WTI Holds Rebound Gains After Across-The-Board Inventory Builds

Oil prices are bouncing back from weakness overnight (strong dollar and Trump ‘drill, baby, drill’ win).

“Overnight trading saw widespread losses across the commodities sector,” said Ole Hansen, head of commodities strategy at Saxo Bank.

Markets believe a Trump presidency “is expected to bring about the promised tariffs on imported goods, particularly targeting China, potentially triggering a new wave of trade tensions and economic disruptions.”

The dollar has been lifted on expectations Trump’s fiscal plans and tariff proposals would stoke inflationary pressures, curtailing the scope for Fed rate cuts.

The strengthening dollar “leaves oil market participants grappling with election-related uncertainties that can only be answered in the coming months,” Mukesh Sahdev, global head of commodities at Rystad Energy, said in a note.

But for now, let’s focus on the immediate fundamentals.

API

-

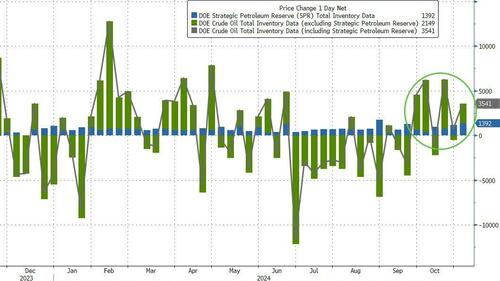

Crude +3.13mm (0.00mm exp)

-

Cushing +1.72mm

-

Gasoline -928k (-900k exp)

-

Distillates -852k (-300k exp)

DOE

-

Crude +2.15mm (0.00mm exp)

-

Cushing +552k

-

Gasoline +412k (-900k exp)

-

Distillates +2.95mm (-300k exp)

A Green sweep of inventory builds across crude and all products last week with Distillates stocks soaring by the most since July

Source: Bloomberg

Crude stocks rose even more as the Biden admin added 1.39mm barrels to the SPR…

Source: Bloomberg

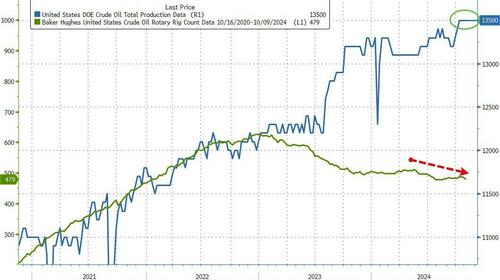

US crude production was flat at record highs last week…

Source: Bloomberg

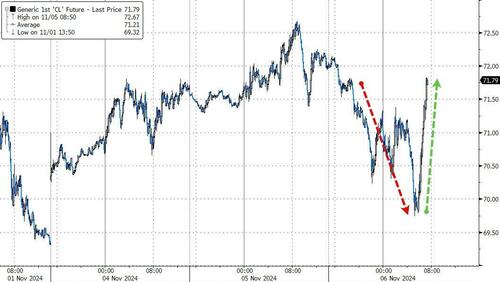

WTI was trading just below $72 ahead of the official print.

Source: Bloomberg

U.S. oil producers are looking forward to less regulations on crude production under a Donald Trump presidency, meaning higher oil supply and consequently lower prices.

But it’s not that straightforward: Trump has also vowed to put more sanctions on Iranian and Venezuelan barrels, meaning the global market could become tighter, potentially boosting prices.

“Conceptually, the impact of a potential second Trump term on oil prices is ambiguous, with some short-term downside risk to Iran oil supply … and thus upside price risk,” Goldman Sachs commodities analysts wrote in a research note Monday.

“But medium-term downside risk to oil demand and thus oil prices from downside risk to global GDP from a potential escalation in trade tensions.”

At the same time, the increase likelihood of trade wars under Trump could dampen global economic growth and slow oil demand.

“US foreign policy is shaping up to be a potential factor for oil markets in the near term” over Iran, said Vivek Dhar, an analyst at Commonwealth Bank of Australia.

Trump expressed his enthusiasm for increased U.S. oil production while giving a speech from the Republican campaign headquarters in Florida on Wednesday, just hours before his victory was confirmed. He made a reference to Robert F. Kennedy, Jr., the independent candidate who he said would become a part of his team.

“Bobby, stay away from the oil, stay away from the liquid gold!” Trump said in a joking tone.

“We have more than Saudi Arabia and Russia.”

Kennedy is known for his history of environmental activism.

But a further push to open drilling projects, putting more supply on the market, would lead to lower prices, thereby decreasing revenues for American producers, said Cole Smead, president and CEO of Smead Capital.

“If the Trump administration opens up federal leases for oil and gas, Federal lands would get 25% per barrel of revenues. You will have a lot of trouble finding an oil company that can make money at $52.50 per barrel with what they have left from a $70 barrel,” Smead said in emailed notes.

“The only thing that will cause drill baby drill to happen is higher oil prices based on these margins.”

“Drill baby, drill is going to run into the energy vigilantes,” he added. “Now that equity investors in the energy business know what free cash flow looks like they won’t give it up. They will allow capital expenditures to go up over their dead body.”

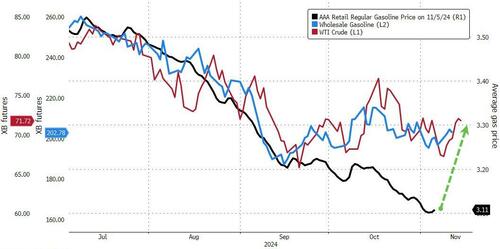

And how long before pump prices revert higher to catch up to crude?

Miraculous how those prices were suppressed into the election, eh?

Tyler Durden

Wed, 11/06/2024 – 10:36

via ZeroHedge News https://ift.tt/6CHDeNO Tyler Durden