Yields At Session Low After Solid 7Y Auction Stops Through

After a stellar 2Y, and a solid 5Y auction earlier this week, today’s sale of $44 billion in 7Y paper closed out the week’s accelerate coupon issuance, and it did so in style, with another solid auction.

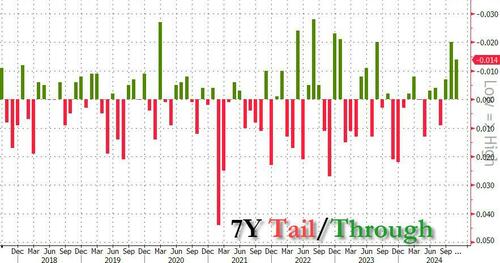

The auction prices at a high yield of 4.183%, down from 4.215% last month and stopping through the When Issued 4.197% by 1.4bps, the third consecutive stop through in a row.

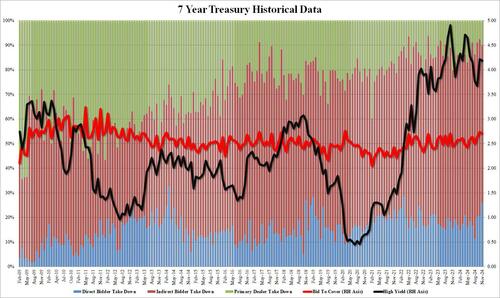

The bid to cover was 2.709, down from 2.737 but above the 2.585 six auction average.

The internals were weaker with Indirects taking down 64.1%, down from last month’s 71.2% and below the recent average of 72.3%. However, the foreign demand was more than made up by Directs who, like yesterday, saw a surge in demand and took down 25.9% of the auction, the highest since March 2022.

Overall, this was a solid if not spectacular result, yet the big stop through was enough to leave the 10Y flat near session lows, and about 6bps below Tuesday’s close.

Tyler Durden

Wed, 11/27/2024 – 12:03

via ZeroHedge News https://ift.tt/jaSYRPt Tyler Durden