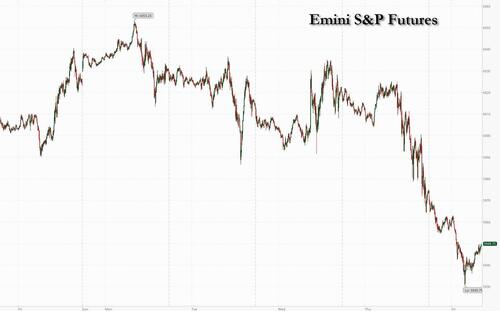

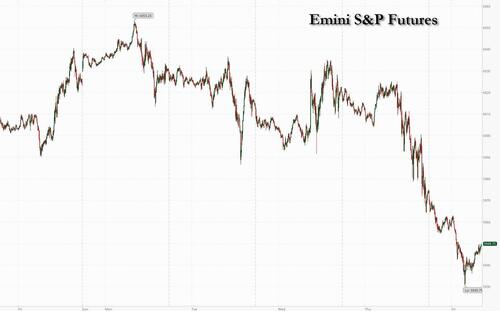

US equity futures drop, and global stocks slide after Fed chair Jerome Powell signaled the Federal Reserve was in no rush to cut interest rates, and unease built over the composition of Donald Trump’s cabinet. As of 8:00am ET, S&P futures were down 0.5%, off session lows; and pointing to a second day of declines; Nasdaq 100 futures were down 0.9% with Mag 7 mostly lower: AAPL, MSFT and META are all 1.0% lower. Drugmakers Moderna, Novavax and BioNTech all slid in New York premarket trading after Trump picked vaccine-skeptic RFK Jr, as his Health secretary. Domino’s Pizza Inc. was among the prominent gainers, after Buffett took a small stake in the restaurant chain. Europe’s Stoxx 600 index slipped 0.3%, on track for its fourth weekly drop, with pharma sector among the biggest laggards, while the MSCI Asia Pacific Index climbed as much as 0.7%, snapping a five-day loss. Bond yields are modestly lower, and the USD retreated, trimming its weekly gain, as some market participants took profit before key data later on Friday and ahead of speeches from Federal Reserve policymakers despite Powell’s clearly hawkish comments. Commodities are mixed, with oil flat, reversing an earlier loss of -1.4%; base metals are lower, while precious metals rise.

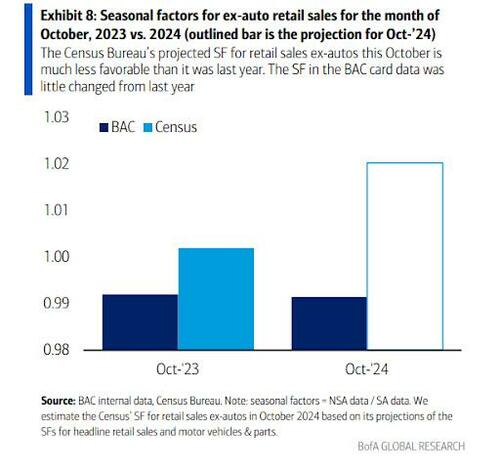

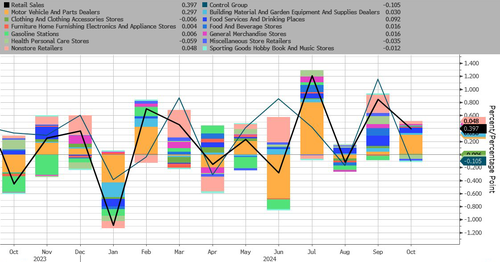

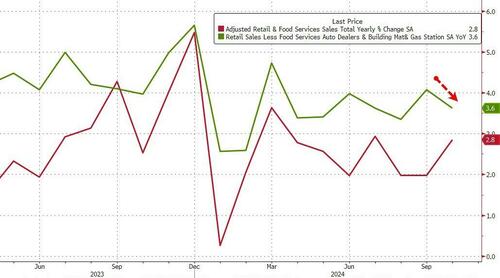

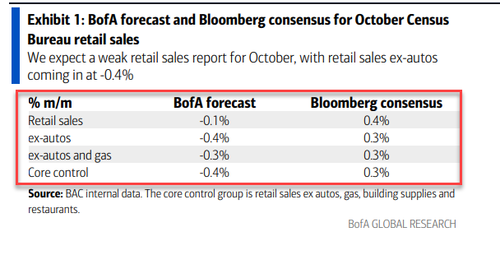

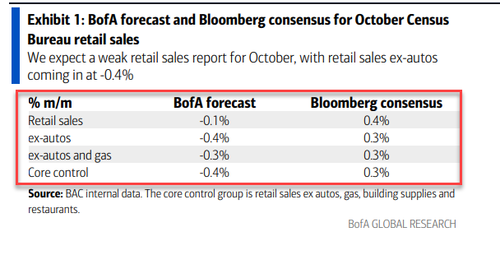

Today, we will receive a slew of growth data: more clarity on the Fed’s path may emerge Friday, with retail sales data due and a host of Fed officials set to speak. Bank of America real-time credit and debit card data suggest a big miss in today’s retail sales print. We also get the October Industrial Production data.

In pre-market trading, Moderna and other vaccine makers fell in premarket trading after President-elect Donald Trump said he was tapping vaccine skeptic Robert F. Kennedy Jr. to lead the Department of Health and Human Services. Moderna -2%, Novavax (NVAX) -1%. Domino’s Pizza rose 6% after Berkshire Hathaway bought stock in the pizza chain as Chairman Warren Buffett cut back on some long-held investments. Here are some other notable movers:

- Alibaba ADRS (BABA) rises 3% as a profit beat offset revenue that came in below analyst estimates.

- Applied Materials (AMAT) drops 8% after the semiconductor capital equipment company gave an outlook that raised concerns over chip spending.

- Despegar.com (DESP) rises 13% after the online travel booking services company reported third-quarter revenue that beat estimates.

- Palantir (PLTR) gains 2% after the AI software maker said it was transfering its stock listing to Nasdaq from NYSE.

The S&P has now given up about a third of the trough-to-peak gains notched after the US presidential election, as some of the optimism over corporate growth under Trump fades. There’s also realization that interest rates will fall less quickly than anticipated, with recent data showing still-elevated inflation pressures and Powell confirming the Fed may take its time easing policy.

“Equity markets seem to be adjusting to the new rate cut trajectory but it doesn’t seem to be a game changer,” said Mathieu Racheter, head of equity strategy at Julius Baer Group Ltd. “Some controversial cabinet announcements obviously do not help the market.”

Powell’s remarks have pushed odds on a December rate cut to less than 60% from roughly 80% a day earlier. Yields on two-year Treasuries steadied after jumping in the previous session in response. The higher-for-longer rates view is supportive for the dollar, however. The greenback stayed below two-year highs hit on Thursday, but is set for its seventh straight weekly gain. More clarity on the Fed’s path could emerge later Friday, as the US releases retail sales data and a host of Fed officials are set to speak.

In Europe the Stoxx 600 index slipped 0.3%, on track for its fourth weekly drop, with pharma sector among the biggest laggards, after Trump named RFK Jr to the top health-policy role. Vaccine makers Sanofi, GSK Plc and AstraZeneca Plc fell after the news. Generali and Aegon are both among the biggest gainers, both on their respective solid earnings. Here are the biggest movers Friday:

- Generali advance as much as 5.7%, the best performing stock on the Stoxx 600 Insurance Index, after the Italian insurer beat profit estimates and analysts said it’s on track to meet targets

- Aegon shares rise as much as 4.1% to hit their highest level since May, after the financial services and insurance company lifted its operating-capital generation guidance for the full year

- Evotec surges as much as 23% after the German drug developer received a non-binding proposal from Halozyme Therapeutics to acquire the company for €11 per share, valuing the firm at €2b

- Continental shares rise as much as 3% to their highest intraday value since June as UBS says the planned spinoff of the German car parts firm’s automotive division looks increasingly likely

- Land Securities shares rise as much as 3% after the property investment firm upgraded its guidance. Shore Capital noted management is more confident about an improvement in rental growth

- TT Electronics jumps as much as 39%, the biggest gain in four years, after rejecting takeover proposals tabled by fellow London-listed firm Volex, which has slumped as much as 11% this morning

- InterContinental Hotels edge up as much as 1.1%, hitting a new record-high, after analysts at Barclays upgraded the stock and said they now prefer the hotelier over its rival Whitbread

- European vaccine makers trade lower on Friday, weighing on the broader healthcare sector, after US President-elect Donald Trump said he’s tapping Robert F. Kennedy Jr. to run the Department of Health and Human Services

- Cargotec falls as much as 9.5% after the Helsinki-listed company signed an agreement to sell its MacGregor business to funds managed by Triton for an enterprise value of €480m

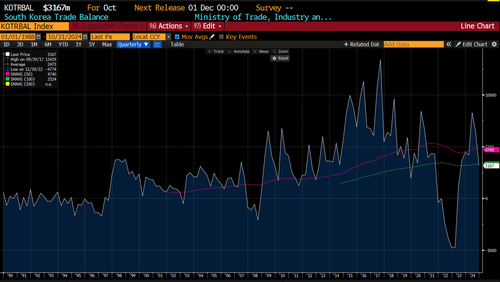

Earlier, in Asia the MSCI Asia Pacific Index climbed as much as 0.7%, snapping a five-day loss. Samsung Electronics provided the biggest boost as the South Korean chipmaker rose the most in four years. Mizuho Financial Group and Toyota Motor were among the other notable contributors to the advance. China’s CSI 300 Index dropped despite signs of resilience in the nation’s economy as concerns over a deepening rift with the US outweighed signs of economic stabilization. “Concerns over the Trump administration continue to suppress market risk appetite,” said Ken Chen, an analyst at KGI Securities, referring to Chinese equities. “In addition, some investors interpreted authorities’ appeal to build a slow bull market as an intention to cool down the rally, so they chose to take profit when they can.”

The dollar retreated, trimming its weekly gain, as some market participants took profit before key data later on Friday and ahead of speeches from Federal Reserve policymakers. The market pivoted from Trump trades to the Fed’s cautious tone on interest-rate cuts. Traders pared back December Fed rate-cut odds after Chair Powell’s remarks on economic resilience, stabilizing Treasury yields after Thursday’s swings. The yen outperformed G-10 FX near 155.20/USD on intervention speculation.

In rates, treasuries are mixed with front-end outperforming, recouping some of the losses from late Thursday after comments by Powell curbed wagers on a December rate cut. The yield curve is steeper, likewise reversing part of the flattening reaction to Powell. Front-end yields are richer by more than 3bp with 30-year slightly cheaper on the day; 2s10s and 5s30s curves are nearly 3bp steeper near session wides, erasing about half of Thursday’s flattening. Two-year USTs outperform comparable bunds and gilts, with US yields down 2bps to 4.32%; the US 10-year is little changed around 4.43%, Germany’s also little changed while UK 10-year yield is ~1bp lower on the day. Friday’s US session includes four Fed speakers and retail sales data.

In commodities, oil and gold headed for a weekly drop, weighed down by the stronger dollar. WTI crude drops 1.1% to $67.94, gold steadies at $2,566/oz.

Another of the so-called Trump trades, Bitcoin, also gave up some gains. It hit a record $93,000 level earlier this week on hopes of crypto-friendly policies from the new US administration, but has since dipped back to $87,000. “Much of the good news is already priced into Bitcoin. What the market needs now are concrete political steps from the Trump administration,” said Jochen Stanzl, Chief Market Analyst at CMC Markets. “Otherwise, as with many US equities, a cooling-off is overdue for this ‘Trump trade’ as well.”

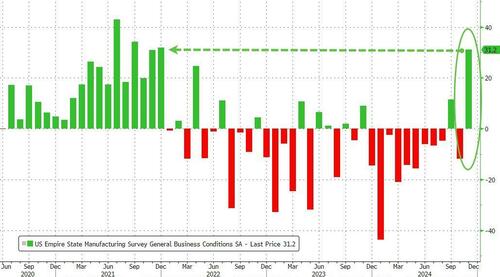

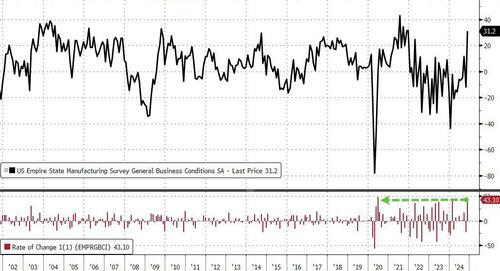

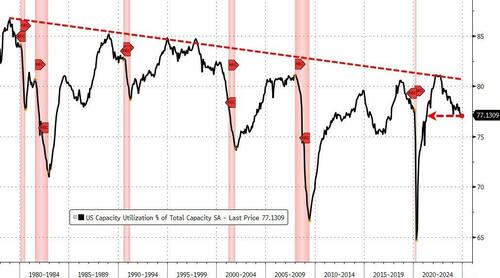

Looking at today’s US economic data calendar we get November Empire manufacturing, October retail sales and import/export price indexes (8:30am New York time), October industrial production (9:15am) and September business inventories (10am). Fed speaker slate includes Goolsbee (8:30am, 2:05pm), Collins (9am, 10:30am), Williams (1:15pm) and Barkin (3pm)

Market Snapshot

- S&P 500 futures down 0.6% to 5,940.50

- MXAP up 0.4% to 182.01

- MXAPJ up 0.2% to 575.59

- Nikkei up 0.3% to 38,642.91

- Topix up 0.4% to 2,711.64

- Hang Seng Index little changed at 19,426.34

- Shanghai Composite down 1.5% to 3,330.73

- Sensex down 0.1% to 77,580.31

- Australia S&P/ASX 200 up 0.7% to 8,285.15

- Kospi little changed at 2,416.86

- STOXX Europe 600 down 0.4% to 504.95

- German 10Y yield little changed at 2.35%

- Euro up 0.4% to $1.0571

- Brent Futures down 1.1% to $71.79/bbl

- Gold spot up 0.0% to $2,565.78

- US Dollar Index down 0.13% to 106.53

Top Overnight News

- US President-elect Trump picked RFK Jr to be Health and Human Services Secretary and said North Dakota Governor Burgum will be the Interior Secretary. It was separately reported that a US private funds group asked Trump to review harmful rules, preserve pro-growth taxes and promote alternative assets: Reuters.

- China’s October economic data was mixed, with solid retail sales (+4.8% Y/Y, about 100bp ahead of the Street’s +3.8% forecast and up from +3.2% in Sept) but soft industrial production (+5.3% vs. the Street +5.6%) and continued pressure in real estate. Reuters

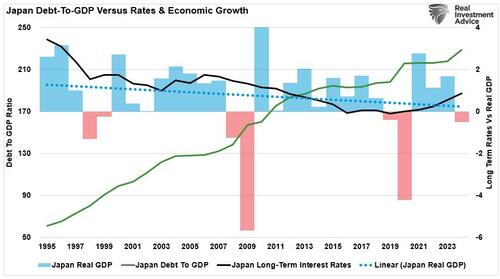

- Japan’s Q3 GDP slowed vs. Q3, but it still came in ahead of expectations while consumption rebounded, keeping the BOJ on track to continue tightening policy. WSJ

- Kazuo Ueda will speak on Monday in what may be his last major scheduled speech before next month’s BOJ meeting. The head of one of Japan’s largest labor unions said workers need to see consistent gains in real wages for the BOJ to continue raising interest rates. BBG

- Musk met with Iran’s UN Ambassador and discussed ways for Tehran and Washington to defuse tensions. NYT

- The UK economy cooled by more than expected last quarter, with most industries experiencing subdued growth amid growing concerns over Labour’s first budget. In September, GDP shrank 0.1% — consensus was for 0.2% growth. BBG

- The euro area’s GDP will increase by 1.3% next year and 1.6% in 2026, the European Commission said. That’s slightly stronger than what the IMF predicted last month and notably higher than the 0.8% seen by officials for 2024. BBG

- Senate Republicans are skeptical of Donald Trump’s aggressive new tariff plans — especially lawmakers from states with large agriculture industries that could bear the brunt of likely foreign retaliation. Politico

- Franklin Resources will begin taking over parts of its Western Asset Mgmt. and cutting costs following a recent exodus of assets. BBG

- Gold’s decline may continue on momentum-driving sales before bottoming, MLIV said. CTAs could sell an additional 15% of their holdings in the coming sessions, TD Securities said. Gold ticked up on the day. BBG

- Fed’s Collins (2025 voter) says a December rate cut is “certainly on the table but is not a done deal”, according to WSJ. Expects lower rates will be warranted. Says Fed policy is restrictive. Does not see signs of new price pressures. There will be more data between now and December meeting.

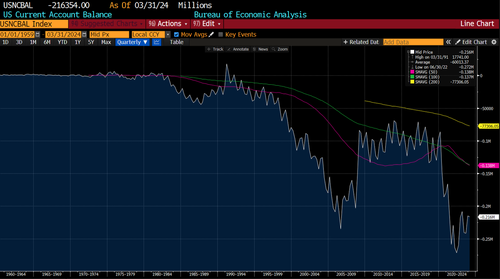

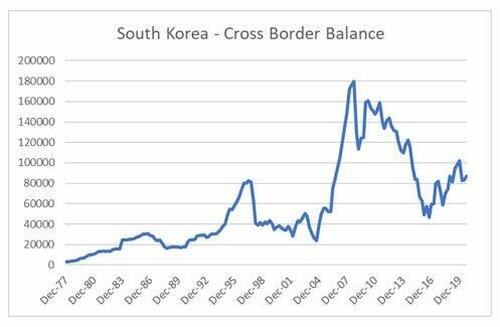

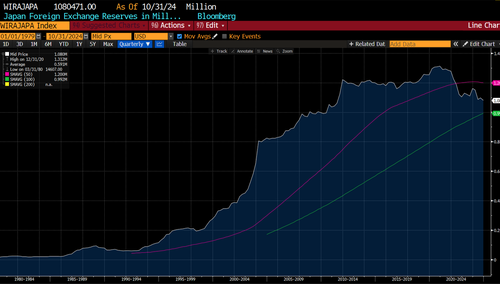

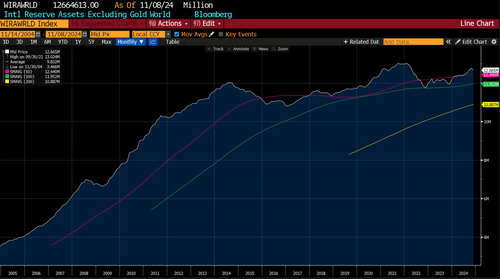

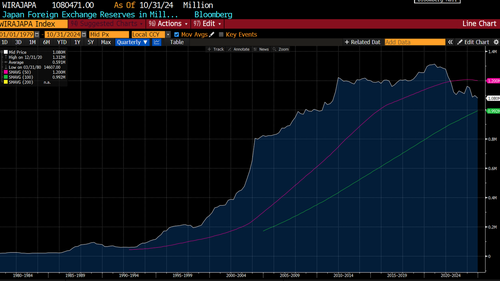

- US Treasury’s semi-annual currency report found no major US trading partners manipulated currency to gain unfair trade advantage in four quarters through June 2024 as no major trading partners met all three criteria for enhanced analysis during the review period. However, the monitoring list of trading partners whose currency practices ‘merit close attention’ includes China, Japan, South Korea, Singapore, Taiwan, Vietnam and Germany.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a predominantly positive bias albeit with gains capped following the uninspiring handover from Wall Street and as participants digested recent earnings releases and mixed Chinese activity data. ASX 200 was led by outperformance in Utilities and with gains in nearly all sectors aside from Healthcare amid headwinds for the latter following pressure in the industry stateside after US President-elect Trump picked vaccine sceptic RFK Jr as HHS Secretary. Nikkei 225 rallied on the back of recent currency weakness and with outperformance seen in some financial names after Japanese megabanks’ earnings results, while GDP data was mostly either inline or better than expected. Hang Seng and Shanghai Comp ultimately gained but saw mixed price action throughout the day after various data releases in which Industrial Production disappointed but Retail Sales topped forecasts, while Chinese Home Prices showed a steeper Y/Y drop although the M/M decline moderated. Participants also digested tech earnings and the PBoC’s largest daily liquidity injection via reverse repos in over four years which is meant to counteract factors including maturing MLF loans and tax payments.

Top Asian news

- China’s Finance Ministry will reduce export tax rebate rate for refined oil products, photovoltaics, batteries, and select non-metallic mineral products from 13-9% from Dec 2024. Will cancel the export tax rebate for aluminium and copper products, and chemically modified animal, plant, or microbial oils and fats.

- Alibaba (BABA/ 9988 HK) reportedly mulling offering USD 5bln in bonds.

- China’s MOFCOM is releasing a dual-use item export control list, which will be effective from December 1st; does not involve adj. to specific scope of export control.

- Hong Kong revises 2024 GDP forecast to 2.5% (prev. forecast at 2.5-3.0%)

- PBoC injected CNY 981bln via 7-day reverse repos with the rate at 1.50% which was the largest daily cash injection through reverse repos since February 2020, while it stated that Friday’s cash injection through reverse repos was meant to counteract factors including maturing MLF loans and tax payments.

- China’s stats bureau said domestic demand is still insufficient but noted major economic indicators recovered ‘markedly’ in October and China’s consumer expectations improved, while they will consolidate the trend in economic recovery, step up policy adjustments and expand domestic demand. Furthermore, it stated that recent policies have shown positive effects on the economy and it is increasingly confident of achieving the 2024 economic growth target but noted that consumption growth still faces some constraints.

- Japanese Finance Minister Kato said they will take appropriate action against excessive FX moves, while he added that one-sided, sharp moves were seen in the FX market and it is important for FX rates to move stably reflecting fundamentals.

European bourses began the session on a mostly lower footing, in a continuation of the losses seen on Wall St. in the prior session; a paring of the strength seen in Europe on Thursday may also be at play. Since the cash open, sentiment gradually improved, but indices now display a mixed picture in Europe. European sectors are mixed vs initially opening with a strong negative bias. Energy is towards the top of the pile, with Banks and Insurance following just behind. Healthcare is by far the clear underperformer, with several heavyweights within the sector seeing notable downside after US President-elect Trump picked vaccine sceptic RFK Jr as HHS Secretary. US equity futures are entirely in the red, with slight underperformance in the tech-heavy NQ, in a continuation of the negative price action seen in the prior session; which was ultimately sparked by a hawkish-leaning Powell. US finalises USD 6.6bln chips subsidy award for TSMC, according to the US Commerce Department.

Top European news

- European Commissions sees EZ economic growth at 0.8% in 2024, 1.35% in 2025, 1.6% in 2026. Sees EZ inflation at 2.4% in 2024, 2.1% in 2025, 1.9% in 2026. Sees German GDP to expand by 0.7% in 2025 (prev. forecast 1.0%). GDP growth expected to accelerate to 1.3% in 2026 (remains below EZ avg. of 1.6%). German economy contract 0.1% this year vs 0.1% growth in spring forecast.

- Germany’s SPD leader says they do not need to wait for a new gov’t to begin debt brake reform, willingness to reform from the opposition leader is a good starting point, via Handelsblatt.

FX

- DXY is pulling back after another surge on Thursday which saw a high of 107.07, with hawkish Powell keeping the buck afloat in late hours. Ahead, US retail sales and a number of Fed speakers. Comments from Fed’s Collins who noted that a December rate cut is “certainly on the table but is not a done deal”, had little impact on the index.

- EUR is benefitting from a softer Dollar and seeing a rebound from yesterday’s worst levels (1.0496 low) as the pair attempts to climb back to yesterday’s best (1.0582).

- GBP is relatively flat and unable to benefit from the pullback in the Dollar following downbeat GDP data across the board.

- JPY is the G10 outperformer after a week of underperformance with desks citing pre-weekend profit-taking, whilst Japanese GDP data mostly matched or topped estimates. USD/JPY overnight hit a fresh weekly high of 156.74 before pulling back to a current 155.40 low.

- Antipodeans are modestly firmer as DXY pulls back from its weekly highs, in turn offering some reprieve to peers alongside the base metals complex.

- PBoC set USD/CNY mid-point at 7.1992 vs exp. 7.2482 (prev. 7.1966).

- Indonesia’s Central Bank says it has conducted “triple intervention” within the FX market to maintain market confidence.

Fixed Income

- USTs are under slight pressure as markets continue to digest the hawkish tone from Powell. As it stands, USTs have climbed above the overnight low at 109-06, and currently sits below its session high at 109-16+. Yields are currently firmer across the curve with the short-end leading after the Fed Chair. US Retail Sales and Fed speak is due.

- Bunds spent first part of the morning with a very slight negative bias, in-fitting with USTs. Benchmarks seemingly derived some support most recently from the latest Commission forecasts. EZ-specific updates have been fairly limited, but the docket ahead sees Lane, Cipollone & Panetta.

- Gilts are the modest outperformer as the morning’s GDP data serves as a dovish impetus. Though, market pricing hasn’t really changed with just a ~20% chance of a December cut. Up to a 93.89 peak, having surpassed the 93.85 from Thursday but is yet to test the 94.00 mark.

- UK DMO plans to hold three syndicated Gilt sales in the January-March 2025 period; intends to sell a new 10yr Gilt and 20-25yr I/L syndication in February and March.

Commodities

- Crude is lower across the board heading into the end of the week amid efforts to reach a ceasefire between Israel and Lebanon whilst Iran attempts to cool tensions with the US. Brent Jan also trades towards the lower end of its USD 71.33-72.39/bbl range.

- Mixed trade across precious metals this morning despite the substantial pullback in the Dollar, with some potential tailwinds emanating from attempts to cool geopolitical tensions amid efforts to reach a ceasefire between Israel and Lebanon whilst Iran attempts to cool tensions with the US. Spot gold yesterday briefly dipped under its 100 DMA (2,545.21/oz) to a USD 2,536.71/oz low.

- Mixed trade across base metals with a positive bias in recent trade as prices recover alongside the pullback in the Dollar. 3M LME copper trades on either side of USD 9,000/t in a current USD 8,997.50-9,077.50/t range. Copper caught a slight bid following news that China’s Finance Ministry will cancel the export tax rebate for aluminium and copper products.

Geopolitics: Middle East

- The Senior Advisor to Iran’s Khamenei says “we support any ceasefire decision taken by the Lebanese government and resistance”.

- Israeli source says Hezbollah’s response to the American outline is expected “within days”, according to Kann News.

- Iran provided written assurances to the US administration in October that it was not seeking to kill Presidential contender Trump, via WSJ citing a US official; assurances which were intended to cool tensions between the US and Iran.

- Iran is preparing for Operation Sincere Promise 3 to respond to the Israeli attack, according to Sky News Arabia citing a Member of the Expediency in Iran.

- Israeli army issues new warnings to evacuate buildings in Burj al-Barajneh and Ghobeiry in the southern suburb of Beirut, according to Sky News Arabia.

- Israeli forces push deeper into Lebanon in a widening war campaign, while the expanding ground operation risks protracted conflict but could build leverage for ceasefire talks, according to WSJ.

- Hezbollah said it targeted a military base in Israel’s Tel Aviv and targeted a gathering of Israeli enemy forces in the Kiryat Shmona settlement with a barrage of rockets, according to Sky News Arabia.

- Elon Musk and Iran’s ambassador reportedly discussed how to ease US and Iran tensions, according to NYT. Iran’s ambassador told Musk during the meeting on Monday that sanctions waivers should be obtained from the Treasury Department, while Iranian sources said the meeting was positive, according to Al Arabiya.

Geopolitics: Other

- US President-elect Trump said they will avoid what happened before with their military in Afghanistan and will deal with the situation in Ukraine better, as well as work to reach a solution to the crisis.

- US President Biden administration official said the US must be prepared to expand its nuclear weapons force, while the decision on expanding US nuclear force will be left to President-elect Trump, according to WSJ.

- US and UK brought into force an amendment to the 1958 agreement between the two countries for cooperation in the uses of atomic energy in defence which will make the agreement enduring in its entirety, according to the US State Department.

- North Korean leader Kim guided a test of attack drones and ordered the mass production of suicide drones.

- Taiwan President Lai is planning to stop in Hawaii and maybe Guam during a visit to Pacific allies in the coming weeks, according to sources cited by Reuters.

- China’s Coast Guard said with China’s permission, the Philippines sent a civilian ship to transport supplies to its ‘illegally’ beached warship at the Second Thomas Shoal.

- The US plans additional sanctions to restrict Russia’s energy trade, plans to prohibit banks from dealing with Gazprombank, according to Nikkei.

US Event Calendar

- 08:30: Oct. Retail Sales Advance MoM, est. 0.3%, prior 0.4%

- Oct. Retail Sales Ex Auto MoM, est. 0.3%, prior 0.5%

- Oct. Retail Sales Control Group, est. 0.3%, prior 0.7%

- 08:30: Oct. Import Price Index MoM, est. -0.1%, prior -0.4%

- Oct. Import Price Index YoY, est. 0.3%, prior -0.1%

- Oct. Export Price Index MoM, est. -0.1%, prior -0.7%

- Oct. Export Price Index YoY, est. -1.7%, prior -2.1%

- 08:30: Nov. Empire Manufacturing, est. 0, prior -11.9

- 09:15: Oct. Industrial Production MoM, est. -0.3%, prior -0.3%

- Oct. Capacity Utilization, est. 77.1%, prior 77.5%

- Oct. Manufacturing (SIC) Production, est. -0.5%, prior -0.4%

- 10:00: Sept. Business Inventories, est. 0.2%, prior 0.3%

Central Bank speakers

- 08:30: Fed’s Goolsbee on CNBC

- 09:00: Fed’s Collins Gives Opening Remarks

- 10:30: Fed’s Collins Appears on Bloomberg TV

- 13:15: Fed’s Williams Gives Opening Remarks

DB’s Jim Reid concludes the overnight wrap

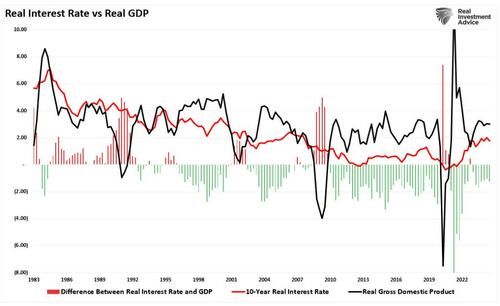

Risk assets struggled for momentum yesterday, with the S&P 500 (-0.60%) losing ground as investors reflected on some sticky inflation data and increasingly elevated valuations. The initial catalyst for that was the US PPI inflation for October, where the core PPI reading was stronger than expected, which added to fears that inflation could become stuck above the Fed’s target. Then later in the session, that narrative was reinforced by some hawkish comments from Fed Chair Powell, which added fresh doubts about the likelihood of a December rate cut. By the close, that meant futures had dialled back the probability of a December cut to 62%, down from more than 82% the previous day. Moreover, those moves have seen further momentum overnight, with the probability of a December cut down to 59% this morning, whilst the 10yr Treasury yield is currently at a 4-month high of 4.46%, and S&P 500 futures (-0.32%) are pointing to further losses.

In terms of Powell’s remarks, he explicitly said that the economy “is not sending any signals that we need to be in a hurry to lower rates”, and that its strength “gives us the ability to approach our decisions carefully”. Indeed, yesterday we found out that the weekly initial jobless claims fell to their lowest level since May, at 217k. So there was plenty of support for that message of economic strength, and it was a much more hawkish message from Powell relative his Jackson Hole speech in August, where he said that the “time has come for policy to adjust”. He also noted that yesterday’s PPI data was stronger than the Fed had pencilled in, seeing the data as consistent with a +2.8% yoy core PCE print.

Whilst the PPI data wasn’t that alarming by the standards of the high inflation of 2022-23, the problem was it showed inflation remaining stubbornly above levels consistent with the Fed’s target. For instance, the core PPI reading was at +0.3% (vs. +0.2% expected), which pushed up the year-on-year measure to +3.1% (vs. +3.0% expected). Moreover, that comes on the back of core CPI staying at +0.3% for a third month running, so the concern is that inflation is getting stuck at those levels. Now it’s worth noting that the Fed officially target the PCE measure of inflation, rather than the CPI or PPI measures, and we don’t get the PCE numbers until the end of the month. But we know several categories from the PPI release feed into the PCE, and those were on the stronger side, with sizeable increases in airfares and portfolio management prices. So one to look out for when the October PCE is released on November 27.

Against that backdrop, there were growing signs that investors were becoming more concerned about inflation. For instance, the US 2yr inflation swap up +0.7bps on the day to 2.63%, which is its highest in almost six months. In turn, that led to a notable rise in front-end Treasury yields, with the 2yr yield (+5.9bps) closing at 4.35%, its highest since July, having been near flat on the day before Powell’s comments. However, yields declined at the long end, with 10yr and 30yr yields -1.5bps and -4.9bps lower, respectively. So in some ways it was a mirror image of the curve steepening seen the previous day. One theme that persisted was dollar strength however, and the dollar index (+0.18%) posted a fifth consecutive advance to reach a one-year high.

For US equities, Powell’s comments reinforced what had already been a more challenging day, with the S&P 500 (-0.60%) seeing its largest decline so far this month. The NASDAQ (-0.64%) and the Magnificent 7 (-1.30%) saw sizeable declines, with Rivian (-14.30%) and Tesla (-5.77%) among the worst performers after Reuters reported that president-elect Trump plans to eliminate the consumer tax credit for electric vehicles. The small-cap Russell 2000 (-1.37%) lost ground for a third consecutive day, which marked its worst 3-day run since early August. By contrast in Europe, equities saw a strong rebound from the last couple of days, with the STOXX 600 up +1.08%, alongside gains for the DAX (+1.37%), the CAC 40 (+1.32%) and the FTSE MIB (+1.93%).

On the rates side in Europe, sovereign bond yields saw consistent declines, with those on 10yr bunds (-4.6bps), OATs (-5.6bps) and BTPs (-8.6bps) all moving lower. That also followed the release of the accounts from the ECB’s October meeting, where they delivered another 25bp rate cut. It said that if the slowdown in various indicators were just temporary, then an October rate cut would be like bringing forward a December cut, and so “there was little risk associated with cutting, especially given that interest rates would remain in restrictive territory”.

Overnight in Asia, we’ve had a mixed set of data out of China this morning. On the positive side, retail sales came in stronger than expected, with a +4.8% year-on-year reading in October (vs. +3.8% expected). However, industrial production was a bit weaker than expected at +5.3% year-on-year (v.s +5.6% expected). So Chinese equities have been steady against that backdrop, with the CSI 300 (-0.03%) and the Shanghai Comp (+0.02%) hovering either side of unchanged.

Elsewhere in Asia, we also had Japan’s Q3 GDP data overnight, which was a bit faster than expected with an annualised quarterly gain of +0.9% (vs. +0.7% expected). That’s helped support the Nikkei (+0.87%) to a stronger gain this morning, although it wasn’t all good news in the release, as Q2 growth was revised down to an annualised pace of +2.2% (vs. +2.9% previously). In turn, the Japanese Yen is losing ground for a 5th consecutive day against the US dollar, and this morning is trading at 156.45, which is its weakest level since July.

To the day ahead now, and data releases include US retail sales, industrial production and capacity utilization for October, along with UK GDP for Q3. Central bank speakers include the Fed’s Collins and Williams, and the ECB’s Lane and Cipollone. Lastly, the European Commission will release their latest economic forecasts.