Vanguard Adds 3 New Proxy Vote Options, Expands Shareholder Choice Pilot

In the latest evidence of the ongoing erosion of the environmental, social and governance (ESG) movement, investment titan Vanguard has doubled the amount of assets covered by a program that gives investors the power to choose a proxy-voting philosophy — while also adding two more voting options within that program.

“Vanguard Investor Choice is grounded in the foundational belief that empowering investors to influence how their proxies are voted helps create a healthier corporate governance ecosystem,” said John Galloway, Global Head of Investment Stewardship at Vanguard. The program will now cover nearly 4 million investors and almost $250 billion in assets — still a small slice of the more than $10 trillion in Vanguard assets under management.

Vanguard also announced that it is working with retirement plan sponsors to extend the pilot program’s availability to 401(k) and other retirement plan participants. Here’s the updated list of funds eligible for the program, with the three new additions in italics:

- Vanguard S&P 500 Growth Index Fund

- Vanguard Russell 1000 Index Fund

- Vanguard ESG U.S. Stock ETF

- Vanguard Mega Cap Index Fund

- Vanguard Dividend Appreciation Index Fund

- Vanguard High Dividend Yield Index Fund

- Vanguard Tax-Managed Capital Appreciation Fund

- Vanguard Tax-Managed Small-Cap Fund

The decades-long rise of passive investing has put the Big Three indexers — BlackRock, Vanguard and State Street –in a position of major power to steer corporate agendas. It’s also put them in the crosshairs of angry investors and federal and state Republican officials who think shareholder returns should be the only consideration when voting proxies.

Giving investors the power to choose their own proxy-voting philosophy for shares held on their behalf extricates Vanguard and other firms from competing pressures applied by ESG enthusiasts and opponents. Vanguard now provides a choice of five such proxy philosophies for funds that are covered by the expanding Investor Choice pilot program:

-

Vanguard-Advised Funds Policy: Shares are voted “in a manner that seeks to maximize long-term shareholder returns.”

-

Company Board-Aligned: The fund investor’s proportionate share of votes on each measure is cast in alignment with the recommendations of the company’s board of directors

-

Glass Lewis ESG: Glass Lewis is a proxy advisor; in this option, the investor’s shares go all-in on the woke agenda that emphasizes “climate action,” diversity, “equity” and social issues

- Third Party Wealth-Focused Policy: An investor’s shares are voted per the recommendation of Egan-Jones, which will focus on maximizing shareholder value without consideration of political or social factors

-

Mirror Voting Policy: Votes an investor’s proportionate shares in approximately the same proportions as the votes cast by other shareholders. (This follow-the-crowd approach replaces a “not voting” policy that directed Vanguard to not cast any vote on any proposal.)

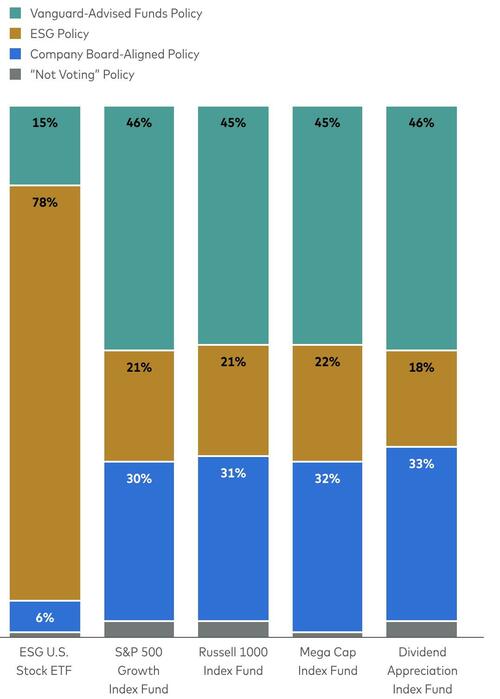

The last two are new for the 2025 proxy-vote season. In September, Vanguard shared data on the breakdown of choices made by investors in the Investor Choice pilot using the previous set of options. Putting aside the outlier ESG US Stock ETF fund, Vanguard investors overwhelmingly favored non-ESG voting, with around 75% choosing to go with either the company board recommendation or Vanguard’s judgement on the best option for shareholder returns:

Although they’ve shown varying degrees of dedication to ESG, BlackRock, Vanguard and State Street are routinely lumped together and subjected to blanket condemnation for promoting the philosophy to society’s detriment. However, Vanguard announced earlier this year that it didn’t support a single one of 400 ESG shareholder proposals during the 2024 US proxy-vote season.

BlackRock, State Street, and Vanguard collectively own a *giant* chunk of nearly all public companies. They foist environmental & social agendas (“ESG”) onto their portfolio companies via proxy voting & shareholder engagement. The corporate virtue-signaling game is a symptom of a… https://t.co/mNXvaUsExR

— Vivek Ramaswamy (@VivekGRamaswamy) November 19, 2023

In December 2022, Vanguard withdrew from the Net Zero Asset Managers Initiative, a coalition that once had 300 asset managers signed on to reduce greenhouse gases and lower the earth’s temperature by 1.5 degrees Celsius by 2050. “[Vanguard is] not in the game of politics,” CEO Tim Buckley told the Financial Times at the time. In mid-February of this year, JPMorgan and State Street quit the Climate Action 100+ pact, while BlackRock reduced its involvement in the initiative.

Tyler Durden

Wed, 11/20/2024 – 06:55

via ZeroHedge News https://ift.tt/IGfS1OZ Tyler Durden