US futures and European stocks fluctuated ahead of today’s jobs report that will help determine the path for interest rates. As of 8:00am, S&P futures are 0.3% higher, reversing earlier losses, with small-caps leading. Nasdaq futures rise 0.4% with AMZN and TSLA notable movers in MegaCap Tech (AMZN +1.4%; TSLA +1.2%). Bond yields are higher, extending Thursday’s treasury selloff, 10-yr yields rise 3bps higher. The Bloomberg Dollar Index was slightly lower, but still set for the biggest weekly gain in nearly six months as traders pared back expectations for aggressive US rate cuts. Commodities are mixed with oil higher, base metals lower, and precious metals slightly higher. Oil prices extended their gains after Israel carried out huge bombing raids on Hezbollah targets near Beirut airport alongside ground attacks in southern Lebanon; this followed the biggest one-day jump in oil prices in almost a year amid spiraling Middle East tensions. Today, the key macro focus will be NFP release: Wall Street consensus expect a 150k print, with the unemployment rate unchanged at 4.2% (see our preview here).

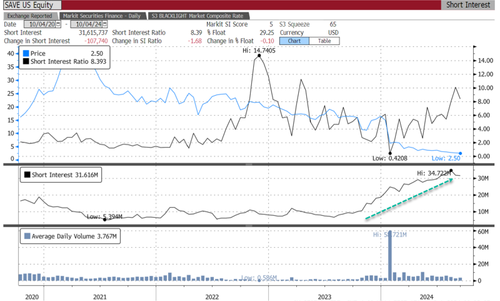

In premarket trading, Spirit Airlines sinks 37% as the WSJ reported that the budget carrier is preparing for a bankruptcy filing. Shipping stocks globally fell after US dockworkers agreed to end a three-day strike that had paralyzed trade on the East and Gulf coasts. In US premarket trading, ZIM Integrated Shipping Services Ltd. slumped more than 7%. In Europe, A.P. Moller-Maersk A/S dropped 6.6% and Hapag-Lloyd AG fell 12%. The stocks had rallied on expectations the strike would lead to increased container rates. Here are some other notable premarket movers:

- Align Technology (ALGN) slips 1% after CFRA downgraded the Invisalign owner to strong sell, citing industry-wide headwinds and an elevated valuation.

- Rivian (RIVN) drops 8% after the EV company cut its production guidance for the full year.

- SilverCrest Metals (SILV) gains 11% after entering a pact to be purchased by Coeur Mining.

- Summit Therapeutics (SMMT) rises 11% after the company said FDA granted fast track designation for the proposed use of its ivonescimab cancer drug in combination with platinum-based chemotherapy.

While investors keep a watchful eye over geopolitical events, they are also assessing the latest signals on the health of the US economy. Friday’s jobs report is expected to show an increase in payrolls for September, while the unemployment rate is forecast to hold steady at 4.2%.

“The slew of data that has come out from the US in the last week or two was so strong that I actually think the market could even tolerate a payrolls number that’s on the low end of the range,” said Elliot Hentov, head of macro policy research at State Street Global Advisors. “The soft landing narrative is very powerful right now and you would have to have more than one data point that’s disappointing to knock us out of that.”

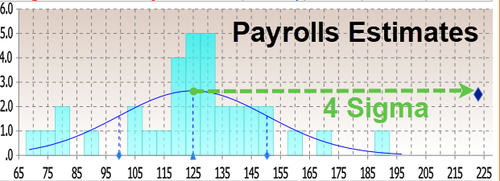

According to BofA strategist Michael Hartnett, as well as Goldman Sachs, risk assets are likely to rally if the report is within the range of market expectations. The addition of between 125,000 to 175,000 jobs last month would support a soft economic landing and keep bond yields in a range, sparking a risk-on trade, Hartnett wrote in a report. A “blowout” report showing greater than 225,000 payrolls and an unemployment rate of less than 4.1% would drive the 30-year Treasury yield above 4.5%, the strategist said. Meanwhile, jobs below 75,000 alongside an unemployment rate of above 4.3% would be “recessionary.”

Traders are also bracing for extra volatility following the payrolls report. The options market is betting the S&P 500 Index will move roughly 1.15% in either direction after the data, according to Goldman Sachs. If it happens, that would be roughly in line with the past two jobs prints, and the biggest move in two weeks.

Elsewhere, oil headed for its strongest weekly increase in two years on fears that Israel may decide to strike Iranian petroleum facilities in retaliation for a missile assault on its territory. The US and its allies warned of “uncontrollable escalation” in the Middle East after Israel carried out huge bombing raids overnight near Beirut airport aimed at Hezbollah commanders and facilities.

European stocks tick higher on Friday, reversing some of the week’s losses ahead of US jobs data which could give investors better clarity about the Federal Reserve’s next move. The energy and real estate sectors lead gains while media equities are among the biggest laggers. Stoxx 600 rises 0.2% to 517.17 with 399 members up, 191 down and 10 unchanged. Here are some of the biggest movers on Friday:

- Volvo Car shares rise as much as 5.4% after a report the Swedish government will abstain in Friday’s vote regarding the EU Commission’s proposal of higher tariffs on Chinese electric vehicles.

- DSV gains as much as 9.3% to trade at the highest since January 2022, after the Danish logistics firm sold €5 billion in shares without resorting to a discount in order to finance its takeover of Deutsche Bahn’s Schenker.

- Covivio shares rise as much as 4.6% after both Barclays and Citi double-upgrade the French real estate firm.

- Scor shares rise as much as 4.7% after the reinsurance company was upgraded to buy at Berenberg, which believes the recent hurricane season was not as bad as feared and expects the balance sheet to improve.

- Recordati shares jump as much as 5.9% in Milan, the most since April 2023, after the Italian pharmaceutical company signed an agreement to acquire the global rights to the rare disease drug Enjaymo from Sanofi for up to $1.1 billion.

- Redcare Pharmacy shares rise as much as 5% as analysts highlight the company’s strong prescription sales in Germany in the third quarter.

- European shipping stocks fall as dockworkers at US East and Gulf coast ports agreed to start moving cargo again while they continue collective bargaining with their employers on a new contract.

- SSE shares drop as much as 2.2% to hit their lowest level in almost two months after the energy utility was downgraded by analysts at Jefferies, which see a more balanced risk-reward profile following the strong gains in the stock this year.

Earlier in the session, Asian stocks advanced as the rally in Hong Kong shares resumed, while traders assessed the impact of escalating tensions in the Middle East. The MSCI Asia Pacific Index rose as much as 0.6%, with Tencent and Alibaba among the biggest boosts. Chinese shares in Hong Kong advanced after retreating in the previous session, as investors pinned hopes on Golden Week holiday spending data that may give the market another leg up. The mainland Chinese market is shut through Monday. Shares in Japan gained after the yen weakened further. South Korean stocks also advanced, while Taiwan edged lower after the market reopened following a two-day closure due to a typhoon.

“We are looking forward to how consumers have reacted in the Golden Week holiday, and how the government follows up with more fiscal support,” said Tai Hui, chief Asia market strategist at JPMorgan Asset Management, in a Bloomberg TV interview. “That would be a key factor in sustaining the rally that we have seen so far.”

In FX, the yen is the best performer among the G-10 FX, rising 0.3% to around 146.47 against the greenback. The Bloomberg Dollar Spot Index is flat ahead of the US jobs report. The pound rises 0.2%, boosted by BOE Chief Economist Pill who warned against cutting interest rates “too far or too fast.” A decent beat for UK construction PMI also helped. Both have weighed on gilts which underperform their German counterparts, with UK 10-year yields rising 5 bps to 4.07%. Treasuries are little changed across the curve.

In rates, treasuries hold small losses concentrated in short maturities as the US trading day begins, lifting yields except the 30-year toward the highest levels of the past month. Front-end and intermediate yields are higher by 1bp-2bp with long end little changed, flattening the yield curve slightly; 5-year exceeded its 50-day average level for the first time since May; 10- and 30-year yields exceeded their trendlines earlier this week. US 10-year yield at about 3.86% is 1.3bp higher on the day vs increases of 2bp-6bp for most global counterparts. US yields trail steeper increases for UK and euro-zone yields ahead of September US employment data at 8:30am New York time that may revive the case for a half-point Fed rate cut in November.

In commodities, crude oil rises for a fourth straight day and adding to the biggest one-day jump in almost a year as fears that Israel may decide to strike Iranian crude facilities keep the market on edge. WTI is up 1% at ~$74.45 a barrel, briefly exceeding $75 for the first time since Aug. 30. Spot gold is steady at $2,657/oz.

Looking at today’s calendar, the economic data calendar includes only September jobs report; median estimates in Bloomberg survey are for a 150k increase in nonfarm payrolls and a 4.2% unemployment rate, unchanged from August; crowdsourced whisper number for nonfarm payrolls change is 152k. Fed speakers scheduled include New York’s Williams (9am), and Chicago’s Goolsbee (10am, 10:30am and 4pm).

Market Snapshot

- S&P 500 futures little changed at 5,753.00

- STOXX Europe 600 up 0.2% to 517.32

- MXAP up 0.4% to 195.65

- MXAPJ up 0.3% to 624.74

- Nikkei up 0.2% to 38,635.62

- Topix up 0.4% to 2,694.07

- Hang Seng Index up 2.8% to 22,736.87

- Shanghai Composite up 8.1% to 3,336.50

- Sensex down 0.8% to 81,806.07

- Australia S&P/ASX 200 down 0.7% to 8,150.00

- Kospi up 0.3% to 2,569.71

- German 10Y yield little changed at 2.17%

- Euro little changed at $1.1022

- Brent Futures up 0.9% to $78.31/bbl

- Gold spot up 0.1% to $2,659.68

- US Dollar Index little changed at 101.92

Top Overnight News

- Dockworkers at ports along the East and Gulf Coasts agreed to suspend their strike until Jan 15 after the two sides reached a tentative agreement on compensation (wages are set to rise 62% over 6 years) and will negotiate over other outstanding issues over the coming months. ILA announced shortly after it reached a tentative agreement with USMX on wages and that all current job actions will cease and all work covered by the master contract will resume with immediate effect. WaPo

- Former US President Obama is to campaign for Democratic candidate and VP Harris in the run-up to the election, according to Washington Post.

- Japan’s new prime minister has instructed his cabinet ministers to come up with a comprehensive economic package, taking his first step toward the goal of ensuring the country manages to fully exit deflation. Shigeru Ishiba said Friday that the stimulus package will focus on easing the burden of rising living costs, boosting growth and strengthening relief and preparedness measures for natural disasters. WSJ

- Israel bombed a meeting of Hezbollah’s senior leadership around midnight on Thursday, a gathering that included Hashem Safieddine, the presumed successor of Hassan Nasrallah, the group’s longtime chief who was assassinated in an airstrike in Lebanon last week, according to three Israeli officials. NYT

- Israel does not possess the capabilities to take out Iran’s nuclear installations: only the US has the scale and weapons for such an operation. FT

- Euro-area inflation is now very near to the European Central Bank’s 2% target for consumer-price growth, according to Governing Council member Mario Centeno. WSJ

- Investors poured the most cash into US money-market funds last quarter since the March 2023 banking crisis, pushing the sector’s total AUM to a record $6.46 trillion. BBG

- Spirit Airlines’ stock is down 40% premarket. Its efforts to restructure its debt and avoid filing for bankruptcy have hit a snag, people familiar said. BBG

- Blackstone expects the private credit market to balloon to $30 trillion, fueled by lending for infrastructure projects and greater participation from pension funds

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid light pertinent catalysts for the region heading into the weekend and the latest US NFP report. ASX 200 fell with almost all sectors in the red and miners leading the retreat although energy bucked the trend after the oil surge. Nikkei 225 traded higher owing to recent currency weakness and after PM Ishiba instructed to compile a comprehensive economic package, although the gains were limited in the absence of any major macro drivers or key data releases. Hang Seng outperformed in a rebound from yesterday’s profit-taking with the advances spearheaded by tech strength and the energy sector was also boosted by the recent surge in oil prices.

Top Asian Markets

- Japanese Chief Cabinet Secretary Hayashi said PM Ishiba instructed to compile a comprehensive economic package, while Hayashi added that they will compile a supplementary budget after the lower house election.

- Germany will reportedly vote against EU tariffs on Chinese EVs, according to sources via Reuters.

European bourses, Stoxx 600 (+0.3%) began the session on a modestly weaker footing, but has edged off lows as the morning progressed. Trade still remains tentative in the run-up to today’s key US NFP report. European sectors are mostly firmer trade with no real theme or bias. Energy resides at the top of the chart. To the downside, very mild losses seen in Technology and Media, although the breadth of the losses are modest. US Equity Futures (ES U/C, NQ +0.1%, RTY -0.1%) are trading very modestly above the unchanged mark, with traders very mindful of the looming US NFP report. DoJ and SEC back class action alleging NVIDIA (NVDA) hid crypto mining revenue, according to Cointelegraph.

Top European Markets

- “EU countries approve duties (up to 35% [additional tariffs]) on unfairly subsidized Chinese electric cars, despite Germany’s last-minute opposition”, according to Politico (as expected)

- BoE’s Chief Economist Pill said ample reason for caution in assessing the dissipation of inflation persistence; need for such caution points to a gradual withdrawal of monetary policy restrictions. Further cuts in the Bank Rate remain in prospect but it will be important to guard against the risk of cutting rates either too far or too fast. He remains concerned about the possibility of structural changes sustaining more lasting inflationary pressures. “does not think level of interest rates is having more than a marginal impact on UK business environment”

FX

- USD is mixed/flat vs. peers in the run-up to today’s eagerly anticipated NFP print. A strong release could see DXY make a more sustained breach of the 102 mark after venturing as high as 102.09 on Thursday.

- EUR is flat vs. the USD after being softer vs. the USD for the past five sessions on account of a dovish ECB repricing and as Powell guided markets towards a 25bps (as opposed to a 50bps) cut earlier in the week. For now, EUR/USD remains within yesterday’s 1.1008-49 range.

- GBP is a touch firmer vs. the USD after what was a particularly bruising session yesterday on account of comments from BoE Governor Bailey that the Bank could begin cutting rates at a faster pace. Cable has picked itself up from a 1.3093 low yesterday to a 1.3167 peak today but this is a far cry from the 1.3270 high seen on Thursday.

- JPY is attempting to claw back some losses vs. the USD which were triggered earlier in the week by comments from Japanese PM Ishiba, downplaying the possibility of a near-term rate cut. USD/JPY ventured as high as 147.23 but has since returned to a 146 handle.

- AUD/USD is steady vs. the USD but in close proximity to yesterday’s low that was triggered by the hot ISM services print which dragged the pair lower to a 0.6829 base vs. the 0.6942 YTD peak printed earlier in the week.

Fixed Income

- USTs are flat, in contrast to European peers in what appears to be an attempt to claw back some of yesterday’s ISM services-induced losses which dragged the Dec’24 contract to a 113.28+ low vs. the 114.14+ high seen earlier in the session. All focus will be on today’s US NFP report.

- Bunds have extended the pullback seen since Tuesday which saw the Dec’24 10yr print a fresh contract high at 136.20. EZ-specifics has been light so focus will be on the US employment data. The German 10yr yield has continued its upside and has been as high as 2.174% vs. the 2.011% multi-month low printed earlier in the week.

- Gilts kicked the session off on the backfoot inline with European paper and a reversal of yesterday’s upside that was driven by dovish comments from BoE Governor Bailey. Downside for the UK 10yr was added to by comments from BoE Chief Economist Pill who took a more hawkish stance than his boss.

Commodities

- Crude is holding an upward bias against the backdrop of heightened geopolitics heading into the weekend, with Israel’s response yet to come. Brent’Dec resides near its weekly best in a USD 77.39-78.42/bbl range.

- Mixed trade across precious metals ahead of the US jobs report but spot gold holds a mild upward bias on the back of the aforementioned geopolitics. Spot gold briefly topped yesterday’s high (USD 2,663/oz).

- Base metals hold a mild upward bias but largely treading water in a tentative market awaiting the US jobs report. Mainland Chinese markets remained closed overnight for Golden Week holiday.

- UAE’s ADNOC set Nov Murban crude OSP at USD 73.41/bbl (prev. USD 77.94/bbl)

Geopolitics

- Iranian Supreme leader Khamenei said will strike again if necessary. Adds “we will not delay nor rush to respond to Israel”.

- Israeli army calls on residents of 20 towns in southern Lebanon to evacuate, according to Sky News Arabia

- Hezbollah announces targeting of northern Haifa with a rocket barrage, according to Sky News Arabia.

- Israel’s military called for the immediate evacuation of specific buildings in Beirut’s southern suburbs and multiple Israeli raids were then reported in the area, while Israel also conducted a strike on the outside perimeter of Beirut Airport. Furthermore, Israel’s Channel 14 reported that Hezbollah’s Executive Council head Hashem Safieddine was the target of Israel’s attack in Beirut and Israel’s military said it killed Zahi Yasser Abdel Razak Ofi who is the head of the Hamas network in the West Bank’s Tulkarm.

- Ukraine’s military said it hit fuel storage facility in Russia’s Voronezh region

- Ukrainian drone strikes targeted a fuel depot in the Russian town of Anna in Voronezh Oblast, while the Russian emergencies ministry later announced that a fuel depot was on fire in Russia’s Perm region.

- North Korean leader Kim warned North Korea will use nuclear weapons if South Korea and the US use force, while he said enemies’ threats will not take away North Korea’s nuclear weapons and it has irreversibly secured nuclear power, as well as the system and function for using it, according to KCNA.

US Event Calendar

- 08:30: Sept. Change in Nonfarm Payrolls, est. 150,000, prior 142,000

- Change in Private Payrolls, est. 125,000, prior 118,000

- Change in Manufact. Payrolls, est. -8,000, prior -24,000

- 08:30: Sept. Unemployment Rate, est. 4.2%, prior 4.2%

- Underemployment Rate, prior 7.9%

- Labor Force Participation Rate, est. 62.7%, prior 62.7%

- 08:30: Sept. Average Hourly Earnings MoM, est. 0.3%, prior 0.4%

- Average Hourly Earnings YoY, est. 3.8%, prior 3.8%

- Average Weekly Hours All Emplo, est. 34.3, prior 34.3

DB’s Jim Reid concludes the overnight wrap

Markets have remained focused on the Middle East over the last 24 hours, as investors weigh up the likelihood of a fresh escalation and how Israel might respond to Iran’s missile strikes last Tuesday. That response from Israel is yet to materialise, but there was a fresh spike in oil prices after President Biden was asked whether he’d support an Israeli strike on Iran’s oil facilities, and he said “we’re discussing that”. That immediately led to a market reaction, and Brent crude (+5.03%) saw its largest daily increase since last October to $77.62/bbl. Indeed, since the news of Iran’s strikes came through, Brent crude has now seen its biggest 3-day gain in 18 months, having risen by +8.15% since Monday’s close. And broader volatility has also mounted, with the VIX index closing back above 20pts yesterday for the first time in nearly a month.

Whilst the geopolitical situation has dominated attention, yesterday also brought another strong batch of US data, which cast fresh doubt on how quickly the Fed would cut rates. In particular, the latest ISM services index for September came in at a 19-month high of 54.9 (vs. 51.7 expected), which was above every economist’s estimate on Bloomberg. So that led to more scepticism on the idea that the US was heading into a sharper downturn, and the new orders component also surged to a 19-month high of 59.4. That came alongside several other releases, including the initial jobless claims for the week ending September 28. They posted an increase to 225k (vs. 221k expected), but the 4-week moving average still fell back to its lowest level since May, at 224.25k.

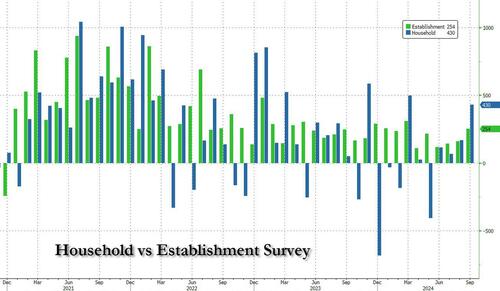

Macro data will be in the spotlight again today, as we’ve got the latest US jobs report for September coming out. Bear in mind that on the day of the last two reports, the S&P 500 sold off by more than -1.7%, so this is something markets have been very reactive to, particularly given that other labour market data has been slowing down recently. In terms of what to expect, our US economists are looking for nonfarm payrolls to come in at +150k, with the unemployment rate rounding up to 4.3% on the back of a slight pick up in participation. For our economists’ full preview and to register for their post-release webinar, see here. The jobs report will be very important for the Fed’s next decision, with market pricing still in the balance between a 25bp and a 50bp cut. But there’s another jobs report on November 1 in the week before the Fed’s next decision, so we have plenty of data still to come that can influence the decision.

Ahead of the jobs report, yesterday’s strong US data led markets to dial back the chance of aggressive rate cuts over the coming months. For instance, Fed funds futures pricing for December 2025 rose by +8.9bps, closing above 3% for the first time since early September. In turn, that led to a fresh selloff for US Treasuries, with the 2yr yield (+6.3bps) up to 3.71%, whilst the 10yr yield (+6.4bps) was up to 3.85%, which is its highest closing level in a month. So we’ve seen a clear tick up in yields over recent sessions, as the solid US data has made it harder to justify the pricing of rapid cuts more normally associated with recessions. Moreover, the rise in yields coupled with higher geopolitical risks helped the dollar index (+0.31%) advance for a fourth session in a row, leaving it on course for its best week since April.

Over in Europe, sovereign bond yields saw a similar trend, with those on 10yr bunds (+5.4bps), OATs (+7.9bps) and BTPs (+6.2bps) all moving higher. The main exception was here in the UK, where the 10yr gilt yield fell -0.9bps. That followed comments from BoE Governor Bailey, who said in an interview with the Guardian that if the news on inflation remained positive, then they could become “a bit more activist” about cutting rates. The comments also contributed to a fall in sterling, which ended the day down -1.10% against the US Dollar.

For equities, geopolitical fears outweighed the more positive US data, and the major indices fell back on both sides of the Atlantic. For the S&P 500 (-0.17%) it was only a modest decline, but that still left the index at a two-week low. Small-cap stocks underperformed in particular, with the Russell 2000 (-0.68%) losing ground for a third consecutive session. And in Europe there were also sharp losses that saw the STOXX 600 fall -0.93%.

Looking forward, it’s been widely reported that EU member states will vote today on whether to impose tariffs on Chinese electric vehicles. Our European economists have published a preview of the decision (link here), where they expect EU countries to give the green light to additional tariffs. Reuters have reported that Germany will vote against the introduction of tariffs, although their reports have also said that others including France and Italy are in favour.

Overnight in Asia, the Hang Seng (+1.75%) has posted a further advance after the previous day’s losses, leaving the index on track to close at its highest level since January 2023. Markets in mainland China remain shut for a holiday, but there’ve been gains elsewhere, with the Nikkei (+0.27%) and the KOSPI (+0.62%) both posting smaller advances. Similarly, US equity futures are also pointing to modest gains, with those on the S&P 500 up +0.07%.

In terms of yesterday’s other data, we did get the final services and composite PMIs from around the world. In the Euro Area, they were a bit stronger than the flash readings, with the final composite PMI at 49.6 in September (vs. flash 48.9). However, the US composite reading came down a bit from the flash print to 54 (vs. flash 54.4).

To the day ahead now, and data releases include the US jobs report for September, along with the German and UK construction PMIs for September, and French industrial production for August. From central banks, we’ll hear from ECB Vice President de Guindos, the ECB’s Villeroy, Simkus, Kazaks, Muller, Centeno and Escriva, the Fed’s Williams and the BoE’s Pill.