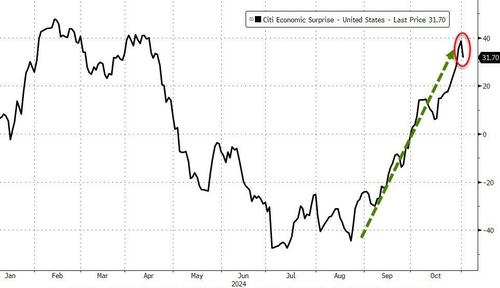

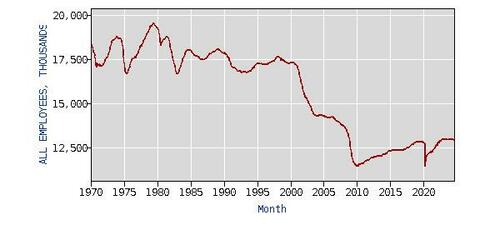

Halloween Hangover: ‘Payrolls & PMI’ Puke Sparks Chaos Across Markets

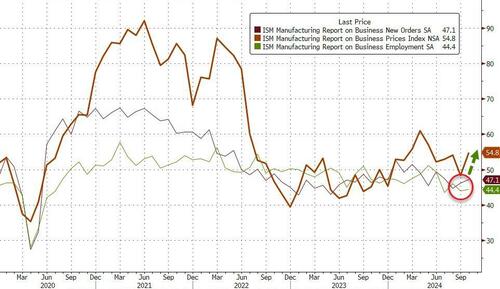

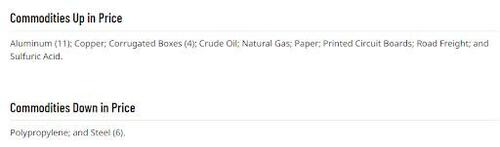

Hot on the heels of AMZN, AAPL, and INTC malarkey, this morning’s jobs data was shitshow… and the manufacturing PMIs just rubbed more salt in that wound.

Of course, it was all shrugged off as ‘hurricane and strike’-related because Bidenomics is freaking awesome, yo!

Source: Bloomberg

However, the machines and their human friends went to town on it, sparking utter chaos across all asset classes.

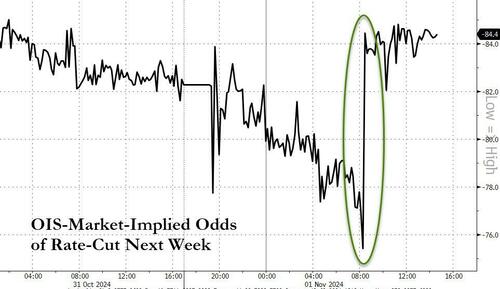

The initial reaction was a huge kneejerk lower in Treasury yields, the dollar, and VIX; and a spike higher in stocks, crypto, and gold as rate-cut expectations soared.

The odds of a 25bps cut next week spiked significantly…

Source: Bloomberg

But then, everything started to unwind as traders realized that the jobs number was not bad enough (net of hurricanes) to prompt a ‘growth scare’, but was bad enough to give Powell enough cover to cut rates next week and push inflation even higher.

First things first, expectations for rate-cuts in 2024, and even more so 2025, started to tumble – back to unchanged (108bps cuts expected to end 2025)…

Source: Bloomberg

Futures trod water overnight with the big tech earnings chopping them around but once the algos got a look at payrolls everything went vertical. However, as the day wore on and yields spiked, stocks saw derisking…

The surge in stocks today managed to get The Dow and Small Caps into the green for the week (but then the selling pressure hit). S&P and Nasdaq were the biggest losers on the week…

Under the hood in equity-land, INTC, AAPL, and AMZN were the big movers from earnings last night.

INTC is up bigly on modestly better guidance (despite admitting the AI project is failing on its goals)…

AMZN bounced back from weakness after earnings (AWS growth slowing) to put in a big day…

AAPL did not bounce back from its post-earnings plunge…

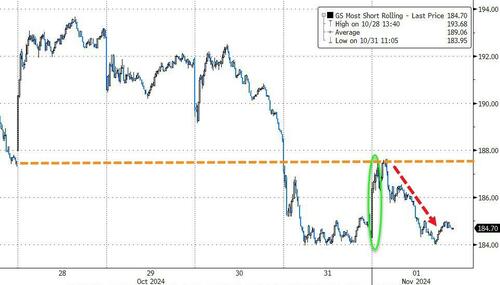

‘Most Shorted’ Stocks were instantly squeezed higher at the open, but spent the rest of the day giving it all back…

Source: Bloomberg

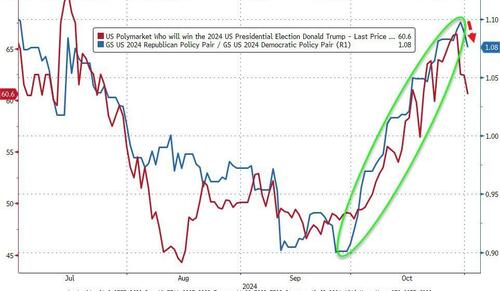

Some modest profit-taking in the ‘Trump Trade’ today…

Source: Bloomberg

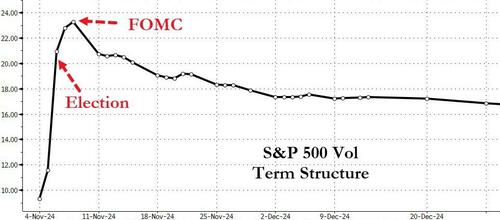

VIX ended higher on the day and significantly higher on the week as the vol term structures gets jiggy around next week’s mega risk catalysts…

Source: Bloomberg

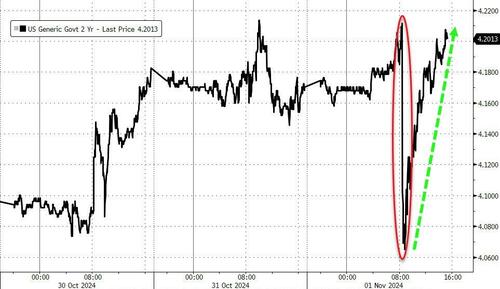

Stocks were not quite as whipsawed as bonds. the 2Y yield crashed 15bpas on the payrolls print… only to rip all back higher to close up 3bps on the day…

Source: Bloomberg

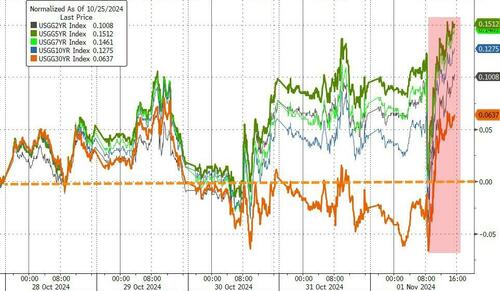

A chaotic week in bond-land for sure. By the end of the week, all yields were higher with the belly lagging and the long-end the least gly horse in the glue factory…

Source: Bloomberg

The dollar puked lower on the ‘dovish’ bad data then spent the rest of the day ripping higher to end the week higher…

Source: Bloomberg

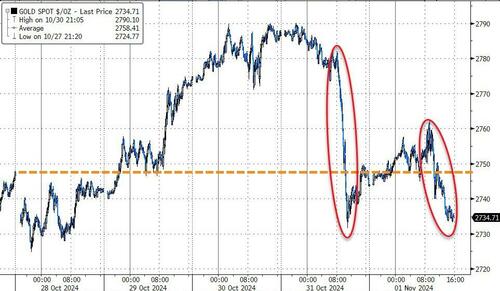

Gold’s price action this week was also wild – hitting a new record high before getting monkeyhammered yesterday and today to end the week red. That was gold’s worst week since June…

Source: Bloomberg

Bitcoin followed a similar trajectory to gold this week – driving higher to new record highs before getting clubbed like a baby seal the last two days…

Source: Bloomberg

Oil ended the week lower despite recovering most of the Sunday night futures collapse (Israel-Iran optics)…

Source: Bloomberg

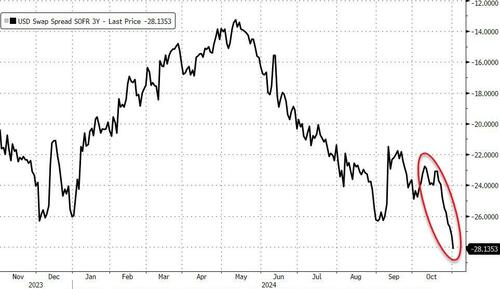

Source: Bloomberg

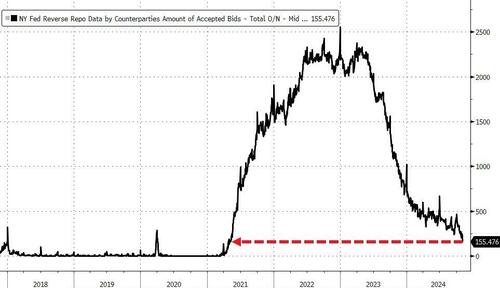

…and reverse repo usage is collapsing (liquidity needs?)

Source: Bloomberg

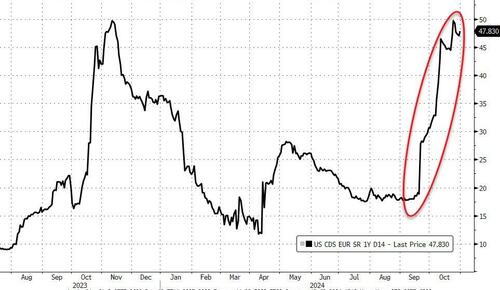

Is that why USA sovereign risk is blowing out?

Source: Bloomberg

On that cheery note, have a great weekend.

Tyler Durden

Fri, 11/01/2024 – 16:00

via ZeroHedge News https://ift.tt/t79rf2a Tyler Durden