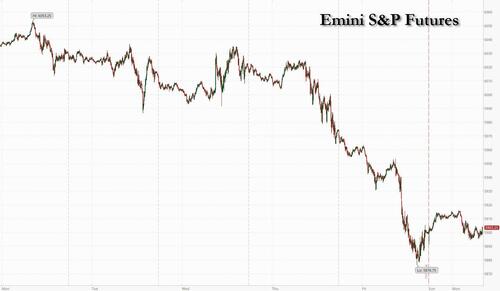

US futures are higher even as European and Asian markets fail to stay positive, as traders waited for fresh pointers on growth and the future of interest rates. As of 8:00am ET, S&P 500 futures rose 0.1%, while Nasdaq 100 futures added 0.3% as Tesla shares surged 8% in premarket trading on speculation Trump’s team will ease self-driving car rules; the boost was enough to offset the 2% drop in NVDA ahead of its earnings Wednesday. Bond yields resume their trek higher (10y 4.47%, +3bp this morning) after sliding on Friday, while the USD is trading near session highs erasing an earlier drop. Commodities are mostly higher led by oil (+0.9%), aluminum (+5.3%) and precious metals (gold +1.1%, silver +1.5%). Gold rose more than 1% after Goldman analysts predicted the precious metal would hit a record by the end of next year. Bitcoin recovered from its biggest two-day retreat since the US vote to trade past the $90,000 mark. This week, the key focus will be earnings (NVDA, WMT, TGT) and global PMIs.

In premarket trading, Tesla gained 7% after Bloomberg reported that members of President-elect Donald Trump’s transition team have told advisers they plan to make a federal framework for fully self-driving vehicles one of the Transportation Department’s priorities. Nvidia falls 2% after the Information reported that the chip giant has asked its suppliers to change the design of the server racks for its new Blackwell graphics processing unit due to an overheating problem. Here are some other notable premarket movers:

- Astera Labs (ALAB) gains 3% as Citi initiates coverage of the semiconductor stock with a buy rating, saying the shares provide artificial intelligence investors with a unique opportunity.

- CVS Health (CVS) gains 1.5% after naming Glenview Capital Management founder Larry Robbins to its board as part of an agreement with the activist firm that’s been pressuring the company for change.

- Liberty Energy (LBRT) climbs 5% after President-elect Donald Trump nominated Chris Wright, who runs the Colorado-based oil and natural gas fracking services company, to lead the Energy Department.

- Newmont (NEM) rises 2% after agreeing to sell Musselwhite for up to $850 million.

- Shift4 Payments (FOUR) rises 5% after S&P Dow Jones Indices said the company will replace R1 RCM in the S&P MidCap 400 prior to the opening on Nov. 20.

- Super Micro Computer (SMCI) climbs 12% as the server maker approaches a deadline to either file a delayed 10-K annual report or submit a plan to file the form to Nasdaq in order to remain listed on the exchange.

- Syndax Pharmaceuticals (SNDX) rises 7% after the FDA approved its drug Revuforj (revumenib) for the treatment of certain leukemia patients.

While the S&P 500 has given up more than half its rally since Trump’s election win, Morgan Stanley’s Mike Wilson – best known for being bearish and wrong for much of 2023 and 2024 – is now predicting gains will resume over the longer term. Wilson, once considered a prominent bear on Wall Street, sees the S&P 500 ending next year up around 11% from Friday’s close amid improving economic growth and further Fed interest-rate cuts. Goldman Sachs analysts, meanwhile, said gold will reach a record $3,000 an ounce by December 2025 due to central-bank buying and US interest rate cuts.

“It should be a quieter week as the recent relentless wave of US macro and political news flow in theory slows down,” said Jim Reid, Deutsche Bank’s global head of macro and thematic research. “The main story on this front being on potential political appointments for the new Trump administration with Treasury secretary the one creating most interest.”

Indeed, Trump’s pick for Treasury secretary is in focus this week along with Nvidia earnings on Wednesday that are set to test the sustainability of AI-led stock gains. US financial leadership under incoming Trump administration remains unclear, with Robert Lighthizer, Senator William Hagerty, Apollo Global Chief Executive Officer Marc Rowan and Kevin Warsh now among the candidates for Treasury secretary.

In Europe, the Stoxx 600 was down 0.3% amid continued worries about potential US tariffs under the new administration and weakness in China. Real estate and technology stocks declined the most, while miners outperformed after iron ore rebounded on signs of robust Chinese steel output in the short term. Here are some of the biggest movers on Monday:

- Melrose Industries shares rise as much as 9.3% after the aerospace technology provider reiterated its profit guidance for this year and next.

- Bavarian Nordic gains as much as 11%, the most since August, after the Danish vaccines maker was upgraded to buy from hold at Carnegie.

- Ence Energia y Celulosa gains as much as 5.1% following an upgrade to buy at Jefferies, which sees pulp prices reaching a bottom in 1Q next year and scope for strong Ebitda growth in renewable biomass energy.

- ASR Nederland rises as much as 3.2% after UBS upgrades the stock to buy from neutral, preferring the Dutch insurer to peer NN Group due to the likelihood of more share buybacks ahead.

- Judges Scientific plummets as much as 19% after the scientific instrument developer says not all the orders it expected to be crystallized and delivered in the second half of the year will be achieved in time.

- UK homebuilders are underperforming on Monday after asking prices for residential properties fell more than usual in November as the budget disappointed prospective buyers and affordability remained stretched, according to Rightmove.

Earlier, Asian equities gave up gains, as initial advances in China disappeared as traders weigh the outlook for more stimulus measures. The MSCI Asia Pacific Index declined 0.1%, with TSMC and SK Hynix among key losers. China’s CSI 300 Index fell 0.5%, while the Japanese benchmark slipped to a near two-week low. Stocks in Taiwan also declined, while Korean equities rose the most in about two months as Samsung shares rose more than 5% on Monday in response to a $7.2bn share buyback plan – the first since 2017 – aimed at boosting its stock, which had fallen to four-year lows last week. Investors are waiting to see if Chinese authorities are inclined to issue more stimulus measures while President-elect Donald Trump’s threat of tariffs looms over the region’s sentiment. Chinese state-owned companies’ stocks received a boost Monday after the country’s securities regulator issued a supportive guideline, urging them to come up with clear and executable plans to boost their valuation.

In FX, the Dollar Spot Index erases a 0.2% drop and traded near session highs while 10-year US Treasury yields edge two basis points higher to 4.46%. The Japanese yen weakened as much as 0.5% to 155.14 against the greenback after Bank of Japan Governor Kazuo Ueda avoided giving a clear hint that he will raise interest rates at a December meeting. EUR/USD +0.1% at 1.0548.

In rates, Treasury futures were near lows of the day in early US trading following similar losses in bunds ahead of several speeches by ECB policymakers this week. US curve steepens as long-end leads losses, pushing 2s10s and 5s30s spreads beyond Friday’s highs. US session has little economic data and no scripted Fed speeches slated. Yields were cheaper by 1bp-4bp across the steeper curve, with 2s10s and 5s30s spreads both ~2.5bp wider on the day; 10-year around 4.465% is ~3bp higher with bunds underperforming by around 0.5bp in the sector. German bonds fall, led by the short-end, as traders remove some ECB interest-rate cut premium ahead of a number of speeches from policymakers this week. German two-year yield climbs 6bps to 2.18%, sector underperforms Treasuries and gilts

In commodities, oil rebounded, with Brent crude trading near $72 per barrel. Bitcoin fell almost 3% over Saturday and Sunday before rising back to $92,000 on Monday morning. Trump has made various pro-crypto pledges, but there are open questions about the timetable for implementation and whether all are feasible — such as setting up a US Bitcoin stockpile.

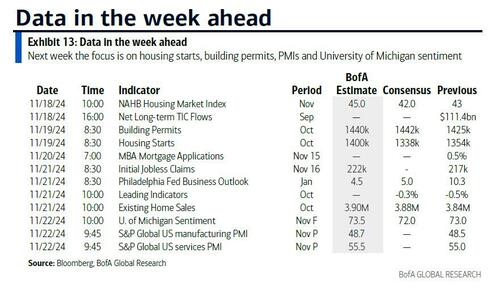

Today’s US economic data calendar includes November New York Fed services business activity (8:30am), NAHB housing market index (10am) and September TIC flows (4pm). Fed speaker slate includes Goolsbee at 10am. Schmid, Cook, Bowman, Hammack and Barr are scheduled to appear later this week. Eurozone and UK inflation readings due on Tuesday and Wednesday, respectively, will help investors gauge the outlook for Bank of England and European Central Bank policy. A swathe of officials from the respective institutions are also due to speak.

Market Snapshot

- S&P 500 futures little changed at 5,897.50

- STOXX Europe 600 down 0.3% to 501.48

- MXAP little changed at 182.06

- MXAPJ up 0.2% to 576.58

- Nikkei down 1.1% to 38,220.85

- Topix down 0.7% to 2,691.76

- Hang Seng Index up 0.8% to 19,576.61

- Shanghai Composite down 0.2% to 3,323.85

- Sensex down 0.3% to 77,322.56

- Australia S&P/ASX 200 up 0.2% to 8,300.17

- Kospi up 2.2% to 2,469.07

- German 10Y yield little changed at 2.39%

- Euro up 0.2% to $1.0566

- Brent Futures up 0.5% to $71.39/bbl

- Gold spot up 1.1% to $2,591.11

- US Dollar Index down 0.13% to 106.55

Top Overnight news

- Chinese leader Xi Jinping told President Biden that Beijing remains committed to stable relations with the U.S., an expression of hope for continuity in ties before Donald Trump returns to the Oval Office in the midst of promises to squeeze Beijing over trade. WSJ

- China’s population is expected to shrink by ~51M over the next 10 years as the country continues to grapple within enormous demographic headwinds. BBG

- BOJ’s Kazuo Ueda avoided giving a clear hint that the BOJ will raise rates at its December meeting, saying the timing of its next adjustment will depend on the economy and prices. The yen weakened. BBG

- US pump prices are set to dip below $3 a gallon, a three-year low, just in time for Thanksgiving travel, which is expected to reach pre-pandemic levels. BBG

- As western leaders look to talks with Putin, Russia hit Ukraine over the weekend with one of the largest missile and drone barrages of the entire war. WSJ

- Nvidia asked suppliers to redesign server racks for its new Blackwell GPU, leading to worries about delays, the Information reported. BBG

- Trump is broadening his search for a Treasury Sec and rather than Bessent or Lutnick, could decide to select Kevin Warsh, Sen. Bill Hagerty, or Apollo’s Marc Rowan. WSJ

- Trump seeks assurances from Treasury Sec candidates that they will execute a plan to implement sweeping tariffs. FT

- US President-elect Trump picked Chris Wright to be Energy Secretary and named Commissioner Brendan Carr as the Chairman of the FCC. It was also reported that Trump is considering Kevin Warsh and Marc Rowan for US Treasury Secretary, according to NYT, while Trump was reportedly seeking a pledge that his Treasury Secretary will enact tough tariffs, according to FT.

- Tesla +7.7% in the premarket after people familiar said Trump’s team is seeking to encourage the development of fully self-driving vehicles. BBG

- Fed’s Barkin (2024 voter) said on Friday that he always expected core PCE would stay in the ‘high twos’ in H2 and is still seeing progress on inflation, while he added that pricing power is getting more limited, according to a Yahoo Finance interview. Furthermore, Barkin said he hopes and expects that inflation numbers will come down in Q1, as well as noted that they are a long way from knowing what will happen with tariffs and it is hard to know the impact.

- Fed’s Collins (2025 voter) said on Friday that there is not a moment where policy forward guidance is a good idea and Fed policy is well positioned for what lies ahead in the economy, while she added it is too soon to say the impact of the election on the economic policy and the Fed needs to see data before deciding on the December FOMC. Furthermore, Collins said they do not need the labour market to soften further and they are not seeing signs of fresh inflation pressures, while she added the data suggests more room to run on the balance sheet rundown, as well as noted that monetary policy is restrictive and will need to ease over time.

- Fed’s Goolsbee (2025 voter) said on Friday that he does not like tying the Fed’s hands and there is still more data to come when asked about a December rate cut or pause, while he added that markets react immediately and in most extreme terms. Goolsbee also said the Fed needs to focus on longer trends and he will be looking at rate cuts along the lines of the September Fed policymaker projections.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week with a mildly positive following last Friday’s tech-led declines on Wall St which were triggered by hot US data and with quiet newsflow from over the weekend aside from Russian geopolitical-related headlines. ASX 200 was contained as losses in tech, healthcare and financials offset gains in utilities, commodities and consumer stocks. Nikkei 225 declined at the open after last Friday’s currency strength and with a surprise contraction in Machinery Orders, although was off today’s worst level with some mild support seen as the yen weakened following BoJ Governor Ueda’s comments. Hang Seng and Shanghai Comp traded higher amid a focus on recent earnings releases and after the PBoC continued its liquidity efforts, while Chinese President Xi said that China is ‘ready to work’ with Trump during a meeting with US President Biden.

Top Asian News

- RBA’s Kent says most borrowers have buffers to help manage higher interest rates; Worth reviewing the RBA’s approach to forward guidance from time to time; forward guidance in Australia might be less useful than in the US

- US President Biden told Chinese President Xi that keeping open lines of leader-to-leader communication is vital through transition and beyond, while they agreed that AI will not ever take control of nuclear weapons and Biden raised concerns about unfair, non-market economic practices by China and issues in the South China Sea.

- Chinese President Xi told US President Biden that China’s commitment to a stable, healthy and sustainable development of China-US relations remains unchanged and China is willing to maintain dialogue, expand cooperation and manage differences with the US government in an effort to realise a smooth transition period in China-US relations. Xi also told Biden that common interests between their countries are expanding rather than shrinking and that containing China is unwise, unacceptable and bound to fail. Furthermore, Xi said the China-US relationship would make considerable progress when the two countries treat each other as a partner and a friend and that he is ready to work with Donald Trump to manage ties.

- Chinese President Xi told US President Biden the Taiwan question, democracy and human rights, the system, and rights to development are China’s four red lines which allow no challenge, while Xi said the US should refrain from making any moves that have a chilling effect and told Biden to deal with the Taiwan issue with “extreme caution”, according to state media.

- China’s Commerce Minister met with the Canadian Minister for International Trade in Peru and discussed the tariff situation.

- China’s securities regulator said it is to improve the coordination mechanism for overseas listing supervision and regulation, while it will expand the scope of eligible stocks under the stock connect.

- China and the EU are said to have reached a “technical consensus” in talks regarding tariffs the bloc applied to Chinese electrical vehicles, according to a Weibo account affiliated with the state-run China Central Television cited by Automotive News.

- BoJ Governor Ueda said they will continue to raise the policy rate and adjust the degree of monetary support if the economy and prices move in line with their forecasts, while he also stated there is no change to BoJ’s stance to underpin economic activity and the timing of rate hike will depend on economic, price, and financial outlook. Ueda said they will make a policy decision by updating the economic and price outlook with data and information available at the time, while he noted that gradually adjusting the degree of monetary support will contribute to durably achieving the price target through sustained economic growth and they must be vigilant to various risks including overseas and market developments. Furthermore, Ueda said there are numerous factors they want to check including on US economy but won’t necessarily wait until there is clarity for all of them and if they don’t adjust the degree of monetary support appropriately, they could be forced to hike rates rapidly.

European bourses began the session on a mixed/flat footing, and initially lacked any firm direction. Soon after the cash open, sentiment improved, however, this upside quickly dissipated to show a mostly negative picture across Europe. European sectors hold a strong negative bias, with only a couple of sectors in positive territory. Basic Resources tops the pile, benefiting from strength in underlying metals prices. Real Estate & Tech are found at the foot of the pile, hampered by the relatively high yield environment. US Equity Futures are mixed, with slight outperformance in the tech-heavy NQ, attempting to pare back some of the hefty losses in the prior session. Barclays cuts Europoean Healthcare to underweight, Utilities to Market weight, Luxury, Insurance to Overweight

Top European News

- ECB’s Nagel says global integration would have to decline substantially to prompt a notable increase in inflationary pressures. Proposed tariffs by US President-elect Trump would upend international trade but only have a “minor impact” on inflation.

- ECB’s de Guindos says balance of risks have shifted to growth from inflation.

- ECB’s Makhlouf does not think the job is done on taming inflation; services inflation is higher than he wants. Adds that he does not feel the need to rush, at the moment. Says ECB must think like a long-distance runner. Says prudence and caution have a premium to them, ECB should continue in that manner

- UK government confirmed the spread of bird flu in commercial poultry at premises near Rosudgeon, St. Ives, Cornwall, according to Reuters.

FX

- DXY has kicked the week off on a contained footing with not much to shift the macro dial over the weekend. DXY is currently caged within Friday’s 106.33-96 range. If upside resumes, last week’s YTD peak sits at 107.06.

- EUR/USD currently sits towards the upper end of Friday’s 1.0516-93 range as the USD gives back some of its recent gains. EZ-specific newsflow has been light, but ECB’s Lagarde and Lane are due later.

- JPY is the marginal laggard vs. the USD across the majors after BoJ Governor Ueda continued to signal a lack of urgency to hike rates but reiterated the BoJ will continue to adjust monetary support if the economy and prices move in line with their forecasts. He later warned they could be forced to hike rapidly if they don’t adjust the degree of monetary support appropriately. USD/JPY currently sits towards the bottom end of Friday’s 153.85-156.74 range.

- GBP is steady vs. the USD but in close proximity to Friday’s multi-month low at 1.2597 that was triggered by a soft outturn for Q3 UK GDP. Docket for today is light, but inflation/PMI data is due later in the week.

- Antipodeans are both marginally softer vs. the USD with not much in the way of fresh drivers to instigate price action. Both currencies remain sensitive to the fallout from the US election and the tone that Trump will strike towards China.

Fixed Income

- Minor losses for the Dec’24 UST with prices currently in consolidation mode after the election. The Dec’24 UST contract is currently within Friday’s 108.30-109.23+ range; the lower bound of which was a contract low. The US yield curve is marginally bull-steepening with the 2s10s wider by around 14bps.

- Bunds are lower in a slight unwind of some of last week’s upside. Macro focus around the Eurozone remains on the growth outlook with ECB’s de Guindos this morning remarking that this is where the Bank is currently focusing. The Dec’24 Bund contract is currently lingering below the 132 mark, having breached the low on Friday to a current trough of 131.62. ECB President Lagarde & Lane are due to speak later.

- Gilts are marginally softer, in-fitting with price action in global peers. The macro narrative towards the back-end of last week was characterised by the soft outturn for Q3 UK GDP. The Dec’24 Gilt contract is currently capped by resistance at 94.00 which coincides with Friday’s peak. The UK 10yr yield currently lingers just above Friday’s trough at 4.46%.

Commodities

- WTI and Brent are firmer in what has been a choppy session for the complex thus far, having initially swung between gains and losses since the cash open. Brent’Jan 25 resides towards the upper end of a USD 70.70-71.80/bbl range.

- Precious metals are on a firmer footing, having rallied overnight alongside strength in silver, but without a clear catalyst driving the upside. XAU currently holds towards the upper end of a USD 2,566-597/oz range.

- Base metals hold a positive bias, continuing the price action seen overnight, where the complex benefited from a generally positive risk sentiment in APAC trade overnight.

- US President Biden’s administration plans on releasing a study on LNG environmental impacts and hopes to finalise a clean fuel bill before the January 20th Inauguration Day, according to the White House.

- Goldman Sachs sees Brent crude trading USD 70-85/bbl but could climb on harsher Trump sanctions on Iran, while it reiterated its gold target of USD 3,000/oz by December 2025.

- Russia’s Ilsky oil refinery (300k bpd) has asked government for help, mainly over facility modernization and high interest rates.

Geopolitics: Middle East

- A Lebanese official says “We are open to the content of the draft US proposal and deal with it positively”, via Al Jazeera.

- Israel conducted a strike on Beirut which killed Hezbollah’s media relations chief Mohammad Afif, according to security sources cited by Reuters.

- Tens were killed in an Israeli strike on a residential building in northern Gaza’s Beit Lahiya, according to Reuters.

- Iranian Foreign Minister Araqchi said he strongly denies the reported meeting between Iran’s envoy and Elon Musk, while he added if the IAEA Board of Governors passes a resolution against Iran, Tehran will take reciprocal action and implement new measures in its nuclear program.

- Iran reportedly keeps the door open to talks with US President-elect Trump and its Deputy Foreign Minister noted that Tehran favours negotiations but will not yield to maximum pressure strategy, according to FT.

Geopolitics: Ukraine

- US President Biden’s administration lifted restrictions on Ukraine using US-made weapons to strike deep inside Russia, according to sources familiar with the decision cited by Reuters. NYT also reported that President Biden allowed Ukraine to strike Russia with long-range US missiles, while Ukrainian President Zelensky said missiles speak for themselves and such things are not announced regarding long-range strikes.

- Russia’s Kremlin on reported decision by Biden Administration to allow Ukraine to strike deep into Russia says these reports did not have official sources; if such a decision has been made by the US, this will usher in a new round of tensions. It would mean a new situation with the involvement of the US in the Ukraine conflict. If Western weapons are fired deep into Russia, this will not be Ukraine doing the targeting, but those countries which gave permission.

- US President Biden’s decision to allow Ukraine to use long-range missiles to hit the Russian depth was communicated to Kyiv about 3 days ago, while the motive behind the decision is to deter North Korea from sending more troops to Russia, according to a source cited by Axios.

- Russian upper house’s international affairs committee deputy head Dzhabarov said the decision to allow Ukraine to strike inside of Russia with US missiles is an unprecedented step that could lead to World War Three and will receive a swift response, according to TASS. Furthermore, it was also reported that a senior Russian senator said the US decision to allow Kyiv to strike Russia with long-range weapons represents escalation and could result in the Ukrainian statehood being in complete ruins by the morning.

- Ukrainian President Zelensky said Russia launched around 120 missiles and 90 drones in a massive combined air strike on Ukraine’s energy infrastructure early on Sunday morning, while Ukraine’s largest private power company said the Russian air strike damaged thermal power stations, according to Reuters. Furthermore, Russia’s Defence Ministry said Russian forces launched a massive strike on Ukraine’s critical energy infrastructure facilities that support the defence industry and military enterprises, according to RIA.

- Russian forces struck critical infrastructure in Ukraine’s Zaporizhzhia region and western Ukraine’s Rivne region, while Russia’s missile attack damaged energy infrastructure in Ukraine’s north-western Volyn region.

- Poland activated aircraft to ensure airspace security after Russia launched a missile attack on Ukraine.

- French President Macron said the massive Russian attack on Ukraine shows Russian President Putin does not want peace and they must continue helping Ukraine defend itself.

- Australia’s Defence Minister Marles said Japanese troops are to have regular deployment in Australia and focus on cooperation between Australian and US Marines.

- North Korean leader Kim urged the military to improve capabilities for fighting an actual war, while he added that threats by the US and allies brought tensions and calls for war preparations, according to KCNA.

- North Korea said Russia’s delegation led by the national resources minister arrived in North Korea, according to KCNA. It was separately reported that North Korea may end up sending 100k troops to Russian President Putin to support Russia’s war in Ukraine although it was also stated that the move is not imminent and troops could rotate in batches, according to Bloomberg.

US Event Calendar

- 08:30: Nov. New York Fed Services Business, prior -2.2

- 10:00: Nov. NAHB Housing Market Index, est. 42, prior 43

- 16:00: Sept. Total Net TIC Flows, prior $79.2b

DB’s Jim Reid concludes the overnight wrap

I went to bed at 7:30pm last night as a bout of suspected food poisoning has left me drained. I had a fever in the night which probably explains why I had the most peculiar dream where I was flying on a magic carpet. So please read the rest of the daily below this morning in that context.

At least it should be a quieter week as the recent relentless wave of US macro and political news flow in theory slows down with the main story on this front being on potential political appointments for the new Trump administration with Treasury secretary the one creating most interest with a huge amount of jockeying for position over the weekend between what are perceived to be the front runners, namely Scott Bessent and Howard Lutnick. Elon Musk endorsed the latter over the weekend suggesting he would be a disruptor. Indeed one of his recent quotes is that “When was America great? 125 years ago. We had no income tax, and all we had was tariffs.” So this will be a fascinating race.

Although the macro world will be much quieter this week just when you thought it was a good point to have a lie down after a busy few weeks, the biggest global earnings event happens after the bell on Wednesday with $3.48 trillion of market cap at stake. Yes you guessed it Nvidia reports after the bell. For context, the entire FTSE, DAX and CAC have a market cap of £2.08tn, €1.71tn and €2.31tn, respectively. So it’s like a whole G7 country’s stock markets reporting at exactly the same time.

The next most important event might be the global flash PMIs on Friday. The reason being that they may capture some of the initial sentiment impact from around the world regarding Trump’s victory. Europe will be especially interesting on this front as the continent awaits their trade fate.

Outside of that there will be a focus on inflation with final Eurozone CPI (tomorrow), Canadian CPI (tomorrow), UK CPI (Wednesday), German PPI (Wednesday), and Japan CPI (Thursday) being the key ones. For the UK, our economist sees a mixed bag of inflation data, with headline CPI (DB forecast 2.07% YoY) and RPI (DB forecast 3.29%) picking up amid higher energy prices but core CPI is seen declining to 3.07% YoY and services CPI slowing to 4.78% YoY. His full preview is here. In Japan, our Chief Japan economist sees the nationwide CPI printing 2.1% YoY for core inflation ex. fresh food (2.4% in September) and core-core inflation ex. fresh food and energy at 2.2% (+2.1%).

There are also plenty of central bank speakers which you can see in the day-by-day week ahead at the end as usual which includes all the other data highlights this coming week.

Over the weekend, the war in Ukraine made headlines as President Biden authorised Ukraine to use US long-range missiles to strike targets hundreds of miles inside Russia for the first time, according to reports. That followed Russia embarking on its largest missile/drone attack on Ukraine in months on Saturday night. It seems ahead of Trump taking office both sides want to be in as strong a position as they can as any possible deal will be negotiated from their current position in the war.

Moving onto Asia, it’s a mostly bright start to the week with the KOSPI (+1.90%) leading the way, driven by a rally in Samsung Electronics (a recent big laggard) after the company announced a surprise stock buyback plan. Chinese stocks are also higher, with the Shanghai Composite (+1.24%), the Hang Seng (+1.18%), and the CSI (+1.08%) all in positive territory following a call from China’s securities regulator for listed companies to boost stock returns through share buybacks and other methods. Conversely, the Nikkei (-1.03%) is bucking the regional trend after BOJ Governor Kazuo Ueda indicated that the central bank would continue raising rates if the economy and prices evolve as expected. S&P 500 (+0.28%) and NASDAQ 100 (+0.73%) futures are strong for this time of day after a sizeable -2.24% slump for the latter on Friday.

Early morning data showed that Japanese core machine orders unexpectedly contracted -4.8% y/y in September (v/s +1.8% expected) as against a -3.4% drop in the previous month.

Recapping last week now, markets lost ground from their post-election surge as the week progressed, as concerns about inflation and a potential trade war dampened risk appetite. In particular, US core CPI came in at +0.3% for a third month running in October, whilst core PPI was also at +0.3%, raising fears that inflation was becoming stuck above the Fed’s target. Then on top of that, Fed Chair Powell himself said that the economy was “not sending any signals that we need to be in a hurry to lower rates”. So that led to growing doubts about a December rate cut, and futures dialled back the probability of a cut to 58%, down from 65% the previous week and a high of 82% last Wednesday.

With investors pricing in more hawkish policy, 2yr Treasury yields rose +5.0bps on the week, though they retreated -4.2bps amid a risk-off mood on Friday. The rise in yields was larger at the long-end, with the 10yr yield up +13.5bps (+0.3bps Friday) to 4.44%, its highest weekly closing level since May. That rise was led by real yields, with the 10yr real yield +15.9bps higher (+0.7bps Friday) to 2.11%. In turn, that meant the dollar index strengthened for a 7th consecutive week to a one-year high, having risen by +1.61% (+0.01% Friday). That dollar strength was partly as the rise in yields was not matched in Europe, with investors pricing a widening rate differential between the Fed and the ECB with the 10yr bund yield actually falling -1.1bps over the week (+0.3bps Friday) to 2.35%.

In the equity space, the S&P 500 fell -2.08% (-1.32% Friday), its worst performance in ten weeks, and erasing 60% of its post-election jump. The retreat was fairly broad, with weakness among chipmarkers and pushing the Philadelphia Semiconductor index -8.64% (-3.42% Friday), while the small-cap Russell 2000 was down -3.99% (-1.42% Friday). European equities saw a relative outperformance, with the STOXX 600 only down -0.69% (-0.77% Friday), but this still marked a 4th consecutive weekly decline for the index.

Finally, it was another strong week for Bitcoin, which was up by another +17.08% in the week ending Friday, with a closing value of $89,511. Moreover, at its intraday peak on the Wednesday, Bitcoin had risen as high as $93,462. However, for commodities it was a pretty poor performance, with Brent crude down -3.83% to $71.04/bbl, whilst gold suffered its worst weekly performance since June 2021, with a -4.53% decline last week to $2,563/oz.