Chinese Automakers Are Dethroning Their Once-Dominant Japanese Competitors

China is doing the unthinkable and dethroning once dominant Japanese automakers, who are struggling to compete in China.

China is the world’s largest car market and domestic brands are dominating with a surge of electric vehicles. Chinese companies are also expanding into Southeast Asia, challenging the long-standing dominance of brands like Toyota, Honda, and Mitsubishi, according to w new report by Bloomberg.

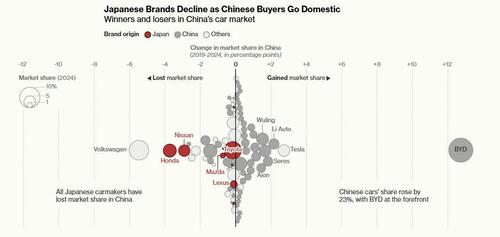

Between 2019 and 2024, Japanese automakers experienced the steepest market share declines in China, Singapore, Thailand, Malaysia, and Indonesia, according to Bloomberg’s analysis of sales and registration data.

Japanese automakers are losing ground across Asia, with all six tracked by Bloomberg experiencing declines in China. Even Toyota, the global leader in car volume, has seen its sales stagnate. In Southeast Asia, a traditional stronghold for Japanese brands, market share has dropped sharply.

In Thailand and Singapore, Japanese carmakers now control just 35% of the market, down from over 50% in 2019, while streets once dominated by Nissan and Mazda are increasingly filled with Chinese brands.

The Bloomberg profile notes that Toyota remains competitive in some segments, like pickups, but the broader outlook is troubling for automakers once renowned for efficiency and reliability. Their slow pivot to fully electric vehicles puts them at risk of falling behind in a market driven by advanced battery technology and smart software.

Although Chinese automakers face high tariffs in Europe and the U.S., the erosion of Japanese dominance in Asia could signal wider challenges ahead.

Toyota’s stronghold in Southeast Asia is supported by regional production of gasoline cars with larger engines, appealing to local preferences. In 2023, Thailand and Indonesia accounted for nearly 10% of Toyota’s 11 million global vehicle output. However, other Japanese brands, like Nissan, are struggling.

Nissan’s outdated lineup and lack of hybrids contributed to profit losses and production cuts, with its presence in Jakarta now fading.

Meanwhile, Chinese automaker BYD has rapidly gained traction in Indonesia, ranking as the sixth top-selling brand just months after delivering its first vehicles. Its $40,000 Seal EV is proving especially popular.

Japan’s global auto production share has dropped from over 20% two decades ago to 11%, while China has surged to dominate, now accounting for nearly 40% of worldwide car manufacturing. Chinese automakers are leveraging their expertise in low-cost batteries and flexible supply chains to expand into Southeast Asia, the Middle East, and Africa, further challenging Japan’s dominance in these markets.

Tyler Durden

Wed, 11/27/2024 – 17:20

via ZeroHedge News https://ift.tt/pmZkStD Tyler Durden