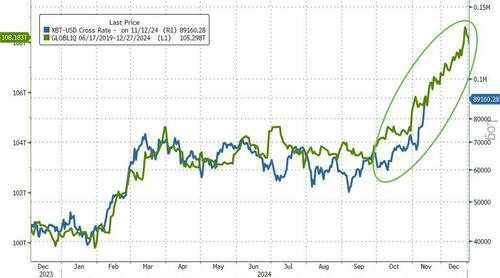

The ‘Trump Effect’ on crypto markets is spreading around the world with South Korea’s News 1 reporting the stunning news that the trading volume of the five domestic won market exchanges (Upbit, Bithumb, Coinone, Korbit, and GOPAX) in the past 24 hours, surpassing the average daily trading volume of KOSPI and KOSDAQ stock exchanges.

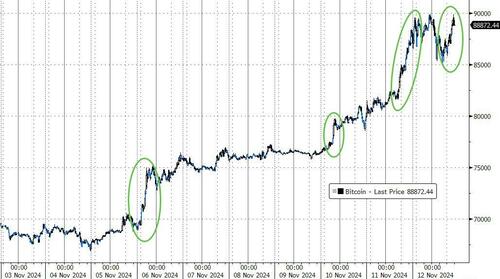

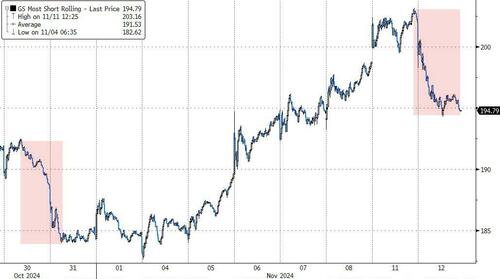

That helped push Bitcoin up to $90,000 overnight…

By pursuing a more lenient regulatory environment, Trump aims to fulfill his campaign promise to transform the United States into the “crypto capital of the planet.”

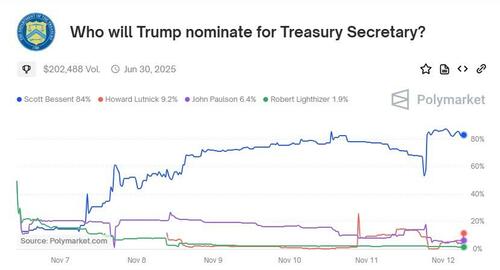

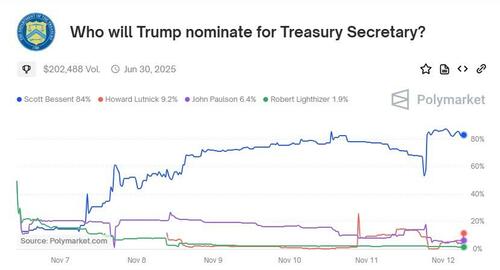

As Vivian Nguyen reports at CryptoBriefing.com, Scott Bessent, a strong advocate for crypto, particularly Bitcoin, has an 88% probability of becoming the next Treasury secretary under a second Trump administration, according to prediction platform Polymarket.

“I think everything is on the table with Bitcoin,” Bessent said in a statement shared by Terrett.

“One of the most exciting things about Bitcoin is that it brings in young people and those who have not participated in markets before. Cultivating a market culture in the US, where people believe in a system that works for them, is the centerpiece of capitalism.”

If appointed as Treasury secretary, Bessent could bring major transformations to US economic policy regarding digital assets, including the possibility of establishing a strategic Bitcoin reserve, an idea hinted at by Trump during his keynote speech at the Bitcoin 2024 Conference in July.

Sources familiar with the matter told The Washington Post that Trump plans to select pro-crypto candidates for key positions as part of his strategy to make the US a global crypto hub with early discussions have centered on a set of financial regulatory agencies including the SEC.

WaPo reports that the names under consideration for the SEC and other positions include Daniel Gallagher, a former SEC official now at the financial technology firm Robinhood, which offers crypto wallets as well as stock trading; and Hester Peirce and Mark Uyeda, two Republican commissioners at the agency, the people said.

A Republican donor, Gallagher previously faulted the SEC for taking a “scorched earth” approach to crypto.

Peirce and Uyeda, meanwhile, have criticized their agency for policy and enforcement actions taken under President Joe Biden.

Peirce is seen as a potential interim chair of the SEC, once Trump takes over the White House, who could later lead a federal task force on crypto policy.

“The commission’s war on crypto must end, including crypto enforcement actions solely based on a failure to register with no allegation of fraud or harm,” Uyeda told Fox Business this month.

“President Trump and the American electorate have sent a clear message. Starting in 2025, the SEC’s role is to carry out that mandate.”

“His days are numbered,” said Brad Garlinghouse, the chief executive of Ripple with regard to Gary Gensler – the current SEC Chair, adding that the company has “been in touch” with the Trump transition team.

“I think it’s clear this is an area they intend to continue to focus on. I think Trump and a bunch of people realize there’s a new set of technologies that are likely to define the next couple of decades.”

However, nothing grows in a straight line and as CoinTelegraph reports, cryptocurrency markets may be overheating during the current parabolic rally, with some industry leaders warning of an incoming deleveraging ahead of the next leg up.

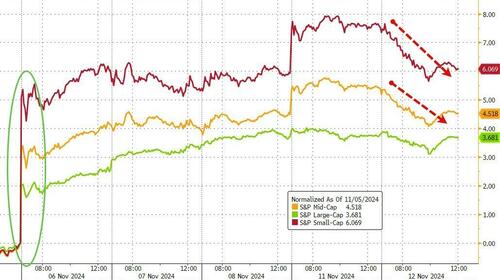

Crypto investor sentiment has risen to 80, or “extreme greed” on Nov. 12, a day after Bitcoin price surpassed the $85,000 record high on Nov. 11, according to data from the Crypto Fear & Greed Index from alternative.me.

The last time the index had a score of 80 was on April 9, just before Bitcoin saw an over 18% correction in the following three weeks, from over $69,135 to its bottom above $56,500 on May 1, Bitstamp data shows.

Bitcoin needs deleveraging before reaching $100,000

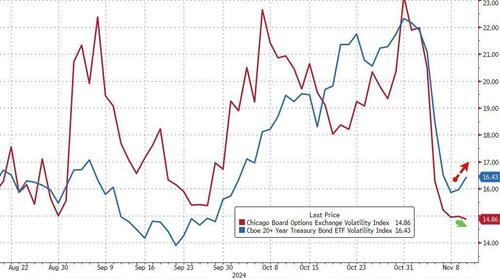

The current leveraged ratios, or the amount of borrowed funds used for trading positions, is reaching unsustainable levels, warned Kris Marszalek, the co-founder and CEO of Crypto.com.

Marszalek wrote in a Nov. 12 X post:

“Leverage needs to be cleaned up before attack on $100k. Please manage your risk carefully.”

While investors should exercise caution, Donald Trump’s presidential victory will likely contribute to Bitcoin’s continued price appreciation, according to Shunyet Jan head of derivatives at Bybit, who told Cointelegraph:

“Elevated funding rates and a bullish options skew suggest that both retail and institutional investors are eagerly positioning to capture further upside, with many leveraging their positions. The high funding rates, in particular, underscore the level of leveraged bets, reflecting strong demand for long exposure as confidence continues to build.

Some analysts expect Bitcoin to rise above the record $100,000 mark before the end of the year, driven by expected improvements in macroeconomic conditions due to Trump’s presidential victory.

While euphoria may be imminent:

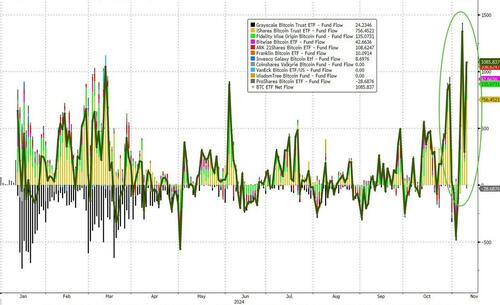

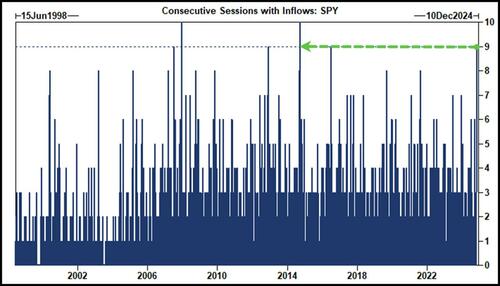

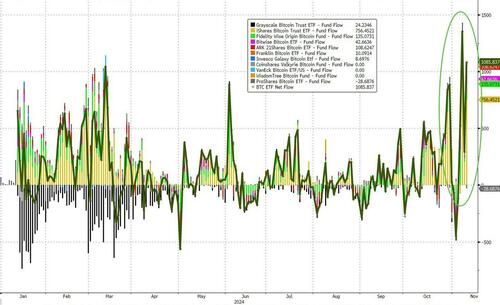

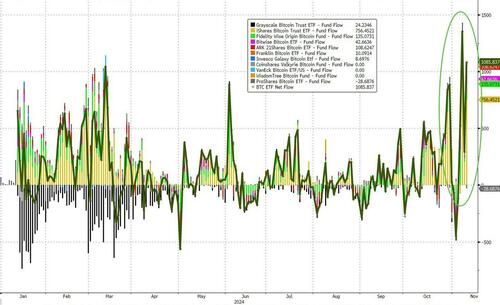

Amid record BTC ETF inflows…

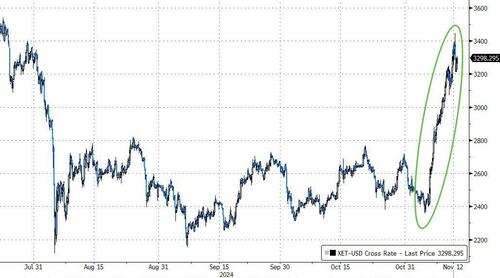

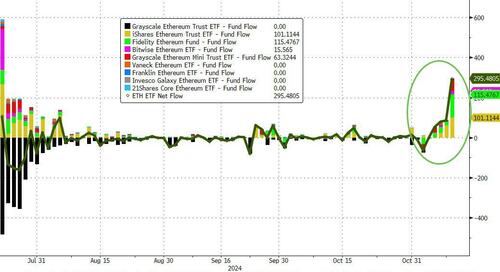

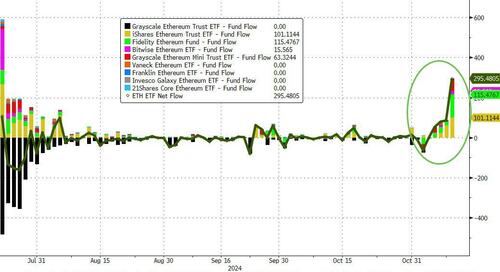

And record ETH ETH inflows too…

Google Trends suggests that moment is not here yet…

Finally, along that line of thought, BitcoinMagazine’s Pete Rizzo raises an interesting point :

The race is on to front-run the US government.

Herein lies the problem: The United States has essentially telegraphed to the world that it intends to buy an asset that’s in scarce supply, without the concrete ability to do so.

Even with a majority in the House of Representatives and Senate, passing the Strategic Bitcoin Reserve Legislation 2024 will still require an act of Congress, and the agreement of lawmakers. It would seem foolish to expect this won’t be complex or time-consuming.

For example, the bill proposes revaluing the Federal Reserve’s gold holdings, as well as integrating Bitcoin into government financial systems. Questions will likely abound, as will operational challenges. Let’s remember it took all of three years for SEC Staff Bulletins to be adjusted just to value Michael Saylor’s public markets Bitcoin buying spree correctly.

This is the nature of government — slow and bureaucratic. Even with Trump, RFK, and other Bitcoin backers in positions of power, the chances that the U.S. government begins to acquire Bitcoin on January 20, 2025 seem infinitesimal. This is not saying that it won’t happen at all, just that it won’t be timely.

This is even to omit that there could be a prioritization challenge. Maybe the crypto lobby wants to move quickly on the long delayed market infrastructure bill. If so, Congress could become more consumed with the guardrails for exchanges, and redefining securities laws than the question of the strategic reserve. After all, they helped bankroll Trump’s win.

How much could Bitcoin rise in the meantime? With the bull market in full force, I’d argue that institutions and governments have every reason to become active in the market. There are many regimes around the world where the executive branch has enough power to begin accumulating Bitcoin today. They’d be foolish not to frontrun the U.S. government.

El Salvador started this process in 2021, and it has amassed over 5,900 Bitcoin. Yet, it faced 2-3 years of market headwinds, as traders countered its entries. Lest we forget El Salvador bought hundreds of Bitcoin at $60,000, a move that for years was fuel for its enemies.

Trump may yet do his part to boost Bitcoin. Yet, in telegraphing his intentions, he’s almost certainly created conditions that can be exploited by savvy traders.

Time will tell them if, among them, we’ll see other nation states.