If you’ve ever been on a road trip through Pennsylvania, Ohio, or Indiana, you’ve probably driven past a billboard advertising Amish furniture, quilts, or cheese.

You may have even driven past a horse and buggy, driven by someone who looks straight out of the 1800s.

The Amish are a Christian sect known for their simple, traditional way of life, rooted in 17th-century Anabaptist beliefs.

Rejecting modern technology, the Amish believe that innovations like cars, electricity, and smartphones make life too easy, undermining their core values of hard work, humility, and self-sufficiency. They emphasize strength of the community over the freedom of the individual.

Different Amish groups pick and choose which technologies are acceptable to preserving their way of life. Some may appear to be living in the early 1900s, with limited electricity and even a community phone connection.

But other, stricter communities may shun every technology created after 1850.

And in this way, it struck me, that the Amish are a lot like unions.

You may have heard that the International Longshoremen’s Association, the dockworkers’ union, went on strike earlier this week.

The initial strike only lasted a few days; the companies quickly gave in to their demands, not so much out of principal, but in large part due to political pressure from the White House.

There are still a number of details to be worked out, but as it stands right now, dockworkers will receive a 62% increase in pay over six years.

Obviously any worker should be free to negotiate maximum pay with their employer. And the employer should be able to hire and fire at will based on employees’ performance and skill. That’s how a free labor market works.

But I was pretty surprised to learn that starting pay for a dockworker is over $81,000 per year. And with the increase of 62%, it will bring an entry-level dockworker to $131,000 per year.

In fact, you’d be hard-pressed to find better paid blue collar workers. According to port regulators, more than half the dockworkers at the New York-New Jersey port were bringing in over $150,000, and close to 20% earned over $250,000 per year.

Over on the West Coast, the average full-time dockworker earns almost $233,000.

I find it pretty ironic that the national jobs report came out today, as the dockworkers struck a deal.

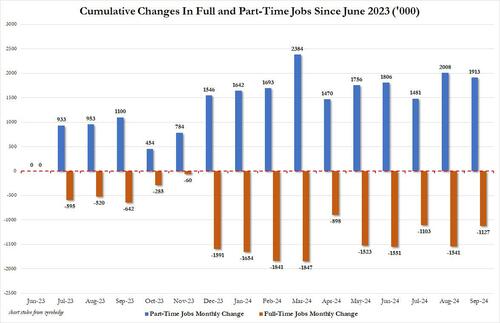

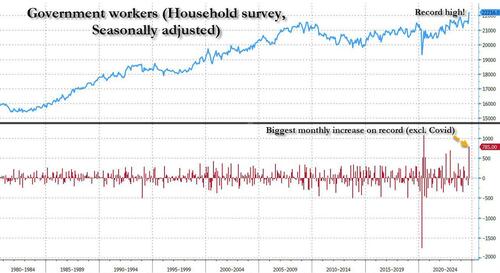

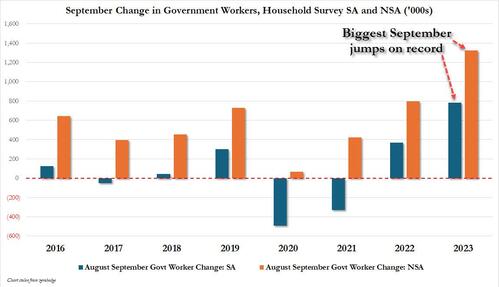

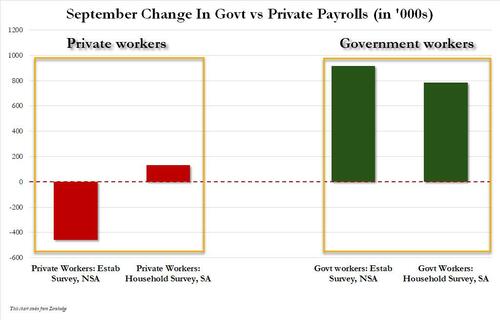

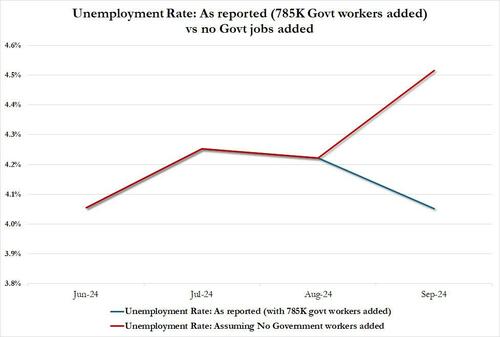

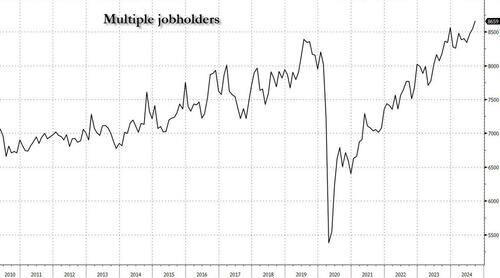

The headlines are about blowout job gains. But when you look deeper, you see that the quarter million jobs created were, as usual, bartenders, waiters, and government employees.

Manufacturing jobs were down. And even those factory workers still employed don’t make nearly as much as the longshoremen.

But although the strike has ended, negotiations have not. This is just a tentative deal that allows further negotiations until January 15.

And as if the absurd increase in pay wasn’t enough, dockworkers are also demanding a complete BAN on automation at the docks.

It’s a bit like the Amish; they want to reject new technology… though not for religious reasons or some statement on work ethic. It really comes down to protecting their jobs.

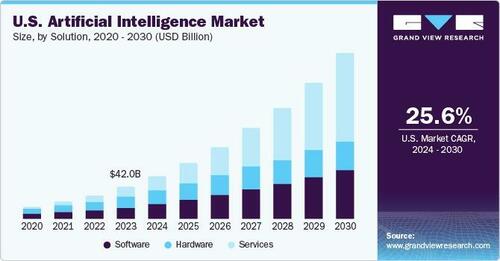

The Union bosses understand that the 62% pay increase will create strong incentives for the transportation companies to automate. AI, robotics, etc. will be a LOT more cost effective than paying people hundreds of thousands of dollars per year… with the added benefit that robots don’t unionize.

So the unions essentially want to get rid of the competition. This will keep prices higher at the docks… which ultimately passes on additional costs to consumers for everything from food to furniture.

Maybe Kamala and Joe Biden have a point when they blame inflation on “greed”. Except in this case, it’s not corporate greed. It’s union greed.

Like I said, I have no problem with employees demanding higher wages. That’s part of the most basic tenets of capitalism.

The problem is with corrupt union bosses who distort the market, make the world less productive, and drive higher inflation for everyone else.

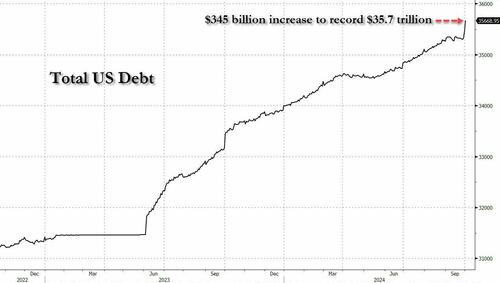

Automation is exactly what America needs to pull itself up by its bootstraps, and get the economy humming so that its debt and deficit problems melt away.

But there are clearly some very politically powerful forces doing everything they can to stop that.

Given that Kamala’s administration pressured the employers to offer workers an enormous pay increase, I have to assume she cares more about cushy union jobs than bringing costs for consumers down, or spurring the US economy.

Adding to the irony of the poor dockworkers strike, is that the man with the megaphone, the head of their union, makes nearly $1 million per year, lives in a 7,000 square foot mansion in the suburbs of New York City, and drives a Bentley.

Both the Bentley-driving union boss, and the fact that Kamala sides with him, shows you exactly what type of leadership this country currently relies on.

Unfortunately, that makes it unlikely that the country starts moving in the right direction anytime soon. And that’s yet another reason is makes sense to have a Plan B.

Source

from Schiff Sovereign https://ift.tt/7F1Etex

via IFTTT