prediction markets can be more accurate than public polls

In 2018 and 2020, Crane published two peer-reviewed studies in which he compared the forecasting accuracy of the prediction market platform PredictIt against the poll data aggregator FiveThirtyEight from statistician Nate Silver.

In both cases, the research concluded that the betting prediction market was more accurate than Silver’s forecast across presidential, senate, house and governor races.

“Sentiment is what polls measure, accuracy and truth are what markets seek to measure.”

Crane highlighted the key difference between polls and prediction markets: Polls ask people who they want to win, and markets ask people who they think will win through an economic incentive model, which rewards them for accurate analysis.

He stressed that traders don’t care about which candidate other people want to win; they care about who will win, making markets more accurate.

If a model continually fluctuates from 40% to 60% back to 40%, etc. while the underlying market hasn’t really moved, it’s a pretty clear sign the model is just noise.

See below. https://t.co/wDsyXeqHMr

— Harry Crane (@HarryDCrane) September 29, 2024

Grant Ferguson, director of public outreach for the Department of Political Science at Texas Christian University, told Cointelegraph that prediction markets could be superior to polls as real money leads individuals to set aside their personal preferences and “think logically about what is true, not what they want to be true.”

Crane said that election markets have two primary advantages: hedging and information aggregation.

He explained that these markets allow individuals and businesses to hedge risks to one-off, isolated outcomes, such as the result of an important election.

When companies or individuals have less uncertainty or risk to worry about, they can operate more efficiently and confidently as they can prepare beforehand, which benefits the broader economy. Essentially, allowing hedging reduces the negative impacts of unforeseen events across the entire economy, Crane said.

Crane concluded that prediction markets’ higher accuracy is due to sounder research involved in betting markets. Prediction markets “aggregate diverse pieces of information to arrive at the single most reliable forecast of elections,” motivated by the economic incentive involved with a bet.

“The economic incentives promote participation from informed traders. Informed traders, in effect, share their information with the market in return for profits gained from being correct.”

The most accurate analysis of the available data will award the participants from the wagers. However, Crane conveyed that the information these traders share benefits everyone, including most of the general public who do not participate in these markets, by “providing them with a reliable and objective forecast of important events in the public interest.”

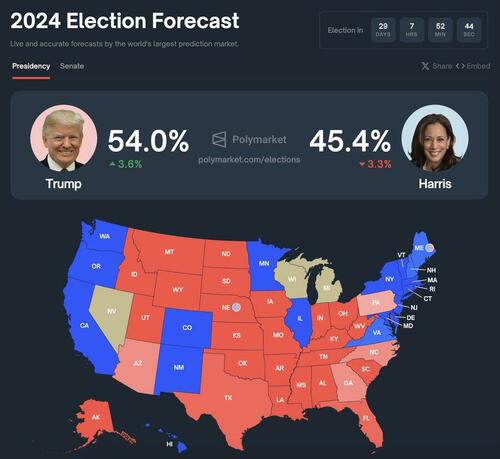

Polymarket growth positioned it as a trusted metric for US elections

As the US election looms with its uncertainties and geopolitical implications, prediction markets surrounding the 2024 presidential race are particularly hot.

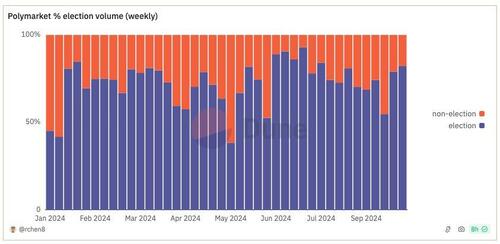

Polymarket offers a number of different betting pools, ranging from science to crypto to pop culture. But the market that has provided the most volume and mainstream media attention is the bet on the outcome of the US elections. Polymarket’s pool on the US election has surpassed $1 billion in volume, constituting 80% of Polymarket’s total volume.

Polymarket % election volume weekly. Source: Richard Chen/Dune Analytics

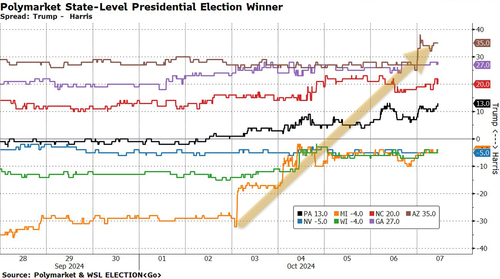

Crane thinks that “any betting platform with significant volume and without significant restrictions to participation should be a reliable metric” for forecasting elections and other major events. Polymarket’s rapid growth in 2024 has earned it a place on the Bloomberg Terminal as a metric for tracking the US election outcome.

We are in the process of adding @Polymarket data to WSL ELECTION

! pic.twitter.com/aNM087bcwS — Michael McDonough (@M_McDonough) August 29, 2024

Despite Kalshi’s victory against the CFTC, Polymarket has decided to remain offshore. It stopped operating in the US after it reached a $1.2 million settlement with the CFTC in 2022 for failing to register with the agency. Since then, Polymarket doesn’t officially operate in the US. Us users are blocked from the site with geo-fencing.

Crane believes that Polymarket data on the US election outcome remains relevant even though there, in principle, aren’t any US citizens involved in the betting pool. He said that the relevant information for forecasting the US election is available internationally.

On top of that, wager participants could effortlessly gain access to expertise by hiring US-based consultants or partners. He said that there is no validity in claiming that US citizens are the best-qualified to predict the outcome of the elections.

Despite Polymarket being based offshore and blocking US citizens from its platform, CFTC Chair Rostin Behnam has warned that if their “footprint” in the US becomes big enough, they should register their derivative contracts or risk facing enforcement actions.

The dark side of the election markets

Cantrell Dumas, director of derivatives policy for nonprofit and non-partisan financial organization Better Markets, told Cointelegraph that prediction markets may be understood as a public good, but “only under certain conditions.”

He noted the Iowa Electronic Markets (IEM), a group of real-money prediction markets/futures markets operated by the University of Iowa Tippie College of Business, as an example.

Unlike normal futures markets, the IEM is not-for-profit; the markets are run for educational and research purposes, therefore its volume is very low. Dumas mentioned that IEM demonstrates that an adequate regulated market limited to small-scale academic or research purposes can offer valuable information that enhances public understanding of election dynamics.

Dumas believes that larger betting markets, such as Kalshi or Polymarket, could raise concerns about the commercialization of elections, undermining public trust.

He explained that for prediction markets to be beneficial, “they must adhere to strict oversight and the academic, non-speculative model.”

Dumas said that there is low public confidence in democracy among US citizens since former President Donald Trump claimed the 2020 elections were “rigged” and “fraudulent.”

He believes these accusations led to widespread belief among many voters that the election system is untrustworthy. In this context, he said that the risk of “introducing predictive markets could amplify these fears,” making it easier for individuals to claim that financial speculation is driving electoral outcomes, thus further undermining public faith in the fairness of elections.

“Betting on elections diminishes the civic duty of voting and reduces it to a financial transaction, which could erode public trust in the democratic system.”

For Dumas, the risks to election integrity stem from potential manipulation, public distrust and the ethical implications of turning elections into betting opportunities. The US allows bets on sports or casinos. However, Dumas believes that US elections should be treated differently “due to their direct role in upholding democracy.”

Having the freedom to create wagers on any topic has raised an ethical debate about betting limits.

On Oct. 1, as the Israelí conflict expanded into Lebanon, Vitalik Buterin, co-founder of Ethereum and Polymarket investor, responded to concerns about the morality of including bets related to wars.

I support these existing. The point of polymarket is that from the perspective of traders it’s a betting site, but from the perspective of viewers it’s a news site. There’s all kinds of people (incl elites) on twitter and the internet making harmful and inaccurate predictions…

— vitalik.eth (@VitalikButerin) October 1, 2024

Buterin said that the dividing line on whether someone should place a bet is if the market acts as a “primary incentive for people to do bad things so they can insider trade on them.”

The question remains: Do prediction markets influence behavior, or are they merely accurate forecasting tools based on existing data? Place your bets.

Tyler Durden

Mon, 10/07/2024 – 15:40

via ZeroHedge News https://ift.tt/gR13OeQ Tyler Durden