Solid 5Y Auction Sees Highest Direct Bid In A Decade

After yesterday’s stellar 2Y auction, many expected today’s sale of 5Y paper to be similarly solid especially with yields flattish on the session after yesterday’s massive flattening which pushed the 2s10s back into inversion. And they were not disappointed.

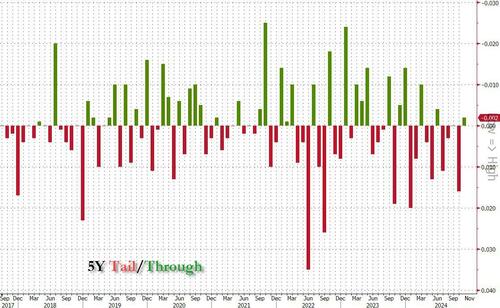

Starting at the top, the auction priced at a high yield of 4.197%, up from 4.138% in October and the highest since Jun. It also stopped through the When Issued 4.199% by 0.2bps. This was the first non-tailing auction since June.

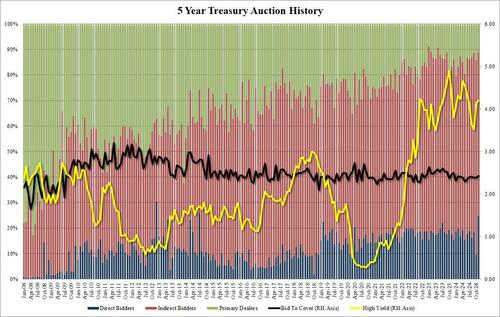

The bid to cover was also solid: at 2.43, it was up from 2.39 last month and above the 2.38 six-auction average.

The internals were uglier: indirects were awarded 64.12%, down from 76.35% and the lowest since February. But while foreign buyers were leery, local Direct bidders were not and at 24.58%, Directs took down the biggest chunk of the auction since July 2014. This meant that Dealers were left with just 11.3% of the auction, the lowest since September 2023.

Overall, a decent, if hardly spectacular auction and one which did little to move yields in the secondary market.

Tyler Durden

Tue, 11/26/2024 – 13:33

via ZeroHedge News https://ift.tt/J9rbzMI Tyler Durden