The Magic Of Classic US Gold & Silver Coins

By Jesse Colombo of The Bubble Bubble Report

Most gold and silver investors begin their journey by purchasing modern bullion coins, such as the American Gold and Silver Eagles from the United States Mint—a practical and popular way to invest in precious metals, and how I started as well. However, I soon discovered that the United States once minted gold and silver coins for everyday circulation, not just for investment purposes like today’s bullion coins. As I delved deeper into these classic American coins, I developed a profound appreciation for their elegance, historical significance, and connection to a time when the U.S. dollar was made from and backed by gold and silver. In this article, I aim to share the benefits and joys of investing in these timeless pieces of American history.

Four years after the ratification of the United States Constitution, Congress passed the Coinage Act of 1792. This landmark legislation established the U.S. dollar as the nation’s standard unit of currency, created the United States Mint, and set forth regulations for coinage. The Act designated the silver dollar as the official unit of money and declared it lawful tender. It also introduced three gold coins: the $10 “eagle,” the $5 “half eagle,” and the $2.50 “quarter eagle,” laying the foundation for the nation’s monetary system. The $20 “double eagle” coin containing 0.9675 troy ounces of gold was introduced in 1849 as a means to utilize and market the significant influx of gold from the California Gold Rush.

From 1795 to 1933, the United States Mint produced gold coins designed for everyday use rather than for investment or collecting. During this period, silver coins were commonly used for daily transactions, while gold coins primarily served as a means of savings and wealth preservation. Gold coins were also used for large purchases, such as land, and in commercial transactions. Due to their high value, gold coins were typically owned by the affluent. In particular, most $20 gold double eagles were stored in bank vaults and seldom circulated in everyday life because of their substantial value, even at the time.

Since pre-1933 U.S. gold coins were rarely used in everyday transactions, a significant number of them have survived in excellent condition, including many graded as Brilliant Uncirculated (BU). What I find fascinating is that many of these coins—provided they are not rare dates or strikes—are surprisingly common and can often be acquired at premiums similar to, or even lower than, modern bullion coins. Yet, they carry with them a rich historical legacy! Many reputable bullion dealers, such as SD Bullion, JM Bullion, Money Metals Exchange, and APMEX, offer these remarkable coins, making them accessible to collectors and investors alike.

If your primary goal is to invest in gold while still enjoying a touch of history (as opposed to collecting rare coins), focusing on common-year $20 gold double eagles from the late-1800s and early-1900s is your best bet. As far as classic coins go, these coins typically carry the lowest premiums over the spot price of gold. For instance, SD Bullion currently offers Brilliant Uncirculated $20 Saint-Gaudens double eagles at a 6.05% premium over the spot price of gold. By comparison, the ultra-popular modern 1 oz American gold eagle bullion coin is available at a 5.69% premium. In my opinion, that extra 0.36% premium is well worth it for owning a tangible piece of history!

The smaller $10, $5, and $2.50 gold eagle-series coins are certainly fascinating, and I personally own a few. However, they tend to carry significantly higher premiums compared to the $20 gold double eagles, making them less ideal for investment purposes. Among the $20 gold double eagles, the 1907–1933 Saint-Gaudens design is often regarded as one of the most beautiful coin designs in history, which has made it highly sought after. In contrast, the 1849–1907 Liberty Head $20 gold double eagle, while more understated in appearance, is still a desirable piece (and one I also own and appreciate). Notably, the 1933 Saint-Gaudens $20 gold double eagle holds the distinction of being the most valuable gold coin ever sold, fetching an astonishing $18.8 million in 2021 and setting the record for the most expensive coin in history.

In addition to classic American gold coins, I also enjoy investing in classic American silver coins, which were minted for everyday circulation between 1794 and 1970. During this period, dimes, quarters, half-dollars, and dollar coins were made from silver alloys. Today, these coins are a popular way to invest in silver and are commonly referred to as “junk silver,” pre-1965 silver coins, or 90%, 40%, and 35% silver coins. While I own some higher-value U.S. silver coins, such as early 20th-century pieces and silver dollars, the best option for most investors is to focus on common-date silver dimes, quarters, and half-dollars from the mid-twentieth century. These tend to have lower premiums compared to silver coins with greater numismatic value. For finding the best deals on junk silver, I recommend using FindBullionPrices.com, a great resource for comparing prices.

I absolutely love the look, feel, heft, and distinctive “clink” sound of classic American silver coins, which stand in stark contrast to soulless modern non-silver coins. Even when these silver coins have a weathered or slightly tarnished appearance, I find them even more charming, as they carry a tangible sense of history—evidence of the countless hands that have touched and handled them over the years. In fact, I often prefer circulated and weathered silver coins to pristine modern bullion coins because I can freely touch and handle them without worrying about tarnishing or leaving fingerprints. Unlike gold, silver naturally tarnishes, so I feel less guilty about enjoying these historic coins in a hands-on way, adding to their unique appeal.

America’s currency was once backed by and literally made from precious metals, which have served as money par excellence for approximately 6,000 years. However, the U.S. dollar has been steadily devalued since the establishment of the Federal Reserve in 1913. Unfortunately, the Federal Reserve has been a terrible steward of the nation’s currency, enabling excessive government spending by creating new dollars. For instance, within just six years of the Fed’s founding, the dollar lost half of its purchasing power—a trend that has persisted over time.

To add insult to injury, President Franklin Delano Roosevelt took the United States off the Gold Standard in 1933, ceased the minting of gold coins, and banned private ownership of gold. This policy required individuals to turn in their gold eagle coins to the government, which then melted them down. However, many of the pre-1933 U.S. gold coins available today were spared from this fate because they had been stored in European bank vaults, allowing them to survive unscathed and find their way back into the market decades later.

In 1965, the United States stopped minting dimes, quarters, and half-dollars from their traditional 90% silver alloy, replacing it with a cheaper nickel-and-copper composition. This marked yet another significant debasement of the U.S. dollar. As the melt value of the older silver coins soon exceeded their face value, those who recognized their greater worth quickly removed them from circulation. This historical shift explains why these silver coins remain popular among investors and collectors even today.

Finally, on August 15, 1971, President Richard Nixon ended the convertibility of the U.S. dollar into gold for foreign governments, effectively transforming the dollar into a pure fiat or “paper” currency with no intrinsic backing. This pivotal decision removed all constraints on the creation of new money, marking the final nail in the coffin for the dollar’s integrity and purchasing power. Over the ensuing decades, this shift paved the way for rampant inflation, unaffordable housing and other necessities, skyrocketing national debt, and an ever-widening wealth gap. To dive deeper into the steady debasement of the U.S. dollar and its far-reaching consequences, check out my detailed article on ZeroHedge.

Contrary to popular belief, inflation is not simply the rising cost of goods and services—that’s merely the inevitable consequence. True inflation is the expansion of the money supply itself. As Nobel Prize-winning economist Milton Friedman famously stated, “Inflation is always and everywhere a monetary phenomenon.” General inflation is rooted in monetary policy, not in supply shocks like energy crises or droughts that temporarily raise prices for specific goods.

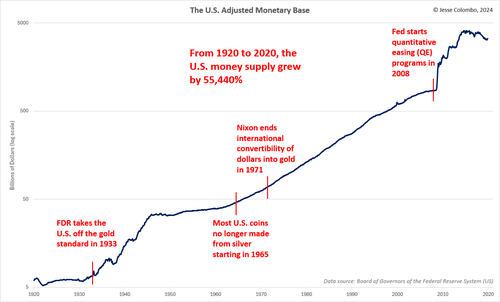

A long-term chart of the U.S. adjusted monetary base, a key measure of the money supply, reveals a staggering 55,440% increase from 1920 to 2020. Curiously, the Federal Reserve stopped publishing this data series in late 2019—a move that raises serious questions. Could they be attempting to obscure the extent of the dollar’s debasement? You decide.

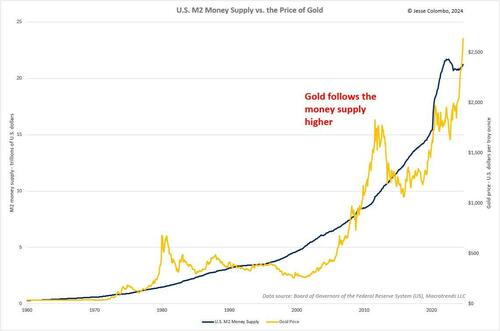

Another key measure of the money supply is the M2 money supply, and its correlation with the price of gold is clear. This relationship highlights why gold serves as an excellent long-term hedge against money printing and inflation. Silver also tracks the M2 money supply, though its price tends to exhibit greater volatility compared to gold.

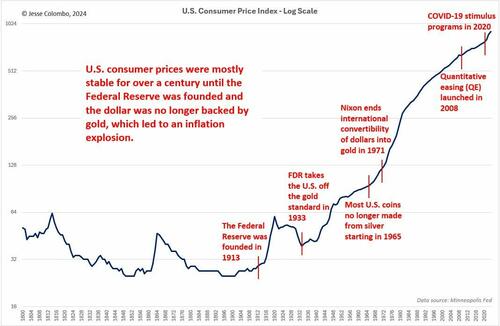

The long-term U.S. Consumer Price Index (CPI) chart, which dates back to 1800, vividly illustrates how each successive erosion of the dollar’s integrity has led to soaring living costs and a dramatic decline in the dollar’s purchasing power. Remarkably, consumer prices in the United States were relatively stable for nearly a century until the establishment of the Federal Reserve in 1913. This marked a turning point, unleashing inflation on an unprecedented scale. Since the Fed’s inception, U.S. consumer prices have risen more than thirtyfold!

It’s difficult to imagine a time without steady, relentless inflation, but that was the reality throughout much of the 19th century. During this era, money was far sounder, backed by gold and silver, providing a stable foundation for the nation’s economy—despite the lack of modern technology and so-called “sophistication” we have today.

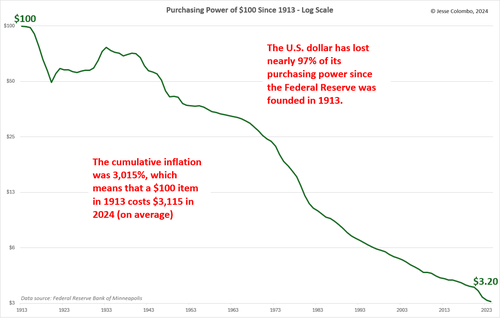

Since its creation in 1913, the Federal Reserve has overseen the U.S. dollar’s staggering loss of nearly 97% of its purchasing power—a decline that shows no signs of stopping, unfortunately:

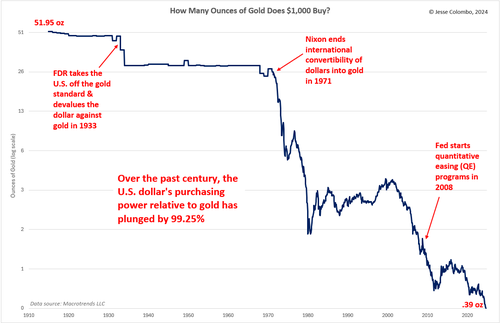

Another striking way to visualize the dollar’s dramatic loss of purchasing power is by comparing it to gold. Over the past century, the U.S. dollar has lost an astonishing 99.25% of its purchasing power relative to gold.

The harsh reality is that the devaluation of the dollar will continue until it meets the same fate as every paper currency throughout history—complete worthlessness. Unfortunately, it’s not just the dollar that is on this trajectory; the euro, British pound, Japanese yen, Chinese yuan, and other fiat currencies are all on the same precarious path. Governments have always struggled to resist the temptation of money printing, a practice enabled by paper currencies but restrained when money is backed by gold and silver.

As I recently explained, the U.S. national debt has surged past $36 trillion, with annual interest payments now exceeding $1.1 trillion. This staggering figure surpasses federal spending on defense, income security, health, veterans’ benefits, and even Medicare, making it the second-largest expense for the U.S. government—second only to Social Security. This unsustainable fiscal situation will inevitably compel the U.S. to rely heavily on printing more money just to meet its obligations—a vicious cycle that will accelerate the currency’s decline.

Classic American gold and silver coins evoke a bittersweet feeling for me. On one hand, I love that they serve as a tangible reminder of a time when we had sound money; on the other, it saddens me that this era of monetary integrity is long gone. Anyone with wisdom and foresight should safeguard their hard-earned wealth with gold and silver—timeless forms of money that have reliably served humanity for thousands of years.

While I enjoy investing in modern bullion coins and bars, there’s something uniquely special about pre-1933 American gold coins and pre-1965 silver coins. Their history, craftsmanship, and connection to a bygone era set them apart. I believe you’ll understand exactly what I mean once you hold a piece of this history in your own hands.

If you enjoyed this article, please visit Jesse’s Substack for more content like this

Tyler Durden

Thu, 11/21/2024 – 10:40

via ZeroHedge News https://ift.tt/wxmpqh3 Tyler Durden