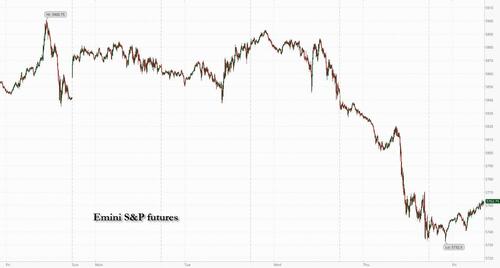

Futures are higher on the first day of the month and ahead of what may be a very poor jobs report, with MegaCap tech leading. As of 8:00am ET, S&P futures were 0.4% with the benchmark on track for its worst weekly performance in more than a year amid unease over the outlook for artificial intelligence and cloud computing following results from Microsoft and Meta; Nasdaq futures gained 0.5%, as AMZN and INTC surged 5.8% and 5.7%, respectively, after strong earnings while AAPL is down -1% after its guidance disappointed; NVDA is rebounding and is up +2.0% this morning. Bond yields are flat, and the USD is fractionally higher. Commodities are mixed, with oil higher (WTI +2.9%) amid renewed tension in the Middle East, base metals lower, and precious metals modestly higher. The main event today is the jobs report, but we also get the Mfg ISM, US Mfg PMI, and Construction Spending.

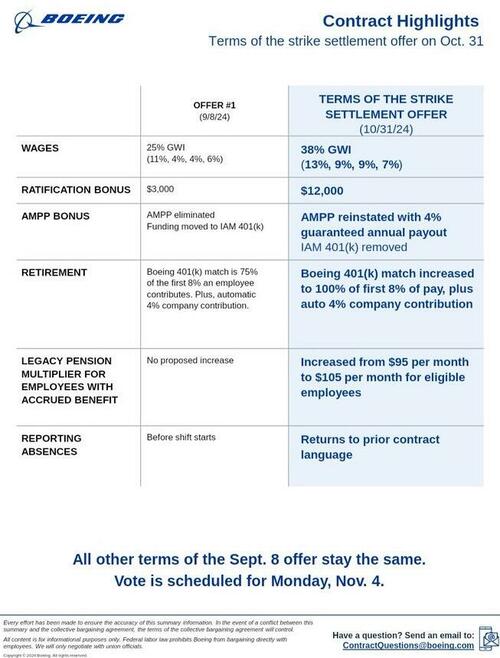

In premarket trading, Amazon.com and Intel shares surged on optimistic earnings results, while Apple declined after reporting softer demand in China, a miss in wearables and services revenue and disappointed with its holiday quarter guidance. Oil majors Exxon Mobil and Chevron both rose after earnings beats. Boeing gained after the aircraft maker reached a tentative agreement to end a labor dispute. Here are all the notable movers this morning:

- Abbott Laboratories (ABT US) shares rise 5.1% after a St. Louis jury cleared the company, along with a unit of Reckitt Benckiser, over claims they hid risks their premature-infant formulas can cause a bowel disease that severely sickened a baby boy. It was the firms’ first trial win in litigation over the products.

- ADMA Biologics (ADMA) shares rise 14% after KPMG agreed to be the biotech’s auditor, according to a filing, which analysts said should remove an overhang on the stock.

- Apple (AAPL) shares fall 1.7% after the iPhone maker reported fourth-quarter results that were weaker than expected on notable metrics, including its Services business and revenue in the intensely competitive China market.

- Amazon.com (AMZN) shares rise 7.1% after the e-commerce and cloud computing company reported third-quarter results that beat expectations and gave a solid outlook. Analysts cited margins, AWS and the international retail business as highlights of the quarter.

- Atlassian (TEAM) shares soar 21% after the enterprise software developer forecast revenue for its fiscal second quarter ahead of expectations and also beat first-quarter adjusted earnings consensus. KeyBanc Capital Markets upgraded the company to overweight, noting that it had cleared a high bar.

- Globalstar (GSAT) shares surge 56% after the company agreed to deliver expanded services to Apple over a new mobile satellite services network, including a new satellite constellation, more ground infrastructure and increased global licensing.

- Intel (INTC) shares gain 5.4% after the chipmaker reported third-quarter revenue that beat the average analyst estimate, raising optimism about the company’s turnaround effort. Analysts were positive about the quarter, but said that expectations were low going into the results.

- PayPal (PYPL) shares dip 0.5% after Phillip Securities downgraded the payments technology company to accumulate from buy, citing recent stock performance.

- Super Micro Computer (SMCI) shares fall 3.3%, putting the stock on track to drop for a third consecutive day, since Ernst & Young resigned as the company’s auditor, citing concerns about governance and transparency.

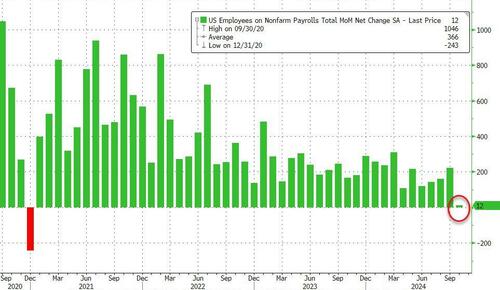

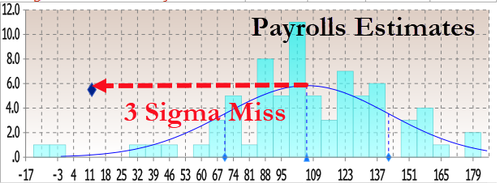

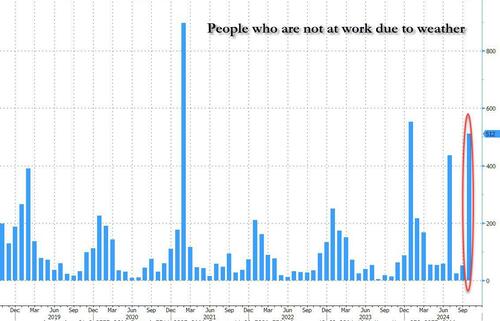

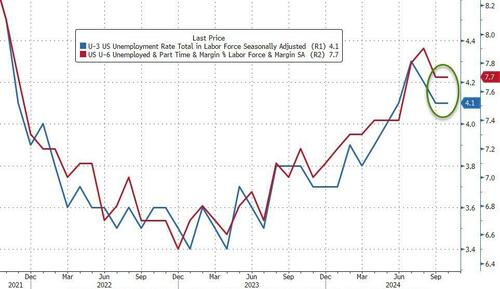

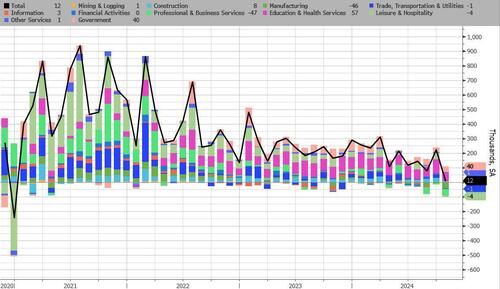

Today’s payrolls report (full preview here) could show job growth weakening, after the core PCE yesterday posted its biggest monthly gain since April. That muddied the water ahead of next week’s Fed policy meeting, with swaps pricing in 20 basis points of easing, down from 24 at the start of the week. Investors are also bracing for next week’s US election, with the VIX rising to levels last seen during the August market upheaval.

The “highly anticipated employment report, a busy week of earnings that includes a handful of the Magnificent Seven names, rising yields and, of course, next week’s U.S. election are all contributing to building angst in the market, not to mention the FOMC meeting,” said Adam Turnquist, chief technical strategist at LPL Financial. “We may need to wait until after Election Day for volatility to normalize as the VIX futures curve points to potential elevated near-term turbulence for stocks.”

In Europe, the Stoxx 600 index advanced 0.7%, snapping three straight days of declines after they posted the worst monthly drop in a year on Thursday; it remains on track for its biggest weekly drop in two months. Gains for energy stocks helped prop up the gauge, with Shell Plc, Total Energies SE and BP Plc adding more than 1%. Consumer products also gained, boosted by Reckitt after a baby formula trial win. Reckitt Benckiser soared 10% after a unit of the household goods company was cleared by a jury over claims it hid health risks of its premature-infant formula. Only the travel & leisure sector is declining. Here are some of the most notable movers:

- Reckitt shares gain as much as 12%, their steepest rise since March 2000, while Abbott Labs rises in US premarket trading after a St. Louis jury cleared the companies over claims they hid risks their premature-infant formulas can cause a bowel disease that severely sickened a baby boy.

- HelloFresh shares rally as much as 11% to the highest since March after JPMorgan raises recommendation to overweight from neutral, saying earnings estimates are bottoming out while the stock’s valuation has become attractive following the meal-kit provider’s strategy pivot to shore up its profitability.

- Universal Music shares rise as much as 5.6% after reporting a stronger-than-expected growth in revenue generated from music subscriptions.

- Scout24 shares rise as much as 4.1%, hitting a new record high. Analysts at Barclays increased their price target on the stock by 10% after the online property platform said annual revenue growth will be at the upper-end of its guidance range as it reported a beat on Thursday.

- Boohoo shares gain as much as 6.7% after the online fashion retailer appointed Dan Finley, chief executive officer of the firm’s Debenhams unit, as group CEO.

- Kalmar shares gain as much as 12% to reach a record high after the Finnish industrial crane firm reported blow-out earnings. DNB flagged beats on most key metrics.

- Meyer Burger shares sink as much as 25% to a record low after the Swiss solar panel maker reported a wider first-half loss.

- Fugro shares fall as much as 21% after the Dutch geological data firm’s third-quarter earnings missed estimates, with revenue coming under pressure amid “short-term market-driven challenges” in the Americas, as well as conflicts in the Middle East, according to a release.

- Fielmann shares fall as much as 11%, the steepest intraday drop in two years, after the German eyewear firm’s third-quarter results missed estimates.

Earlier in the session, Asian stocks declined, set to cap their fifth-straight week of losses, as a stream of earnings reports failed to lift sentiment ahead of next week’s US election and a key meeting of China’s legislative body. The MSCI Asia Pacific Index fell as much as 0.8% Friday, on course for its longest weekly losing streak in more than two years. Japanese stocks fell the most since Sept. 30, after the yen strengthened against the dollar following Bank of Japan Governor Kazuo Ueda’s comments; benchmarks in Australia and South Korea also slipped. Tech megacaps including TSMC and SoftBank were among the biggest drags on the regional gauge. Equity benchmarks rose in Hong Kong after a private survey showed China’s manufacturing activity unexpectedly picked up last month, a sign of stabilization on Beijing’s stimulus blitz. Traders are awaiting a session by the Standing Committee of National People’s Congress over Nov. 4-8, where further fiscal measures may be announced.

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The yen weakens 0.5%, extending declines after the DPP chief said the BOJ shouldn’t raise interest rates before March. The Swiss franc drops 0.5% after CPI surprised to the downside.

In rates, US Treasuries were steady after minor gains Thursday. But October was the worst month for Treasuries in two years after the heavy selling of the past few weeks that reflected a rethink on US interest rates given signs of resilience in the economy. Front-end yields are higher by 1bp-2bp inside Thursday’s ranges, which included the highest 2- and 5-year yields since July-August. 10-year yields around 4.29% are only slightly cheaper on the day amid similarly muted price action in bunds and gilts; 5s30s spread near 30bp is ~1bp tighter on the day, 13bp on the week UK bonds fell, extending losses this week after the Labour government’s pivotal budget and plans for additional bond sales unleashed a wave of selling. UK 10-year yields rise 2 bps to 4.47%.

In commodities, brent crude futures rose 2% to $74.30 after a report that Iran could be preparing to attack Israel from Iraqi territory in the coming days. European stocks gain for the first time in four days, led by energy and personal care names. US equity futures also rise as Amazon and Intel shares rally in premarket post-earnings, offsetting a fall in shares of Apple. Spot gold is steady around $2,746/oz.

Market Snapshot

- S&P 500 futures up 0.3% to 5,753.00

- STOXX Europe 600 up 0.5% to 507.91

- MXAP down 0.6% to 185.03

- MXAPJ up 0.2% to 591.43

- Nikkei down 2.6% to 38,053.67

- Topix down 1.9% to 2,644.26

- Hang Seng Index up 0.9% to 20,506.43

- Shanghai Composite down 0.2% to 3,272.01

- Sensex down 0.7% to 79,389.06

- Australia S&P/ASX 200 down 0.5% to 8,118.83

- Kospi down 0.5% to 2,542.36

- German 10Y yield little changed at 2.41%

- Euro down 0.2% to $1.0859

- Brent Futures up 2.7% to $74.76/bbl

- Gold spot up 0.4% to $2,754.19

- US Dollar Index up 0.13% to 104.11

Top Overnight News

- China’s Caixin manufacturing PMI for Oct comes in ahead of expectations at 50.3 (up from 49.3 in Sept and higher than the Street’s 49.7 forecast). WSJ

- China has slashed its dependency on US food imports, putting it in a better position to withstand increased trade tensions w/Washington. RTRS

- South Korea’s conservative President Yoon Suk Yeol is weighing directly providing arms to Ukraine, a potentially consequential shift in the conflict, in response to North Korea’s deployment of troops to the Russian front line. FT

- Blinken says Israel and Lebanon are making progress on how to implement a UN resolution that could be the foundation for ending the present war. RTRS

- Donald Trump sued CBS, alleging it engaged in election interference by airing two different versions of an interview with Kamala Harris. He’s seeking $10 billion in damages. LeBron James endorsed Harris. BBG

- Apple shares fell premarket after a tepid sales forecast added to lingering concerns about the China market. Amazon reported strong results in cloud and e-commerce. Intel sparked optimism over its turnaround after its revenue outlook slightly beat. Shares jumped. BBG

- We estimate nonfarm payrolls rose by 95k in October, below consensus of +105k and the three-month average of +186k. Alternative measures of employment growth were mixed, and strikes and the recent hurricanes likely weighed on payrolls growth this month. GIR

- The oil and gas industry has achieved the biggest labor productivity gains of any US sector over the past decade. Crude output has risen to a record 13.3 million barrels a day, 48% more than Saudi Arabia — all with less than a third of the rigs and far fewer workers than 10 years ago. BBG

- Boeing and union leaders representing 33,000 striking workers reached a tentative deal that includes a 38% wage increase over four years and a $12,000 signing bonus, though doesn’t reinstate defined-benefit pension plans. Workers will vote on the proposal Monday. Shares rose premarket. BBG

- China’s residential property sales rose in October, the first year-on-year increase of 2024, as the government’s latest stimulus blitz brought back buyers. The value of new-home sales from the 100 biggest real estate companies rose 7.1% from a year earlier to 435.5 billion yuan ($61.2 billion), reversing from a 37.7% slump in September, according to preliminary data from China Real Estate Information Corp. Sales surged 73% from a month earlier. BBG

Earnings

- Apple Inc (AAPL) Q4 2024 (USD): Adj. EPS 1.64 (exp. 1.58), Revenue 94.93bln (exp. 94.58bln), Products revenue 69.96bln (exp. 69.15bln), iPhone revenue 46.22bln (exp. 45.04bln), Mac revenue: 7.74bln (exp. 7.74bln), iPad revenue: 6.95bln (exp. 7.07bln), Wearables, home, and accessories revenue: 9.04bln (exp. 9.17bln), Service revenue: 24.97bln (exp. 25.27bln), Greater China revenue fell 0.3% Y/Y to 15.03bln (exp. 15.8bln), Co. expects Q1 rev. growth at low to mid-single digits.. -1.1% pre-market

- Amazon.com Inc (AMZN) Q3 2024 (USD): EPS 1.43 (exp. 1.14), Revenue 158.9bln (exp. 157.2bln). +6.2% pre-market

- Intel Corp (INTC) Q3 2024 (USD): Adj. EPS -0.46 (exp. -0.02), Revenue 13.3bln (exp. 13.02bln). +6.1% pre-market

- Chevron Corp (CVX) Q3 2024 (USD): adj. EPS 2.51 (exp. 2.43), revenue 48.9bln (exp. 48.99bln). +2.8% pre-market

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the tech-heavy losses stateside and heightened geopolitical concerns, while Chinese markets outperformed after further encouraging manufacturing PMI data. ASX 200 declined with nearly all industries subdued aside from the commodity-related sectors. Nikkei 225 slumped at the open after recent currency strength and the hawkish tone from BoJ Governor Ueda. Hang Seng and Shanghai Comp were underpinned after the Chinese Caixin Manufacturing PMI followed suit to yesterday’s official release with a surprise return to expansion territory, while the attention was also on recent earnings reports.

Top Asian News

- China National People’s Congress Standing Committee proposed a law amendment for further refining government debt supervision, while it added the provision state council and above county-level governments should report on debt management progress.

- IMF expects Asia’s economy to expand by 4.6% in 2024 and 4.4% in 2025 but noted risks to Asia’s economic outlook are tilted to the downside and that an acute risk for Asia is an escalation in tit-for-tat retaliatory tariffs between major trading partners. Furthermore, it stated that persistent downward price pressures from China can hurt countries with similar export structures and provoke trade tensions, as well as noted that China’s property sector problems have not been addressed comprehensively, leading to plummeting consumer confidence.

- Japan’s Opposition, DPP Chief Tamaki says “the BoJ should not raise interest rates for at least half a year”.

European bourses, Stoxx 600 (+0.6%) are entirely in the green, with sentiment lifted following strong results from Amazon/Intel which have ultimately been able to outmuscle pre-market losses in Apple. European sectors hold a positive bias. Optimised Personal Care tops the pile, lifted by Reckitt after it received a favourable litigation decision. Energy follows close behind, with oil prices firmer amid heightened geopolitical tensions – as such, Travel & Leisure lags. US equity futures (ES +0.1%, NQ +0.4%, RTY +0.1%) are modestly firmer, and with sentiment on a stronger footing after good results from Amazon and Intel; traders await US NFP/ISM Manufacturing later in the session.

Top European News

- Moody’s says the UK budget creates challenges as it warns of a muted UK growth, according to the FT.

- S&P says UK fiscal position is constrained following budget announcements; new budget decisions, however, do not have an immediate impact on headline budgetary forecasts for the UK

FX

- USD is broadly firmer vs. peers with DXY back above the 104 mark. Today’s main data highlight is of course the US NFP report whereby expectations are for a cooling in the headline rate to 113k amid weather and strike activity distortions; the unemployment rate is not expected to be impacted. For now, DXY is tucked within yesterday’s 103.82-104.21 range.

- EUR is softer vs. the USD after a recent run of gains that have been underpinned by firmer growth and inflation metrics from the Eurozone. EUR/USD has been as low as 1.0858 but is holding above Thursday’s low at 1.0843.

- After two sessions of losses vs. the USD in the wake of Wednesday’s UK budget, Cable is attempting to stabilise and has managed to make its way back onto a 1.29 handle after drifting as low as 1.2843 Thursday.

- After strengthening vs. the USD in the wake of the BoJ policy announcement and subsequent hawkish Ueda press conference yesterday, JPY has returned to its recent trend of losses vs. the USD. USD/JPY has been as high as 152.83.

- Antipodeans are both marginally softer vs. the USD in quiet newsflow for both countries.

- CHF is the laggard across the majors following soft Swiss inflation data. The release has stoked fears that Switzerland could enter into deflation next year and therefore expectations of a 50bps cut by the SNB have heightened (currently priced at 28%).

- PBoC set USD/CNY mid-point at 7.1135 vs exp. 7.1122 (prev. 7.1250).

Fixed Income

- USTs are a handful of ticks lower, 110-09+ base matches the week’s opening level and is 6+ ticks clear of Thursday’s WTD base. Focus entirely on Payrolls, forecast range of -10k to +200k, with ISM Manufacturing thereafter.

- Bunds are softer as the week’s bearish action continues but thus far we remain clear of the WTD 131.15 trough by around 30 ticks but still in the red for the week as a whole by over a full point.

- Gilts opened lower by 21 ticks, stabilised briefly before slipping to a 93.45 trough, a low which is just above yesterday’s 93.18 contract low. As such, while the UK’s 10yr yield is elevated it remains shy of 4.5% and Thursday’s 4.52% YTD high.

- UK Treasury official says the scenario currently is very different from the Truss-budget.

Commodities

- Crude is on a firmer footing as recent rhetoric brings back risk-premium into the weekend. Focus on an Axios piece that Iran is reportedly preparing a major retaliatory strike from Iraq within days. Brent’Jan 25 currently near session highs of USD 74.94/bbl.

- Spot gold is firmer, though action is minimal with the metal contained into NFP & ISM Manufacturing. Holding just above the USD 2750/oz mark and yet to make any real headway into recovering towards the USD 2790/oz ATH from early-doors yesterday.

- Base metals are firmer, owing to the Chinese Caixin Manufacturing PMI making a surprising return to expansionary territory. 3M LME Copper above the USD 9.6k mark, though the move has paused for breath with the docket now light until the US data deluge.

Geopolitics

- Lebanese Prime Minister Mikati says “the continuation of Israeli attacks is an indication of Tel Aviv’s rejection of all efforts to cease fire”, via Asharq News

- Iran’s supreme leader Khamenei instructed the Supreme National Security Council on Monday to prepare for attacking Israel, according to NYT citing three Iranian officials familiar with the war planning. Khamenei was said to have made the decision after he reviewed a detailed report from senior military commanders on the extent of damage to Iran’s missile production capabilities and air defence systems around Tehran, critical energy infrastructure and a main port in the south.

- Israel conducted strikes on Beirut suburbs for the first time in days, while a Lebanese news agency reported that dozens of buildings in the southern suburbs of Beirut were flattened by Israeli raids, according to Sky News Arabia.

- Islamic Resistance in Iraq said it attacked with marches a vital target in the south of the occupied territories several times since dawn today, according to Al Jazeera.

- US Defence Secretary Austin spoke to Israeli Defence Minister Gallant and reaffirmed the US remains fully prepared to defend US personnel and partners across the region against threats from Iran, according to the Pentagon.

- US State Department issued a response to Israel’s cabinet decision on extending indemnification for correspondent banking between Israel and West Bank in which it stated the short-term extension creates another looming crisis by November 30th and called for Israel to swiftly extend indemnification for essential banking relationships for at least a year.

- North Korea’s Standing Committee Chairman Choe says we need to strengthen nuclear weapons and improve readiness for a retaliatory nuclear strike.

US Event Calendar

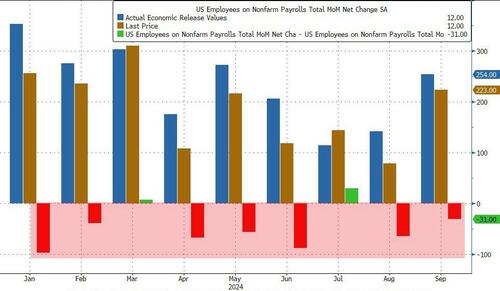

- 08:30: Oct. Change in Nonfarm Payrolls, est. 100,000, prior 254,000

- Oct. Change in Manufact. Payrolls, est. -30,000, prior -7,000

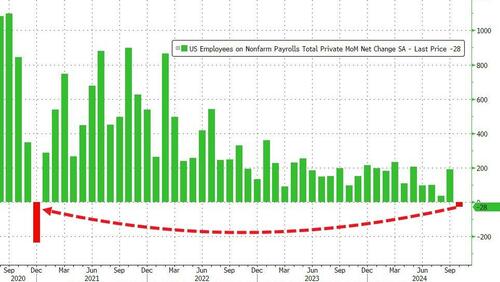

- Oct. Change in Private Payrolls, est. 70,000, prior 223,000

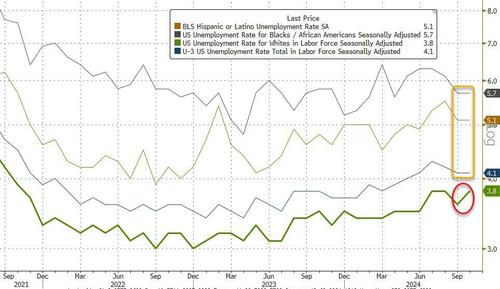

- 08:30: Oct. Unemployment Rate, est. 4.1%, prior 4.1%

- Oct. Underemployment Rate, prior 7.7%

- Oct. Labor Force Participation Rate, est. 62.7%, prior 62.7%

- 08:30: Oct. Average Weekly Hours All Emplo, est. 34.2, prior 34.2

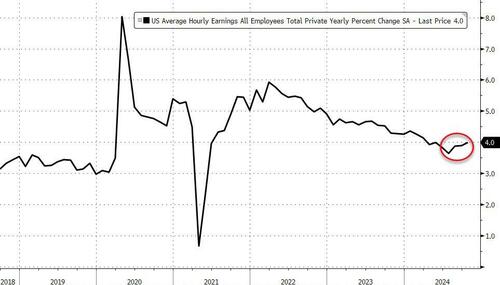

- Oct. Average Hourly Earnings YoY, est. 4.0%, prior 4.0%

- Oct. Average Hourly Earnings MoM, est. 0.3%, prior 0.4%

- 09:45: Oct. S&P Global US Manufacturing PM, est. 47.8, prior 47.8

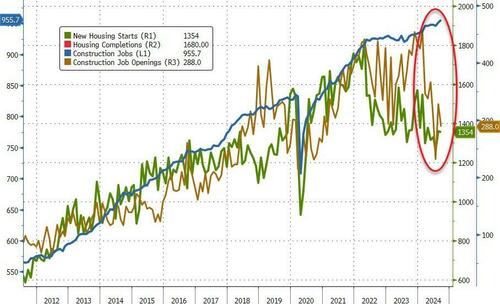

- 10:00: Sept. Construction Spending MoM, est. 0%, prior -0.1%

- 10:00: Oct. ISM Manufacturing, est. 47.6, prior 47.2

- Oct. ISM Employment, est. 45.0, prior 43.9

- Oct. ISM New Orders, est. 47.0, prior 46.1

- Oct. ISM Prices Paid, est. 50.0, prior 48.3

DB’s Jim Reid concludes the overnight wrap

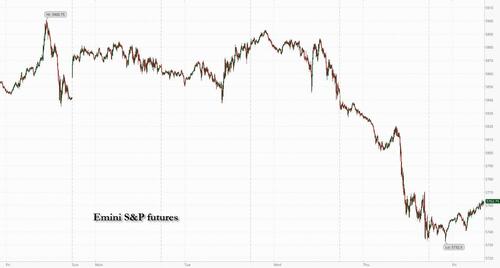

Markets finished October on a rough note yesterday, with the S&P 500 (-1.86%) posting its biggest decline in nearly two months, whilst UK assets lost significant ground thanks to investor concerns about Wednesday’s Budget. We’ll have more to say in our monthly performance review out shortly, but the declines mean that Bloomberg’s global bond aggregate has just experienced its worst month since September 2022, back when inflation was still raging and the Fed was hiking by 75bps each meeting. And for equities it’s been a lacklustre month as well, with the S&P 500 losing ground for the first time in six months.

In terms of the last 24 hours, there were several factors driving the losses, but an important one was disappointment at the big tech earnings after the previous day’s close. That meant the Magnificent 7 (-3.55%) slumped back, with Microsoft (-6.05%) experiencing its biggest daily decline in two years after they announced a weaker forecast for cloud revenue growth. But even though tech stocks led the declines in the S&P 500 (-1.86%), the losses were pretty broad, and the equal-weighted version of the index (-1.10%) also saw its weakest day since early September. Those moves were echoed in Europe too, where the STOXX 600 (-1.20%) fell to its lowest level since mid-August.

After the close, we did hear from Apple and Amazon who delivered a mixed set of results. Apple’s shares fell by close to 2% in post-market trading as it signalled slower sales growth “in the low-to-middle single digits” for the coming quarter, versus analysts’ projections for a 7% increase. By contrast, Amazon gained nearly 6% after delivering a strong profit beat. So with six of the Mag-7 reporting so far, we’ve seen an equal split of positive (Tesla, Alphabet and Amazon) and negative (Microsoft, Apple and Meta) reactions. That’s helped US equity futures to stabilise again this morning, with those on the S&P 500 pointing to a +0.24% gain.

The other big sell-off yesterday happened in the UK, as markets reacted negatively to the extra borrowing announced in the previous day’s budget. Specifically, the spread of 10yr gilt yields over bunds widened by +9.4bps to 206bps, which is their biggest gap since October 2022, back when Liz Truss was still Prime Minister. Moreover, in absolute terms, the 10yr gilt yield was up +9.5bps to 4.44%, which is its highest level since November 2023, and at the height of the sell-off they’d been up as much as +18bps intraday to 4.53%. So it was only thanks to the late recovery that things weren’t even worse. The effects were clear across other asset classes too, and sterling was the worst-performing G10 currency yesterday, weakening by -0.49% against the US Dollar to $1.2899. And with the extra borrowing announcements, investors also dialled back their expectations for rate cuts from the Bank of England, so by the close they were pricing in 80bps of rate cuts by the June 2025 meeting, down from 86bps on Wednesday.

Bonds also struggled in the rest of Europe, albeit to a much lesser extent than in the UK. This followed an upside surprise in the Euro Area inflation print, which raised doubts as to how quickly the ECB would be able to cut rates in the months ahead. It showed headline inflation was back at the ECB’s target of +2.0% in October (vs. +1.9% expected), while core CPI remained at +2.7% (vs. +2.6% expected). So it contributed to a sell-off in front-end yields as investors priced out the chance of rate cuts, with the 2yr German yield up +2.2bps. Further out the curve, yields were much steadier however, with those on 10yr bunds (-0.1bps) basically unchanged at 2.39%.

Over in the US, there’s still plenty of focus on Tuesday’s election, and yesterday saw markets react to the perception that a Republican sweep scenario was marginally less likely relative to the day before, with the prospects ticking down on prediction markets. At the margins, that was helpful for US Treasuries, given it would be more difficult to enact expansive fiscal plans under divided government, and the 10yr Treasury yield came down -1.6bps to 4.28%. Moreover, it was clear that several Trump trades were unwinding a bit, with Trump Media & Technology Group (-11.72%) falling for a second day, whilst Bitcoin fell -3.98%. Forecasting models remain very tight, with FiveThirtyEight’s model placing a 53% likelihood on a Trump victory.

Investor attention will remain on the US today given the US jobs report for October, which is the last one ahead of the Fed’s decision next week. As a reminder, the last jobs report was much stronger than expected, with nonfarm payrolls at +254k in September, alongside positive revisions to the previous couple of months. This time around though, our US economists are forecasting a weaker +100k print, which partly reflects a 44k drag from striking workers, as well as a negative impact from Hurricane Milton, which struck Florida during the October survey period. They also expect the unemployment rate to tick up a tenth to 4.2%. Click here for their full preview and how to register for their subsequent webinar.

Ahead of that, we did get some decent data on the US labour market yesterday, with the weekly initial jobless claims down to 216k in the week ending October 26 (vs. 230k expected), which is their lowest level since May. We also had the latest PCE inflation report for September, which the measure that the Fed officially target. That showed core PCE was up to a 5-month high of +0.25%, and the year-on-year rate remained at +2.7% (vs. +2.6% expected). But headline PCE was down to just +2.1% on a year-on-year basis, which is the lowest rate since February 2021. In the meantime, the Employment Cost Index for Q3 came in at +0.8% over the quarter, the weakest since Q2 2021.

In geopolitical news, oil prices rose after Axios reported that Israeli intelligence suggested Iran was planning a retaliatory strike against Israel using its proxies in Iraq. Brent crude rose +0.84% yesterday and is trading another +1.34% higher this morning at $74.14/bbl. Meanwhile, gold (-1.57%) saw its biggest retreat since July yesterday, slipping back from its record high on Wednesday.

Overnight in Asia, the sell-off has generally continued for risk assets, with the Nikkei (-2.43%) currently on course for its biggest decline in a month. Indices across other countries have also lost ground, with the KOSPI down -0.27%, and the S&P/ASX 200 down -0.51%. However, markets in mainland China and Hong Kong have outperformed, which comes as the Caixin China manufacturing PMI has moved back into expansionary territory in October with a 50.3 reading (vs. 49.7 expected). So against that backdrop, the Shanghai Comp (+0.33%), the CSI 300 (+0.65%) and the Hang Seng (+1.00%) have all posted solid gains this morning.

To the day ahead now, and US data releases include the October jobs report, along with the ISM manufacturing. Otherwise, earnings releases include Exxon Mobil and Chevron.