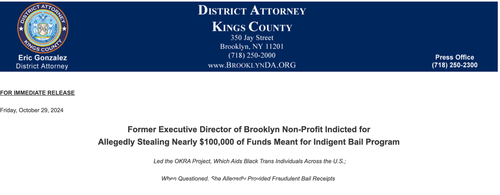

LGBTQ+ Activist Once-Featured In Apple Ad Indicted For Grand Larceny After Looting Nonprofit

A far-left LGBTQ+ activist was indicted for grand larceny and falsifying business records in New York after being accused of looting $100,000 from a woke Brooklyn nonprofit while serving as the head of the organization.

The former executive director, Dominique Morgan, of the OKRA Project, a nonprofit used to pay bail funds for the Black trans community, siphoned money from the nonprofit and splurged it on Mercedes-Benz payments, home renovations, luxury clothing purchases, and restaurant meals.

Brooklyn District Attorney Eric Gonzalez wrote in a statement that Morgan, a Black trans person, was charged with one count of second-degree grand larceny and 23 counts of first-degree falsifying business records. Morgan was released without bail and ordered to return to court in mid-December. If convicted of the top count, the defendant faces five to 15 years in prison.

“It is alleged that between July 14, 2022, and July 27, 2022, the defendant had approximately $99,000 transferred to her personal account in order to purportedly use those funds to pay for bail. Instead, she used the money on a $19,000 California Closet renovation, car payments for a Mercedes Benz, purchases at apparel stores and other expenses including meals,” DA Gonzalez wrote in a statement.

Gonzalez continued, “When asked by OKRA for proof of the payments toward bail, she allegedly submitted purported bail receipts for 23 individuals who were supposedly arrested in Fulton County, Georgia, and Douglas County, Nebraska. An audit by OKRA revealed that those receipts were fraudulent and that no such persons were arrested in those counties at the time.”

NEW: Dominique Morgan, an LGBTQ activist and former executive director of a nonprofit that supports Black Trans people, was just indicted for siphoning nearly $100,000 in donations meant for bailing people out of jail and using it for her own personal expenses.

Is anyone… pic.twitter.com/zI4CHhud5O

— Libs of TikTok (@libsoftiktok) October 30, 2024

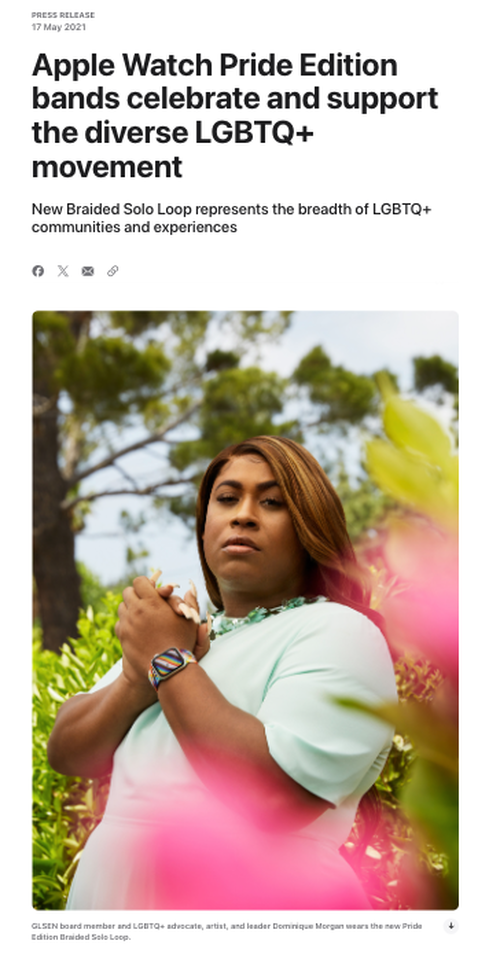

In 2021, Apple was incredibly proud to promote rainbow iWatches, featuring Morgan, the trans activist, in a press release…

Morgan also worked with these brands.

Apple was most likely boosting its DEI score with an ad featuring Morgan. Great job, Apple.

Tyler Durden

Fri, 11/01/2024 – 15:40

via ZeroHedge News https://ift.tt/CEafXJd Tyler Durden