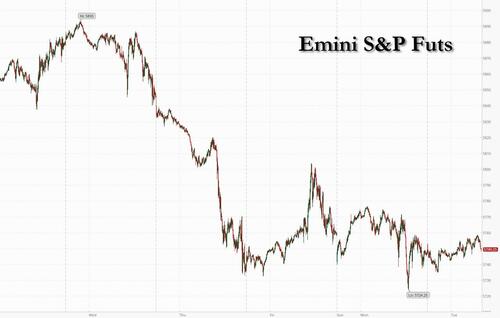

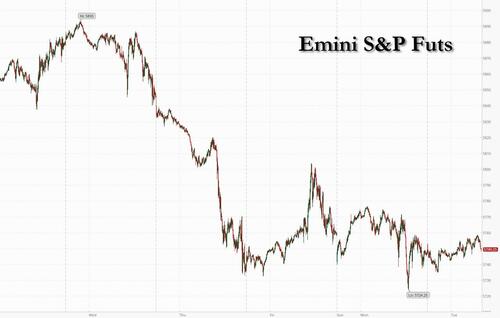

Futures are higher led by tech as voting gets underway in a very tight presidential race between Donald Trump and Kamala Harris (full election day guide here). As of 8:00am S&P futures are up 0.1%, off session highs; Nasdaq futures are 0.3% higher with Mag7 names mostly higher as Semis also have a bid. DJT is +6% pre-mkt; BA is +2% after the company secured a labor deal ending an 8 week strike. Palantir surged 13% on record profit and high demand for its artificial intelligence software. The dollar was steady, while 10-year Treasury yields advanced four basis points to 4.32%. The commodity complex is stronger today led by Energy and Base Metals; brent trades aroun $75.50. The macro data focus is on ISM Services and the Election, although we may have to wait for the results: in 2016, Trump was declared winner early Weds but in 2020, Biden was declared winner on Sat.

In premarket trading, Boeing shares rose 1.9% after workers voted to accept a new labor contract and end a strike that’s crippled jetliner production for 53 days, clearing a major obstacle for the US planemaker to restore its operations and finances. Celanese shares plunged 16% after the chemical manufacturer’s fourth-quarter profit guidance disappoints following “severely constrained demand” in the third-quarter. Here are some other notable premarket movers:

- Archer-Daniels-Midland (ADM US) shares drop 6.0% after the agricultural trading giant reported preliminary adjusted earnings per share for the third quarter that missed the average analyst estimate.

- Astera Labs (ALAB US) shares surge 24% after the company reported adjusted earnings per share for the third quarter that beat the average analyst estimate.

- Hims & Hers (HIMS US) shares jump 8.2% after the telehealth platform reported third-quarter revenue that came ahead of estimates. Additionally, the company also increased its full-year adjusted Ebitda forecast.

- Lattice Semi (LSCC US) shares tumble 18% after the chipmaker’s forecast for the fourth quarter came in below the average analyst estimate. Analysts note weakness in the industrial and auto end markets.

- Marqeta (MQ US) shares plunge 41% after the payments platform and card provider’s fourth-quarter net revenue growth forecast disappointed analysts and threw into doubt its prospects for next year.

- NXP Semi (NXPI US) shares fall 5.6% after the semiconductor device company’s fourth quarter revenue forecast missed the average analyst estimate. Analysts note end-demand weakness for its industrial/Internet of Things (IoT) products.

- Palantir (PLTR US) shares rise 13% after the data-analysis software company reported third-quarter results that beat expectations and raised its full-year forecast. Analysts note strong demand for AI applications from enterprise clients.

- QuinStreet (QNST US) shares rise 34% after the company reported first quarter revenue that beat the average analyst estimate. It also boosted its revenue guidance for the full year.

- Vimeo (VMEO US) shares soar 16% after the video-software company’s fourth-quarter revenue forecast came ahead of analyst expectations. Meanwhile, the company reported third-quarter earnings per share that also beat consensus.

- Wynn Resorts (WYNN US) shares slump 4.5% after the casino operator reported adjusted earnings per share for the third quarter that missed the average analyst estimate.

Traders are taking a cautious approach after one of the most tumultuous and dramatic presidential campaigns in modern history. With polls suggesting a photo-finish result, the likelihood of a disputed result means that the vote count could eventually drag on for days or even weeks.

“What you can see across markets now is that no one is ready to take clear investment positions on the election,” said Alexandre Hezez, chief investment officer at Groupe Banque Richelieu in Paris. “The uncertainty is palpable across all asset classes. There’s such a massive gap between the program of the two candidates that caution is of the essence.”

Options data suggests stock traders are pricing in a 1.8% move in either direction for the S&P 500 on Wednesday, according to Citi. The swings will likely be most obvious in individual stocks and sectors, as has been the case so far this election season. “A tough count will increase uncertainty on the markets, a scenario that produces not many winners,” said Guillermo Hernandez Sampere, head of trading at asset manager MPPM.

Some hedge funds are favoring currency options that will gain from a weaker dollar should Harris win the presidency. Close polling in especially Iowa jolted leveraged funds to re-evaluate who will emerge victorious, with some unwinding bullish greenback bets on Monday.

There are additional catalysts likely to move the market this week. Election Day will quickly be followed by Thursday’s Federal Reserve’s decision and Jerome Powell’s press conference, where he’ll give details on the central bank’s interest-rate path. A big chunk of US firms are due to report earnings.

In Europe, the benchmark Stoxx 600 was little changed, with volumes tracking about two-thirds of the 20-day average. Miners and utilities the leading outperformers, while consumer products and chemicals stocks are the biggest laggards. Here are the biggest movers Tuesday:

- Associated British Foods shares gain as much as 6.2% after the company beat earnings estimates following a better-than-expected performance from Primark and announcement of a share buyback

- Syensqo shares rise as much as 9% after the Belgian maker of chemicals and aircraft materials, reported better-than-expected third-quarter results and narrowed its guidance range for full-year earnings

- Carrefour shares in Europe jump as much as 4.3%, the most since February, as they followed the rise in the company’s ADRs overnight after they closed 7.6% higher in New York

- UK water stocks, Pennon, Severn Trent and United Utilities gain on Tuesday, with Citi and JPMorgan seeing a positive set-up for the sector ahead of regulator Ofwat’s Final Determination proposals expected next month

- Vestas Wind Systems shares drop as much as 12% to hit their lowest level in over four years after warning its adjusted Ebit margin will be at the low end of its guidance range and third-quarter earnings missed expectations

- Deutsche Post shares fall as much as 3.8%, the most since an Oct. 30 profit warning, after the German firm posted results that Citi said were in line with that release

- Schroders shares plummet at much as 14% to their lowest in over four years. The asset manager flagged key headwinds that will weigh on results in the final quarter, which analysts at Panmure Liberum expect to be negative for consensus estimates

- Coloplast shares drop as much as 4.4% after the medical products maker posted adjusted Ebit and margin for the fourth quarter that was weaker than what analysts had expected

- Ambu A/S shares sink as much as 15% after the Danish medical equipment company reported earnings that missed analyst expectations and wrote down its gastroenterology endoscopy business

- Aramco shares decline by as much as 0.7%, most since Oct. 15, after Saudi oil giant posted lower 3Q net income that also missed estimates. The company maintained its quarterly dividend at $31 billion, cushioning investors against crude volatility

- Ryanair shares fall as much as 2.8% after a downgrade at Peel Hunt. Analysts see a “tricky” fourth quarter and a difficult year-on-year comparable for Europe’s largest low-cost carrier, and little upside from the broker’s current target price

- Hugo Boss shares give up earlier gains to trade as much as 6.5% lower, as analysts debate the German high-end apparel maker’s results

- Zalando shares decline as much as 4.2% after the online clothing retailer reported third-quarter results, snapping two sessions of gains

Earlier in the session, Asian stocks climbed, buoyed by a jump in Chinese equities amid expectations for more stimulus and encouraging economic data. The MSCI Asia Pacific Index gained as much as 0.5%, with TSMC, Sony Group and Toyota Motor among the biggest contributors to the advance. Chinese gauges were the best performers in the region, with the onshore benchmark CSI 300 Index up as much as 2%, on track to cap its best day in more than two weeks. Sentiment in China was helped by a proposal to lift local governments’ debt ceiling to swap out their hidden debt. Signs that consumer demand may be on the mend also boosted the mood after a private survey showed China’s service activity expanded at the fastest pace since July. The rally is “more driven by the PMI,” though the debt proposal is good news and will boost the expectation of other measures, said Kenny Wen, head of investment strategy at KGI Asia Ltd. Stocks rebounded in Japan as markets reopened after a holiday. Investors are also on guard as the first day of extended trading hours at the Tokyo Stock Exchange has the potential to cause volatility toward the close.

Overnight, the RBA kept the Cash Rate unchanged at 4.35%, as expected, while it stated the board will continue to rely upon the data and evolving assessment of risks, as well as noted that inflation remains too high and is not expected to return sustainably to the midpoint of the target until 2026. RBA said policy will need to be sufficiently restrictive until the board is confident that inflation is moving sustainably towards the target range and the board is not ruling anything in or out. Furthermore, the SoMP stated that core inflation remains elevated with service inflation expected to decline only gradually and that policy in Australia is not as restrictive as in most peer countries, even after recent rate cuts abroad, while RBA lowered its GDP, household consumption, trimmed CPI and core inflation forecasts.

In FX, the Bloomberg Dollar Spot Index falls 0.1% even as 10Y US Treasury yield rose 4 basis points to 4.33%. “The unwinding of the Trump trade can only go so far given how close the race is,” Maybank analyst Saktiandi Supaat writes in a note. “The DXY index has found support around 103.60 while topside is seen at around 104.60. We see consolidation within this range until a winner is called” USD/JPY was up as much as 0.3% to 152.54 earlier after Democratic Party for the People leader Yuichiro Tamaki said Bank of Japan monetary policy should stay on hold a while longer. Chinese stocks rise after higher-than-expected PMI data in the world’s second largest economy, also promoting a move higher in the Aussie dollar, which outperformed G-10 currencies.

In rates, treasuries are weaker amid bigger declines for European bonds after UK 10-year bond sale drew weakest demand in almost a year, a sign of lingering investor anxiety over last week’s fiscally expansive budget. US yields are 3bps cheaper across a slightly steeper curve; 10-year around 4.33% is ~4bps higher with bunds and gilts underperforming by 1.5bp and 1bp in the sector. The Treasury’s $42 billion 10-year refunding auction follows soft demand for Monday’s 3-year note sale. US 10-year WI yield is around 4.31% ahead of the auction at 1pm New York time, about 24bp cheaper than last October’s, which tailed by 0.4bp

In commodities, oil prices advancd, with WTI rising 0.4% to $71.70 a barrel. Spot gold is steady around $2,738/oz.

To the day ahead now, and of course the main highlight will be the US election. On the data side, US releases include the ISM services for October and the trade balance for September. In Europe, there’s French industrial production for September and the final UK services and composite PMIs for October. From central banks, we’ll hear from the ECB’s Vujcic and Schnabel.

Market Snapshot

- S&P 500 futures up 0.2% to 5,754.25

- STOXX Europe 600 up 0.3% to 510.56

- MXAP up 0.8% to 187.83

- MXAPJ up 0.9% to 601.25

- Nikkei up 1.1% to 38,474.90

- Topix up 0.8% to 2,664.26

- Hang Seng Index up 2.1% to 21,006.97

- Shanghai Composite up 2.3% to 3,386.99

- Sensex up 0.9% to 79,495.14

- Australia S&P/ASX 200 down 0.4% to 8,131.83

- Kospi down 0.5% to 2,576.88

- German 10Y yield up 1.5 bps at 2.41%

- Euro up 0.1% to $1.0894

- Brent Futures up 0.7% to $75.57/bbl

- Gold spot up 0.2% to $2,742.29

- US Dollar Index down 0.13% to 103.75

Top Overnight News

- China’s Caixin services PMI for Oct comes in solidly ahead of expectations at 52 (up from 50.3 in Sept and above the consensus forecast of 50.5), the latest sign of improving economic conditions in the country. BBG

- Chinese Premier Li Qiang expressed confidence that his government can pull off an economic recovery. “The Chinese government has the ability to drive sustained economic improvement,” Li said in a speech Tuesday at the opening of the China International Import Expo in Shanghai. He added that officials had “ample space for fiscal policy and monetary policy,” and reiterated that China would hit its economic growth target of around 5%. BBG

- The Bank of Japan is likely to raise interest rates in coming months with January emerging as the most likely timing, when there will be more clarity on political and market developments, former BOJ board member Makoto Sakurai said on Tuesday. Reuters

- Watch out for an especially volatile Japanese currency while votes are being counted during Asian trading hours. One-week implied volatility in the dollar-yen has jumped to the highest level since early August. BBG

- Ukraine said it has attacked North Korean troops in Kursk while Russia is being accused of plotting to detonate bombs on cargo planes according to the WSJ. WSJ

- BAC (Bank America)’s CEO expects the US economy to maintain stable growth of ~2% next year as both consumers and businesses are in good shape, but he called on Washington to take additional steps to address elevated levels of gov’t debt (Nikkei)

- After a bruising campaign, polls showed Donald Trump and Kamala Harris deadlocked both nationally and across swing states. Early results are due shortly after 6 p.m. ET, though the final outcome may not be known for days. In Dixville Notch, New Hampshire, midnight voting ended in a tie at three votes apiece. BBG

- Boeing workers voted to accept a new labor contract and end a strike that crippled production for 53 days. Hourly workers can start returning to factories as soon as tomorrow. The shares rose premarket. BBG

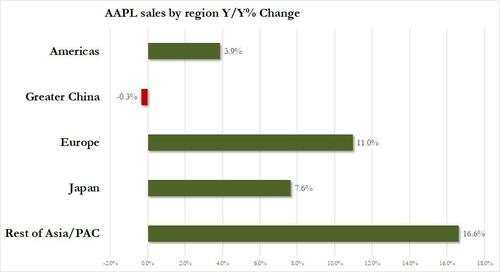

- Apple is studying smart glasses currently available as it considers entering the market, people familiar said. Separately, the company is said to have proposed investing almost $10 million in Indonesia in a bid to have the ban on iPhone 16 sales there lifted. BBG

- Looking at the 2008-2020 election cycles, volumes historically dip the day before the election and on election day as investors await the election outcome. We are already seeing this, S&P Futures top of book liquidity has dropped by ~50% since mid-October: Goldman

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed with most major indices in the green after further encouraging Chinese PMI data although some of the gains were capped as cautiousness lingered heading into the US Presidential Election coin toss. ASX 200 was dragged lower amid weakness across all sectors and underperformance in the top-weighted financial industry, while the RBA decision provided little surprise and the SoMP included a reduction in GDP and household consumption forecasts. Nikkei 225 rallied on return from the long weekend with some encouragement from earnings and strength in exporters. Hang Seng and Shanghai Comp benefitted following the better-than-expected Chinese Caixin Services PMI data, while Premier Li suggested a favourable outlook and optimism regarding economic prospects during his keynote speech at the CIIE.

Top Asian news

- Chinese Premier Li said unilateralism is on the rise and globalisation is impacted by volatility which they must guard against with further opening up, while he added China will upgrade free trade zones and explore free trade and investment agreements with other countries. Li said China will continue to open telecommunications, internet, healthcare, and other sectors for investment, as well as noted that many positive developments in China’s economy indicate a favourable outlook. Furthermore, he said China has fiscal and monetary tools at its disposal and he is confident of meeting this year’s growth target and optimistic about economic prospects in the coming years.

- Former BoJ member Sakurai says the BoJ could hold until January given political and market uncertainty. A renewed JPY fall could spark a hike as soon as December 2024. BoJ will raise rates again in the coming months, with January emerging as the most likely. BoJ will aim to raise short-term rates to 1.5% or 2.0% by the end of Ueda’s term, early in 2028. Debt issuance could prevent a QT acceleration.

- Foxconn (2317 TW) October Revenue +8.59% Y/Y (September +10.9% Y/Y). Looking to Q4, operations are anticipated to show quarterly and yearly growth.

European bourses, Stoxx 600 (+0.2%) opened on a weaker footing, but sentiment did begin to improve into the European morning to display a more mixed picture across Europe. European sectors began the European session on a mixed footing, and with the breadth of the market fairly narrow; sentiment has since improved with sectors now holding a positive bias. Basic Resources leads whilst Energy lags. US Equity Futures (ES +0.1%, NQ +0.2%, RTY U/C) are mixed, with very modest outperformance in the NQ, attempting to pare back some of the losses seen in the prior session. Focus almost entirely on the US election.

Top European news

- Barclaycard stated UK October consumer spending rose 0.7% Y/Y vs Prev. 1.2% Y/Y increase in September.

- UK OBR Chair says gilt market response to the budget was in part due to higher volumes, and also front-loading of spending; OBR had expected the gilt market to be surprised by the market; gilt yields have settled broadly in line with OBR expectations.

FX

- USD is softer vs. peers on election day with price action for DXY dictated at the start of the week by a lowering in the odds of a Trump victory and a scaling back in “Trump trades”. In terms of the order of play for the election, results won’t start filtering out until the early hours of Wednesday (UK time) with the eventual outcome of the election potentially set to drag on for several days depending on how close the race is. DXY is currently sandwiched between Monday’s low at 103.57 and the 200DMA at 103.83.

- EUR is a touch firmer vs. the USD but unable to make its way back onto a 1.09 handle after venturing as high as 1.0914 on Monday.

- GBP gains vs. the USD but with Cable still unable to make its way back onto a 1.30 handle after topping out yesterday at 1.2998.

- JPY is steady vs. the USD with macro drivers for the JPY on the quiet side. Direction for the pair this week will most likely be driven by the USD leg of the equation given events in the US with a Harris victory likely to be viewed as a negative for USD/JPY. USD/JPY is currently contained within a 152.10-55 range.

- Antipodeans both remain underpinned by the slight decline in odds of a Trump Presidency and the potential ramifications for the Chinese economy. On which, China reported encouraging Services PMI data overnight. Furthermore, AUD has also digested the RBA rate decision overnight, which further underscored its position as one of the more hawkish players in G10 FX.

- PBoC set USD/CNY mid-point at 7.1016 vs exp. 7.1019 (prev. 7.1203).

RBA

- RBA kept the Cash Rate unchanged at 4.35%, as expected, while it stated the board will continue to rely upon the data and evolving assessment of risks, as well as noted that inflation remains too high and is not expected to return sustainably to the midpoint of the target until 2026. RBA said policy will need to be sufficiently restrictive until the board is confident that inflation is moving sustainably towards the target range and the board is not ruling anything in or out. Furthermore, the SoMP stated that core inflation remains elevated with service inflation expected to decline only gradually and that policy in Australia is not as restrictive as in most peer countries, even after recent rate cuts abroad, while RBA lowered its GDP, household consumption, trimmed CPI and core inflation forecasts.

- RBA Governor Bullock said in the post-meeting press conference that the last part of bringing inflation down is not easy and rates need to stay restrictive for the time being, while she thinks there are still risks on the upside for inflation and will be ready to act if the economy turns down more than expected but also noted they have the right settings at the moment. Bullock said there were no discussions on specific scenarios for rate changes and the current Cash Rate path priced by the market is as good as any.

- RBNZ Financial Stability Review said financial systems remain resilient amidst economic downturn and that risks to New Zealand’s financial system remain contained, while debt servicing costs are nearing their peak and starting to decline with advertised mortgage rates falling over the last 6 months. RBNZ noted that domestic economic challenges remain and many households and businesses are feeling financial pressure with rising unemployment posing challenges for some borrowers. RBNZ Governor Orr later commented that the real economy is lagging a reduction in interest rates which is a concern and climate change is an existential threat.

Fixed Income

- USTs are essentially unchanged on US election day, yields are under very modest pressure and still within a few bps of the lows from Monday when the Trump Trade was unwinding after weekend updates. Aside from the election, ISM Services is scheduled and a 10yr Note auction is due. Holding at the 110-12 mark in a slim eight tick range which is entirely within Monday’s 110-07 to 110-21+ band.

- Bunds are pressured and slumped at the European cash open though this seems coincidental with the cause of pressure seemingly a breach of support at 131.50 after a handful of overnight lows gave way. After slipping to a 131.33 trough the move ran out of steam and Bunds have since bounced back to 131.50, but remain lower on the session.

- Gilts are underperforming, gapped lower by 26 ticks and continued to slip ahead of the region’s auction. Today’s 2034 tap was fairly robust, but demand was the weakest since Dec’23, taking Gilts back towards the earlier 93.53 trough. Traders now look towards the BoE on Thursday.

- UK sells GBP 3.75bln 4.25% 2034 Gilt Auction: b/c 2.81x (prev. 3.25x), avg yield 4.475% (prev. 4.17%) & tail 0.8bps (prev. 0.9bps)

Commodities

- Mild upward bias across the crude complex as prices hold onto yesterday’s gain which was facilitated by the delay of the OPEC+ output increase. Constructive Chinese Services PMIs and reports that Israel is considering a pre-emptive strike on Iran has helped to prop up the complex. Brent Jan sits in a USD 74.80-75.60/bbl parameter.

- Precious metals are holding an upward bias amid the softer Dollar on the eve of the US Presidential Election coin toss. Spot gold trades in a USD 2,724.76-2,745.06/oz range.

- Base metals are firmer across the board, following the better-than-expected Chinese Caixin Services PMI data, while Premier Li suggested a favourable outlook and optimism regarding economic prospects during his keynote speech at the CIIE. 3M LME copper sits in a 9,666.50-9,760.50/t range.

- Iran approved a plan to increase oil production by 250k BPD, according to the Iranian Oil Ministry website.

- Citi expects copper to rally temporarily to USD 10k/ton over the coming week on the back of China easing, Fed easing and US election outcomes.

Geopolitics: Middle East

- Israel’s Channel 14 reports that “Authorities are considering the possibility of a pre-emptive attack against Iran or waiting for US elections”, via Sky News Arabia; “Indications are growing that Iran may soon attack Israel, perhaps on US election day”.

- Israel’s Channel 12 reports that Iran is likely to attack from several arenas, not just from its territory, via Al Jazeera.

- “Tel Aviv is considering a pre-emptive strike on Iran if there are signs of imminent attack”, according to Cairo News.

- “Prime Minister Benjamin Netanyhu will convene his national security cabinet on Thursday at 7:00 p.m. (17:00GMT) at the Kirya IDF headquarters in Tel Aviv”, according to Times of Israel Berman.

- “The IDF is gradually completing the objectives set for it in ground operations in Lebanon, and Israel is already preparing for the day after the arrangement”, according to N12.

- “Iranian Foreign Minister: We will respond to Israeli attacks in a timely and appropriate manner”, according to Cairo News

- Iranian Foreign Minister said their response to Israel will be appropriate without emotional decisions and that the result of the US elections will not affect their policy, according to Asharq News.

- Hezbollah said it targeted with a rocket barrage a gathering of Israeli enemy forces on the southwestern outskirts of the town of Maroun al-Ras, according to Al Jazeera.

- US Secretary of State Blinken and Israeli Defence Minister Gallant discussed the dire humanitarian conditions in Gaza, while Blinken urged further actions by Israel to increase and sustain humanitarian aid, according to the State Department

- US Secretary of State Blinken said Hamas once again refused to release a limited number of hostages to secure a ceasefire and relief for the people of Gaza, according to Sky News Arabia. It was also reported that Blinken discussed with his Egyptian counterpart the importance of establishing a post-war path that provides governance, security, and reconstruction in Gaza, as well as discussed efforts to promote a diplomatic solution in Lebanon that would enable civilians on both sides of the border to return home.

Geopolitics: Other

- North Korea fired what was thought to be a ballistic missile which appeared to have landed outside of Japan’s EEZ, while Japanese Defence Minister Nakatani said North Korea fired at least 7 missiles which flew to an altitude of 100km and covered a range of 400km.

- Russia’s Defence Ministry says Ukraine has no technical potential to make nuclear weapons but is able to make a ‘dirty bomb’, according to IFAX.

US Event Calendar

- 08:30: Sept. Trade Balance, est. -$84b, prior -$70.4b

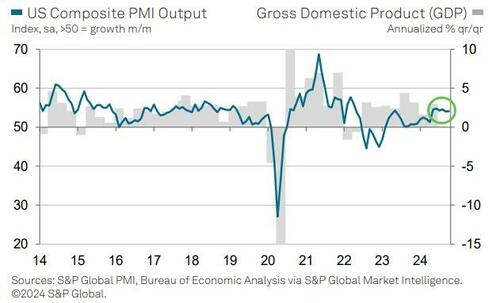

- 09:45: Oct. S&P Global US Services PMI, est. 55.3, prior 55.3

- 09:45: Oct. S&P Global US Composite PMI, est. 54.3, prior 54.3

- 10:00: Oct. ISM Services Index, est. 53.8, prior 54.9

DB’s Jim Reid concludes the overnight wrap

To encourage readers to stay until the end of today’s EMR I will unveil my prediction for what might happen in today’s US election below the day ahead para. No early scrolling please.

As we reach one of the more important and consequential days we will have in our careers, according to the very latest polls it’s a statistical toss-up with 0.1pp separating the two candidates in the popular vote according to RealClearPolitics averages. As I showed in my CoTD yesterday this could easily be the tightest election on record on this measure with the 1880 and 1960 elections the only ones with a less than 0.5pp gap. Trump leads the battleground states by 0.8pp in the RealClearPolitics polling averages but the “best pollster in politics“ according to FiveThirtyEight threw a curveball over the weekend by suggesting that Iowa leans towards Harris by 3pp even though other recent polls in the State have Trump up by around 8pp.

Another thing to consider is that in 2016 and 2020, the polls underestimated Trump, so plenty have argued they might do so again. But then again, the pollsters have made strenuous efforts to correct for that, so lots have argued the reverse might be true this time around, and Trump’s margins were generally overestimated in the Republican primaries earlier this year. Given this, the major forecasting models are completely torn. For instance, FiveThirtyEight gives Trump a 52% chance of winning. That’s largely echoed in prediction and betting markets. Polymarket put Trump’s victory chances at 59% as we hit the last few hours before polls open. This did tick up a bit as yesterday went on, rising from a low of 54% over the weekend. Showing how important the battleground states are though, Polymarket have Harris at 72% to win the popular vote.

For those watching tonight, the excitement will kick off from 7pm ET/midnight London when polls close statewide across six states. Critically, that will include the battleground state of Georgia, which is a state that flipped from Trump to Biden in 2020, and had the closest margin of any state last time at 0.2pts. Then at 7:30pm ET, polls will close in North Carolina, which is another battleground state on the east coast. Bear in mind that both Georgia and North Carolina are basically must-wins for Trump on his path to 270 electoral votes. So if Harris were doing well in both of those, it would be difficult to see a winning path for Trump, unless he also managed to seriously outperform in the Midwest. Remember as well that polling errors are likely to be correlated across the country, so once the first battleground states come in, that should offer us a good clue about where the rest of the night might go.

At 8pm ET, we’ll then get another big round of polls closing, including in Pennsylvania. That’s the most important battleground state in many forecasts, as there’s a decent chance it’s the tipping point state that gives either candidate 270 electoral votes. So if there’s one state you’d want to know the result of, it’s Pennsylvania. Then at 9pm, polls will close in the other Midwestern battlegrounds of Wisconsin and Michigan, as well as Arizona. At this point, if Trump were running strongly in the midwestern trio of Wisconsin, Michigan and Pennsylvania, that would be a very good sign for his campaign, as those are the three states he took in 2016 that pushed him over the winning line.

Depending how close the race is, a winner might be coming into view at some point after this. So in 2012, the Associated Press called the race for Obama at 23:38 ET (04:48 London). In 2016, when things were a bit tighter, AP didn’t call the race until 02:29 ET (07:29 London). And then last time, there were lots of delays with mail-in ballots, and an AP declaration wasn’t made until 11:26 ET on the Saturday. But remember that in every example here, the eventual winner was apparent some time before they cleared the threshold of 270 electoral college votes, so if the major battlegrounds are going the same way, we may well have a good sense before one candidate crosses the winning line.

Whilst the presidential race is in focus, don’t forget that elections to the House of Representatives and the Senate are also happening, which will be crucial for the new President’s ability to enact their agenda. In the Senate, the Republicans are heavily favoured by forecasting models and prediction markets, as only a third of the seats are up for grabs, and most are currently held by the Democrats. So there’s more opportunity for the Republicans to gain seats, and they have plausible pick-up opportunities in West Virginia and Montana. In the current Congress, the Democrats have a 51-49 Senate majority, and the Vice President has the casting vote in the event of a tie, so the Republicans only need to gain one seat if Trump wins, and two if he doesn’t. As it stands, FiveThirtyEight’s forecast gives the Republicans a 92% chance of controlling the Senate.

Over in the House of Representatives it’s a similar toss-up as in the presidential race, with FiveThirtyEight’s model giving the Republicans a 49% chance of victory. In reality, given the correlation of polling errors, it’s likely to go the same way as the presidency. So if a divided government scenario does happen, the most likely permutation would be that the Republicans take control of the Senate, but the Democrats win the Presidency and the House. That would be important as the Senate doesn’t just have a role in passing legislation, but is also the chamber that approves cabinet appointments, Supreme Court justices, and Federal Reserve Governors. In modern times, every President since Bill Clinton has begun their presidency with both chambers of Congress in their party’s control, but there’s no guarantee of that, and last time the Democrats only narrowly ended up with the Senate thanks to the Georgia run-off elections in January.

In terms of the market reaction, there’s been a clear unwinding of the Trump trade over the last 24 hours, which follows a few polls over the weekend that were more favourable to Kamala Harris. In particular, the 10yr Treasury yield fell -9.9bps to 4.29%. They did pull back slightly after trading -12bps lower at one point, but this is still the biggest daily decline since the bad jobs report in early August that kicked off the summer market turmoil. The logic for the Treasury rally is that under a divided government scenario, we’re less likely to see fiscal stimulus, so that’s better news for Treasuries, and with less fiscal stimulus we’re more likely to get rate cuts from the Fed. Clearly the next moves are going to depend on who wins the election and the outcomes in Congress, but for a trip down memory lane, Henry published a note yesterday (link here) running through how markets reacted after each election since 2000.

The unwinding of the Trump trade was reflected among several assets. The dollar index fell by -0.38%, after having fallen as much -0.7% intra-day, whilst the Mexican Peso strengthened +0.93%. And when it came to equities, there were gains among solar energy companies given the perception they’ll do better under a Democratic administration.

Equity moves were more moderate yesterday but showed some investor nervousness ahead of the election. The S&P 500 retreated by -0.28%, with Tesla (-2.47%) leading a -0.92% decline for the Mag-7. Energy stocks were the strongest outperformer in the S&P as oil prices bounced back after OPEC+ pushed back its planned December production increase by one month (Brent +2.71% to $75.08/bbl). Over in Europe it was a similar story of modest losses, with the STOXX 600 down -0.33%. Volatility remained pretty elevated, with the VIX index inching up +0.10pts to 21.98pts.

Here in the UK, it wasn’t noticed much given the US election backdrop, but the spread of 10yr gilt yields over bunds ticked up another +2.5bps yesterday to 207bps. That’s the widest they’ve been since October 2022, back when Liz Truss was still PM, and the 10yr gilt yield (+1.4bps) was also up to a one-year high of 4.46%. Elsewhere in Europe however, yields fell back, with those on 10yr bunds (-1.2bps), OATs (-2.4bps) and BTPs (-1.7bps) all falling.

Asian equity markets are generally on the rise this morning, driven by a series of positive developments from China that have boosted risk sentiment. The CSI (+1.99%), Shanghai Composite (+1.80%), and the Hang Seng (+1.24%) are leading the gains after the fastest expansion in China’s service activity since July. Further support came from the premier’s remarks highlighting the country’s significant policy flexibility. Following a public holiday, Japan’s Nikkei 225 (+1.27%) is also trading notably higher. Elsewhere, the KOSPI (-0.22%) and the S&P/ASX 200 (-0.32%) are seeing minor losses. US equity futures are fairly flat as we hit the big day and 10yr USTs are +1bps higher at 4.30% as we go to print.

Turning our attention back to China, the Caixin/S&P Global services PMI rose to 52 in October, up from 50.3 in September, indicating stronger demand following new stimulus measures from Beijing. However, this contrasts with the official PMI data released last week, which showed a slowdown in non-manufacturing activity in October. Elsewhere, Australia’s Judo Bank services PMI came in at 51.0 in October, higher than last month’s figure of 50.5 as improvements in demand led to new business expanding at the fastest pace in almost two and a half years.

In monetary policy action the Reserve Bank of Australia (RBA) left its key interest rate unchanged at 4.35% for an eighth meeting in a row as it awaits more evidence inflation will soon return to its preferred target range. The press conference has just started as I type this.

To the day ahead now, and of course the main highlight will be the US election. On the data side, US releases include the ISM services for October and the trade balance for September. Meanwhile in Europe, there’s French industrial production for September and the final UK services and composite PMIs for October. From central banks, we’ll hear from the ECB’s Vujcic and Schnabel.

The prediction…….

….. I have absolutely no idea who is going to win. I have high conviction in this view.